Invoices Out

The book Invoices out is used for issuing invoices to customers and for their record. In this book it is possible to issue both bound invoices from the set Sales Orders and unassigned invoices without a Sales Order (the unassigned documents). The invoices serve as tax documents in Accounting. At the same time, the evaluation of article sales and a customer with draw of article from invoices, and it is always done so according to the Invoice Date.

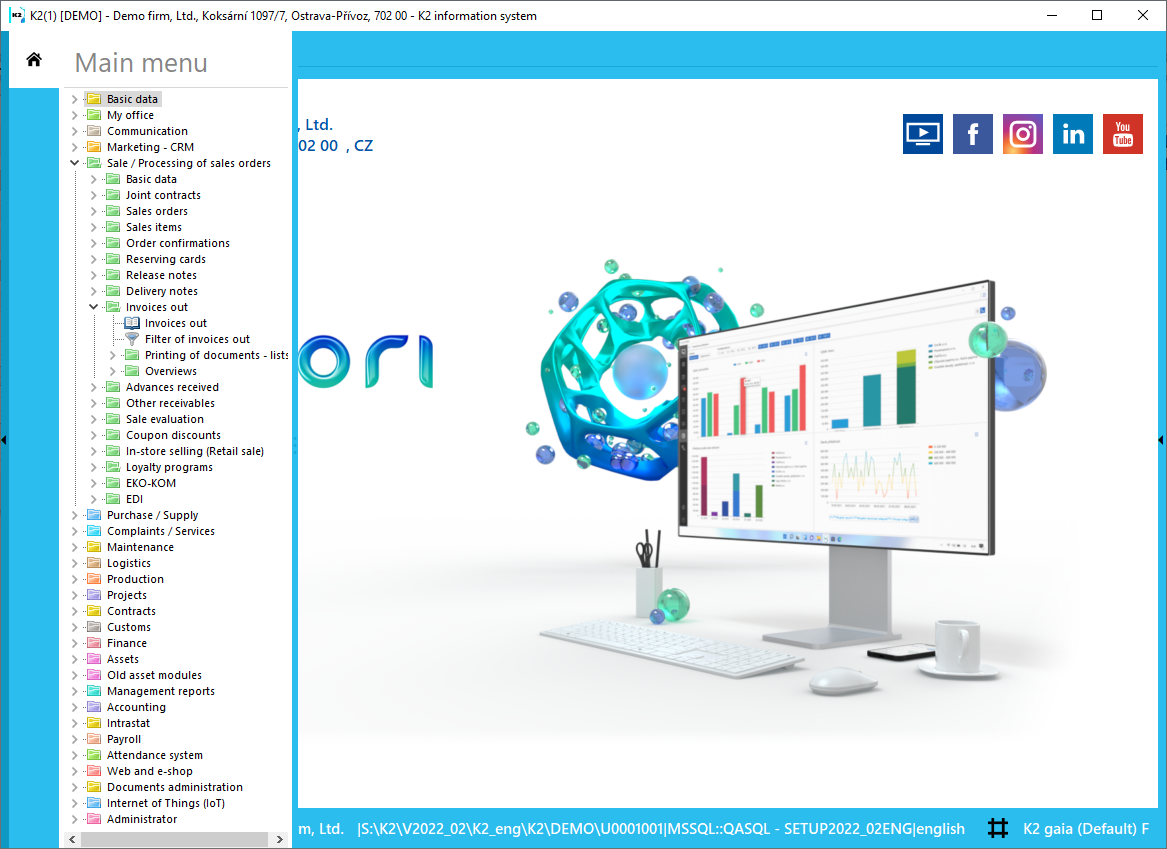

Picture: The opened menu of the Sale / Processing of Sales Orders - Invoices Out module

Book of Invoices Out

On the individual invoice tabs, you will find items that are very similar in both types of invoices (in and out). The same applies to the layout of individual tabs and the nature of the information displayed on them.

