Other Receivable

Other receivables are intended for the registration of receivables that do not result from invoicing. These are, for example, receivables from the tax office (eg in case of excessive VAT deduction, overpayment of income tax), installments, suspensions, etc.

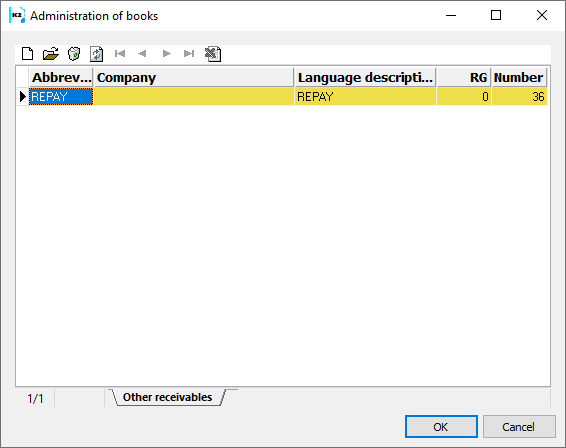

Books of Other Receivables

Other receivables are recorded in the Books of Other Receivables.

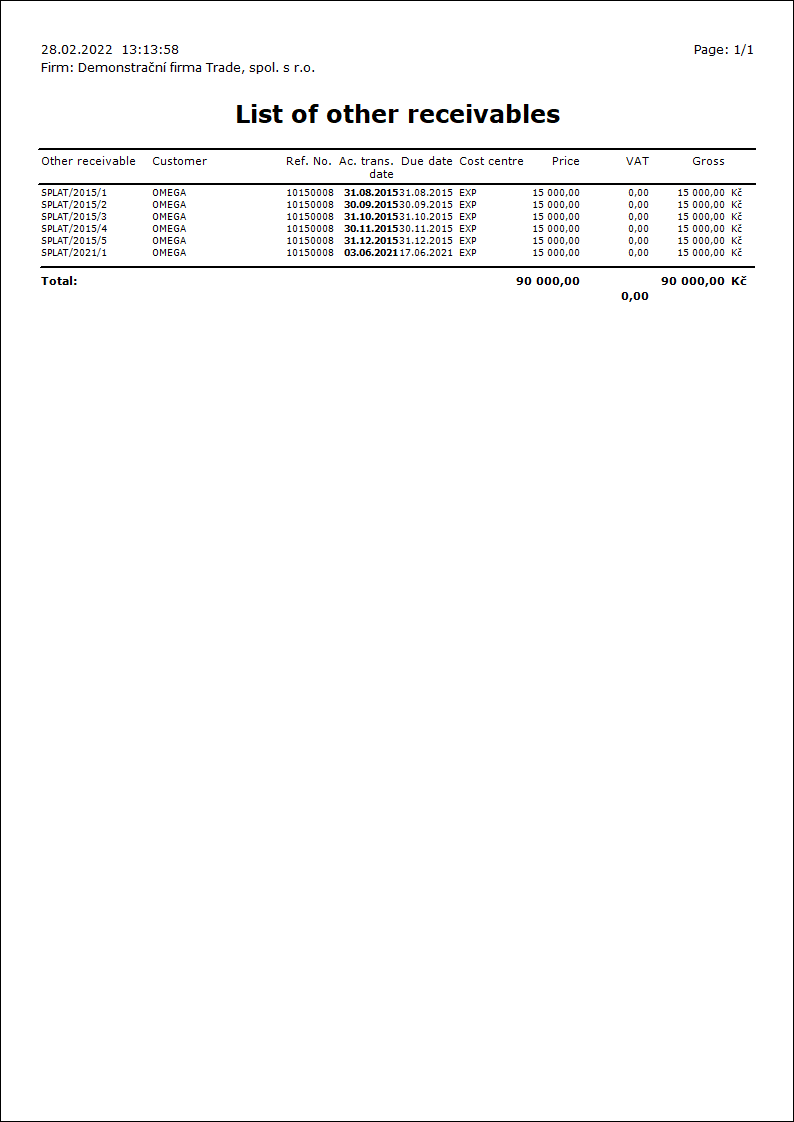

Picture: The Book of Other Receivables book

A detailed description of work with the books and the principle of settings is stated in Administration / System / Administration of Books.

