Cash Discount

Cash Discount is important for providing the sales, which are connected with invoices payments in time limit, either in sale, or in purchase.

You can set the parameters for sale and purchase in Cash Discount function. You can run the function from the tree menu Finance - Cash Discount.

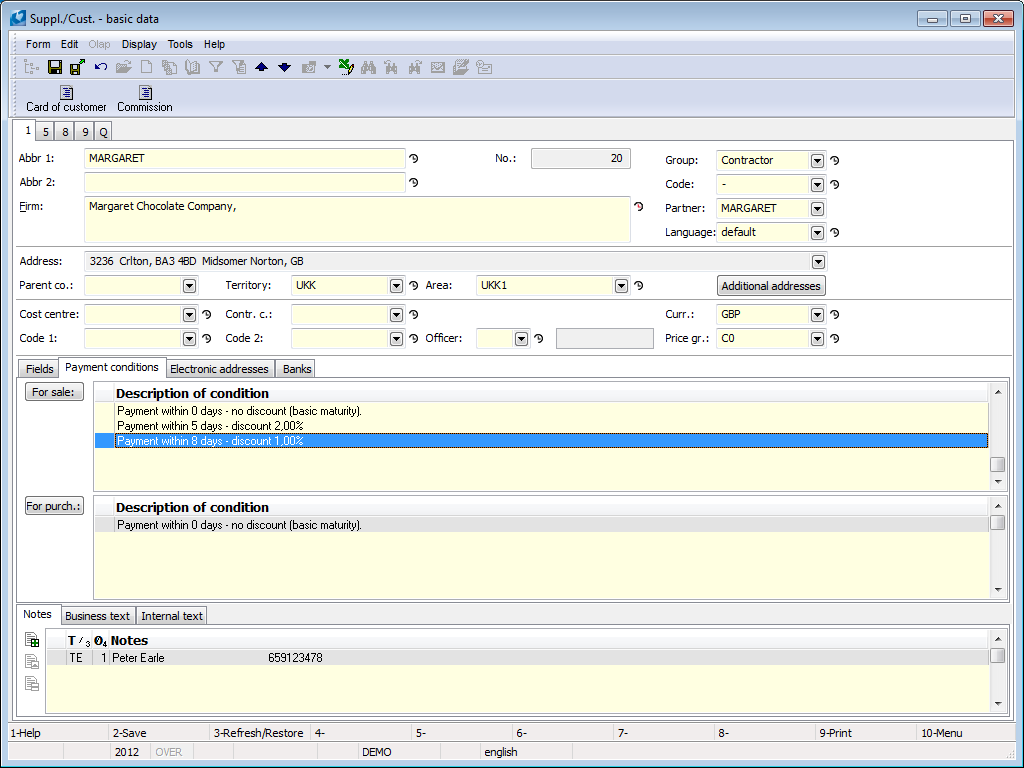

You can define payment conditions (percentage sales), which are used during payment in time limit (related to issue date of an invoice), for particular customer and suppliers on the Suppl./Cust. card. You can change payment conditions on sales orders / orders and invoices.

Once the invoices have been paid within the specified time limit, a cash discount is applied by means of the Apply cash discount - Sale and Apply cash discount - Purchase functions, which may be run from the tree menu Finance - Cash Discount or over the selected invoices by means of Form - Bulk actions. There is a function to print the Invoices list - Cash Discount in the initial form.

Cash Discount uses corrective internal documents - the first document pays invoices, the second one uses a cash discount. These document can not be undo-confirmed manually.

The Cash Discount - Credit note report (INT_DOC03.AM) can be printed on the corrective internal document.

The applied Cash Discount can be cancelled by using the Cancel application of cash discount function which may be run over the selected invoices by means of Form - Bulk actions.

By means of Update payment conditions on sales and purchase order function (Skonto_change_by_baz.PAS) you can update payment conditions accor. to Suppl./Cust. card on sales orders and purchase orders.

Cash Discount Settings

Before a cash discount may be applied, it is necessary to set:

