Processing invoice payments with credit cards

If the company allows its customers to pay for invoices by credit cards of any type, a problem occurs when the operator of the cards receives the payment. This payment is a summary of certain set of separate invoices. Its amount does not correspond with the sum of payments for the card, for it is lowered by the amount for commissions of the operators of the credit cards. It is necessary to pair this payment with each cash register documents, paid invoices and methods of payment By card that are stated on further report from operator of the credit card. It is also necessary to state the hight of commissions, separate the payments from the commission and post these movements.

Invoice payment “By card”

When making a sale with By card method of payment, the process is the same as with In cash method of payment, invoice will be paid by cash register created for payment records of By card payments, and that has a reciept in form of analytics of receivables (collective account 31) and will mean “Receivables for credit card operator”.

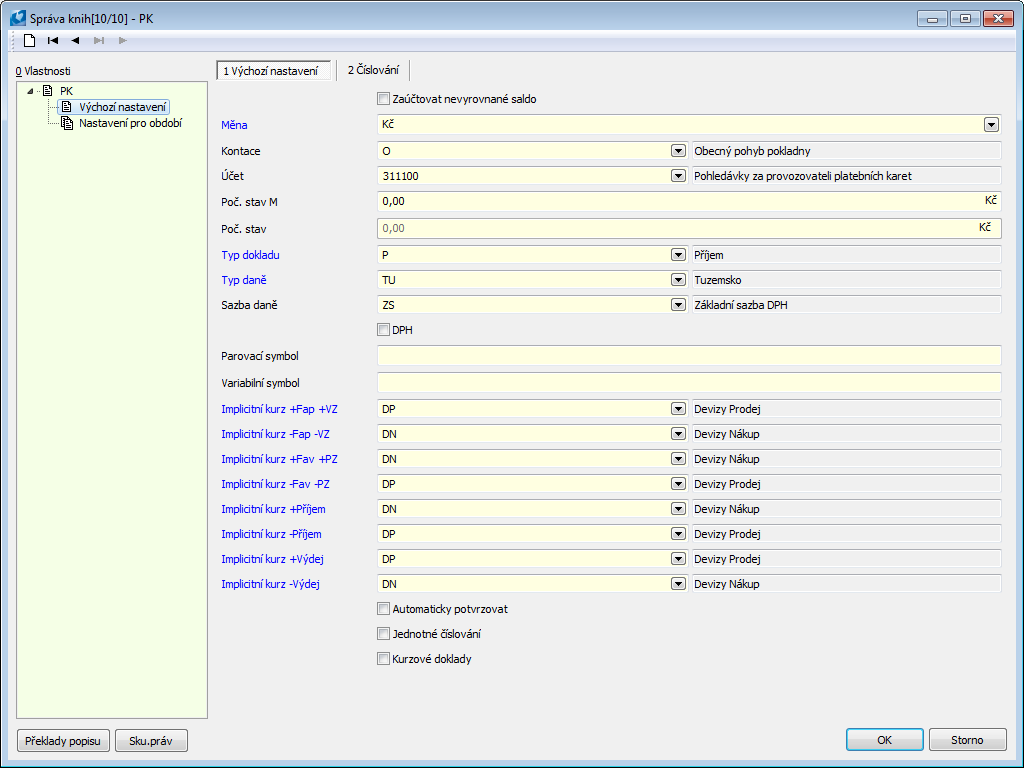

Example: We want to allow customers to pay by card in retail. We start a “PK” cash register - By card. All invoices with By card method of payment will be paid with this cash register. This register will have an account “311100 - Receivables for credit card operator”, that we have introduced for this purpose. Balance In the cash register will create the sum, that was paid by credit cards and will continue to grow.