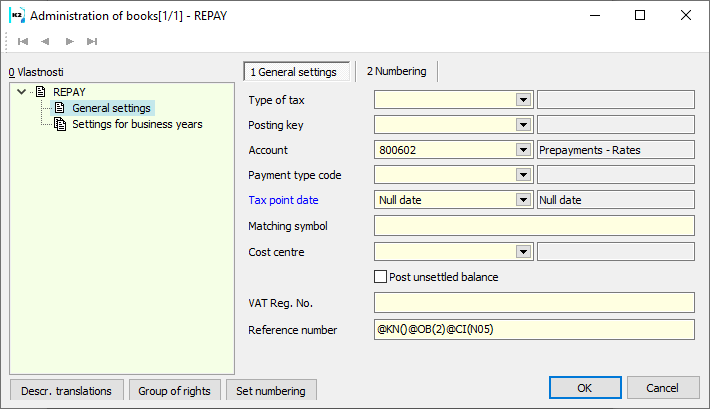

Default Settings

Picture: Administration of Books - Default Settings - Books of Other Receivables

Field description:

Type of Tax |

Tax type of an other receivable - selection from the Type of Tax table. |

Posting key |

A document posting key - selection from the Posting Keys table. |

Account |

A document posting key - selection from The Chart of Accounts table. |

Constant Symbol |

A constant symbol of a document. |

Invoice Date |

Sets the Invoice Date upon doc. issuing, updates the Invoice Date upon changing the Account. Trans. Date. |

Matching Symbol |

Can be combined from fixed entered signs or with variable parameters. |

Cost centre |

This cost centre is pre-filled into a newly created doc. |

Post Unsettled Balance |

Enables to post the document, in which a difference between the total amount on the document and the posted amount occurs. |

VAT Reg. No. of Own Company |

VAT Reg. No. entered in this field automatically appears on the own company details on the reports, which are printed on documents from this book. The field is to be filled in only if we have the VAT reg. No. registration in another country, and in this book we will issue the documents belonging to the VAT declaration of that other state. |

Variable Symbol |

You can pre-set the variable symbols which will be inserted into documents. Variable symbols can be combined from fixed entered signs or with variable parameters "@". A description of parameters may be found in the Settings of Books of Sale / Books of Sale chapter. |

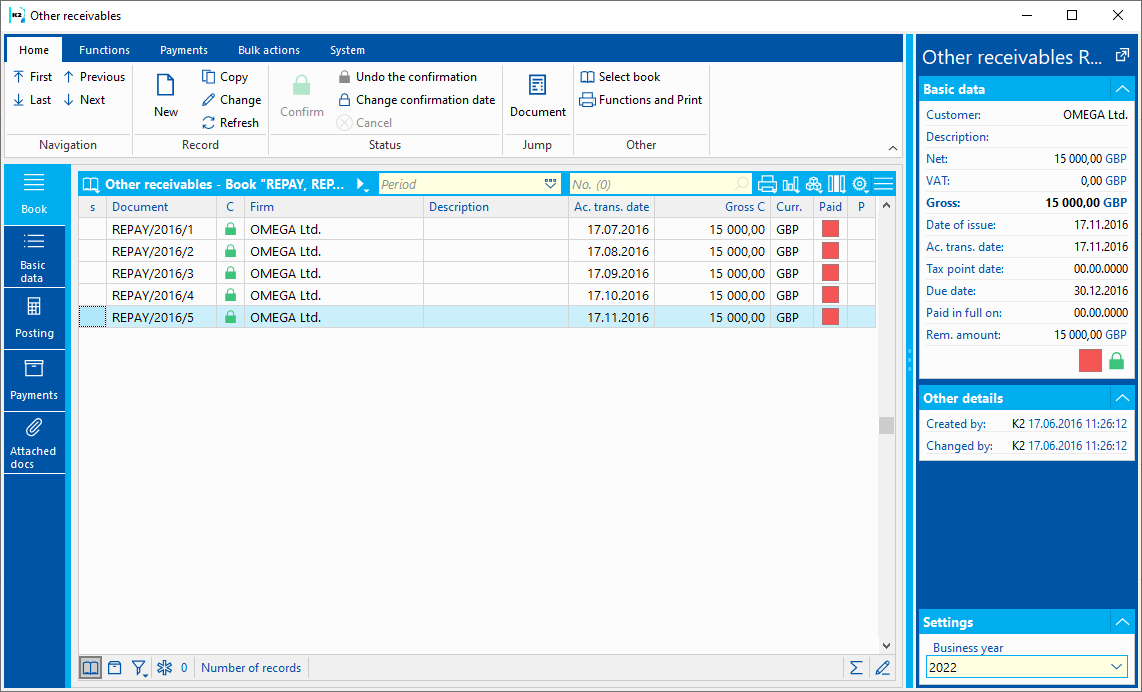

Other Receivables Card

Other Receivables are run from the Sale - Other Receivables - Other Receivables tree menu.

Picture: The Book of Other Receivables

Other Receivable Document

Basic Data (1st page)

Basic data of other receivables tab is used for identification and basic data, and some other information such as the payment method, date of issue, maturity date etc.