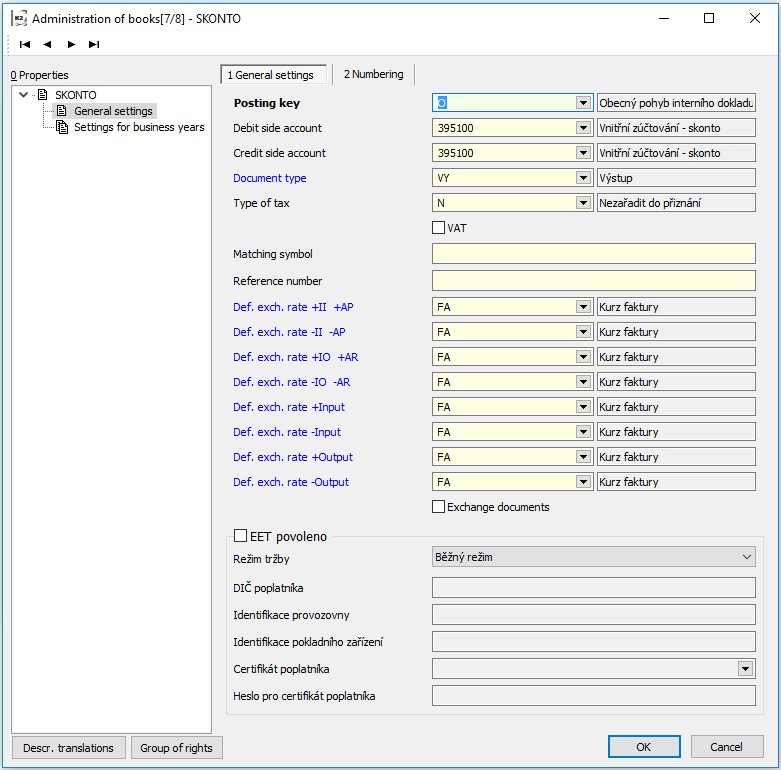

1. Book of internal documents where a cash discount will be applied. In a general setting you can set:

- Posting key = "O" - general movement of an internal document,

- MD account = "395xxx" - internal accounting,

- D account = "395xxx" - internal accounting,

- Document type = “VY”.

Picture: Setting of the Book of internal documents to apply the cash discount

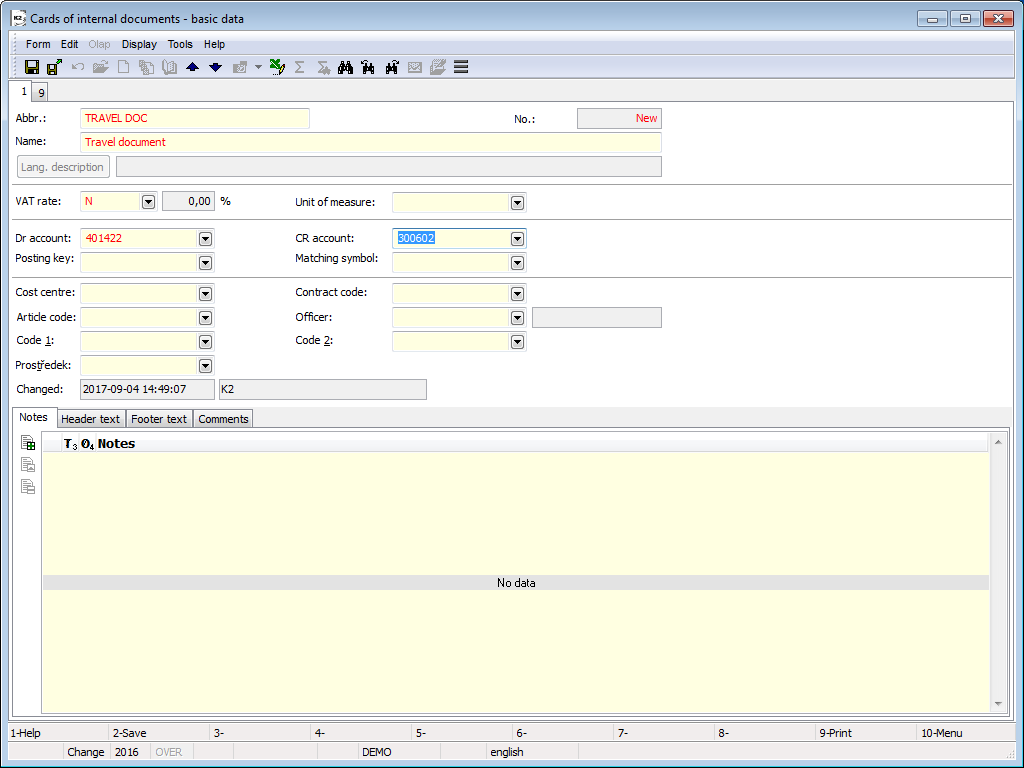

2. Card of internal document to apply cash discount - separately for sale and purchase (a code list can be open from the tree menu Accounting - Internal Documents - Card of internal documents). Enter D account = "568xxx" for the card for sale and for purchase just enter MD account = "668xxx".

Picture: Card of internal document to apply Cash Discount - Sale

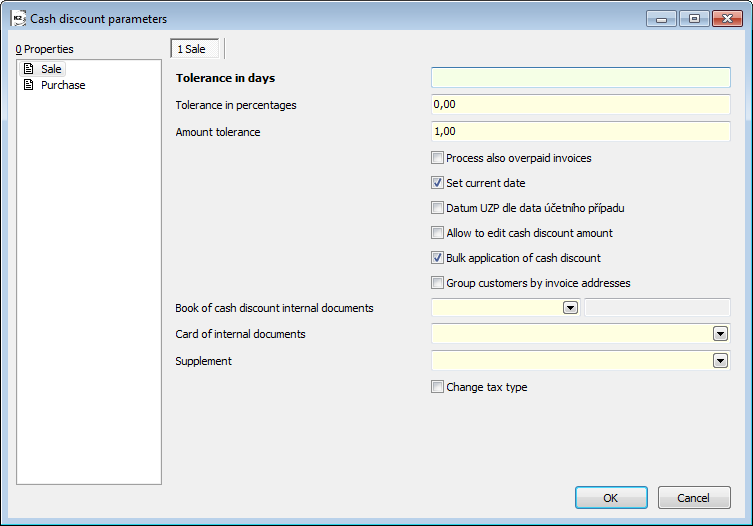

3. Cash Discount parameters - separately for sale and purchase. You can run it from the tree menu Finance - Cash Discount - Cash discount parameters.