Picture: “PK” cash register - Payments by card

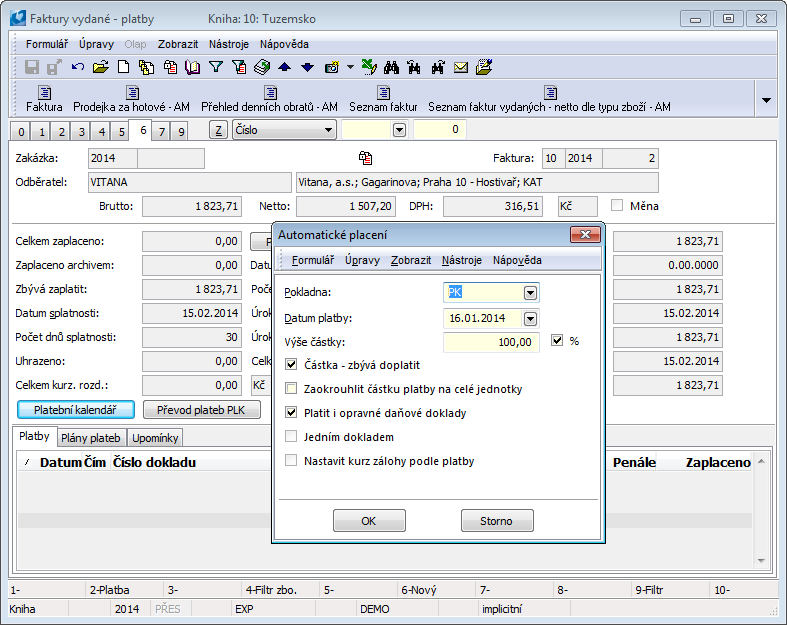

Picture: Examples of invoices paid by “PK” cash register - Payments by card

Tip for user: For better navigation and filtration it is convenient to start a separate cash register for each credit cards operator and separate record in Method of payment code list, e. g.: „EC/MC“, „VISA“ etc.

Match payments made by credit card

Payment from payment card providers is a bank statement item, which represents the total payments by payments card for a certain period reduced by a commission.

Based on the detailed statement of each payment that is available for the bank statement item, the operator will create a cash vouchers filter that will match the detailed statement.

Example: Filter of cash vouchers, which corresponding to a detailed statement of payments to a bank statement item, has been created. The sum of amounts the cash vouchers in the filter is 12,124.40 CZK.

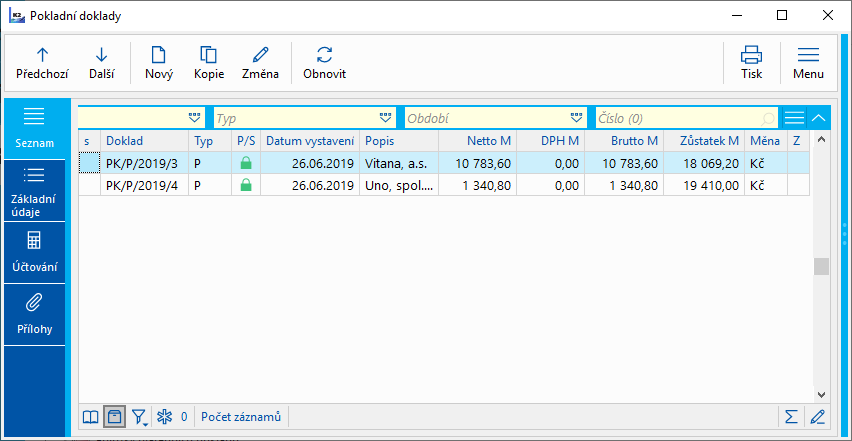

Picture: Filter of cash vouchers corresponding to a detailed statement of payments to a bank statement item

Tip for user: The cash vouchers filter can be created by creating an invoice filter according to the detailed list of the bank statement item and then creating a cash vouchers filter (Actions>Container>Create other container - Cash vouchers ...).

In universal forms it is possible to extract cash register documents from the FAV container:

1) Create a FAV container

2) Create a filter in Cash register documents book for an item condition “Cash register document items”.

3) Then choose a “Different container”, where we choose “Unique number of invoice out” - OK.

The payment item from the payment card provider is Receipt type, and the account on the item is determined in the same way as cash register account for payment cards , in example "311100 - Receivables from operator of the credit card“.

