Credits

The K2 IS allows you to monitor the amount of credit of specific customers, i.e. the business transactions that have not been paid yet. Credits are defined in the Credits book. You can pre-set limits to individual credits, the documents you wish to consider, and limit the use of credits to selected books of Sale only. By monitoring the credits, you can set aside the payments that the customer will pay for in cash.

Credits to individual customers are assigned by inserting the given credit (in universal forms) in the Sale card in Customers/Suppliers in the Credit tab. You may also use the bulk action Credit Settings, which enables you to insert credits to selected customers in bulk. When inserting credits via the Credit Settings bulk action, you may change the limit or edit other parameters of the credit.

If necessary, you can edit the limit amount on a specific customer so that each customer has a different credit limit. The amount of limit on a Customer card has a priority over the limit set in the Book of Credits.

The amount from a document item, which has a Sales Order assigned and whose item is on at least one of the monitored documents, and simultaneously is not on a paid Invoice Out, is loaded into the specific credit. The credit amount is loaded from the invoiced price. Also the item of a free Invoice Out enters the credit (it does not need to have a Sales Order). The total credit amount is then automatically reduced by paid Advances.

If an item has multiple documents monitored, the amount will be loaded for the document standing higher in the Document section (Book of Credits, the Basic Data tab).

If a company exceeds its limit before issuing a document, the user cannot save the document unless they have the Break Maximum Credit right set.

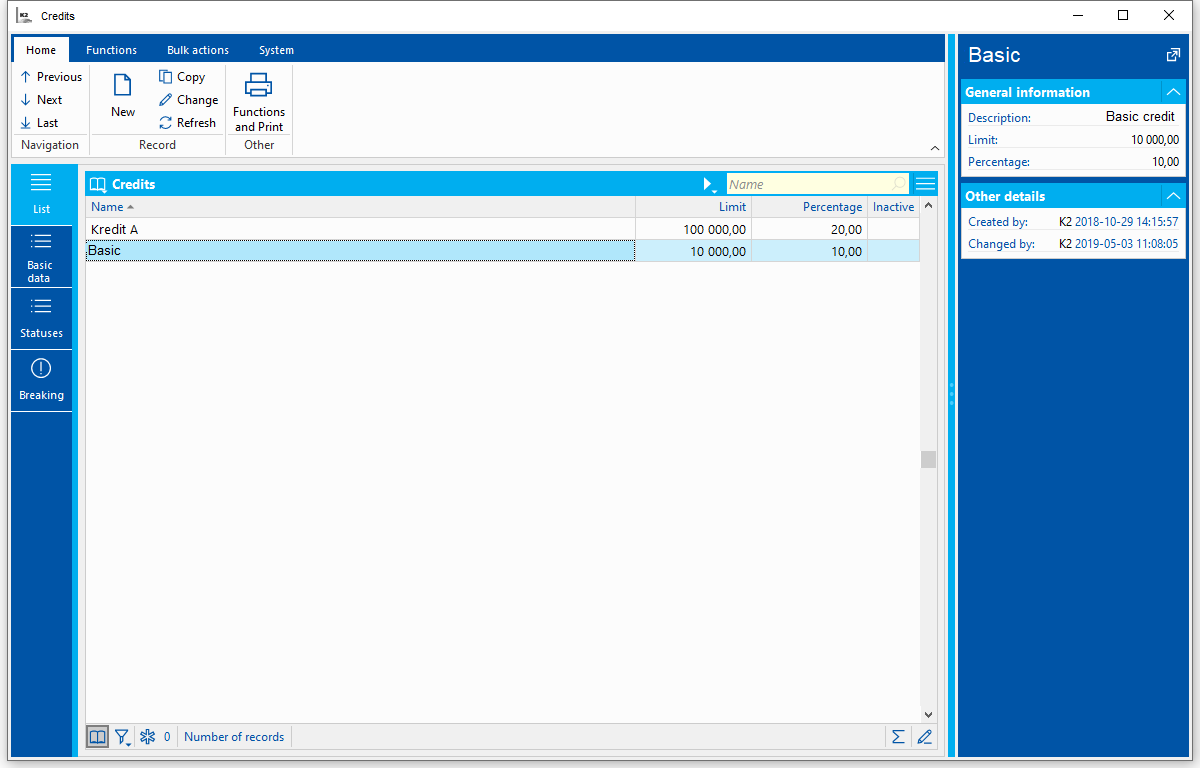

Credits (Book)

Individual credits are entered into the Book of Credits. The List tab will show the list of all credits. Credits may be activated from the Sale / Basic Data / Settings of Sale tree menu.