Picture: Cash discount parameters - Sale

Parameters' description:

Tolerance in days |

Either invoices paid the entered number of days after cash discount deadline have been processed. |

Tolerance in percentages |

Either invoices paid with another amount than those accor. to cash discount conditions - tolerance by percentage, will be processed. |

Amount tolerance |

Either invoices paid with another amount than those accor. to cash discount conditions - tolerance by amount, will be processed. If the Tolerance in Percent parameter is specified together, the value of this parameter is not taken into account. |

Process also overpaid invoices |

When the parameter is on, invoices that are overpaid will also be processed, which contain the cash discount conditions and the cash discount will not be applied. |

Process overpaid invoices regardless of tolerance |

If switched on, invoices overpaid with amount higher then set tolerance will be processed. |

Set current date |

When the parameter is on, the cash discount internal documents will be issued with the current date. If turned off, documents are issued with date according to the last payment of the invoice. |

Tax point date according to Acc. transaction date |

When the parameter is on, the Tax point date on the cash discount internal document is the same as the Accounting transaction date, otherwise it is zero. The parameter is taken into account only if the Set current date parameter is off. |

Allow to edit cash discount amount |

When the parameter is on, you can edit the amount in the Cash Discount column in the Apply cash discount form. |

Bulk application of cash discount |

When the parameter is on, cash discount will apply with one document for all invoices issued to the same business and currency. |

Group customers by invoice addresses |

When the parameter is on together with Bulk application of cash discount parameter, companies will group by invoice address on invoices. |

Book of cash discount internal documents |

Book of internal documents where a cash discount will be applied. |

Card of internal documents |

The internal documents card, which is inserted into the items of cash discount internal document. |

Supplement |

Supplement with predefined text that is inserted into the Footer text of the cash discount internal documents. When the text is not predefined, the text insert into document "Reason for correction: Cash discount". |

Change tax type |

When the parameter is on, by applying cash discount will be created a correction document with the "TV" type of tax to the invoice with tax type "TU" , a correction document with the "T2" tax type is created for the invoices received with the "TK" type of tax. |

Setting payment conditions, billing

Sale:

Example: The customer has a claim to cash discount 2 %, if he pays for the goods within 5 days and 1 % if he pays within 8 days from the date of issue invoice. The customer takes goods off in the total value 15,000 CZK + 20% VAT. He pays invoice 3 days after the invoice has been issued.

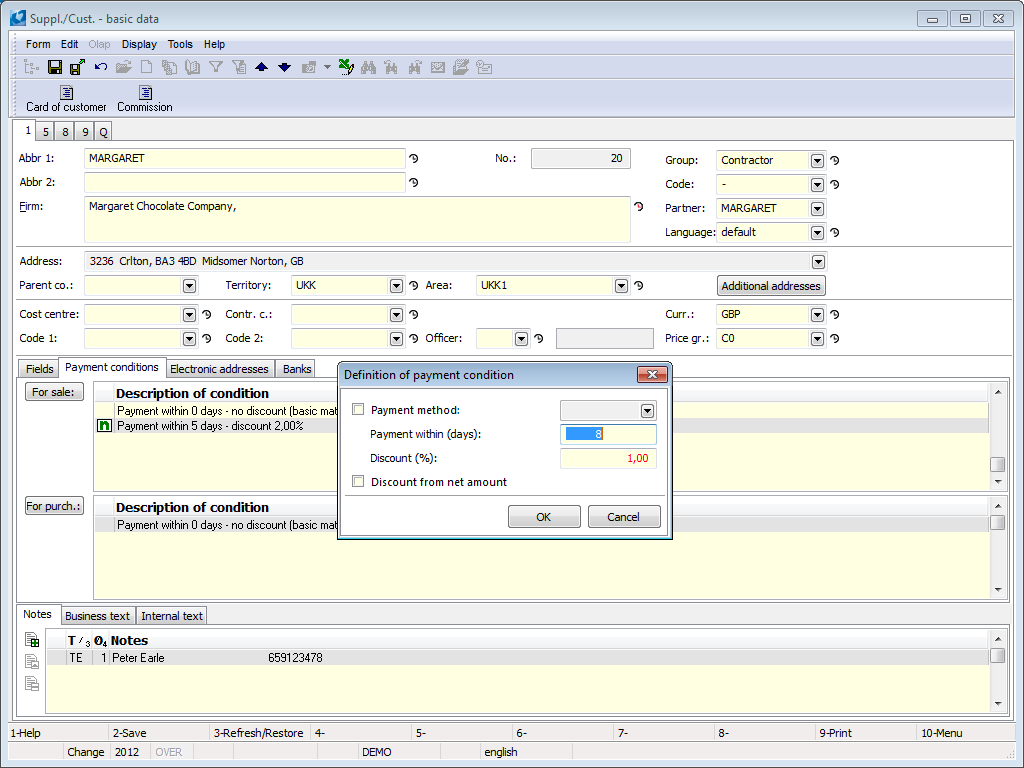

- On the Suppl./Cust. card you will define conditions for cash discount. In Change mode on the 1st page on the Payment conditions tab, press the For sale button - the payment terms for sale will be displayed. Enter "5" in the field Payment within (days) and enter "2" in the field Cash discount (%). In the second row enter 8 days and 1 % in the same way.