Picture: Other Receivable - Basic data tab

Fields description in Basic data:

Document |

The book, business yearn, and the number of an Other Receivable. |

Customer |

A business partner's name that you insert by selecting it from Suppl./Cust. book. |

Status |

The field for selecting from a code list that enables filtering of documents according to the selected status. |

Document type |

Document type (Invoice Out, Internal document...), which is added to receivable. |

Document |

Attached document. After selecting the document type, the appropriate book will be offered. |

Description |

Further Document specification. |

VAT |

If the field is checked, it deals with a Tax Document. The field is preset according to the legislation of the document. |

Gross, Net prices, VAT |

The amounts in document currency. If the doc. is in a foreign currency, the amounts in the Client's currency will be displayed as well. |

Addresses |

The button to display an addressee or the superior company. Closer description is in the chap. Addressee. |

Currency |

The document currency. |

Exchange Rate |

Exch. rate for recalculation to the domestic currency. The rate valid to the date of issue is selected. If the Invoice Exch. Rate According to Acc. Trans. Date option is checked in the Client Paramaters, an exch. rate to the acc. trans. date is filled in. This field cannot be edited any more after you pay and reprice this document. |

Rate 2 |

Current rate for revaulation. |

Exchange Rate According to Date |

This button enters an exchange rate from the exchange list that is valid to the date depending on the Exchange Rate According to the Date of Accounting Transaction parameter. |

Exchange list |

This button opens the preview of exchange list of the given currency and sets the cursor on the rate valid to the date. |

Type of Tax |

Type of tax for inclusion of a receivable in the VAT return. |

Reference number |

The field for Reference number of doc. It can be created automatically according to the settings in Books of Other Receivables. The program notifies you of any eventual duplicities of variable symbols. |

External Number |

External number (text of 60signs). Used to identify a document from another system. |

Account |

Doc. account. The field is automatically filled in with the account according to the settings in the Book of Other Receivables. |

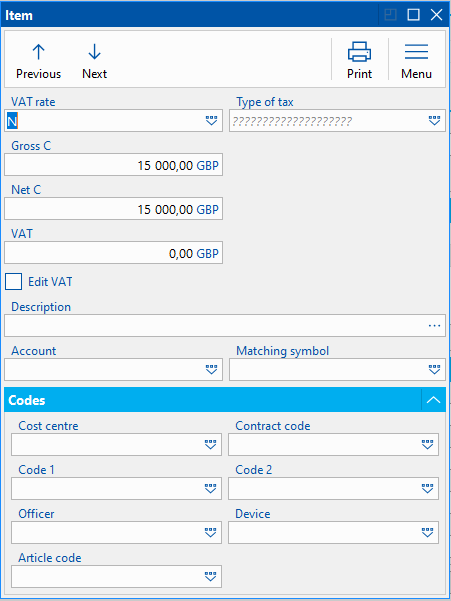

Item field description:

VAT Rate |

VAT Rate items. We choose from Code list Taxes. |

Type of Tax |

Tax type items. We choose from theTax Type code list. |

Gross C, Net C, VAT |

The amounts in document currency. VAT amount cannot be edited. If the doc. is in a foreign currency, the amounts in the Client's currency will be displayed as well. |

Description |

Description of an item. You can select from the Cards of other receivables code list or enter any text without links for a code list. |

Account |

The Selection from the Chart of accounts code list. |

Picture: Other Receivable - Item

VAT editing |

After checking the Edit VAT box, you can edit the Net and VAT amounts. Gross is calculated as their sum. |

Matching Symbol |

Selection from the Matching Symbol code list. |

Cost center, Contract code, Code 2, Code 1, Officer, Device, Article code. |

Selection from code lists. |

Conditions field description:

Payment Method |

Agreed method of payment. |

Payment Conditions, bank account |

The button is used to set the payment terms. |

Terms field description:

Accounting transaction date. |

Acc. trans. date enters the Accounting. |

Date of Issue |

The date of doc. issue. |

Due Date |

The due date of document. According to the settings in the Derive Due Date from Accounting Trans. Date client parameter, the Due date is automatically entered by adding the number of Maturity Days to the value of the Date of Issue field or to the Acc. Trans. Date field. If the Floating Maturity is checked on the Suppl./Cust. card in the Payment Conditions tab, the Due date is filled in according to the Month Shift and Days From The Beginning of Month values. |

Invoice Date |

The date of the taxable supply enters the VAT return. If the Invoice date is null, the document does not enter the VAT Return. |

Control Statement Date |

The date of the Control Statement. It is necessary to be filled only if it differs from the Invoice Date. |

Due date |

Number of maturity days. |

Codes field description:

Cost center, Contract code, Code 1,Code 2, Officer, Device, Article code |

The data used to sort the company's activities. Closer description is in the chap. the Basic Code Lists and Supporting Modules K2 – Notes. |

Buttons:

Accounting information, matching symbol |

After pressing the button, it is possible to enter the pairing symbol and posting key. |

Items of VAT Documents |

After pressing the button, it displays the items of VAT documents in which the other receivable is listed. |

The possible to assign random types and kinds of notes to Other Receivables, eventually you can use the Header Text or the Footer Text. Further work description with comments is listed in the Basic Code Lists and Supporting Modules K2 – Notes chapter There are also the Tasks and Activities tabs. A closer description of work with the folders is stated in the Tasks - Document Folder and the Activities - Document Folder chapters.