Picture: List of credits

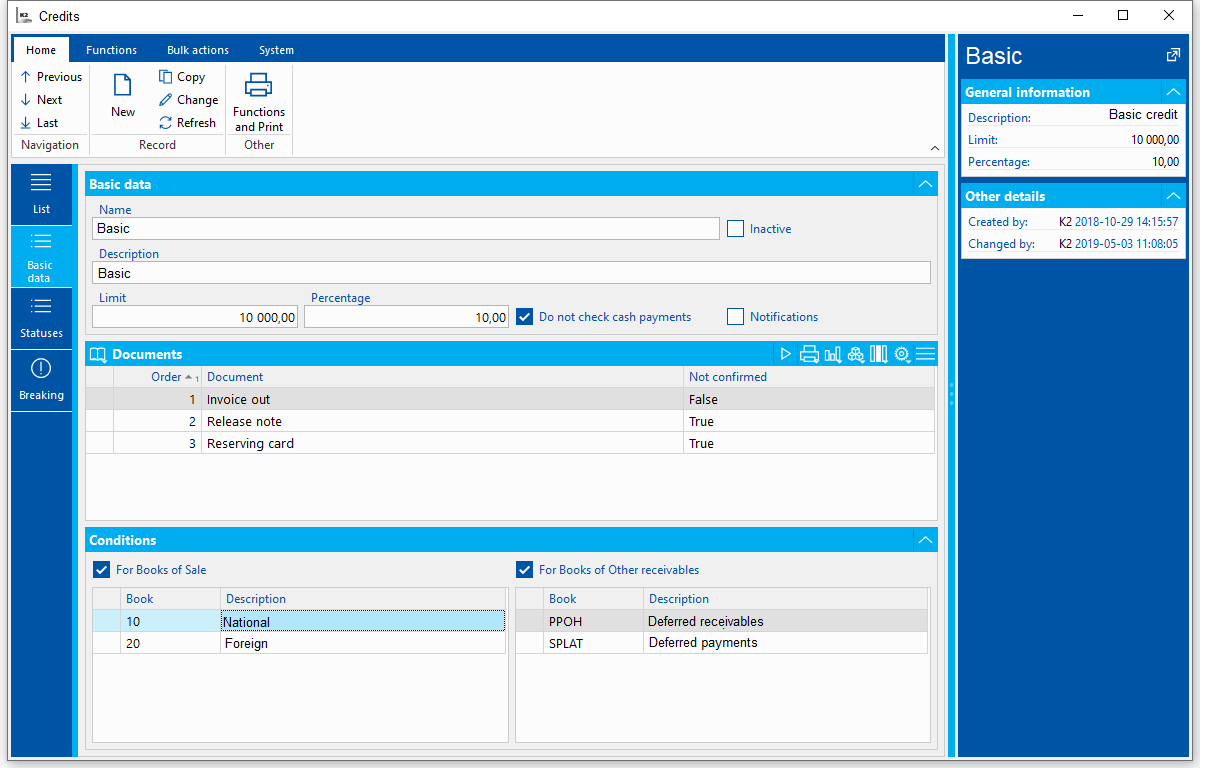

Credits - Basic Data

In the Basic Data tab, you may define the name and description of the credit, the limit, the list of all monitored documents, and you may also restrict the watching of credits to only one book of Sale, or of Other Receivables. You can also set the monitoring of only non-cash payments.