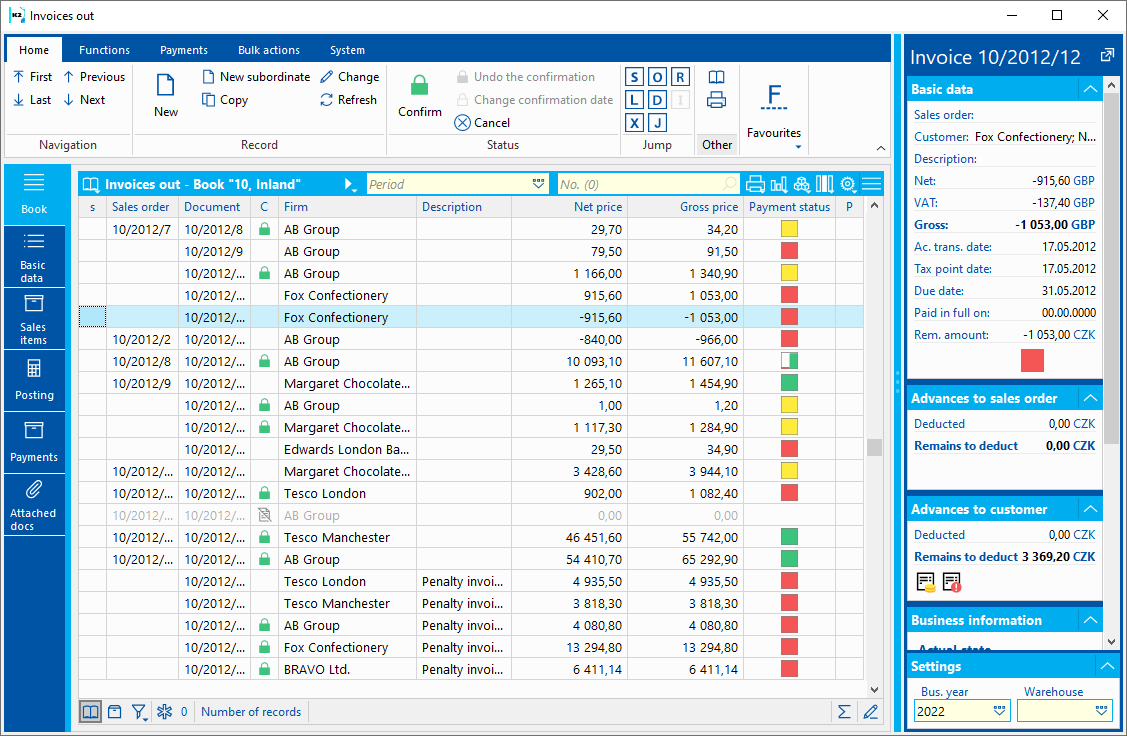

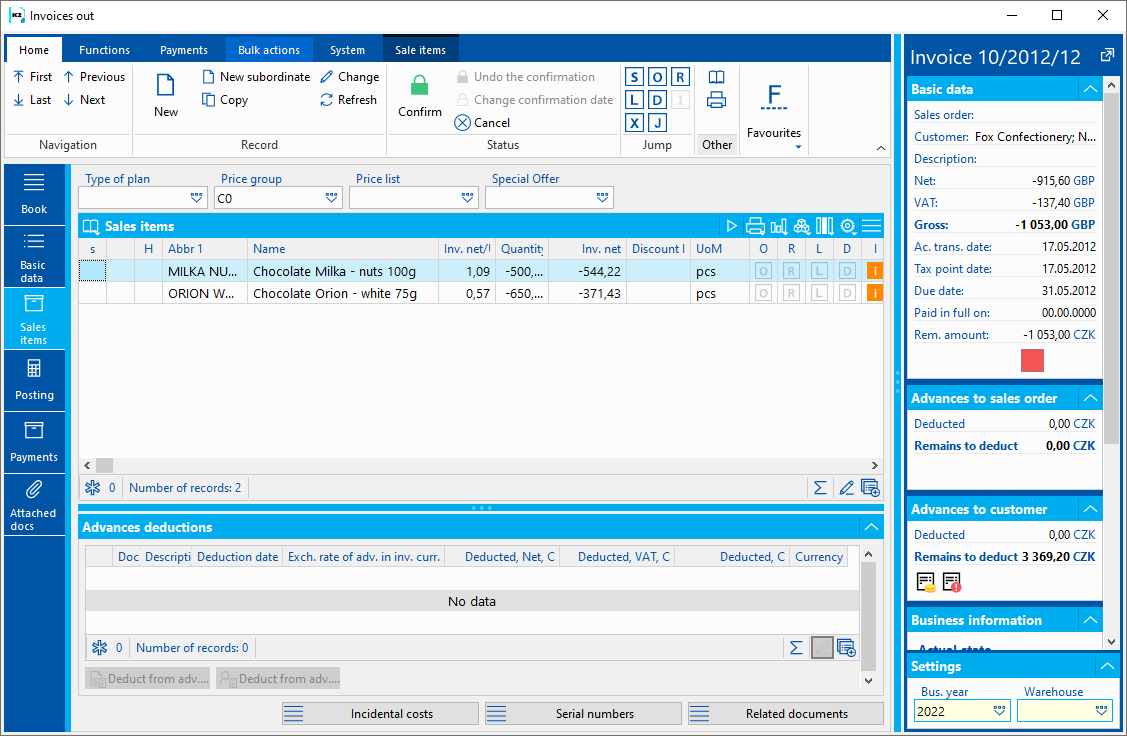

Picture: The Book of Invoices Out

The meaning of the graphic symbols of payments on Invoices Out

![]() unpaid prior to maturity

unpaid prior to maturity

![]() not paid off prior to maturity

not paid off prior to maturity

![]() unpaid after maturity

unpaid after maturity

![]() not paid off after maturity

not paid off after maturity

![]() unpaid after x days past due (the number of days past due when the square is to turn red is entered in the user's parameters, in the Purchase and sale tab in the Flash field after x days past due)

unpaid after x days past due (the number of days past due when the square is to turn red is entered in the user's parameters, in the Purchase and sale tab in the Flash field after x days past due)

![]() not paid off after x days after maturity

not paid off after x days after maturity

![]() overpaid

overpaid

![]() paid

paid

Basic Data

The Basic Invoice Data tab is used to display identification and basic invoice data and some other information, such as the payment method , transport method , date of issue, etc.

Picture: Invoice out - Basic Data

Field description:

Contract |

The number of the Sales Order that the Invoice is linked with. If the invoice has been issued as a free document, this field is empty. Note: Before we create an Invoice, we determine whether the document is linked or free by means of the wizard. It is not possible to change the Sales Order in Change mode any more. |

Invoice Out |

The book, business year, and the number of an Invoice. |

Customer |

A business partner's name that you insert by selecting it from Suppl./Cust. book. In the case of a new partner, you can insert anew Supplier/Customer card into this book with the Ins key (eventually with the F6 key - insert according to the indicated specimen), edit (by pressing the F5 key) or only browse a card (by pressing the F4 key). |

Comp. Reg. No. and VAT Reg. No. |

Button for entering tax identification. Comp. Reg. No. of a customer. If it is not defined here, the Comp. Reg. No. from the Customer card is applied. VAT Reg. No. of customer If it is not defined here, the VAT Reg. No. from the Customer card is applied. Tax number of a customer. If it is not entered, the tax No. from the Customer card is applied. |

Status |

The field for selecting from a code list that enables filtering of documents according to the selected status. |

Description |

Here, it is possible to insert a description manually or by selecting it from the selection menu, insert a more detailed specification of the invoice (purpose for which it was issued…). |

VAT |

When the field is checked, it is a common invoice for which value added tax is paid. The field is preset according to the legislation of the document. |

Credit Note |

If the field is checked, it is a Credit note. |

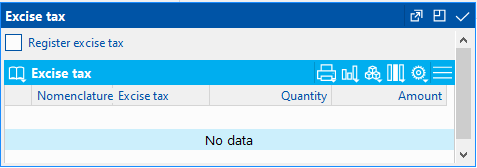

Excise Tax |

If the field is checked, an excise tax will be calculated on the Invoice. |

Prices |

The amount for which the Invoice has been issued. Stated in this row is the Gross price, Net price, and also the amount of VAT. |

Addresses |

The button to display an addressee or the superior company. Closer description is in the chap. Addressee. |

Currency |

The flag indicates that the Invoice is issued in foreign currency. |

Exchange Rate |

The document currency and the exch. rate for recalculation to the domestic currency. The rate valid to the date of issue is selected. If the Invoice Exch. Rate According to Acc. Trans. Date option is checked in the Client Paramaters, an exch. rate to the acc. trans. date is filled in. This field cannot be edited any more after you pay and reprice this document. |

Exchange List |

This button opens the preview of an exchange list of the given currency and sets the cursor on the rate valid on the date of issue of the Invoice. |

Exchange Rate According to Date |

This button enters an exchange rate from the exchange list that is valid to the date depending on the Exchange Rate According to the Date of Accounting Transaction parameter. |

Reference number |

A Reference Number of an Invoice - it can be created automatically according to the settings in Books of Sale. It must be unique - the program will alert you to any duplicate of a Reference No. |

External Number |

External number (60-character text). |

Order No. |

A manually entered order number. |

Account |

The field is automatically filled in by the Account in the Book of Sale. If it is not filled in in the book, the Receivables Account from the 1st page of the Suppl./Cust. card is entered. |

Fields description in Conditions section:

Form of order |

The way the order for goods has been made. |

Method of transport |

Method of transport of goods. Button Note: For the needs of Intrastat, a Mode of transport can be assigned to each method of transport. |

Shipping Method |

The way article will be taken over. |

Payment Method |

The method of paying the invoice. Note: The payment method can influence the Invoice rounding. For further description, see the Rounding of Domestic Invoices Depending on the Payment Method methodology. |

Delivery Terms |

Delivery conditions used for intrastat reporting. |

Buttons Payment Conditions, bank account

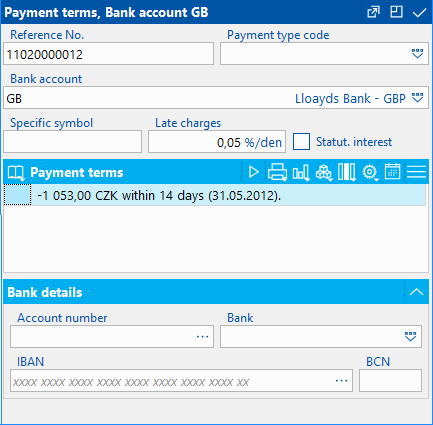

Picture: Invoice out- Payment Conditions, bank account

Reference number |

A Reference Number of an Invoice - it can be created automatically according to the settings in Books of Sale. It must be unique - the program will alert you to any duplicate of a Reference No. |

