Sale Methodologies

Calculation VAT From Above Method in the K2 IS

This methodology is used in Sale only. Using it brings the following restrictions:

- it is not possible to edit the price without the tax and to enter an absolute discount (only the percentage one) on the doc. item with the flag of VAT from above,

- it is not possible to edit the tax summary manually.

You can activate the VAT Calculation From Above option in the Books of Sale and edit it on Sale documents. The following applies:

- The flag is set by the Books of Sale when you create a Sales Order, a free Invoice Out, or an Advance Received.

- If you create an Invoice Out or an Advance Received to a Sales Order, the flag settings is taken from the Sales Order.

- The Net price will be added, the Gross one does not change upon turning on/off the checkbox on the form.

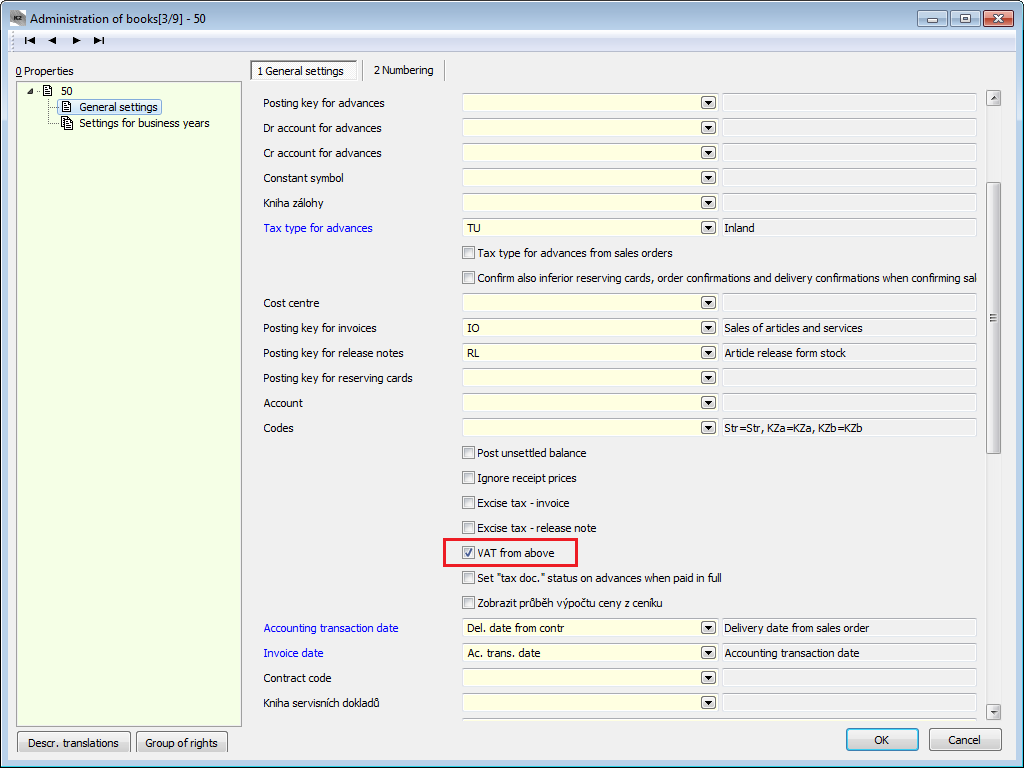

Settings in Books of Sale

Check the VAT calculation from above flag in the Books of Sale. This flag is set into all the periods of the same book automatically and his value is copied into all newly created superior or free documents of sale.

