Guide for transition

Pre-installation preparation

Minimum version to transition

To reinstall on version K2 ori.02, it is necessary to switch from version K2 gaia.06 and higher.

When switching to the K2 ori version, we also recommend studying the Methodology for switching to the K2 ori version.

Tax type, VAT rate, customs tariff

Due to the fact that since the K2 ori version there is a new code list Legislation, where legislation is mandatory for every multi-company, the code list Tax Types, VAT Rates, Customs Tariff has been divided into legislation. Using the button in the reinstallation manager, the fields on the customer and goods are checked, which are divided into multi companies and moved to K2 ori for legislation. If the fields are divided into multi companies that have the same state, the data will be reduced, leaving the data from the newer multi company.

Reinstalling generational versions

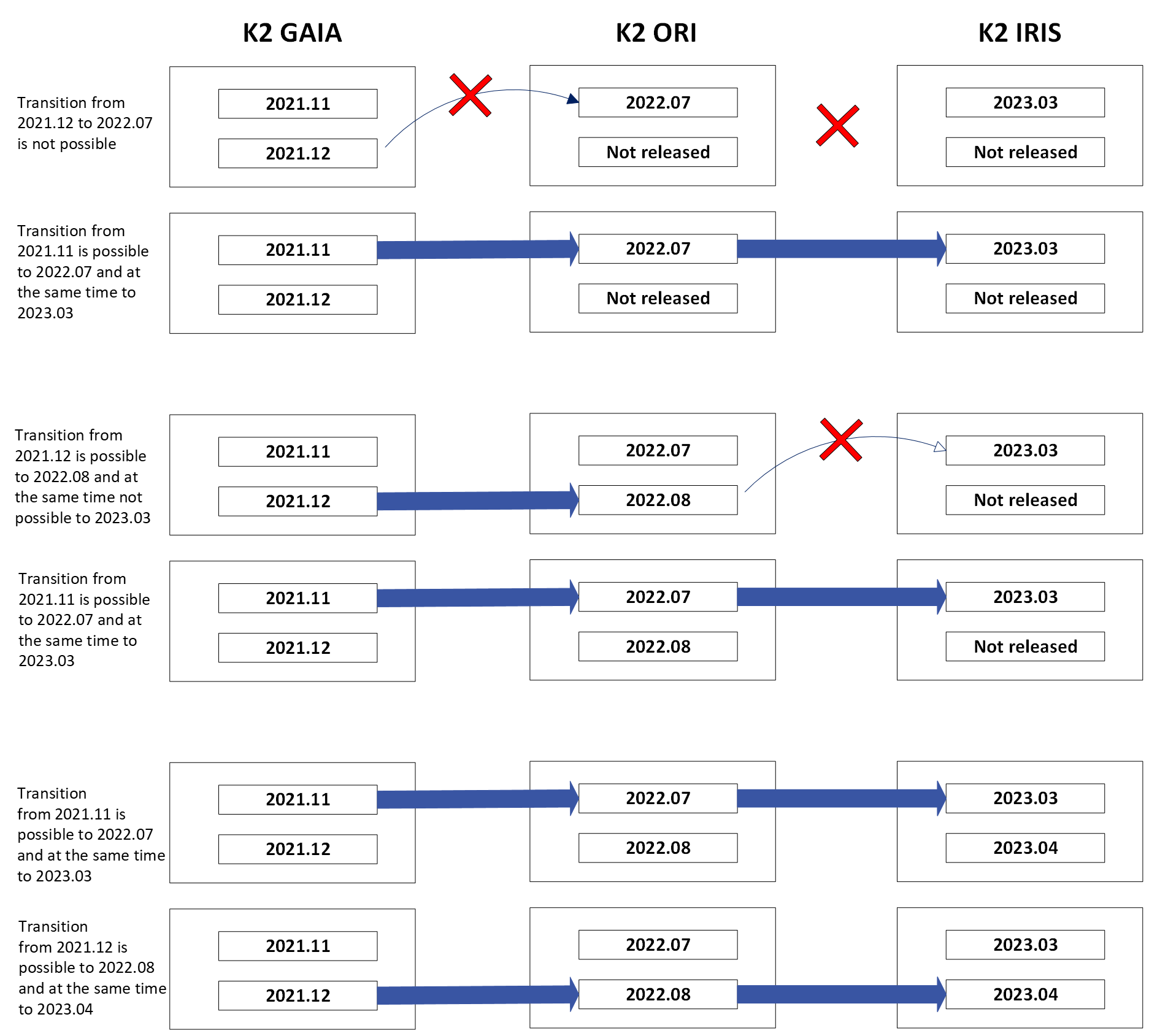

This situation occurs when new release versions are issued, i.e. usually once every quarter, when all 3 versions of new releases have not yet been released.

At the moment it is not possible to reinstall from a newer release of one generation version to older releases of newer generation versions. For the transition between generational versions, it is advisable to use the tip, the so-called Rule 4.