Constant Symbol |

The constant symbol added by selecting from a The menu. |

Bank account |

The bank account of our "Company" to which the payment is to be sent. If the Uniform Bank Connection for IO client parameter is on, the bank account from the customer in the own company is entered, otherwise the bank account set in the Suppl./Cust. card is entered. |

Specific Symbol |

A Specific Symbol for the payment. |

Late Charges (%) |

The percentage of penalty from delay for each day of late payment from the due date - it is filled from the Suppl./Cust. card. It the Statutory interest field is checked, the Late charges is filled from the Statutory interest table. |

Statutory Interest |

A check mark that determines whether the Late charges will be calculated by the contract or by law. |

Account Number, Bank/SCB, IBAN |

The customer bank account number. It is possible to select the account entered in the Customer card (it is not filled in automatically), or enter the value manually. |

Fields description in Terms section:

Accounting Transaction Date |

Acc. trans. date enters the Accounting. You can change the date on an Invoice Out according to the confirmation date of a Release Note by pressing Shift+F2 in the Change mode. |

Invoice Date |

An Invoice Date enters the VAT Return. If the Invoice Date is zero, the document does not enter the VAT Return. |

Date of Issue |

The date of issue of an Invoice. The current date is automatically filled into this field. In case of need, it is possible to overwrite the date by another date. |

Control Statement Date |

The date of the Control Statement. It is necessary to be filled only if it differs from the Invoice Date. |

Due Date |

The due date of an Invoice. According to the settings in the Derive Due Date from Accounting Trans. Date client parameter, the Due date is automatically entered by adding the number of Maturity Days to the value of the Date of Issue field or to the Acc. Trans. Date field. If the Floating Maturity is checked on the Suppl./Cust. card in the Payment Conditions tab, the Due date is filled in according to the Month Shift and Days From The Beginning of Month values. |

Due date |

The number of maturity days in which the Invoice should be paid. The number of days preset in the Client Parameters (Administrator module), resp. from Suppl./Custom. tab. |

Fields description in Codes section:

Cost centre |

Again, this is filled in from the selection menu of cost centres. |

Contract Code |

It is a numeric or text data used to sort activities of the company. |

Device |

A reference to the Device book. It is copied from a Sales Order into the subordinate documents. |

Code 1, Code 2, Officer |

The fields enable user identification, and eventually a link to the Officers book. Closer description is in the chap. For the further description see the Basic Code Lists - Code 1, Code 2, Officer chapter. |

Button Accounting information, matching symbol

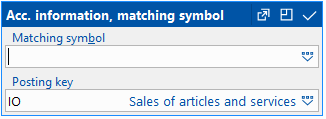

Picture: Invoice out - Accounting information, matching symbol

Matching Symbol |

This field serves for setting the matching symbol definition of the accounting documents (see the Accounting - Matching Symbols chapter). |

Posting key |

Selecting a Posting Key (by selecting it from the selection menu) determines the way how the created Invoice will be posted. Posting Keys are set in the Accounting - Posting Keys module. On 1. page of the Book of Sale, it is possible to set the Posting Key that will be automatically entered into this field. |

Other button

Picture: Invoices Out - Others

Substitute Payment Mode |

The option defines whether a Sales Order is in the substitute payment mode. |

EDI button

Picture: Invoices Out - EDI

Issued by |

The name of the employee who has issued the Invoice. |

Changed By |

The date and name of the employee who made the last change of the Invoice. |

It is possible to attach Comments, Header Text, Footer Text to invoices. The Internal Customer Text tab serves to display the customer's internal text. The payment conditions can be displayed in the Payment Conditions tab.

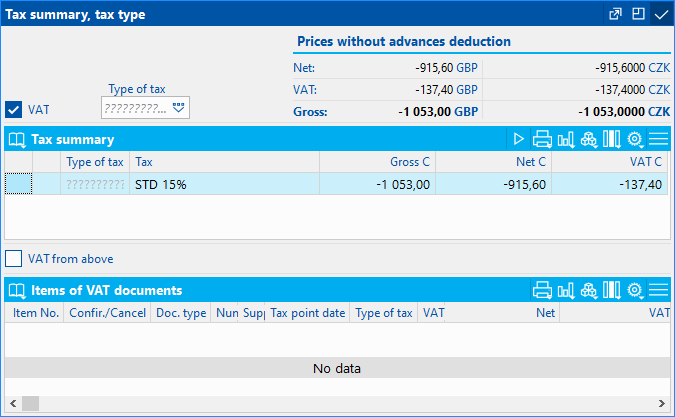

In the upper part of the Tax summary tab are the prices of an Invoice without the deduction of Advances. The displayed Gross, Net and VAT values show an Invoice amount without the deducted Advances.

There is a table of the price recapitulation of the Invoice under this information.

It displays the VAT documents items, in which the Invoice is entered.

Picture: Tax Summary - INVOICES OUT

Type |

Tax type determines into which line of the VAT Return the Invoice will be entered. |

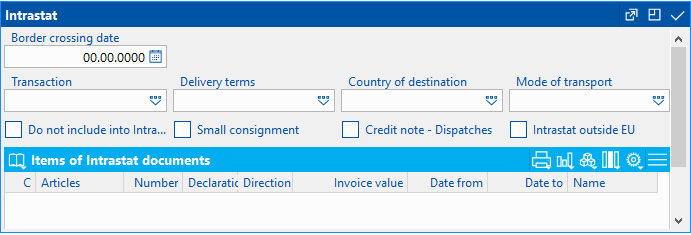

On the Basic data tab, there is an Intrastat button, which is used to enter data important for Intrastat reporting. If an Intrastat document already exists for the invoice, the intrastat items are displayed at the bottom.

At the bottom, the items of the Intrastat document in which the given invoice is issued are displayed.

Picture: Invoice Out - Intrastat button

Border Crossing Date |

Decisive date for entering the invoice into Intrastat. It is filled with the date of the invoice. If the client's parameter is checked. Fulfill the date of crossing the border according to the date of implementation, it is filled with this date. |

Transaction |

Invoice transaction type. |

Delivery Terms |

Invoice delivery Terms. |

State of destination |

Invoice country of destination. Can be filled in if the country of destination is different from the country in the customer's address (or delivery address, if specified). |

Transport method |

Invoice transport method. Can be filled in if the Mode of transport is not specified in the code list Mode of transport. |

Do Not Include into Intrastat |

The checked box will ensure that the document does not enter Intrastat (even if it should enter there according to other conditions). |

Low Value Consignment |

Data on individual consignments of send article, the invoiced value of which does not exceed EUR 200, may be summarized as a Small Consignment under the common article code "99500000". By checking the flag, the invoice is checked to see if the invoice meets the conditions for a small consignment. If the invoice does not meet the conditions, the items in Intrastat will be calculated separately. |

Credit Note in Dispatch |

The checked box ensures that the invoice item issued with a negative quantity reaches Intrastat - dispatch. If the field is not checked, then the given item enters Intrastat - receipt. Note: Suitable to use if the company reports only Intrastat - dispatch. |

Intrastat outside EU |

If it is checked, then the document with the state in the delivery address that does not have the Intrastat flag checked will also enter Intrastat. (If no delivery address is specified, then this is the country in the customer's address). The field addresses situations where sales are made, for example, from an e-shop to the United Kingdom (from 1.1.2021 it is not reported to Intrastat), but some (eg simple) delivery addresses are from Northern Ireland (from 1.1.2021 it is Intrastat). We will create a container for such documents and check this field using the Intrastat bulk change. |

Recapitulation of the Excise tax is displayed.