Picture: Settings of VAT from above calculation

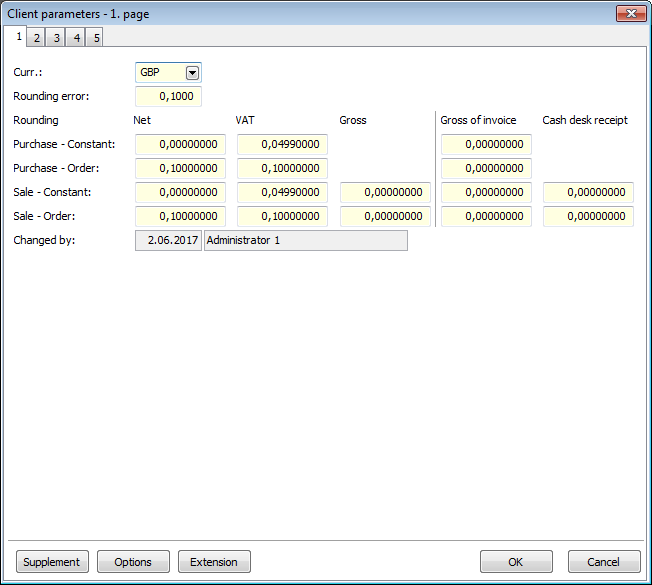

Settings of Rounding in the Administration of Own Companies

In the Rounding tab in the Administration of Own Companies, perform the rounding for this method of calculation in the Gross row of the Invoice (for the VAT calculation from above).

Picture: Settings of Rounding in the Administration of own companies in the Client Parameters

The settings define how to round the price with taxes in particular rows of tax summary. The rounding of the VAT amounts in the VAT column will also be useful. If you usually have multiple tax types on one document, it is better to opt for more specific rounding, as this settings affect each line. If you choose the whole GBP, the rounding differences can be almost 1,50 GBP compared to the sum of particular items in a document with more than three tax types.

Cession of Receivables

In this chapter, cession of receivables from the original creditor (cedent) to a new creditor (cessionary) is described.

Commission

Commissions enable the K2 IS users to keep information about their business activity based on trading via Sales representatives. One may assign Sales representatives to individual customers and define the percentage of the representatives' commission. The commission percentage belongs to the given representative if a business deal is made. It is also possible to display invoices with commissions during a defined period, or to view selected Sales representatives, including the amount of their financial reward.

Commission - Example

The example described in the following chapters demonstrates the individual stages of processing commissions. The first step is to select the commissions on a Customer card. The second part describes a variant, in which we pay the commission after issuing an Invoice regardless of the Invoice amount and of whether the Invoice is paid by the customer. The other variant is related to paying out commissions based on the amount paid for the Invoice. This option is described in the following chapter. A detailed explanation of the 'Commission Processing' form and the option to print the 'Overview of Acknowledged Commissions' is stated at the end of the example.

Example: Assign a Sales representative P003 (MSc John Smith) to the customer Demo Ltd.. Z This representative can claim 5% out of each deal.

Procedure:

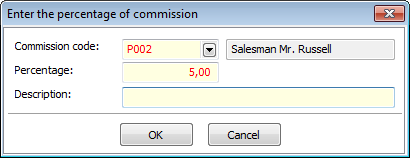

- On the selected Customer card, run the Commission function (the Enter the Commission Percentage script - PROVIZEPROC.PAS), which will create a note of the 'PP' type for the given customer. Define the data about commissions into the form.

Picture: Inserting the percentage of a commission

Field description:

Commission Code |

Select a Sales representative from the list, who will be in charge of the given customer. You may also click on the field and create a new Sales representative with the Ins key. |