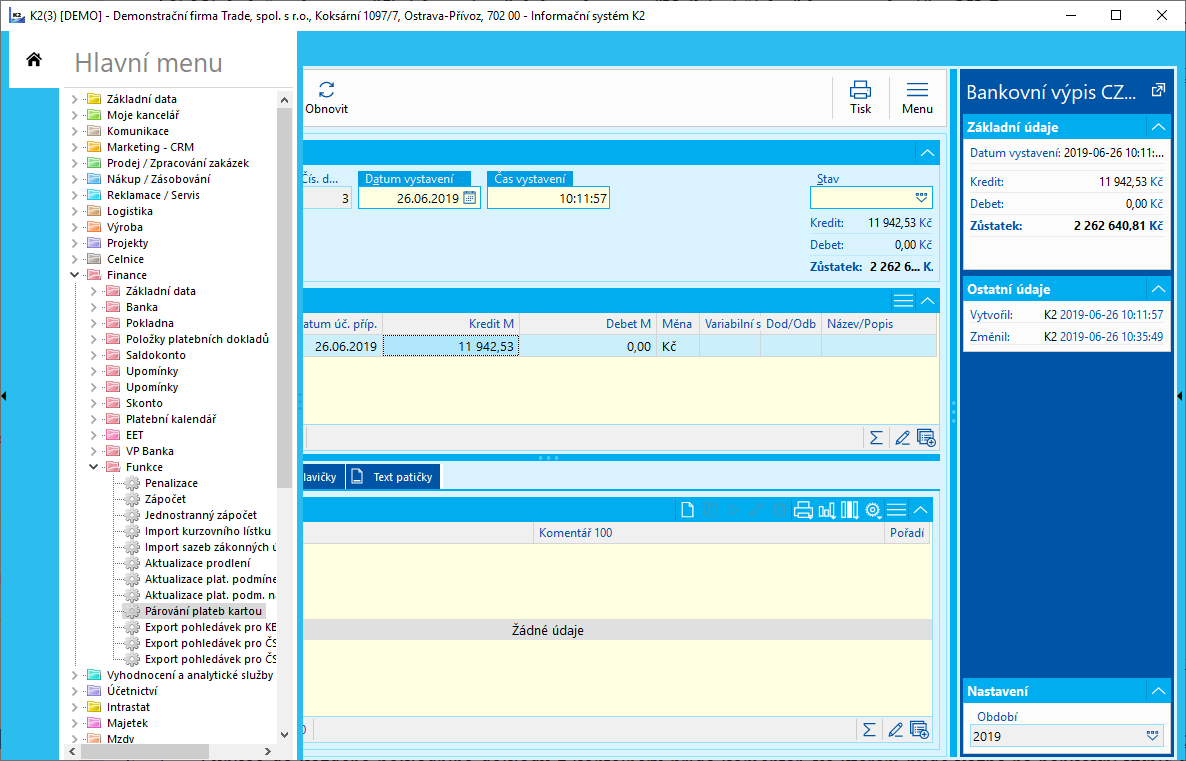

Picture: Start the Match payments made by credit card function - in change mode of bank statement on the payment item of the payment card provider. For example, only this item was in the statement.

In the bank statement in change mode, the function Match payment made by credit card will be started on this item. The function can be run from the tree menu Finances - Functions. Function adds a note to each cash voucher from the filter, in which will be a link to bank statement with payment from the payment card provider. The link will tell you that the card payment is already matched with a bank statement. At the same time, the function creates two items in the bank statement, the amount of which corresponds to the difference between the sum of the cash vouchers items from the filter and the amount of the matched item of bank statement. This will calculate the commission of the payment card company. One item will be type of Payment and the second type Receipt, which will ensure the final financial neutrality of these items on the bank statement. The account Receivable for a payment card providers will be added to the receipt item (for example, account 311100, from the function parameter Ucet_Prijmu). The account Other financial costs will be assigned to the payment item (account analyst 568, for example, account 568000, from unction parameter Ucet_Vydeje). These three items will be accounted for by 'O' - General. If the commission is zero, ie the amount of the statement will correspond to the sum of cash documents, zero items in the bank statement will not be created.

Example: After you run the function Match payments made by credit card there is appear the question "Are you sure you want to match the bank statement item VS: 2001588769 - Payment of provider payment card with Amount: 11/942.53 EUR?. Note the difference between the sum of the cash register filter - 12,124.40 CZK and the amount of the bank statement item 11,942.53 CZK. This difference represents the commission of a payment cards operator.