Picture: Invoice Out - Excise Tax

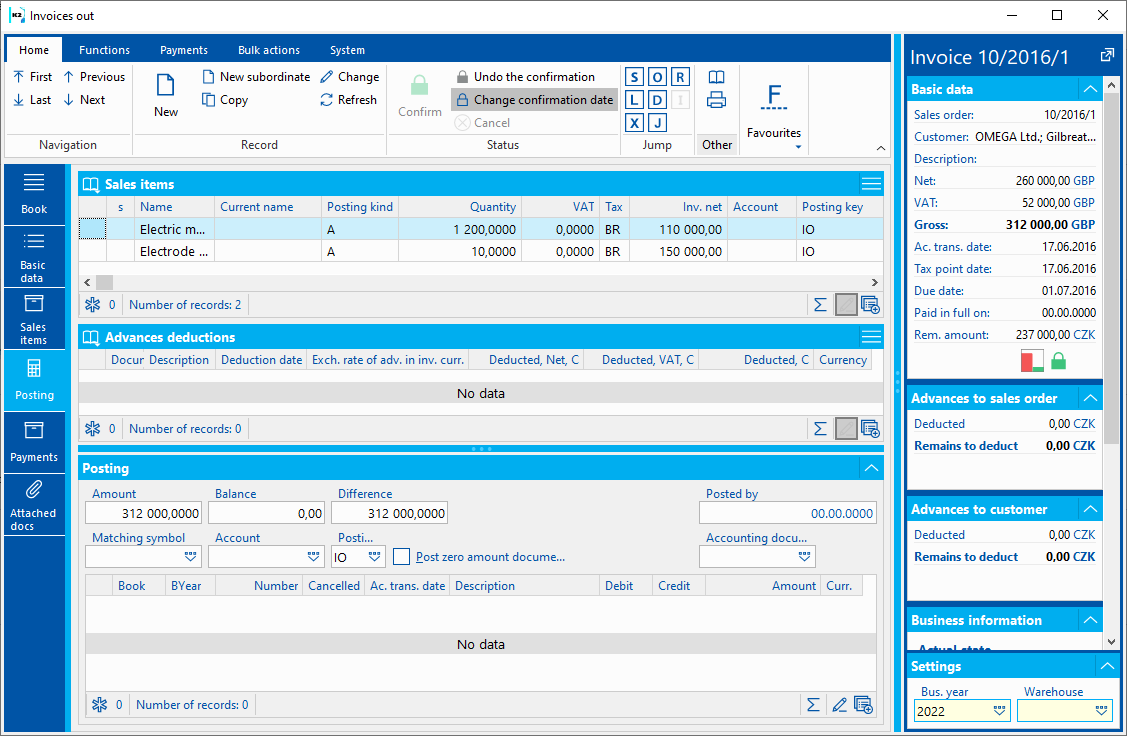

Items

On the Invoice Sales Items tab, you will find a list of individual items for which the invoice is issued. We insert a new item in the Change or in the New record by key Ins. If you issue an unassigned document, the Sale item form is displayed, into which you select a required article and enter the required data. If you issue assigned document, after pressing Ins select the items from the Header Items book. All the items that are sorted to the appropriate Sales Order are stated there; however, no Invoice has been issued for them yet.

Picture: Invoices out - Sale items

The Sale Item form can also be activated by pressing the Enter key over the particular Invoice Out items either in the Change mode or in The Browse mode. In addition, the Change mode allows you to edit the data about invoiced prices, quantities, you can set the codes, etc.

In the heading of the document, you can display the data about the planned and the actual profit and margin of a document. See further description in the Profit, Margin and Stock Price chapter.

Values in the document items, including discounts, can be adjusted in bulk with the Bulk Change of Items button in the Change mode. For further description of this function, see the Bulk Edit Document Items and Purchase and Sale Items chapters.

The list of drawn advances is displayed at the bottom of the invoice, and the amounts that can be drawn are displayed on the right (the amounts are stated in the invoice currency). In the Change mode, the buttons for deducting Advances are accessible.

Description of Selected Fields:

Deduct Adv. Linked w. Sales Order |

Pressing the buttons will open the options for deducting an Advance to a Sales Order to which the Invoice is linked. |

Deduct Adv. Linked w. Customer |

Pressing the buttons will open the options for deducting an Advance to a Customer. |

Remains to Be Deducted from Adv. to Sales Order |

Amount of the paid Advances to a Sales Order that has not been deducted on an Invoice yet. |

Remains to Be Deducted from Adv. to Customer |

Amount of the paid Advances to a Customer that has not been deducted on an Invoice yet. |

Further description is stated in the Deducting an Advance Received on an Invoice Out chapter.

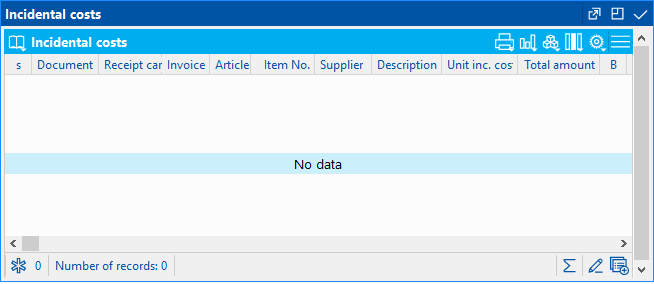

The Ancillary Costs button displays the ancillary costs.

Picture: Ancillary costs

The Serial Numbers button displays the serial numbers on the document.

Picture: Serial numbers

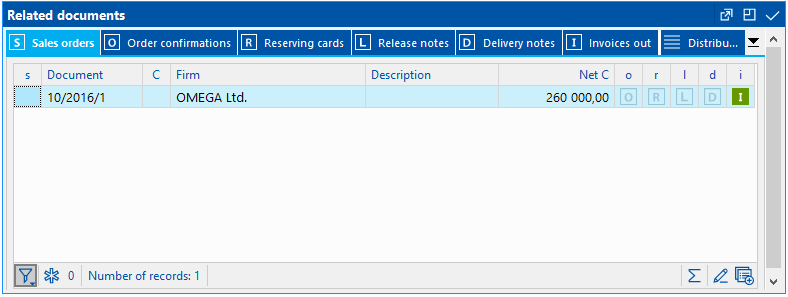

The Related Documents button displays all related documents.

Picture: Related documents

Account assignment

To Posting tab is used to post invoices, which is optically divided into three parts. In the upper part are the individual items of an Invoice. The deducted Advances are displayed below. The lower part serves for the posting of the document.

Note: Closer description is in The Accounting - Account Assignment and Posting chapter.