Commission Percentage |

The amount of commission in Percentage. |

Commission Description |

A brief description of the commission. |

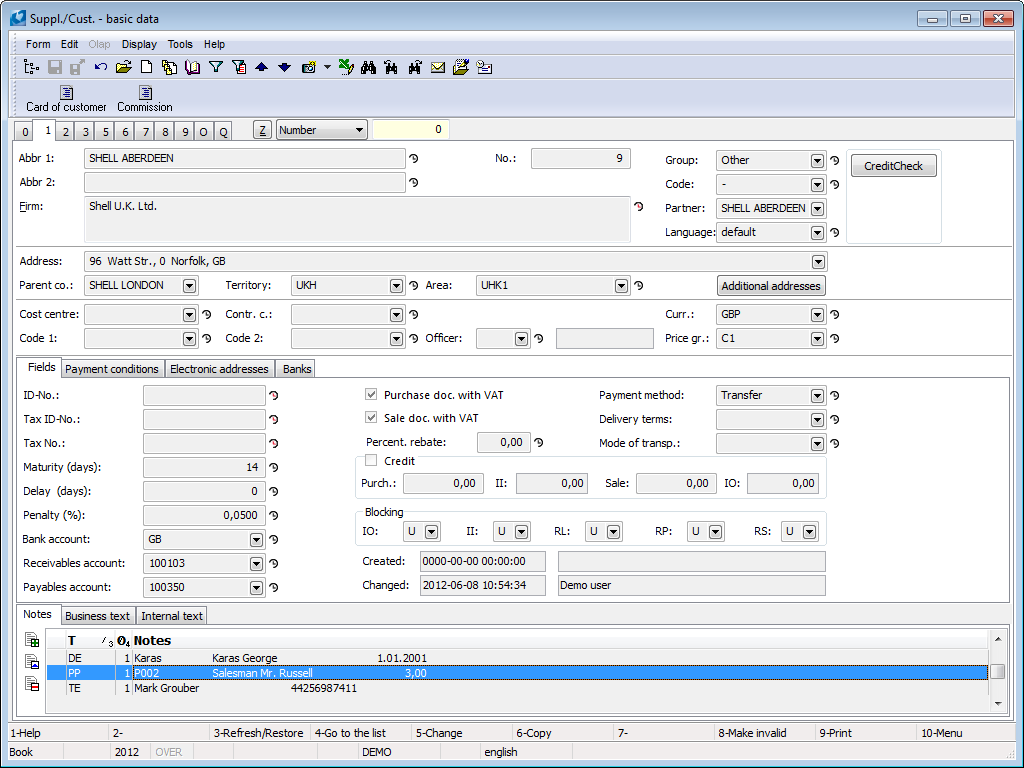

- After pressing the OK button, a note of the 'PP' type will be inserted into the notes on the Customer card.

Picture Inserting the 'PP' type of note

Note: If you wish to transfer the entry access right to the note as well, save the group's ID (the value of the Cis field) into the parameter of the above-mentioned script. The script with the parameter set this way may be activated only by those with the entry access right.

- In the Sales module, we will issue an order worth 100,000 CZK. After saving the Sales Order, a note for the commission will be inserted to the 1st page.

- Issue an Invoice to the customer. After saving the Invoice with F2 or confirming it, a note from the Sales Order will be pasted to the created Invoice.

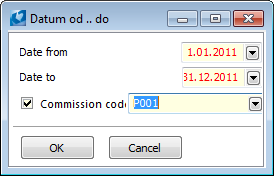

- The Invoices with Commission Filter (FILTRPROVIZE.PAS) function activated over the book of Invoice Out serves to filter invoices with commissions according to the user-selected period. After checking the Commission Code field, you can specify a Sales representative whom the Invoices will relate to. Not checking the field will result in inserting the Invoices related to all Sales representatives into container.

Picture: The open form of the function Filter of Invoices with Commission

- After pressing the OK button and switching into the Container mode, the Invoices with commissions will be displayed.