The application of rule 4 is shown in the picture below (given in the attachment)

Pic.: Rule 4

It follows from the above picture that it is always necessary to determine the target version to which you want to reinstall and to use Rule 4 to calculate through which version the reinstallation must be performed.

Calculation using Rule 4:

We want to reinstall to version iris.01 and the default version is luna.12.

In this example we count 01 + 4 is 05, so the lower version I have to go from is ori.05. I keep counting 05 + 4 is 09, so the next version I will go through is gaia.09.

So the resulting process is luna.12 -> gaia.09 -> ori.05 -> iris.01.

Other changes in version

Legislation

Since the K2 ori version, a new code list has been created. The Legislation field is filled in multi company and Legislation is mandatory in all books. The codes Tax Types, VAT Rate, Customs Tariff, Statutory Interest (new field LegislationId) were divided into legislation.

A new VATRate table was created for the VAT rate code list, data was moved from the BusineswsYearAndTaxGroup table for type 1 (PRD_Typ_Dane) and the new data module TVATRateDm replaces the canceled data modules TTaxDM and TTaxGroupDM.

Code lists Article, Customer, Payment document cards, Other receivables and other payables, Travel orders card are divided into legislation.

In the fields divided into legislation incl. taking over the history, the given fields are divided into multi companies by means of conversion. During the conversion, the number of records is reduced and newer multi companies (companies with larger CompanyId) take precedence during the conflict.

Fields divided into legislation have the suffix Calc in the data modules.

Field on article

A new LegislationLinkArticle table is created and eats the VATRateId, PurchaseTaxTypeId, SaleTaxTypeId, PurchaseTaxTypeRCSId, SaleTaxTypeRCSId, CustomsTariffId fields. The bulk transfer history is for the VATRateId and CustomsTariffId fields, the other converted fields did not have history turned on.

The VATRateId, PurchaseTaxTypeId, SaleTaxTypeId, PurchaseTaxTypeRCSId, SaleTaxTypeRCSId, CustomsTariffId fields are deleted from the CompanyLinkArticle table and moved to the LegislationLinkArticle table.

Field on customer

A new LegislationLinkTradingPartner table has been created. The PurchaseTaxTypeId and SaleTaxTypeId fields have been moved from the division of own companies to the division into legislation. The PurchaseTaxTypeId and SaleTaxTypeId fields have been deleted from the CompanyLinkTradingPartner table.

Removed bits:

- BAZ_Flagy_PlatceDPH (0) – field VATPayerPurchaseBitCalc replaces IsVATPayerPurchaseCalc

- BAZ_Flagy_DPHprodej (14) – field VATPayerSaleBitCalc replaces IsVATPayerSaleCalc

- BAZ_Flagy_StatInterestN (18) – field StatutoryInterestPurchaseBitCalc replaces IsStatutoryInterestPurchaseCalc

- Do not use BAZ_Flagy_PlatceDPH, BAZ_Flagy_DPHprodej, BAZ_Flagy_StatInterestN(18) a BAZ_Flagy_StatInterestP(20) – field Flags cannot be completely canceled yet.

Fields on Payment Document Cards, OR / OL, CP

A new LegislationLinkDocumentCard table with VATRateId and TaxTypeId fields has been created. The TaxPercent and TaxTypeId fields have been deleted from the DocumentCard table and moved to the VATRateId and TaxTypeId fields of the LegislationLinkDocumentCard table.

Clients parameters

Rec_Conf_G.AdvRateOfVAT and Rec_Conf_G.AdvTypeOfTax (FCNG_AdvRateOfVAT and FCNG_AdvTypeOFTax) are deleted, which is replaced by VATRateIdCalc and TaxTypeIdCalc from the Legislation.

Termination of support

Price lists - prefer gross amounts in the price list header

In connection with this change, there was a change in the methods published in the script (adding another output parameter APreferGrossPrice, which returns a flag from the price list header):

- TPriceListDM.FindPriceGross

- TPriceListDM.FindPriceGrossNA

- TArticleDM.PriceFromPriceListGross

App Google play Store

End of Android application support. Dashboards will already be in the K2 website.

App Store

End of iOS application support. Dashboards will already be in the K2 website.

Responsive e-shop

Responsive e-shop is no longer supported from version K2 ori. It has been removed from the installer and will no longer be updated.

K2 4Web (Silverlight)

As of K2 ori, K2 4Web is no longer supported and will no longer be updated. .

Alias for field names

Aliases for field names have been removed. Therefore, each field has only one name, which is also its identifier within the data module. Old names in special modifications will be converted to new ones during reinstallation, see the documentation Upgrading to the K2 ori version.

Tables that are dropped in the K2 ori version

Note

The tables are not physically deleted, they are only renamed so-called Deprecated tables, so they will have the prefix DEL_. The complete deletion will occur in future versions.

Table |

Table description |

EshopArticleInCategory |

Article in eshop category |

Distribution |

Delivery table |