Advances Provided

Advances Provided are a part of the documents in the Purchase module. The basic data and functionality of Advances Provided are similar to Advances Received. Therefore, only the differences of Advances Provided will be described in the following chapters.

Document Advance Provided

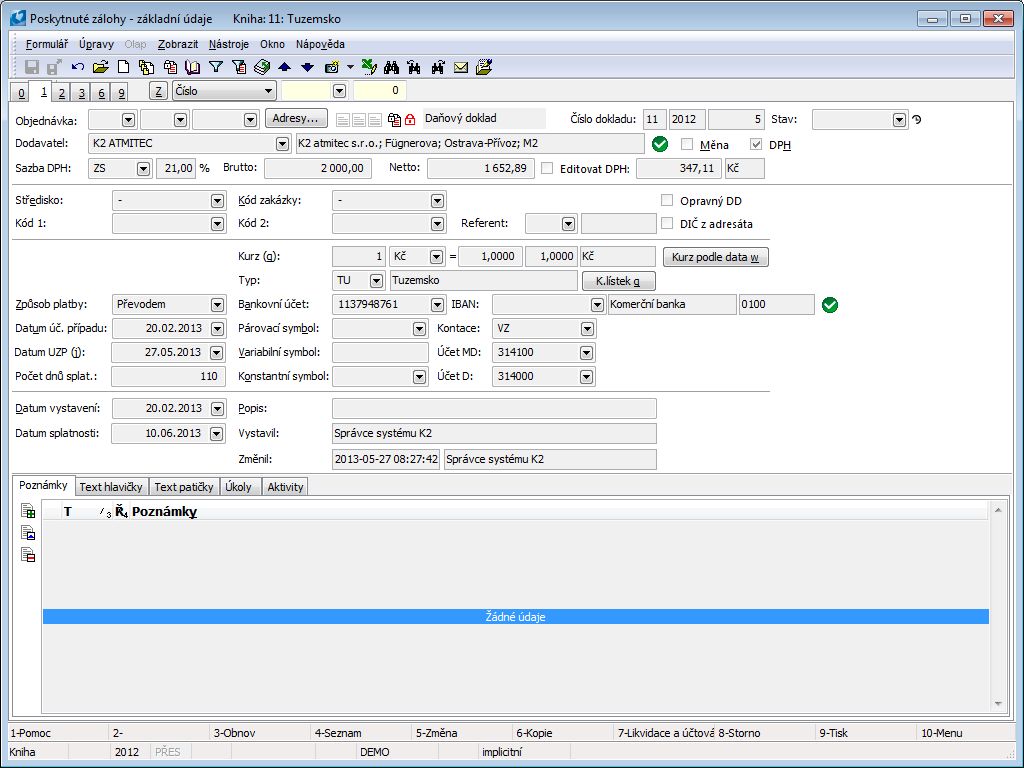

Picture: Advances Provided - 1stpage

Selected fields description:

Edit VAT |

When checking the Edit VAT field, you can edit the Net and VAT amounts. Gross amount is calculated as their sum. |

Bank Account |

Supplier bank account. When creating a new Advance, the default bank account from the Bank tab will be copied to it from the Supplier card. If we check the Optional Bank Account for Invoices In option on the 3rdpage of the Client Parameters, the bank connections is not obligatory. |

IBAN |

Supplier IBAN. When creating a new document, the IBAN from the default bank account from the Bank tab (if set) will be copied to it from the Supplier card. |

In connection with the institute of so-called unreliable VAT payer, the document shows:

- VAT payer reliability icon,

- for a bank account, the icon for verified accounts.

After paying the Advance Provided, the Acc. Trans. Date will change automatically on the document according to the Date of Issue of the payment. Unlike with the Invoices In, the change of the Invoice Date does not happen automatically. We can change the Acc. Trans. Date and the Invoice Dateon the confirmed Advance Provided by using the Ctrl+F6 keys.

The automatic switching of an advance to a tax document cannot be set at Advances Provided.

Deduct Advance Provided to Invoice In

The deduction of Advance Provided in Purchase is similar to the deduction of Advance Received in Sale.

With Advances Provided, t is also possible to edit the deducted Net and VAT amount.

Credit Notes of Advances

The description of Credit Notes over the Advances Provided is similar to the one provided in the chapter Credit Notes to Advances at Advances Received.

Functions over Advances Provided

The functions over Advances Provided are similar to the Functions over Advances Received. There are two more functions over the Advances Provided:

Ctrl+F6 |

You can change the Accounting Transaction Date and the Invoice Date fields on a confirmed Advance Provided by these keys. |

Rounding of Advances

The Advances Provided in the domestic currency will be rounded according to the Client Parameters. If the field "Edit VAT" is checked on the Advance Provided, it will not be rounded at all.

Gross of an advance in a foreign currency (the Currency option is checked) is rounded depending on the setting of rounding of an entered Currency. Net and VAT of an advance in a foreign currency are not rounded.

The rounding is performed during the issue of Advance Provided.