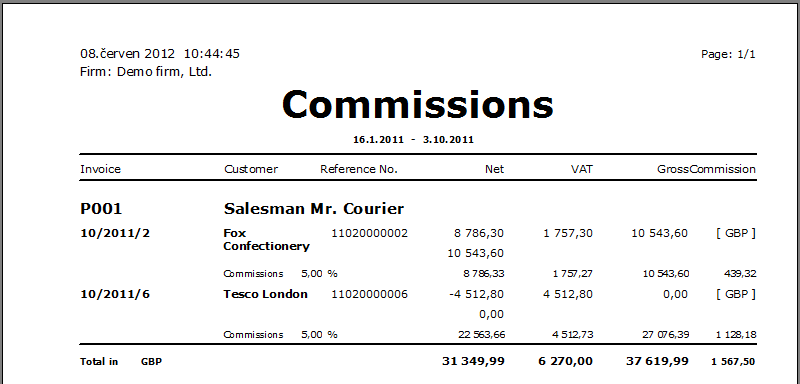

- We can display the respective Invoices by running the List of Invoices Out by Commission report. The Commission column will show the amount belonging to a given Sales representative from the particular Invoices. In our case, it is June 5. 100/000 CZK.

Note: Commissions are always copied from the preceding step. If there is no note stated there, this step is skipped. I.e. if there is no note of the 'PP' type on the Invoice, the note will be loaded automatically from the Sales Order when activating the 'Commission' function. If it is not even there, it will be pasted from the customer. If the commission is not entered at the customer as well, a blank form will open.

Note: 2: If there are more notes of the 'PP' type existing, only the 1st found one will be processed in the documents.

Excluding commission from some sales item:

If we enter a note with the commission code '-’ and some rate (0%) in the Articles or sales item tab, the turnover of these articles will count towards the entered percentage (0%). This includes situations of e.g. transport fees, Advances, etc., for which you do not add a commission to Sales representatives.

Suggestion for user adjustment:

On the Article tab, we can enter a note with the commission code of various representatives, or we can add a note of the given representative to the sales item, but with a different rate than the one in the header. In this case, the given item will calculate with the other entered rate. This allows you to influence various rates of commissions for various kinds of assortment, even when related to various Sales representatives. However, this variant is not set by default.

Picture: The List of Invoices Issued by Commission report

Example: Claims for commissions are evaluated once per month. Mr Smith can claim a commission for an issued Invoice for the Demo Ltd. company in the amount of 5% from 100,000 CZK. You want to note down into the system that the commission has been acknowledged in April 2007 in full amount (i.e. 5,500 CZK).

Procedure:

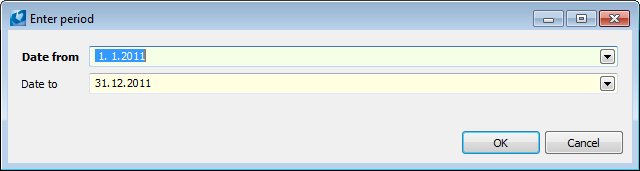

At the end of the month, run the Acknowledge Commissions function. Fill in the period which the Invoice must belong to into the initial form, so that the Invoice may be evaluated. E.g. if your internal methodology defines that the commission will not be acknowledged if the Invoice is older than a year, limit the selection of Invoices in this form.

Picture: Selecting a time interval for evaluation

After selecting the time interval, a form will appear, into which all the confirmed Invoices whose invoice date falls into the interval will load (in the case of evaluating regardless of the payment).