Picture: The Define payment conditions form

Note: The cash discount can be calculated not only from the Gross amount of the invoice but also from the Net amount. The method of calculating the cash discount is selected directly in the form for defining payment conditions (Cash discount from net amount).

Picture: The defined payment conditions for Cash Discount 2 % and 1 %

- Issue a Sales order in the Sale module. The payment conditions are automatically added to the order from the customer. Payment conditions can be edited for the specific sales order.

- Issue an invoice to a sales order. Payment conditions from the sales order will be automatically copied to the invoice. Payment conditions can be edited. Confirm the invoice.

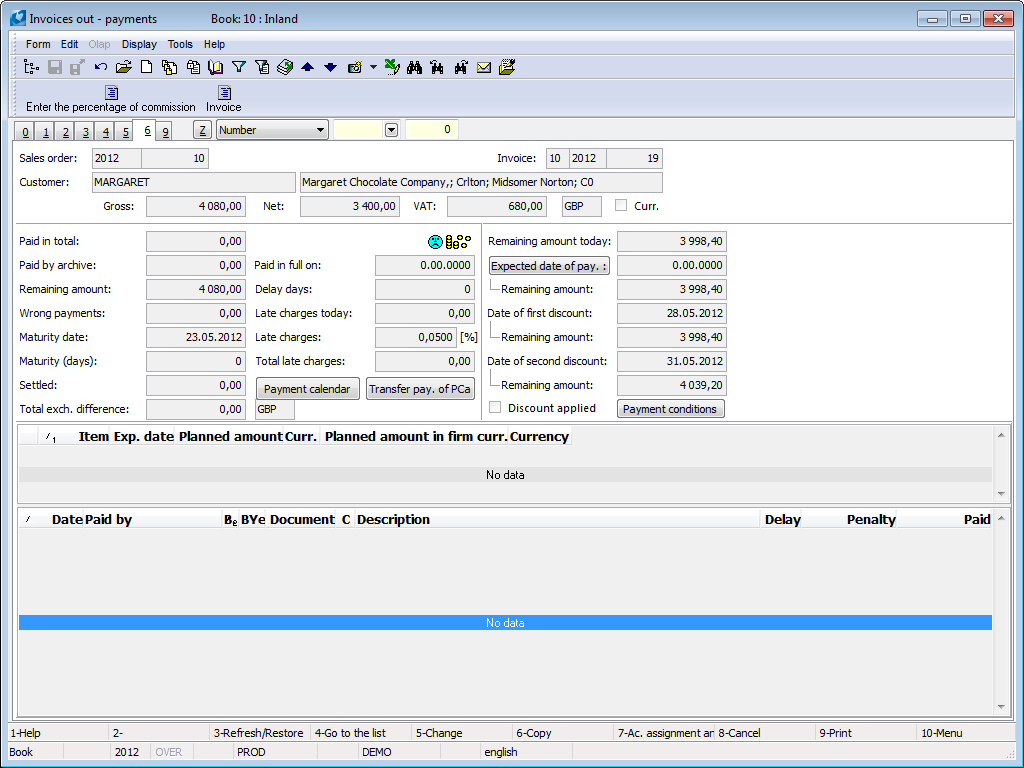

- On 6. page of invoice , the amounts decreased by a percentage rebate of the discount and a date till when you have to pay the invoice are available. It is for purpose to provide an appropriate discount to the customer.

Picture: Invoice Out - 6th page

Purchase - the procedure is analogous to the Cash Discount for Sale:

- Add payment conditions for purchase on the selected supplier's card.

- We will create an purchase order for goods from a supplier that will give us a discount in case of early payment.

- The payment conditions entered in the supplier are automatically saved in the purchase order. They can be edited for the specific purchase order.

- Create an invoice in. Automatically copy the payment conditions from the purchase order and you can still edit them.

- On 6. page of invoice , amounts and dates are available that match the individual cash discount conditions.

Apply Cash Discount

Cash discount for Sale

Example: The customer has a claim to cash discount 2 % if he pays for the goods within 5 days and 1 % if he pays within 8 days from the date of issue invoice. During the month, we billed the customer for 3 deliveries, including 1 under the reverse charge procedure. All invoices are paid by a customer within 5 days after the invoice has been issued.

How to apply Cash Discount:

- After payment of invoices by the customer, we will use from the tree menu Finance - Cash discount function Apply cash discount - sale, which will look for unpaid invoices meeting the cash discount conditions (only searches between confirmed invoices that have defined cash discount conditions).