Picture: The Credits - Basic Data tab

Field description:

Name |

The name of the credit. |

Description |

The description of the credit. |

Limit |

The value of the credit limit is entered here. If a customer exceeds their limit, a message saying that a limit has been exceeded will appear during the issuing of the monitored document. If the user does not have the Break Maximum Credit right, such document cannot be saved. If the user right is active, the document will be saved and will display in the Breaking tab of the specific credit. |

Percentage |

If set, and if a customer has a higher credit limit to the level where the set percentage remains until exhausting the credit, the user will be notified of this fact when issuing the monitored documents. |

Do Not Check Payments In Cash |

If checked, the document with the Payment In Cash field checked in its record about the payment method on the 1st page of the Payment Method code list will not be calculated into the credit. If a customer's limit has been exhausted or exceeded due to saving, a document may still be issued and saved if it is issued with the payment method with the Payment In Cash value. |

Notice |

If checked, the information about the credit will always appear when issuing a monitored document. |

In the Documents section, a list of documents that are watched by the credit is defined. The order of documents is also important. For each type of document, you may set whether you wish to watch also the unconfirmed documents, or only the confirmed ones. Each newly created credit has an Invoice Out document pre-defined by default. This record cannot be deleted. You may insert more documents with the Ins key. You can choose a document of a Release Note, Reserving Card, Delivery Note Out, Other Receivable, and a Sales Order. If multiple documents that are to be calculated into the credit are present in one business transaction, the value will not be calculated into all sections (documents), but to the document that occupies the highest position in the list.

Example No. 1

If there is a business transaction (here represented by an article item on a Sales Order with a confirmed Invoice Out and a confirmed Release Note), and if only confirmed Invoices Out and confirmed Release Notes are being monitored in the Credit 1, the value will be calculated only for the document that meets the criteria of (non)confirmation and that occupies a higher position in the Documents section. In this case, it is an Invoice Out (see the picture Credits - Basic Data tab).

Example No. 2

If there is a business transaction (here represented by an article item on a Sales Order with an unconfirmed Invoice Out and a confirmed Release Note), and if only confirmed Invoices Out and confirmed Release Notes are being monitored in the Credit 1, the value will be calculated only for the document that meets the criteria of (non)confirmation and that occupies a higher position in the Documents section. In this case, it is a Release Note. The value will not be loaded into the Invoices, because the condition of confirmation has not been met.

In the Conditions section, you may define which books the credits will concern. If this is not defined, all the monitored documents from all books will be calculated into the credit. If there are any existing records for books of Sale or books of Other Receivables, only the documents from these books will be monitored. The documents issued in other books will not be calculated into the credits.