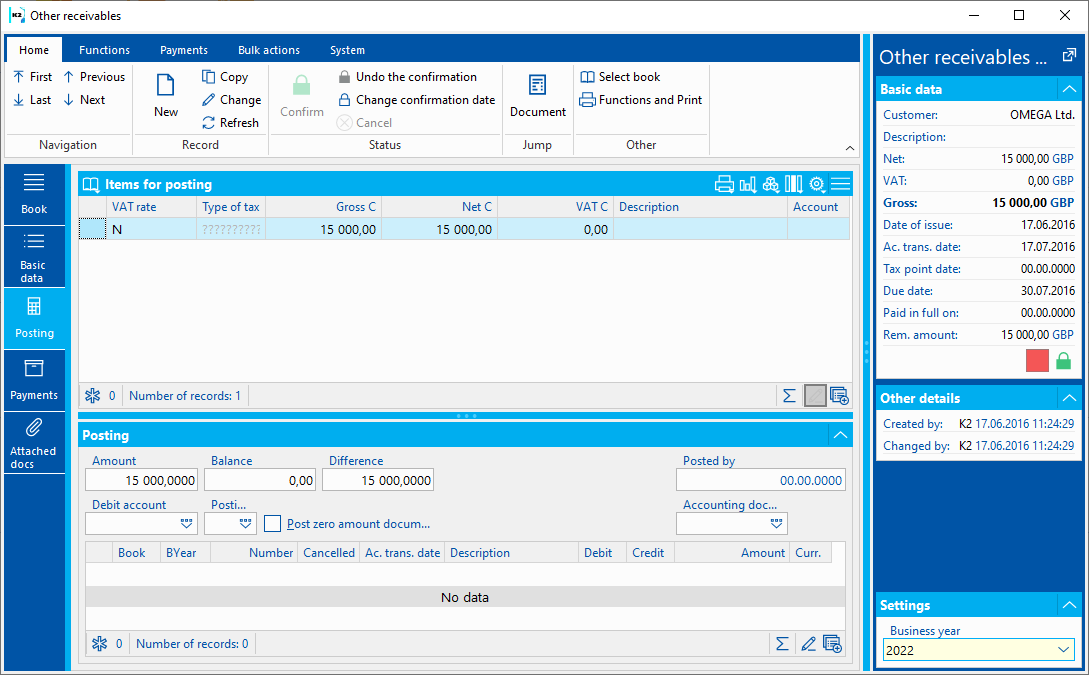

Account Assignment (3rd page)

The Posting tab is used to post other receivables, which is optically divided into two parts. In the upper part of the document are the document's individual items. The lower part serves for the posting of the document.

Note: Closer description is in The Accounting - Account Assignment and Posting chapter.

Picture: Other Receivable - Accounting

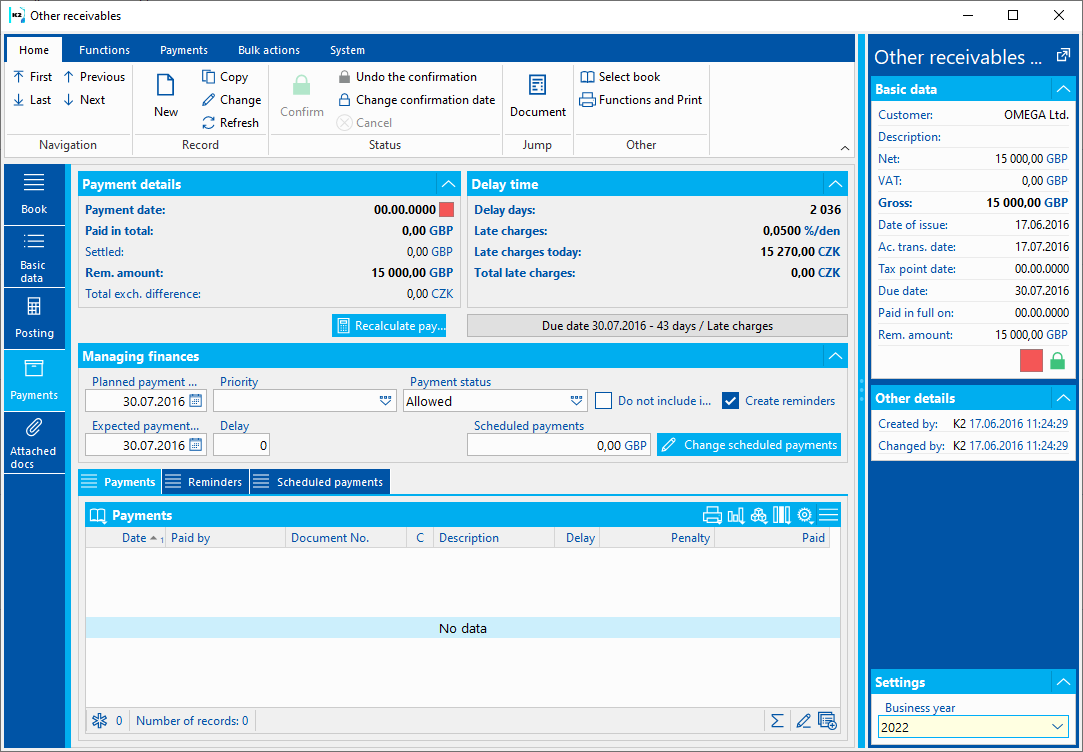

Payments (6th page)