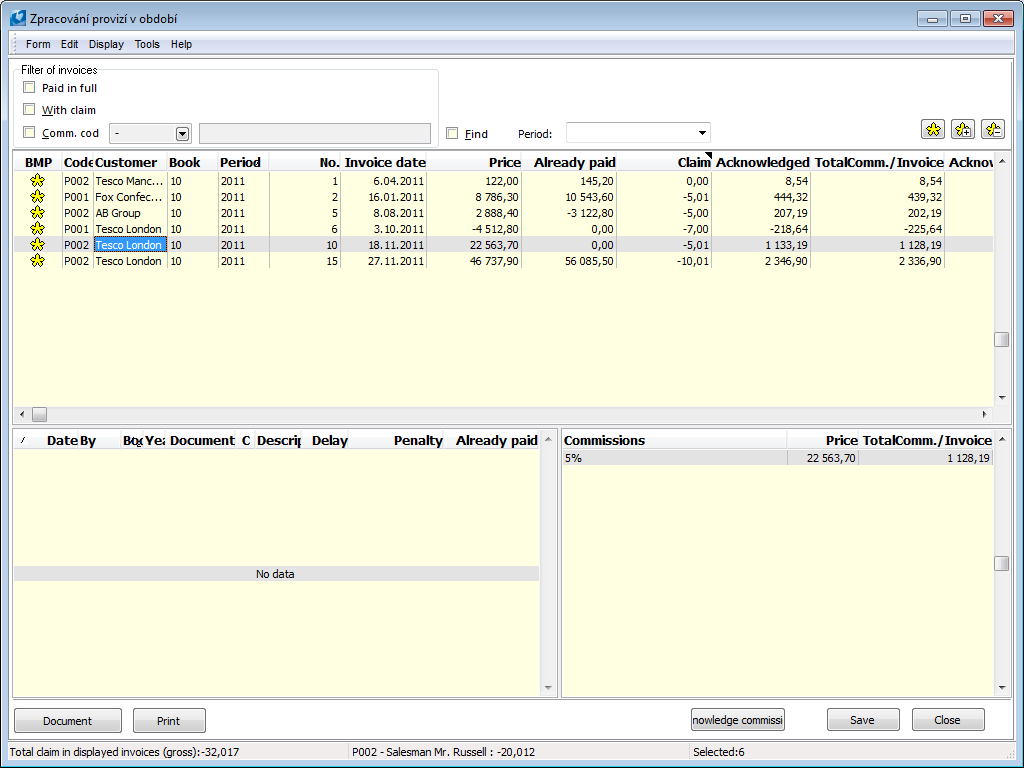

Picture: The Acknowledge Commissions form

In the upper part of the form, you can see an overview of Invoices corresponding to the initial conditions and selected crosses. Only the marked Invoices will be accepted. To indicate the invoices, use the buttons on the right.

The lower left part shows payments relevant to the Invoice on which the light indicator is situated in the upper part; an overview of the total commission amount stated to the same Invoice is situated on the right.

The Document button will show a preview of the Invoice which the light indicator is situated on. The Print button will print the Acknowledged Commissions report (its closer description is provided below). The Acknowledge Commissions button will prepare the notes of the 'PU’ type for saving. These notes contain information about the acknowledged amount of the commission, and the date and period to which the commission has been acknowledged. At the same time, it will edit the values in the upper part of the form according to the acknowledged commissions. The Save button will save all the above-mentioned notes in the K2 IS. If you are not satisfied with the result of the acknowledgment, you can close the form with the Close button without saving the changes. The notes is listed in IS K2, and everything will be restored to the previous state when restarting.

The total of all commissions on displayed selected Invoices may be seen in the last row, i.e. if we had now acknowledged the commissions, how many of them would actually be acknowledged. The other information displays the same information only for the Sales representative from the Invoice on which the light indicator is positioned. The last field shows information about the number of marked Invoices.

Description of selected fields and columns of the upper part of the form:

Paid |

Shows only at a fully paid Invoice. You may pre-set the cross with the chbPaidInFull parameter. |

With Claim |

Only the invoices with claims in absolute value higher than the value of the MinClaim parameter (0,499999 by default) will be displayed. You may pre-set with Claim cross with the chbWithClaim parameter. |

Commission Code |

Checking the cross gives you access to the option of choosing one commission code. After choosing the code, only the Invoices relevant to the particular Sales representative will show. You may pre-set the cross with the chbCommissionCode parameter. |

Search |

Checking this field enables you to search and display already acknowledged commissions. Choose a period from business years to which the commissions are to be acknowledged. After you make your choice, only the Invoices to which a commission of any amount has been acknowledged in the selected period will appear. |

Net (Gross) |

The Net (Gross) of an Invoice. The display of columns depends on whether the commission is calculated from the Invoice's Net or Gross, which is set by the Gross parameter. |