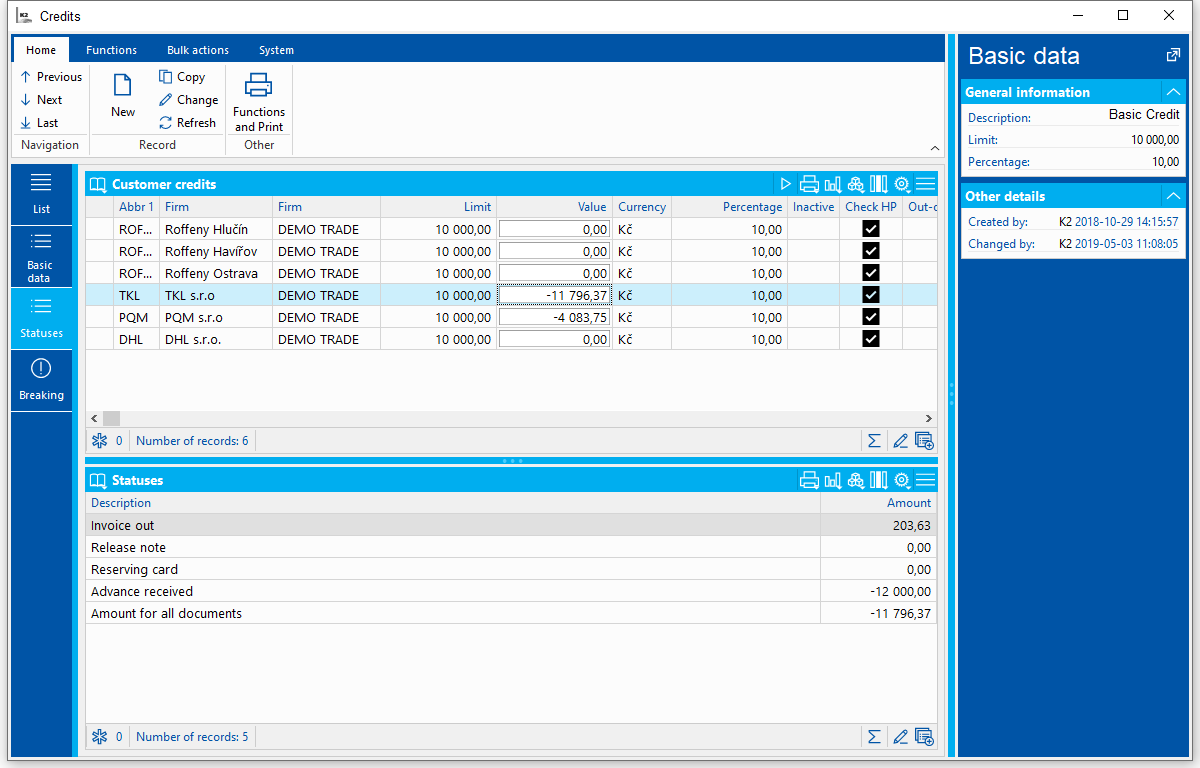

Credits - Status

In the Status tab, you can see a list of customers, whose credit is being monitored. The Value column shows the credit amount. If the value is green, the customer is in the limit. If the value is orange, the percentage remaining to exhaust the limit has been exceeded. The percentage value is set in the Percentage field in the Basic Data tab. If an orange exclamation mark appears in the Outdated column, you must run a recalculation of the credit of the specific Customer card.

Picture: The Book of Credits - Status

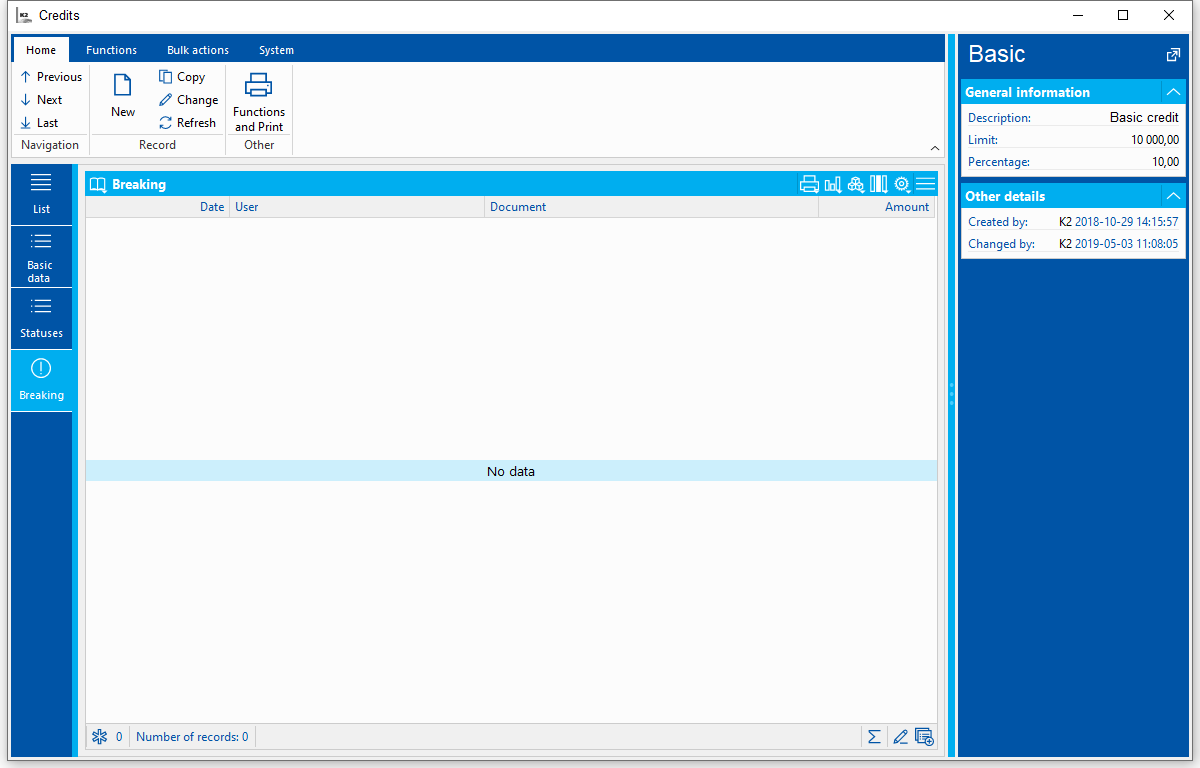

Credits - Breaking

In the Breaking tab is a list of documents with information about the user, and date and time of their creating, even though the limit of the given customer has been exceeded.