On the document in the Payments tab, you can monitor the facts related to the status of payment - whether the document is paid in full or in part, the due date, delay, penalty or information about the individual payments (the lower part of the screen).

Picture: Other Receivable - Payments

When creating a document and changing Suppl./Cust. the Create reminders field is set according to the settings on the Suppl./Cust. tab. Documents with this check mark enter the Create notification function.

Attached Docs.

As in other modules of the K2 program, it is possible to assign documents to this tab. The further description of the work with documents is stated in the Basic Code Lists and Supporting K2 Modules - Attachments chapter.

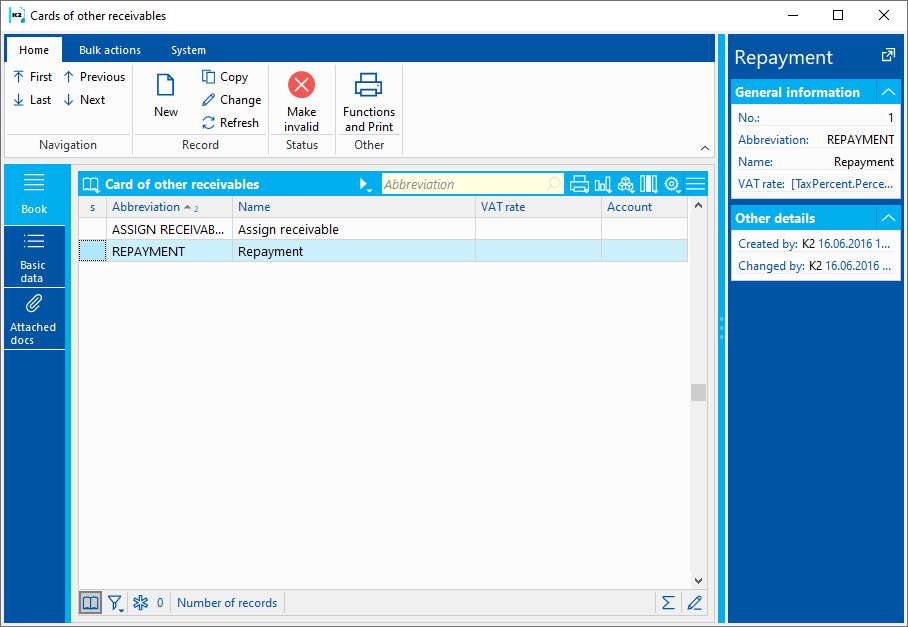

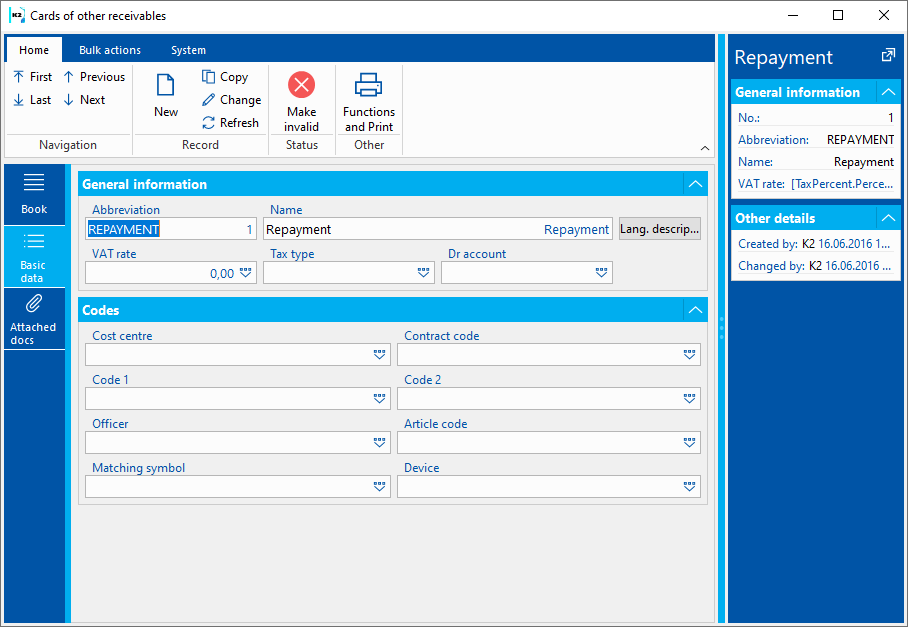

Card of Other Receivables

The Card of Other Receivables code list can be used on the items of Other Receivables. The data from the card are copied into the document item.