Paid |

The amount paid for the Invoice. |

Claim |

A calculated value according to the settings of the function parameters. You may edit it manually by pressing Enter, entering the requested value, and confirm it with Enter again. |

Acknowledged |

How much has been acknowledged for a given Invoice in previous commissions (eventually after or before saving). |

Acknowledged in period |

How many commissions were recognized for a given invoice in the period for which the search is switched on. If the search is not checked, this column always remains null. |

Total Comm./Invoice |

Shows the maximum value that is to be paid in commissions for the Invoice. The claim is always calculated as Total Commission - Acknowledged. |

Example: Claims for commissions are evaluated once per month. You have issued a new Sales Order (and an Invoice) for the Demo company in the Net amount of 100,000 GBP, from which the amount of 70,000 GBP (83,300 GBP) has already been paid off by the company Mr Smith may claim 70 % of his total commission for this Invoice. During the evaluation, we acknowledge him 3,500 GBP and, at the same time, it will become clear that the representative will get 1,500 GBP more for this Invoice after the customer has paid off the Invoice.

Procedure:

Issue a new Sales Order and an Invoice for the amount of 100,000 GBP for the Demo company. A note of the 'PP’ type, the003 Sales representative, and the commission rate of 5% will be pasted into the Invoice from the previous settings . As the next step, add the Acknowledge Commissions script with Payments parameter set to Yes into the tree. Run the script. An initial window will open, where you can select the interval from which the Invoices are to be evaluated. If Payments parameter is active, all confirmed Invoices with the 'PP’ type of note, of which at least one payment has been processed in the selected interval, will be displayed. You can limit the selecting of Invoices via the crosses in the upper part of the form. These crosses, along with other buttons, are described above.

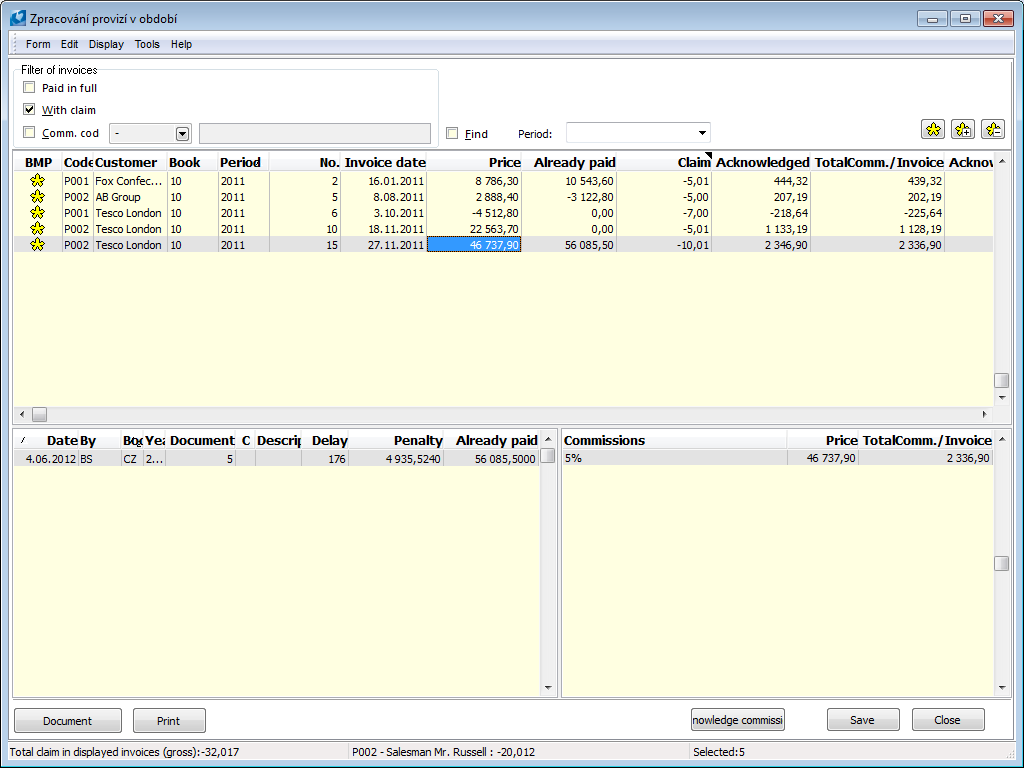

Picture: Invoices corresponding to the conditions set for acknowledging commissions