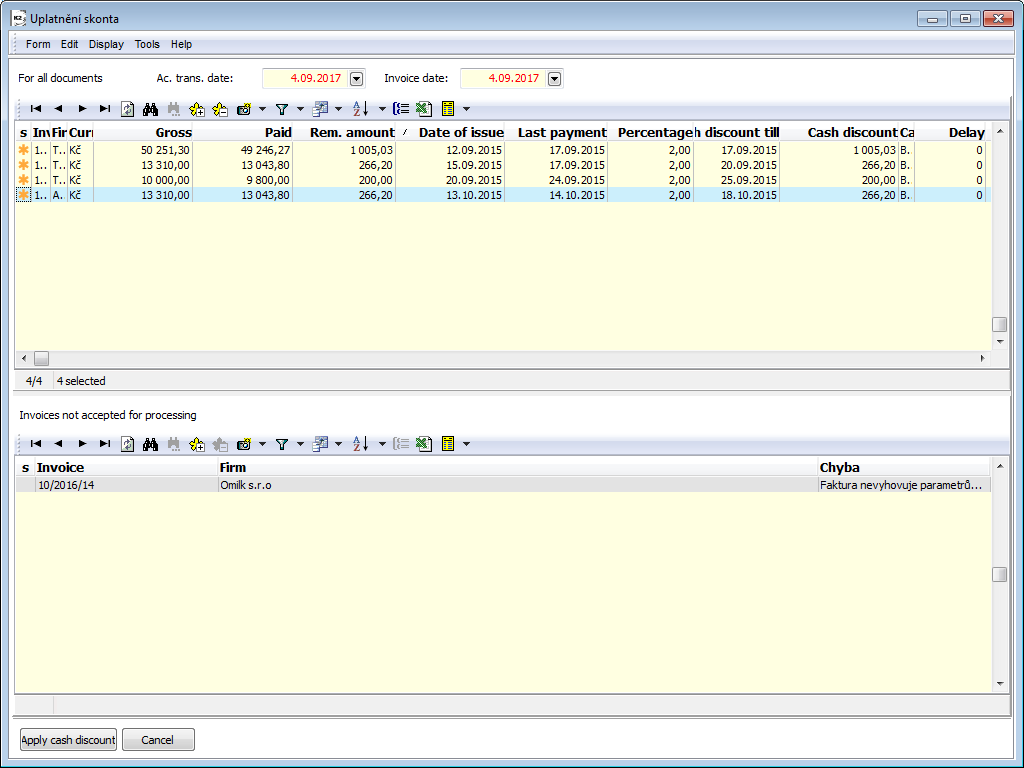

- A form within voices that are appropriate for applying cash discount will appear. There is the text "For all documents" in the upper part of a form. (If you run the function over the selected invoices via Bulk actions - Apply Cash Discount, the text "For selected documents" text is displayed - the function searches only among the selected invoices.)

Picture: Input form Apply Cash Discount

- Any unpaid invoice that meets these conditions is marked with an asterisk. When you want to apply a cash discount for the invoice, the document must be marked with an asterisk.

- When the parameter Set current day is on in the Cash discount parameters, you can enter Account transaction date and Invoice date for the correction documents.

- When you press the Enter key on the invoice line, an invoice book appears with the ruler on the record.

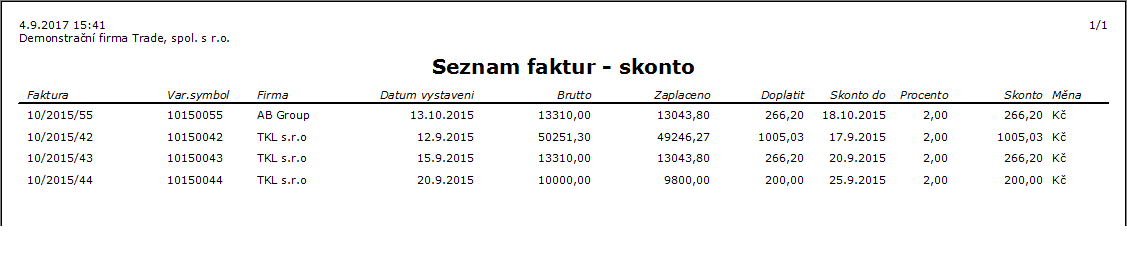

- There is a function to print the Invoices list - cash discount in the initial form.

Picture: Automatic report Invoices list - cash discount

- At the bottom of the form there are documents that are not accepted for processing - the invoices on, which the cash discount conditions are entered and the cash discount is not applied, are partially paid but do not suitable for the apply cash discount.

- Corrective documents are created after pressing Apply Cash Discount button. When the parameter Bulk application cash discount is on, two internal documents are created for each business and currency - one pay invoices, the other apply cash discount..

- To apply a cash discount the field Cash Discount applied is being checked automatically on the 6th page of a particular invoice.