Picture: Card of Other Receivables - Book

Basic Data (1st page)

Basic Data tab serves for data reporting.

Picture: Other Receivable card - Basic data

Field description:

Abbreviation |

The abbreviation of the card of other receivable. |

Name |

The name of the card of Other Receivable. |

VAT Rate |

VAT Rate. |

Type of Tax |

The type of tax. |

Debit Side Account |

The account of an item. |

Cost centre |

Selection from the Cost Centres code list. |

Contract Code |

Selection from the Contract Codes code list. |

Code 1 |

Selection from the Code 1 code list. |

Code 2 |

Selection from the Code 2 code list. |

Officer |

Selection from the Officer code list. |

Article Code |

Selection from the Article Codes code list. |

Matching Symbol |

Selection from the Matching Symbol code list. |

Device |

Selection from the Device code list. |

Attached Docs.

As in other modules of the K2 program, it is possible to assign documents to this tab. The further description of the work with documents is stated in the Basic Code Lists and Supporting K2 Modules - Attachments chapter.

Functions of Other Receivables

Bulk actions can be run over the records marked with an asterisk or in a container from the Form - Bulk Actions.

Description of actions:

Posting key change |

For all marked documents in the container, it changes the values in the posting key field. |

Change Type of Tax |

Change Type of Tax |

Posting |

Bulk posting with account assignment |

Payment by Cash Register |

Pays the document by cash register automatically. Closer description is in the chap. chap. Invoice Payment - Automatic Payment by Cash Register and Internal Document . |

Payment by Internal Document |

The payment is done via an internal document automatically. Closer description is in the chap. chap. Invoice Payment - Automatic Payment by Cash Register and Internal Document . |

Scheduled payment date according to Delay |

Update of the Scheduled Payment Date according to Suppl./Cust. Delay |

Payment Recalculations |

The function for the bulk recalculation of Other Receivables payments. |

Revaluation to the Date of Balance |

This revalues Invoices on the date of balance by an internal document. Closer description is provided in the Accounting - Revaluation to the Date of Balance. |

Cancel Revaluation to the Date of Balance |

It cancels the revaluation to the date of balance. Closer description is provided in the Accounting - Revaluation to the Date of Balance. |

Change Acc. Trans. Date and Invoice Date |

The function enables to change the Acc. Trans. Date and the Invoice Date on unconfirmed documents. |

Functions over Other Receivables

Function description:

Ctrl+F3 |

In Payments tab the Browse will run recalculation of payments. |

Shift+F2 |

Automatic Payment by Cash Register |

Shift+F3 |

Automatic Payment by and Internal Document |

Shift+F5 |

This opens the form for creating reminders in the book. |

Ctrl+Alt+F5 |

The function enables to choose the document Status. |

Shift+F4 |

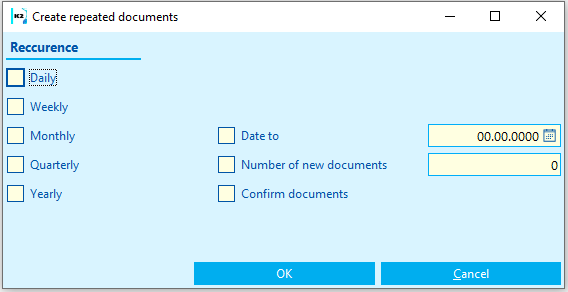

Create documents in bulk - repeated Other Receivables. |

Create Repeated Other Receivables

This function is designated for automatic generation of documents by "copying" the current document, when new documents differ from the current one only in the date. It is used e.g. for creating installments.

After activating the function (Shift+F4), the input form of the function will appear:

Picture: Form Create repeated Receivables function

In the initial form:

- specify the frequency of repeating - set the option Daily, Weekly, Monthly or Yearly,

- check and specify the Date To (Acc. Trans. Date to which the documents should be created) or check and specify the Number of New Documents,

- you can check Confirm Documents.

New documents, the Acc. Trans. Date of which will be set according to the selected frequency of repeating, will be created after pressing the OK button. Due Date will be set according to the number of maturity days in the default document.