Enter the period for which the commissions are processed into the Period field. In our case, it is June 2007. If a part of these commissions had already been processed before, you can select the name of the period and choose from the offered code list. We will leave marked all invoices for which we want to acknowledge the commission. The amount of the commission may also be edited manually by moving the cursor to the value, pressing Enter, entering the requested value, and confirming again with Enter. In order for the changes to be processed, press the Acknowledge Commission button. A message informing about the number of acknowledged commissions will appear. You Could see in the picture, that we want to see only the Invoices with a non-null claim (respectively a claim lower than the value of the MinClaim parameter) (checked the WithClaim cross), and so all of the marked Invoices disappeared after the acknowledgment. They will reappear again along with other Invoices that meet the initial conditions after cancelling the cross.

Attention: Notes about an acknowledged commission ('PU') will be created after pressing the Save button. If you close the form without saving, all progress will be lost!

Example: We want to see an overview of all invoices for which we have recognized a commission for the period of June 2007. You also want to print a document for the particular Sales representatives, based on which they can invoice the claimed commission.

Procedure:

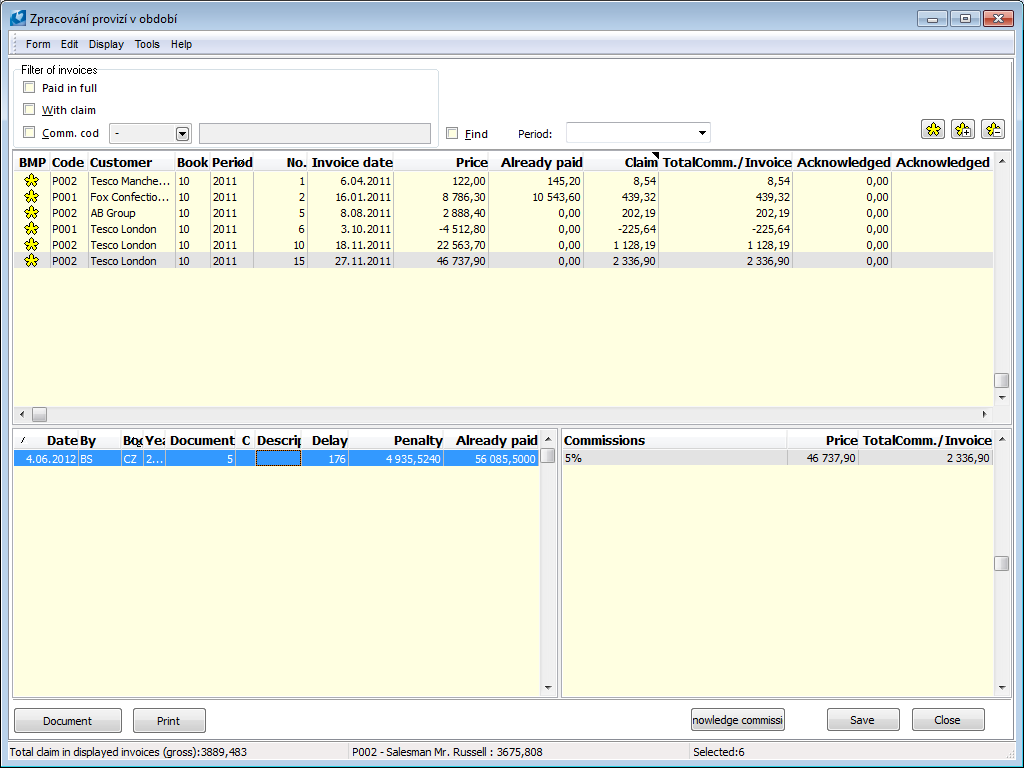

In order to process commissions in a specific period, you need to print an overview of how much in total and to which representatives you are going to pay in commissions. Run the Commission Recognition script, leaving the full display interval in the introductory form. Check the Search cross and choose the requested period In our case, it is June 2007. All invoices for which a commission has been recognized in the selected period are displayed. In such case, the information about the amount of acknowledged commission in the period will appear in the Acknowledged in Period column. This amount may differ from the summation amount of Acknowledged, because a part of the commission for a specific Invoice may had already been acknowledged before, or outside the searched period.