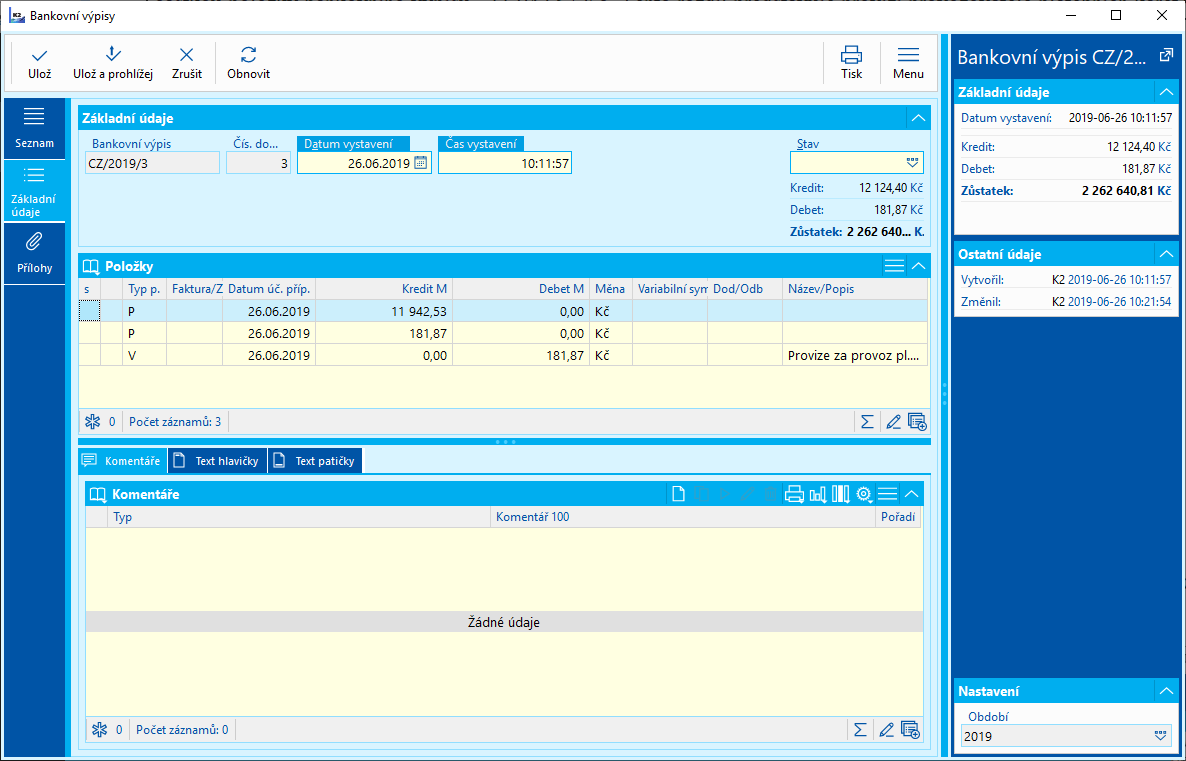

Picture: Bank statement after creating two items with the difference between the sum of the amounts of the cash receipts and the amount of the bank statement item

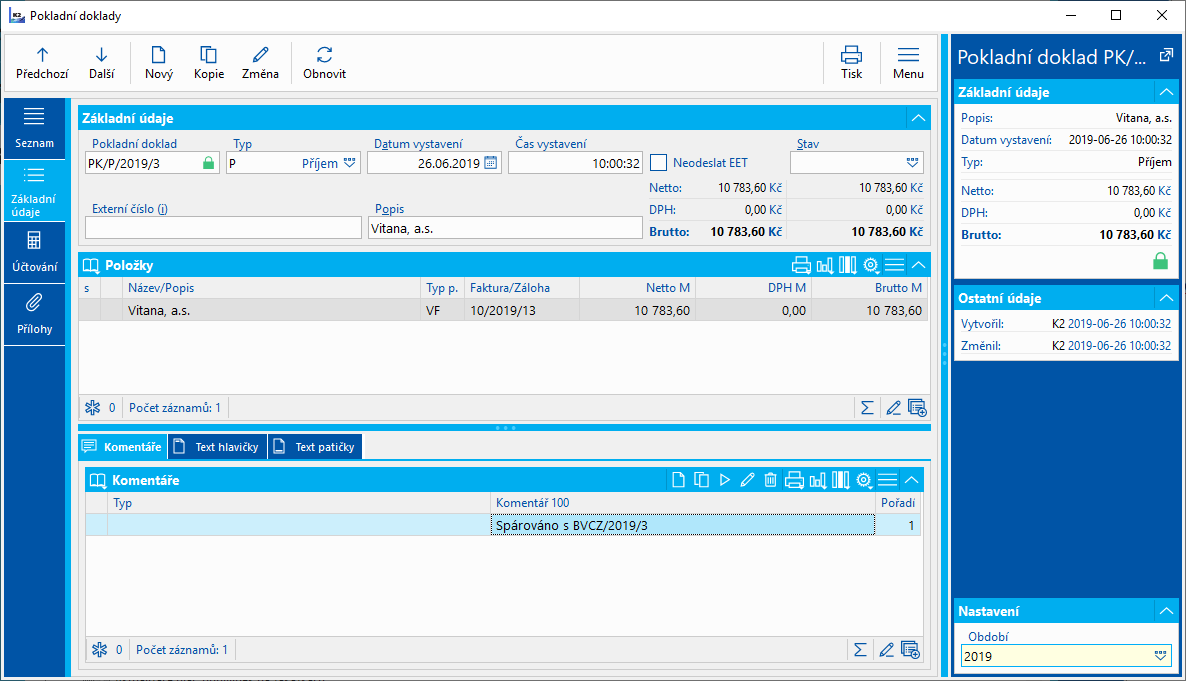

Picture: Example of a cash voucher with a type of note 'PK’. There is an information about matching with the bank statement item

Technical solution

Function for matching payments made by credit card is placed under the keyword Finance with name Match payments made by credit card (PARPLKAR.PAS). It can be activated from the tree menu Finance - Functions - Match "payments by credit card".

Function parameter list:

CostCentre |

Cost centre which will be added into a bank statement items. |

Ucet_Prijmu |

Account for a new created item - receipt on the bank statement. The default value is "311000". |

Ucet_Vydeje |

Account for a new created item - payment on the bank statement. The default value is "568000". |