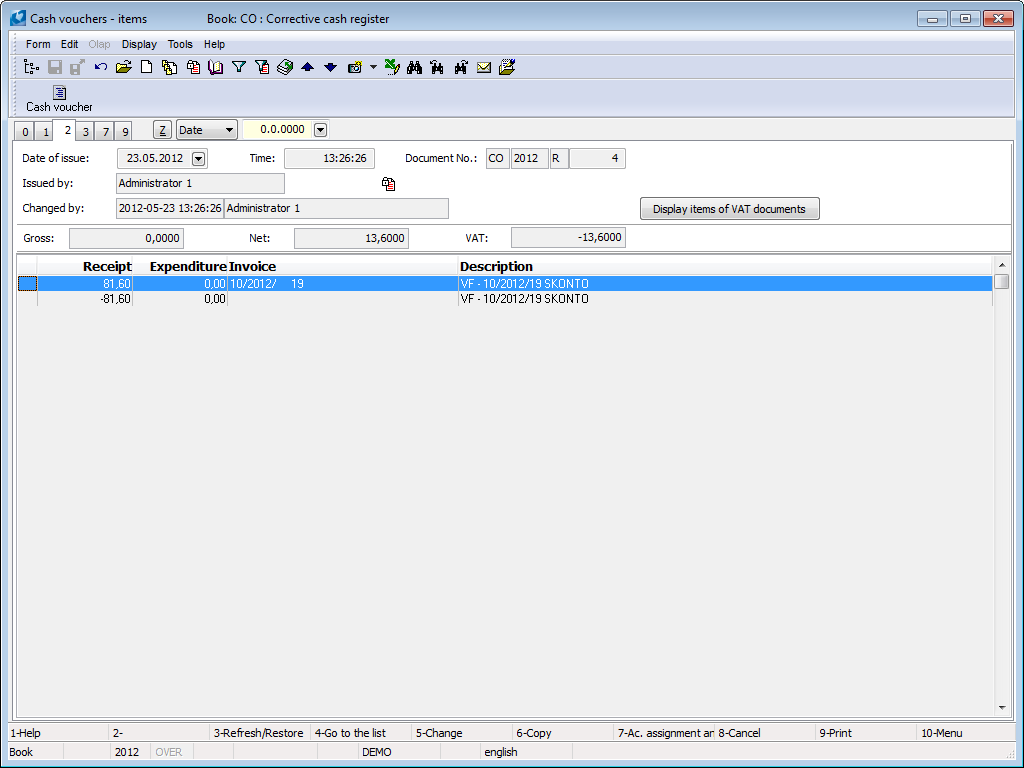

Picture: Internal document - payment of invoices - 2nd Page

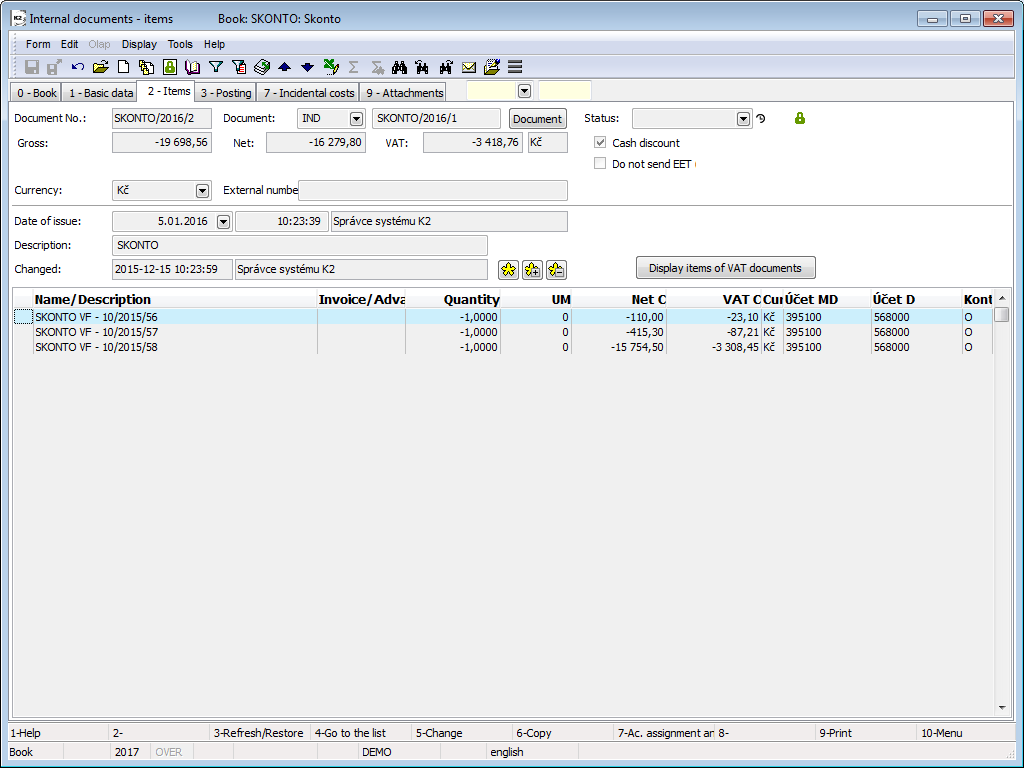

Picture: Internal document - Apply Cash Discount - 2nd Page

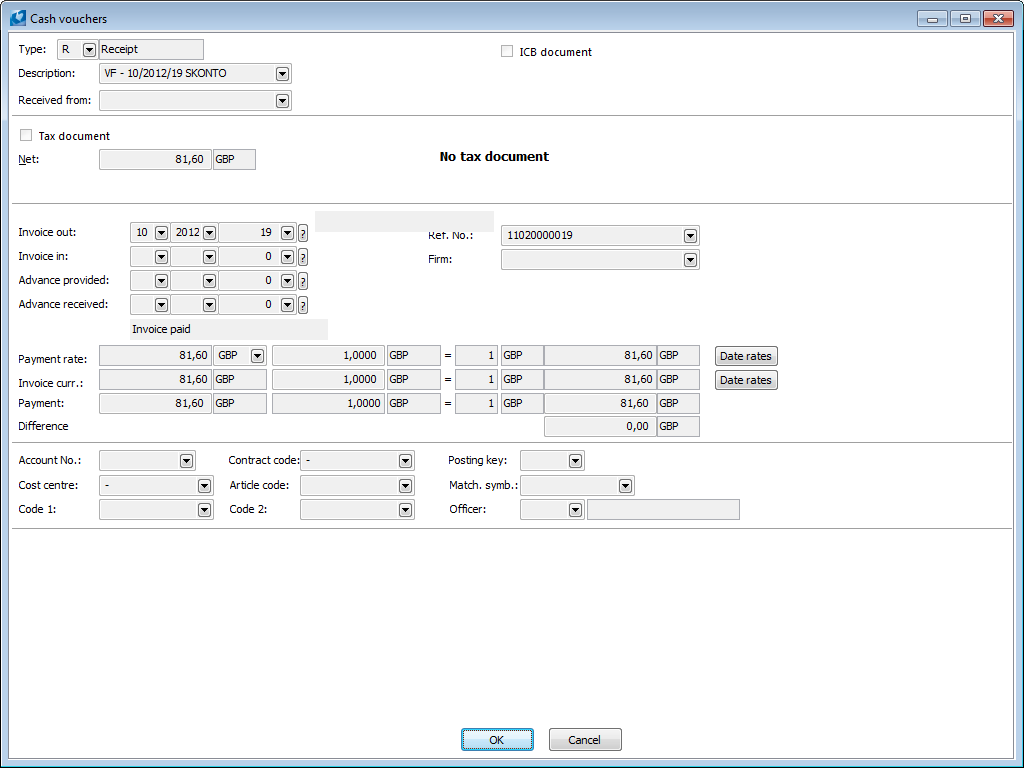