Picture: Invoices Out - Posting tab

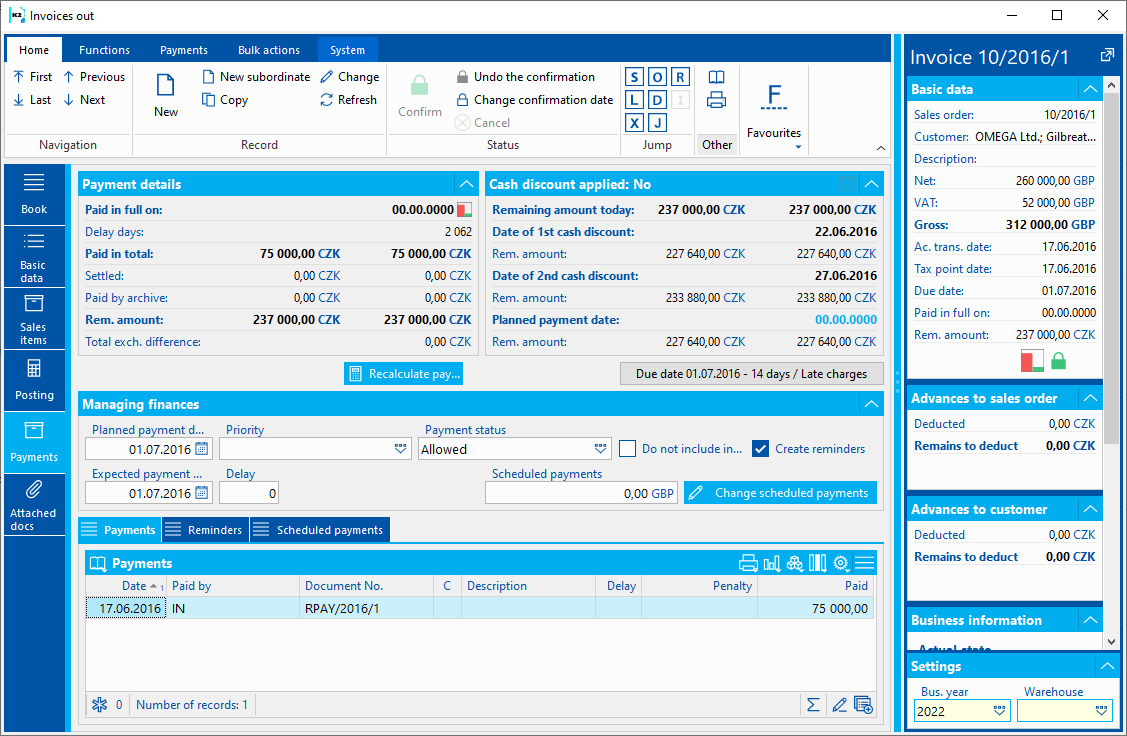

Payments

The Payments tab displays information related to the status of the invoice payment, such as whether the invoice is fully or partially paid, the due date, delays, penalties or information about the individual payments (the lower part of the screen).

Picture: Invoices Out - Payments

Field description:

Paid in Full On |

The real date of the Invoice payment. |

Number of Days Delayed |

The delay of payment in days. |

Paid In Total |

The total amount that has already been paid. |

Settled |

The amount that has been paid by banker's orders. |

Paid by Archive |

The amount paid by the documents, which have been already moved to an archive. |

Remaining Amount |

The amount that remains to be paid. |

Total Exch. Difference |

The total amount of an exch. difference expressed in numbers to the Invoice. |

Discount Applied |

The field serves for marking documents which fulfilled conditions of discount and a discount has already been applied on them. The field cannot be edited by the user. |

Remaining Amount Today |

The amount which remains to be paid on the current date. |

Date of First Discount |

Date of the first discount according to the payment conditions entered on the 1st page of the Invoice. If no payment conditions are defined, this date is identical to the due date. The amount indicated in the field below is an amount to be paid to this date. |

Date of Second Discount |

Date of the second discount according to the payment conditions entered on the 1st page of the Invoice. If no payment conditions are defined, this date is identical to the due date. The amount indicated in the field below is an amount to be paid to this date. |

Planned Payment Date |

The planned date of payment. The due date is automatically added, taking into account the delay from the customer's card to the date of issue of the document. It is possible to change it. |

Due Date |

The due date of an Invoice. |

Number of Maturity Days |

The number of maturity days in which the Invoice should be paid. |

Payment Recalculations |

The Recalculate button recalculates the payments for the Invoice. The recalculation can also be run by using the Ctrl + F3 key combination on the 6th page of an Invoice. If there is an exclamation mark next to the button, the payments on the 6th page are not counted correctly - it is necessary to run the payments recalculation. |

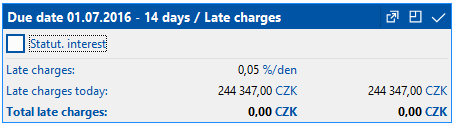

Maturity and late charges

Picture: Maturity and interest

Statutory Interest |

If this field is checked, the interest provided by law will be added to the Invoice. |

Late Charges |

Contractual late charges specified in % per each day of the delay. |

Charges from delay today |

Total charge from delay. |

Total Late Charges |

The amount of late charges calculated from the entered percentage and the delay days on the date of payment. |

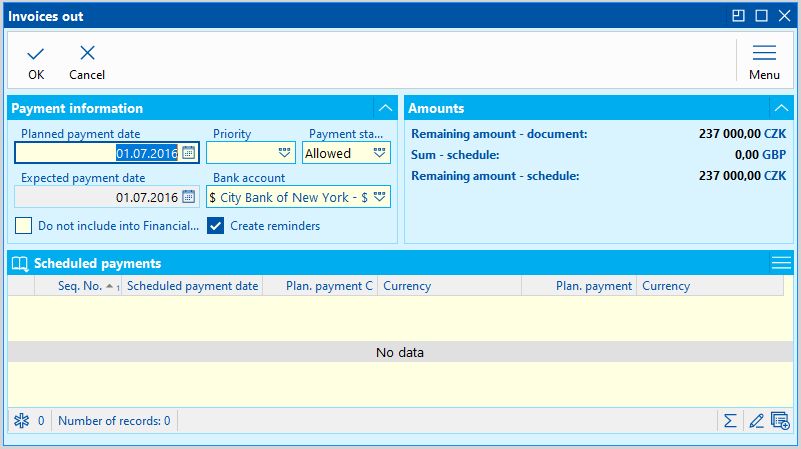

Fields description in the Financial Management section:

Planned Payment Date |

The planned date of payment. The due date is automatically added, taking into account the delay from the customer's card to the date of issue of the document. It is possible to change it. |

Priority |

Used to set the priority for a payment. |

Payment Status |

A payment status that can be used to suspense a payment or completely block it. The payment status can take the values of Allowed, Suspended, or Blocked. You cannot add payments with the Suspended or Blocked payment status to a banker's order. |

Do Not Include To Financial Management |

If this option is checked, the document does not appear in the Financial Management module. |

Create notification |

Documents with this check mark enter the Create notification function. The check mark is set when creating a document and changing Suppl./Cust. according to the settings on the Suppl./Cust. tab. |

Expected Payment Date |

Expected payment date reflected by the current delay from the Customer card. The field cannot be edited. |

Scheduled payments |

Total amount of scheduled payments. It can be set in the Change of scheduled payments button. |

Delay |

Delay set on the Suppl./Cust. tab. |

Change of scheduled payments

With the button it is possible to set some fields related to payments on the invoice, such as Scheduled payment date, Priority, Payment status or bank account. It is also possible to edit the Do not include in financial management and Create reminders checkboxes. With this button, the user can enter scheduled invoice payments.

Picture: Change of scheduled payments

If a rounding error is defined in the Client Parameters, then if the Amount in In the Remaining to pay field (on the Payments tab) less than the set rounding error, the invoices are marked as paid.

Lower part is divided into 3 tabs:

- Payments,

- Payment Plans,

- Reminders.

In the Payments tab there are displayed individual payments of an Invoice. After pressing the Enter key in View on a specific payment, the item of the bank statement, cashier or internal document, or of the bank order by which the payment was made (paid). In the payment document, the ruler is set to the item that corresponds to the invoice payment.