Picture: The Book of Credits - Breaking

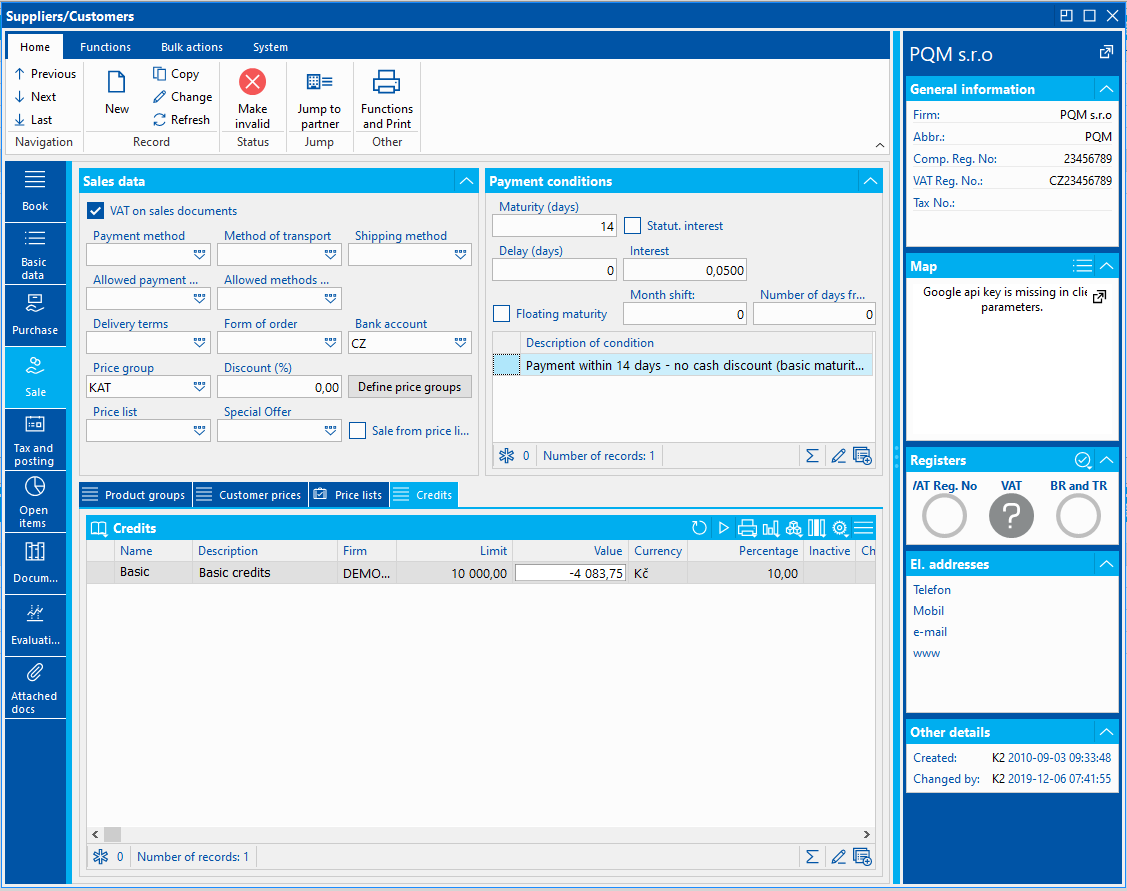

Supplier/Customer - Credits

The credits in the Supplier/Customer code list are recorded in the Sale card in the Credits folder tab.