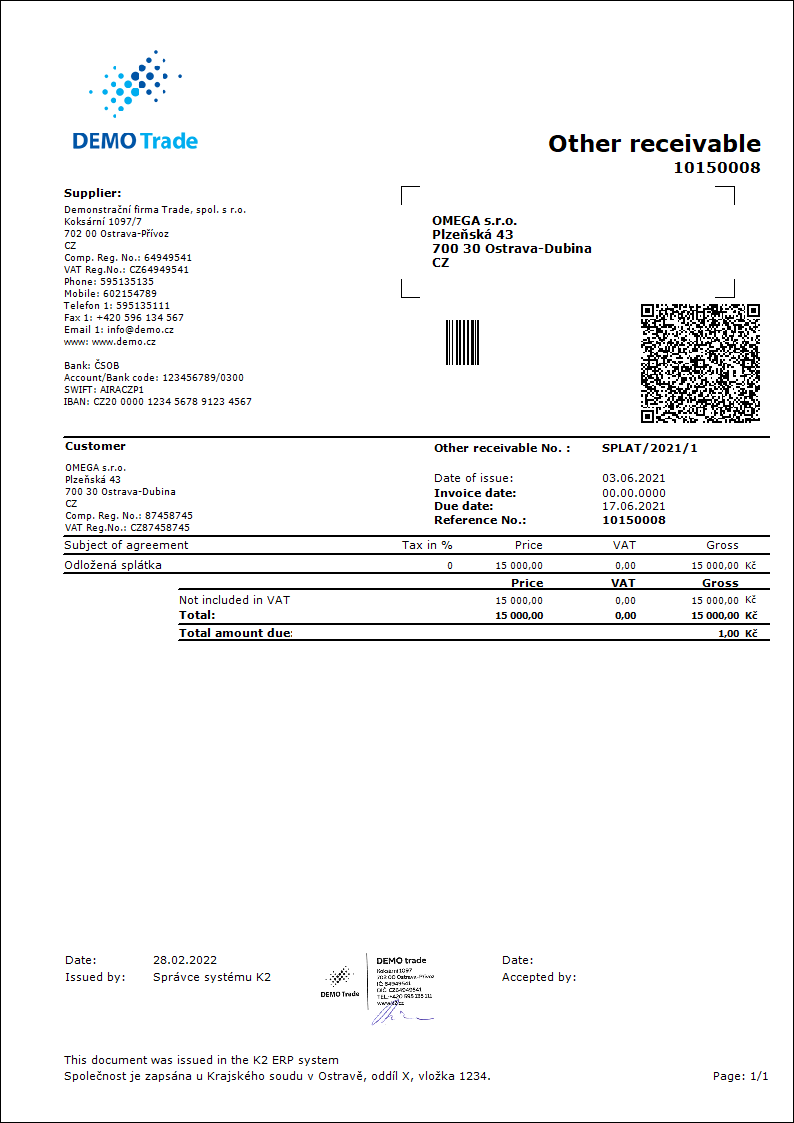

Reports - Other Receivables

Other Receivable

Process No.: ZAK019 |

Iden. Report no.: SZAK163 |

File: Other_Receivable01='AM' |

Report description: The report shows the Other receivable doc. |

||

Address in the tree: [Sale] [Other receivables] [Print the documents] |

||

Report parameters:

Assignment - No Yes - displays document posting (data from the page Posting of the document). |

BankContacts - 1 0 - information about a bank connection is not displayed; 1 - information is displayed only in the header; 2 - only in apart for items; 3 - information about a bank connection is displayed in the header and also in the part for items; 4 - 6 values correspond to the 1 - 3 values; just instead of a bank abbreviation the name of a bank is displayed. |

BarCode - Yes Yes - a bar code is displayed. |

CodeOfCurrency - No Yes - a code of currency is displayed (e.g. USD). No - the sign of currency is displayed (e.g. $). |

Contacts - 1;Addr;TaxNum;Tel1;Fax1;Email1;WWW The parameter has a total of 10 positions, the first three are fixed: 1. position: a user whose contacts from the user card (telephone, mobile, fax, email) are printed. Options: 0 - no user contacts, 1 - the user who has issued the doc., 2 - the currently logged in user, who prints the documents. 2. position: "Addr" - if it is specified, a company address is displayed. 3. position: "TaxNum" - if specified, the ID-No. and VAT Reg. No. are displayed. 4th - 10. position: listed types of electronic addresses of the own company (i.e. there may be up to 7 types). Example: (Contacts - 1;Addr;;TEL1;FAX1;WWW1): The Company Address will be displayed, behind which are the contacts from the user card, (tax numbers are skipped by an empty string on the 3rd place), then there are electronic addresses with Tel1 type, Fax1, WWW1. Note: If one piece of data is suppressed, there is no vacancy. Nevertheless, the default order in the report is always as follows: address, Tax No., user contacts, entered electronic addresses of own company. |

Description - No Yes - information from the Description field from the 1st page of the document is displayed. |

DraftLabel - Yes Yes - if a document is not confirmed, "DRAFT" text is displayed in the background of a report. No - "DRAFT" is not displayed. |

K2Info - Yes Yes - displays an informative text about the document issued by the K2 system. |