Picture: Internal document item - apply Cash Discount - performance with VAT

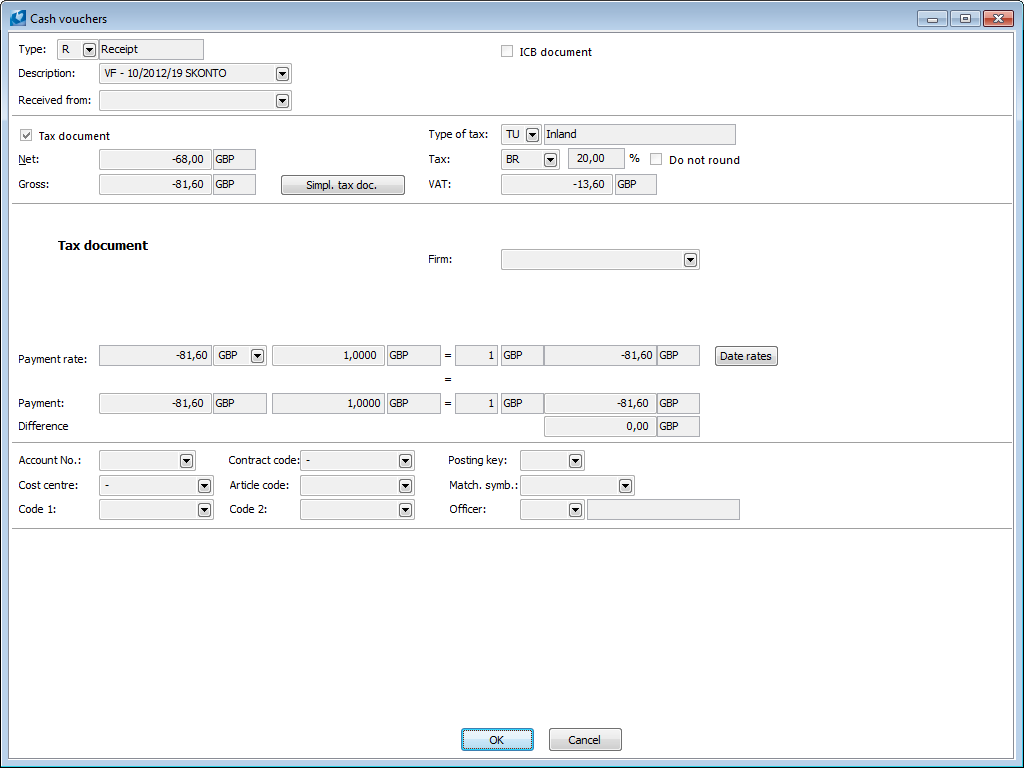

Picture: Internal document item - apply Cash Discount - performance without VAT (e.g. mode PDP)