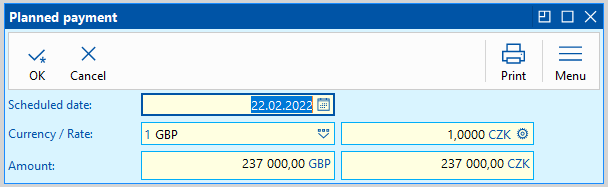

In the Payment plans tab, in the Change state, you can use the Insert key to insert items that will indicate scheduled payments. Define a Date, Currency and Amount that you want to pay at each Plan. The plans created will be displayed in the Financial Management book. It is also possible to change the scheduled payment date on the tab. If the user has set right the Finance / Financial Management / Change Scheduled Payments on the document in the blocked period, he/she can also change the data on the documents that are in the blocked period.

Picture: Form for Scheduled payments

In the Reminders tab, individual Reminders that have been issued on an Invoice are displayed. With the Ctrl+Enter keys, you can switch into the Books of Reminders, the light indicator will be positioned on a specific Reminder.

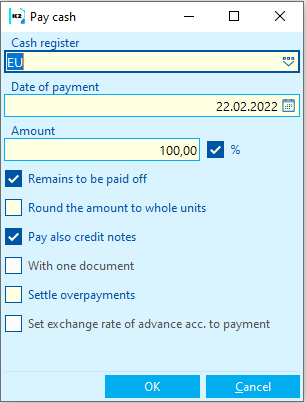

Payment of invoices can be done not only in the Finance module by means of banker's orders, bank statements and cash vouchers, but you can also use the automatic invoice payment directly on invoices out (in). This function can be activated by the following ways:

- Use the Shift + F2 keys to start the Automatic Cash Register function. After pressing the key combination, the Automatic Payment form is called up and after filling in the form data, the current document will be paid by cash voucher.

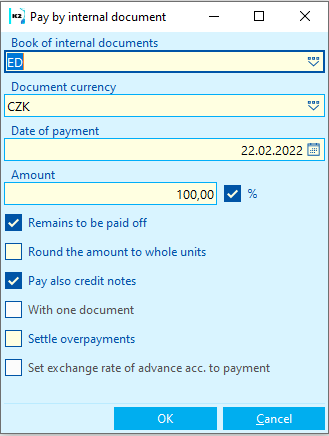

- Automatic payment by internal document function can be run by Shift+F3 key combination. After pressing the key combination, the Automatic Payment form is called up and after filling in the form data, the current document will be paid by internal document.

- Run through the module Menu Form - Bulk actions - Payment by cash register. In this case, it is possible to activate the bulk payment of Invoices either in the table of Invoices (if Invoices are indicated by asterisks), or in the container.

- Run through the module Menu Form - Bulk actions - Payment by internal document. In this case, it is possible to activate the bulk payment of Invoices either in the table of Invoices (if Invoices are indicated by asterisks), or in the container.

Picture: The Automatic Payment form - Shift+F2

Field description:

Cash Register |

Selection of a Cash Register (from theBooks of Cash Register table) from which the payment will be executed. |

Date of Payment |

The date of the payment. |

Amount |

The amount to be paid. Into that field, it is possible to type either the amount in invoiced currency or percentage of partial payment (e.g. to pay 20% of the total invoice amount) If we pay multiple Invoices in bulk by entering the amount (not %), documents with a negative remaining amount are excluded from the payment (they will be shown in the error message). |

Amount - Remaining Amount |

The option for paying the remaining amount (it is used for Invoices that have already been partially paid). That option can be combined with the previous one when it is possible to pay for example only 50% of the remaining amount. |

Round Payment Amount to Whole Units |

This rounds the payment amount to integer units. |

Pay Also Credit Notes |

If an Invoice is issued as a credit note, then it is not possible to pay the Invoice without checking this flag. |

With One Document |

This option is available in automatic payment, which is run on more invoices via bulk action. If you check that option, the selected Invoices will be paid with only one document. Otherwise , a single Cash Voucher will be issued for every Invoice. |

Settle overpayments |

The option to settle unpaid penny balance. If it is checked, the documents' "Pay Off" amount of which is less (or equal) than the rounding error will be paid off. |

Set Exchange Rate of Advance Acc. to Payment |

This option is used for payments of Advances in a foreign currency - it will set an exch. rate according to the Advance payment on the paid Advance (no exchange differences should arise when Advances are paid). |

Note: If the documents are marked with an asterisk, the function pays the documents from the last asterisk. If the documents are in the container, the function pays documents from the first document.

The form of automatic payment by an internal document is similar, and you can also set the Document Currency (i.e. the currency of the internal document).

Picture: The form of automatic payment by an internal document

Attached Docs.

As in other IS K2 documents, it is possible to insert documents or processes on the Invoices out Attachments tab. The further description of the work with this page is stated in the Basic Code Lists and Supporting K2 Modules - Attachments - Connection and links chapter.

There are also the Tasks and Activities tabs. A closer description of work with the folders is stated in the Tasks - Document Folder and the Activities - Document Folder chapters.

Functions of the Invoices Out Module Menu

Bulk actions can be run on the records marked with asterisks or on the records in container.

Description of actions:

Payment Recalculations |

The function for mass recalculation of Invoice Out payments. |

Payment by Cash Register |

This performs an automatic payment of Invoices by the Cash Register. Closer description is in the chap. Invoice Payment - Automatic Payment by Cash Register and Internal Document . |

Payment by Internal Document

|

This performs an automatic payment of Invoices by internal document. Closer description is in the chap. chap. Invoice Payment - Automatic Payment by Cash Register and Internal Document . In this context, the Not Paid Off and Overpaid Documents filter is set. After activating this filter, enter the accounting trans. date, from which you want to select the documents, and the range of the Remaining Amount field (e.g. from -1 to 1). The created filter will contain the 'not paid off' or 'overpaid' documents, which can be paid by an internal document in bulk after marking them with an asterisk. |

Change Type of Tax |

The function for bulk change of the tax type. The change will be reflected in the document header and in the Tax Summary. |

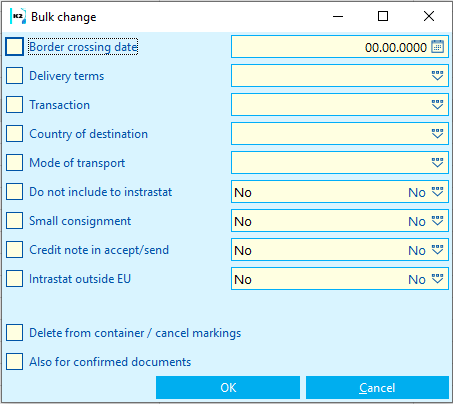

Change Intrastat Data |

It executes the change of records relate to Intrastat (see the Intrastat tab on the 1st page of Invoice out). The user, who wants to make the bulk change, has to have the right Change intrastat documents or the right Bulk change of invoices. |

Picture: The form for changing the Intrastat records

Field description:

Also For Confirmed Documents |

Changes will be made to the confirmed documents too. Note: If the field is not checked and the change of records is to be done on the documents that contain the confirmed document, an error message warning us about the confirmed document will show. |