KeepEnvelopeFormat - No No - the blank space under a place for envelope window is hidden. The saved place is multiplied, if the "ShowBarCode" parameter is set on "No". Useful if the user does not use the window envelopes and does not want to fold the printed document into an envelope according to the cam line guide of a document. Yes - the place is not hidden - the line between items and the address part will always be in one third of the page. |

LangAccordToParams - No If the report has to be printed in a language that is set in the "Field Language" and "Report Language" parameters, you have to set the value of the parameter to "Yes". |

LeftEnvelopeWindow - No Yes - the address of a customer is printed on the right side (determined for sending documents by mail in abroad where a window for envelope is on the left side); No - the address of a customer is on the left side. |

LeftShift - 5 By how many mm the edge of the report is shifted to the left (sets the print on a printer). |

LogoPictureFooter - 0 Parameter adjusts the footer logo display. If the parameter is empty, the footer logo is displayed according to the parameter settings Picture in Footer in the function Administrator - Administration of Own Companies. 0 - nothing is displayed, but a place is kept vacant (for a header paper), 1 - neither picture nor free place. File name with png suffix - specific picture in the Pictures directory of the given company. |

LogoPictureHeader - The parameter corrects the logo header. If the parameter is empty, the header logo is displayed according to the parameter settings Picture in Header in the function Administrator - System - Administration of Own Companies. 0 - nothing is displayed, but a place is kept vacant (for a header paper), 1 - neither picture nor free place. The conditions are to set the parameter KeepEnvelopeFormat to No. File name with png suffix - specific picture in the Pictures directory of the given company. |

OwnCurrency - 0 In documents in foreign currency: 0 - displays just amounts in doc. Currency, 1- Exchange Rate is displayed; 2 - tax recapitulation that is recalculated into company currency is displayed; 3 - either recalculation of Tax recapitulation or Recapitulation Rate is displayed. |

ProportionalFont - Yes Yes - supplements are displayed in the Verdana font type, No - CourierNew font type. |

RefNoAsInvoiceNo - 01/01/2999 If the invoice date of a document (if the invoice date is zero, then acc. trans. date) is greater than or equal to a value in the parameter, then a value of a reference number instead of a document number is displayed in the report in the Registration number field. |

Sign - @Vyst;;; The parameter contains 5 positions: 1st position determines the person whose signature should be displayed. It may be a picture named according to the Logname of the user who has issued the document (@Vyst) or who prints the document - i.e. according to the current login (@akt) or the current Logname.

The value entered in the Stamp field in Administration of Own Companies is used by default. The path and the name of the file is entered here. The path may be entered by using the alias. Instead of entering the specific file name, it is possible to use %s. The picture must always be in the xxx.png format. If it is not filled in the Administration of Own Companies, the file will be searched in the Picturesdirectory.

An example of an entered task in the Stamp field in Administration of Own Companies: via alias: k2*DEMO\Pictures\stamp.png (searches the picture in the Client's path. The file stamp.png in the Pictures directory) via %s: k2*DEMO\Razitka\%s.png (the value entered this way enables to display signed bitmaps to all users who issue documents or are currently logged in and have the file in the PNG format in the directory (in this case the user created Stamp directory).

2nd position: picture height. 3rd position: distance from the left edge. 4th position: distance of a picture from the upper edge of the given section. 5th position: picture width. Example: (Sign - @vyst;27;47;0;83) prints the signature of the user who has issued the document, height is 27 points, left indentation of 47 points, by the upper corner. The picture is 83 points wide.

If the parameter is set to 0, the stamp will not appear. |

SupplFromCustomer - 0 - Nothing is displayed, Empty value - a Business Text from a Customer card is displayed. If the parameter is filled in, and if there is an existing comment type on the Customer card that is identical to the parameter value, the text of this comment is displayed. If the given comment type does not exist, the entered type of supplement from the notes on the Customer (e.g. the DZ type). If both comment and supplement type are identical, the comment has priority over the supplement. |

SupplFromClient - TEXT The TEXT value displays information from the General information field from an own company. Otherwise it displays supplement type from the Client parameters. |

Title - The entered value of the parameter is displayed as a report title. If the parameter is empty, the original name of the document is printed. |

List of Other Receivables

Process No.: ZAK019 |

Iden. Report no.: SZAK164 |

File: Other_List.AM |

Report description: The report displays a List of other receivables. |

||

Address in the tree: [Sale] [Other receivables] [Print the documents] |

||

Report parameters:

NoInteractive - No Yes - does not display the introductory form. |

ReportId - 0 0 - sorting by document number; 1 - sorting by acc. trans. date; 2 - sort by due date; 3 - sorting by gross amount, 4 - sorting by Comp. Reg. No., 5 - sorting by Currency, 6 - sorting by Suppl./Custm., 7 - sort by invoice date, 8 - sorting by cost center. |

ShowBothCurr - Yes Yes - displays amounts in advance currency and also in company currency. |

ShowCustContrAbbr - Yes Yes - display company abbreviation; No - display company name. |