Picture: Credits tab

By default, the columns are set with a name, description, and an own company. Further information includes the limit, the percentage, whether the credit is set to monitoring payments in cash, and if it is active. An exceeded limit is graphically demonstrated in the Value field. The colour green indicates that the customer is in the limit. The colour orange indicates that the customer is still in the limit, but has already exceeded the percentage for filling the limit, and wishes to be notified of the exceeding when issuing a document for this customer. The colour red says that the credit for the given customer has already been exceeded. A customer may have multiple credits assigned to.

The user can assign credit/credits to a customer in the Credits tab in the Change mode with the Ins key, or use the bulk action Credit Settings for selected records.

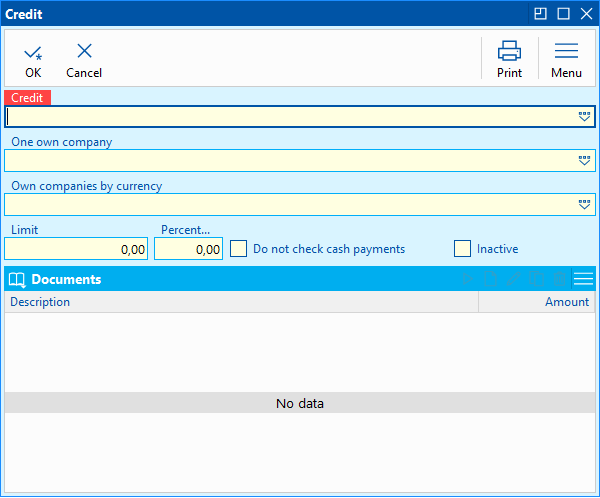

When inserting a record with Ins, a Credit form will appear.

Picture: The Credit form

Field description:

Credit |

Selection of goods from the Book of Credits. The field is mandatory. Choosing a credit will complete the part of Documents. |

One Own Company |

Choosing an own company for the credit. If the credit is to be used for several own companies, you must repeatedly insert the credit with various own companies. If the credit is to be used for all own companies, this field remains empty. |

Own Company According To Currency |

When choosing an own company, this field will be pre-filled in by the currency of the own company and it cannot be edited any more. If you require the credit to be calculated for all of own companies, the One Own Company field should remain empty. You must select the currency in the Own Company According to Currency field. All of the documents in this currency for all own companies will be calculated into the credit. |

Limit |

It is pre-filled in with the value defined in the selected credit. It can be changed. |

Percentage |

It is pre-filled in with the value defined in the selected credit. It can be changed. |

Do Not Check Payments In Cash |

It is pre-filled in with the value defined in the selected credit. It can be changed. |

Inactive |

|

Documents |

After choosing a credit, the documents defined in the Documents section of the selected credit will be completed into the Documents section. The list of documents cannot be edited. |

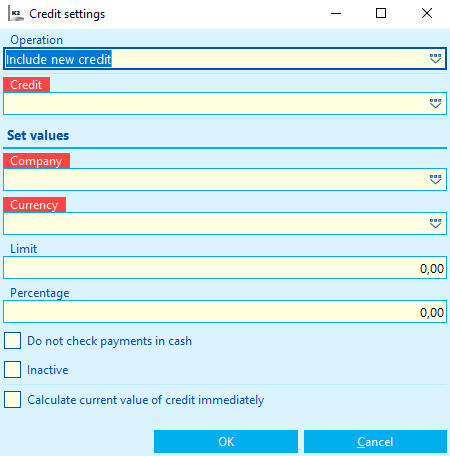

When running the Credit Settings bulk action, a Credit Settings form will appear.

Picture: The Credit Settings bulk action

Field description:

Operation |

The user chooses which operation will be performed for the selected customers. You may assign a new credit, change the credit settings, or delete the credit. |

Credit |

Selection of goods from the Book of Credits. The field is mandatory. |

Company |

Choosing an own company for the credit. |

Currency |

The monitored currency. |

Limit |

It is pre-filled in with the value defined in the selected credit. It can be changed. |

Percentage |

It is pre-filled in with the value defined in the selected credit. It can be changed. |

Do Not Check Payments In Cash |

It is pre-filled in with the value defined in the selected credit. It can be changed. |

Inactive |

|

Calculate Current Value of Credit Immediately |

If checked, the current value will be calculated in the credit settings of a group of customers after the changes. |