Picture: Found Invoices processed in the period of June 2007

This overview may be printed out with the Print button. This report may be run from the script only and only after saving all changes.

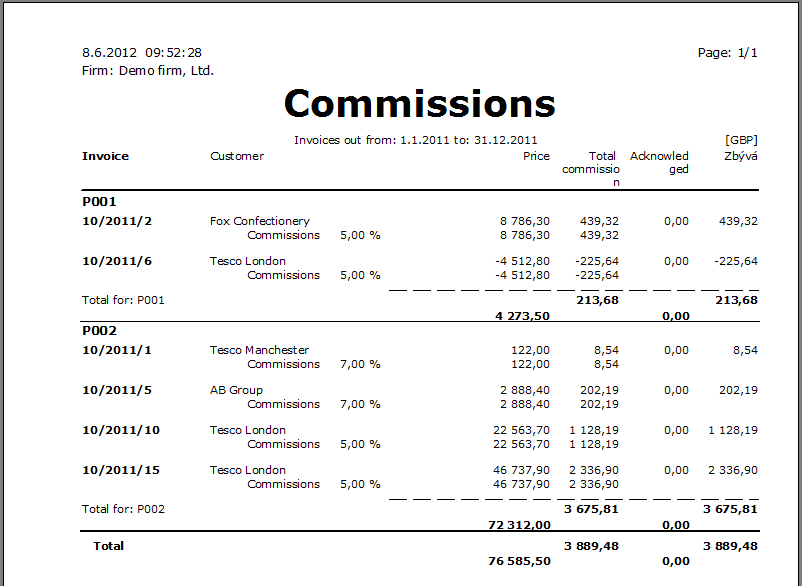

Picture: The Commissions for Period report

If you want to print the overview for only one Sales representative, check the Commission Code cross before running the report and select the requested representative.

If you run the same report (by the same button) when the search is not checked, the report (after saving again) will print out the form contents, i.e. the Invoices that are currently displayed.

Technical solution

List of files:

|

||

|

RF_Provize.pas |

The script is called by the registered functions through the RF_K2STD script, which uses the U_RF_K2 unit. In the unit, the calling is defined as follows:

It is necessary to permit the registered script in the administration of registered scripts. |

|

Provize_main.pas |

The Acknowledge Commissions script determined for the processing of commissions. |

|

Provize_form.pas |

The auxiliary script to the Provize_main.pas script. |

|

ProvizeProc.pas |

Script for inserting a note of the 'PP' type on a Customer card (number of the form of the note = 01006). |

|

FiltrProvize.pas |

Script for filtering of Invoices Out with the note of the 'PP’ type. |

|

U_provize_konst, U_provize_období |

Auxiliary units to the Provize_main.pas script. |

|

||

|

||

|

VF_Provize.am |

The List of Invoices by Commission print report. |

|

F_Provize.am |

The Acknowledged Commissions print report executable only with the button from the Acknowledge Commissions script. |

|

||

|

||

|

DateOdDoKod.txt |

Form to the FiltrProvize.pas script. |

|

FProvize.txt |

Form to the ProvizeProc.pas script. |

|

Provize_form.dfm |

Form to the Provize_Main.pas script. |