Delete from Container |

After the changes are made, the container is emptied. |

Border Crossing Date |

The value that is inserted into the Border crossing date field in an invoice. |

Delivery Terms |

The value that is inserted into the Delivery Terms field in an Invoice. |

Transaction |

The value that is inserted into the Transaction field in an Invoice. |

Country of Destin./Dispatch |

The value that is inserted into the Country of Destin. field (if the bulk change has been run on the Invoice Out). The value that is inserted into the Country of dispatch field (in the case, that the bulk change has been run on the Invoice In). |

Do Not Include into Intrastat |

Yes - the flag in the Do Not include into Intrastat field on the Invoice will be checked; No - the field will not be checked. |

Low Value Consignment |

Yes - the flag in the Low Value Consignment field on the Invoice will be checked; No - the field will not be checked. |

Credit Note in Receipt / Dispatch |

Yes - the flag in the Credit note in dispatch field is checked (in the case, that the bulk change has been run on the invoice out). Yes - the flag in the Credit Note in Receipt field is checked (if the bulk change has been run on the Invoice In). |

Description of Other Actions:

Revaluation to the Date of Balance |

This revalues Invoices on the date of balance by an internal document. Closer description is provided in the Accounting - Revaluation to the Date of Balance. |

Cancel Revaluation to the Date of Balance |

It cancels the revaluation to the date of balance. Closer description is provided in the Accounting - Revaluation to the Date of Balance. |

Function over Invoice out

Function description:

Payment Recalculations |

Function for payment recalculations to invoice. |

Cash Register payment (Shift+F2) |

Runs the form for changing the Invoice date (in the book and on the Basic Data tab in Browse mode). Executable only on corrective tax documents. Starts the function for automatic payment of invoices by the cash register. |

Payment by Internal Document (Shift+F3) |

Starts the function for automatic payment of invoices by internal document. |

Create reminders (Shift + F5) |

This opens the form for creating reminders in the book. |

Ctrl+Shift+Alt+F5 |

On the Payments tab in the Browse, it will open the form for Change of payment by the archive. |

Ctrl+Shift+F8 |

On the Sales Items tab in Browse, runs the form for creating a new service sheet. It is necessary to set up the Complaint / Services module for this functionality. |

Change of scheduled payments |

On the Payments tab, it allows you to enter payment plans and change other information related to the payment of the document, such as change of the planned payment date, priority, payment status, bank account, Create reminders check box and Do not include in financial management. |

Change document status (Ctrl + Alt + F5) |

The function enables to choose the document Status. |

Cancel Invoices (F8)

If an Invoice has already been saved (the number has been assigned to it), it cannot be deleted by any procedure. You can cancel it by pressing the F8 key. A cancelled Invoice remains in the database with the same data, only the flag of cancellation has been assigned to it. It is thus always possible to find out the amount for which it has been issued, and its content. A cancelled Invoice cannot be changed any more, just like in the case of confirmation. By pressing the F8 key again, an authorized person can undo the cancellation of the Invoice. The procedure is the same as when you undo the confirmation.

If a document with allocated incidental costs is cancelled, these incidental costs are automatically deleted. This means that such a document cannot be cancelled if the user does not have the right to allocate incidental costs or the incidental costs are allocated into the item of a Receipt Card, which is in the blocked period.

If an Invoice has been created by mistake and it is not desirable for the it to behave as a cancelled Invoice in the table of Invoices, it is possible to link it to another Order Confirmation by using Matching - Alt+F5, and use the created number for an other Invoice.

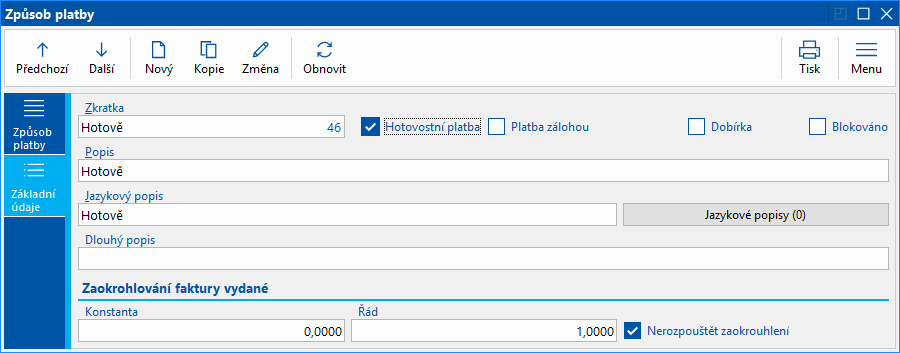

The rounding of domestic Invoices depends on the Payment Method

For Invoices Out It is possible to set the rounding which depends on the Payment Method in the domestic currency. Rounding is set in The code list Payment Method displayed in the View over Invoice out status. In the Constant field, enter the value to be added or subtracted to the rounded number before rounding itself (allows rounding up or down). The value that is to be rounded can be entered into the Order field.

Picture: The Setting of Rounding in Payment Method form

If you set the rounding by the picture, the rounding will be for integer units.

The rounding is processed upon creating an Invoice Out, where the payment method is set, or upon changing the payment method, where it must be a domestic Invoice (the option Currency is not checked), where the Adjusted option is not checked (in the Tax Summary folder). If the Do Not Allocate the Rounding field is off, the rounding difference will be allocated into the Net values and one VAT rate. (This concerns the invoices with the Acc. Trans. Date higher than or equal to the 2019 VAT Legislative - New Method of Calculation From in the Client Parameters. In the case of Invoices with an older date, the rounding difference will always be allocated.)

The Do Not Allocate The Rounding field should always be activated on those payment methods that have the rounding set to integer units and that represent a payment in cash.

Depending on the method of payment, the document is rounded only if its currency is the same as the currency in the client's parameters.

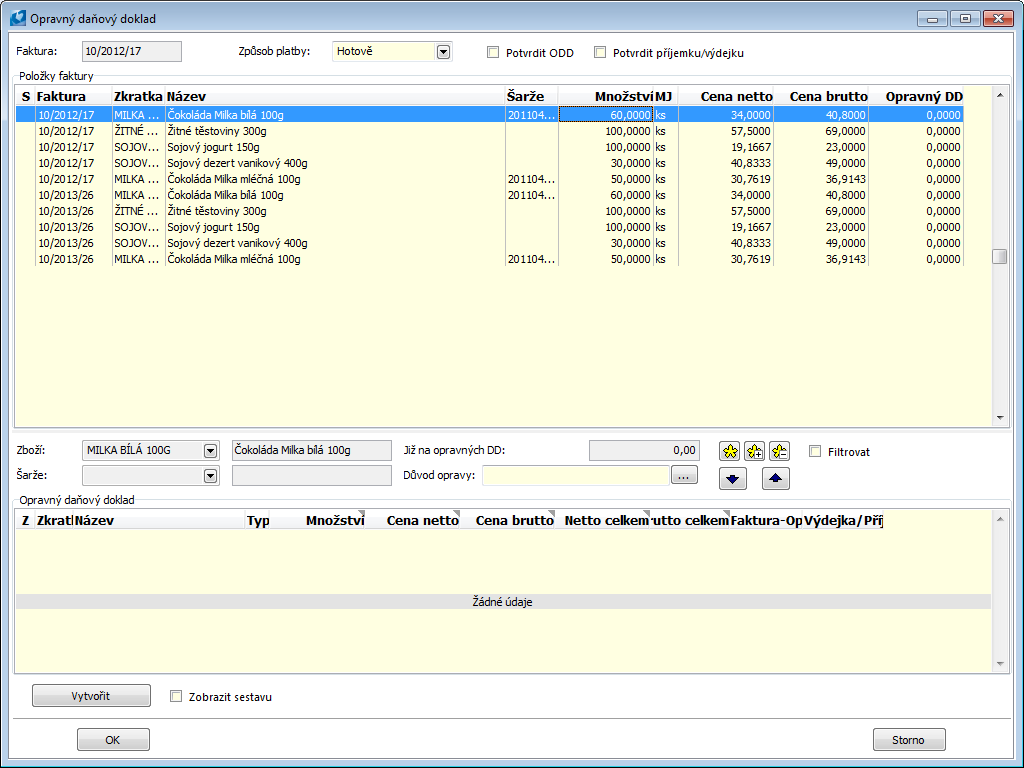

Credit Notes

This function ensures that tax documents are created to the invoice items and to advances and their mutual interconnections. The solution is based on the new invoice being created to the original invoice, or rather to their items. The new invoice (Credit Note) should contain one or two items depending on whether it deals with amount or price corrections. The function also allows you to create corrective tax documents for multiple invoices at once, or only stock documents.