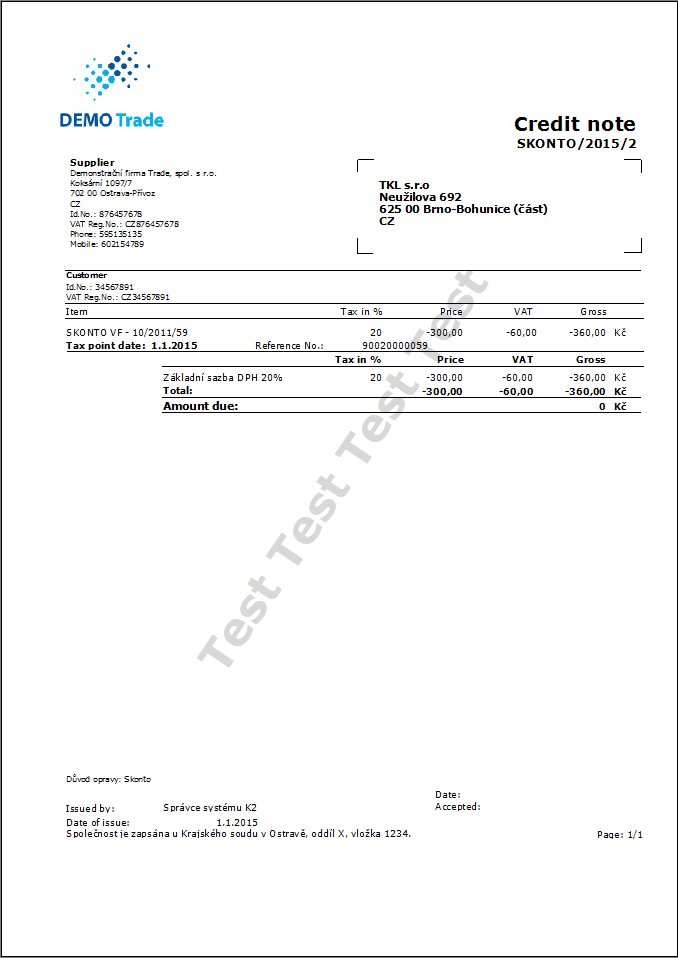

- Print the Credit Note report on an internal document on which a Cash Discount is applied.

Picture: The Credit Note report

Notes:

- If you want to apply a cash discount, the flag Cash Discount will be checked automatically on internal documents - these documents are not able to undo confirm manually. For confirming these documents Finances/Cash Discount/Un-confirm Cash Discount document right is required.

- Into the field Document in the header of an internal document, which is applying the cash discount, just insert a link for the internal document, which pays the invoice.

- If the parameter Bulk application cash discount is off, 2 internal documents are created for each business and currency - one pays invoices, the other applies a cash discount.. Into the field Document in the header of an internal document, which pays an invoice, just insert a link for the invoice, which pays the invoice (internal document is displayed on the 1st page of invoices on Internal documents tab).

Posting - 1 st internal document - payment of invoice(s):

Corrective internal document - invoice payment |

395/311 |

Gross amount |

Posting - 2 nd internal document - payment of cash discount(s):

Corrective internal document - Net |

395/568 |

minus Net amount |

Corrective internal document - VAT |

395/343 |

minus VAT amount |

Cash discount for Purchase

The procedure to apply Cash Discount is analogous to the Cash Discount for Sale:

- From the Finances - Cash Discount tree menu run the Apply Cash Discount - Sale function, which searches for unpaid invoices that meet the discount conditions.

- A form within voices that are appropriate for applying cash discount will appear. There is the text "For all documents" in the upper part of a form. (If you run the function over the selected invoices via Bulk actions - Apply Cash Discount, the text "For selected documents" text is displayed - the function searches only among the selected invoices.)

- Any unpaid invoice that meets these conditions is marked with an asterisk. When you want to apply a cash discount for the invoice, the document must be marked with an asterisk.

- When the parameter Set current day is on in the Cash discount parameters, you can enter Account transaction date and Invoice date for the correction documents.

- When you press the Enter key on the invoice line, an invoice book appears with the ruler on the record.

- There is a function to print the Invoices list - cash discount in the initial form.

- At the bottom of the form there are documents that are not accepted for processing - the invoices on, which the cash discount conditions are entered and the cash discount is not applied, are partially paid but do not suitable for the apply cash discount.

- Corrective documents are created after pressing Apply Cash Discount button. When the parameter Bulk application cash discount is on, two internal documents are created for each business and currency - one pay invoices, the other apply cash discount..

- To apply a cash discount the field Cash Discount applied is being checked automatically on the 6th page of a particular invoice.

- Print the Credit Note report on an internal document on which a Cash Discount is applied.

If a Cash discount is applied on invoices in with the type of tax for which VAT self-assessment is being made (e.g. a reverse tax credit, acquisitions from the EU ...), self-assessment of VAT is automatically created to the internal document to which the cash discount is applied.

Posting - 1 st internal document - payment of invoice(s):

Corrective internal document - invoice payment |

321/395 |

Gross amount |

Posting - 2 nd internal document - payment of cash discount(s):

Corrective internal document - Net |

668/395 |

minus Net amount |

Corrective internal document - VAT |

343/395 |

minus VAT amount |

Cancel application of cash discount

The function Cancel application of cash discountis defined for cancelling of cash discounts that have been applied. Runs over Form - Bulk actions over selected invoices, where the cash discounts have been applied.

The function is able to unchecked the field Cash Discount applied on the 6th page of invoices and it cancels internal documents created by cash discounts. If the cash discount has been applied in bulk, the applying of all invoices that are on one document together with selected invoice will be cancelled.

Update of payment conditions on commissions and sales orders

This function will run an update of payment conditions on unconfirmed commissions or orders; in case of payment conditions being changed on the card of chosen supplier/customer. It is accessible from the tree menu module Finances - Functions - Update of payment conditions on commissions and sales orders or in book Reports in F9 under the key word Cash discount.