An corrective tax document can also be created for advance that is paid and not used up. A new advance (corrective tax document) is created for the default advance with a negative amount (for advances, this is always a price correction).

The function for processing corrective tax documents can be started over a specific invoice out, received advance, invoice received or provided advance. If we run the function from the 0th side, it is necessary to mark the records we want to work with with an asterisk or insert invoices into the container. The function is started by the script Corrective tax documents, which can be run from the tree menu Finance - Corrective tax documents.

Create Credit Notes in bulk

If you want to create a Credit Note to more Invoices at once, the Invoices must meet the following conditions:

- they have been issued to the same company,

- they have set the identical type of tax in header,

- they have set the Currency checkbox identically, and if the Currency checkbox is checked on all Invoices, it must be an identical currency,

- if the CreateNewCommission parameter is set to "No", all the Invoices must be issued in an identical book,

- if the Invoices are not issued in an identical book, the Allow Multi-docs/Allow Adding Superior Document From Other Book client parameter must be set to "Yes".

If the Invoices do not meet some of the conditions mentioned above, the function shows you the reason why it is not possible to run it and it will end itself. If the Invoices meet all of the mentioned conditions, the initial form of the function for creating a Credit Note will appear, in which you indicate the quantity or the price that you want to credit. How to indicate the quantity is mentioned above.

Picture The Credit Note form

If you confirm the form, a new Invoice is created. When creating Credit Notes in bulk to more Invoices at once, the fields that have been taken into the Credit Note from the original Invoice will be taken as follows:

- if the Invoices indicated with asterisks are processed, and the light indicator has been positioned on an other (not indicated) Invoice when activating the script, the header data will be taken from the first indicated Invoice. Otherwise, the header data will be taken from a record on which the light indicator has been positioned when activating the script,

- if a Credit Note is created in a foreign currency to one Invoice, the exchange rate will be entered from the original Invoice (the same as before). If a Credit Note is created to more Invoices, the exchange rate will be entered into the Credit Note from an Exchange list that has been valid to the 1st of January of the current year - foreign exchange centre (if there is not an exchange rate to the 1st of January in the Exchange list, the nearest preceding one is taken).

The Invoice from which the fields are taken for the new Invoice is stated in the header of the form in the 'Invoice' field. A supplement of the "VS" type is inserted into the item of a newly created document. One supplement is created for each original Invoice, from which a Credit Note is created. A reference number of an original Invoice is inserted into the description, and the number of the original invoice in the Book/BusinessYear/Number format is saved into a long text. It is possible to set what will be printed by the ShowFormerInvoice parameter in the Invoice Out print report (VF_DOK01.AM).

A newly created Invoice is linked with all Invoices from whose items the Credit Note has been issued through the 9th page.

Offset of invoice and corrective tax document when creating corrective tax document

In the function for creating corrective tax documents (FA_DOB.pas) for an unpaid invoice, it is possible to create straight internal document, which will offset the invoice and corrective tax document (CTD). For this functionality it is necessary to set the parameters:

- InternalDocBook – Abbreviation of internal document book for offset (by default is empty)

- CreateOffset– Create invoice offset and CTD by internal document (by default is No).

Posting

Correction of Price

Invoice Out |

311/604 311/343 |

10pcs x ?€189,89 |

50 000,- 10 000,- |

Invoice Out (Credit Note) |

311/604 311/343 |

-5pcs x ?€189,89 |

-25 000,- -?€189,89 |

|

311/604 311/343 |

5pcs x ?€75,96 |

10 000,- ?€?75,98 |

Correction of Quantity

Invoice In |

111/321 343/321 |

10pcs x ?€189,89 |

50 000,- 10 000,- |

Invoice In (Credit Note) |

111/321 343/321 |

-5pcs x ?€189,89 |

-25 000,- -?€189,89 |

Credit Notes

Process No.: EXP014 |

Id. Script number: FEXP017 |

File: FA_DOB.PAS |

Script description: This function ensures that tax documents are created to the invoice items and to advances and their mutual interconnections. It is possible to use it in bulk to more invoices and to create only the stock doc. The solution is based on the new invoice being created to the original invoice, or rather to their items. The new invoice (Credit Note) should contain one or two items depending on whether it deals with amount or price corrections. |

||

Address in the tree: [Finance] [Credit Notes] |

||

Script parameters:

AccDate_VF - Accounting transaction date of an Invoice Out - CRN. |

ArticleFilter - No Yes - just the items from the article container will be displayed in an initial form. |

BorderCrossingDate - 0.0.0000 A Border crossing date that will be completed into the items. If the parameter is a zero date, then in the case of a price credit, the date of issue of the credit invoice is added to the items. |

ConfirmInvoice - No Yes - a newly created invoice (Credit Note) and an advance (Credit Note) will be confirmed. |

ConfirmNewCommission - No Yes - if the parameter CreateNewCommission = Yes and its subordinate documents are confirmed, a newly created Sales Order will be confirmed as well. |

ConfirmRel - No Yes - a newly created Receipt Card/Release Note will be confirmed as well. |

ContractCode_VY - The abbreviation of a contract code of a newly created Release Note. |

CopyBatch_RP - Yes Yes - the batch from an original Receipt Card will be inserted into a Credit Note Receipt Card. No - the oldest batch with availability will be inserted into a Credit Note Receipt Card. |

CopyLocation_RP - Yes Yes - the location from an original Receipt Card will be inserted into a Credit Note Receipt Card. No - the location will not be inserted into a Credit Note Receipt Card. |

CorrTaxTypes - No Yes - the type of tax will be changed on a newly created Invoice (usage for the Slovak legislative). |

CreatedDocuments The parameter is necessary for an internal programme usage. |

CreateFreeInvoice - No Yes - a free Invoice will be created in case of price credit note. |

CreateInvoice - Yes No - a new invoice - credit note is not created. It is used if you want to create only the stock documents. |

CreateNewCommission - No The parameter is useful for Invoices Out and In only. Yes - a new Sales Order/Purchase Order is created as well. Items are not included in the original Sales Order/Purchase Order; No - a new Sales Order/Purchase Order is not created. |

CreateOffset – No Create invoice offset and CTD by internal document. |

CreateStockDoc - Yes Yes - creates a Receipt Card/Release Note to an Invoice. |

CopyPaymentCondition - Yes No - does not copy the payment conditions into a new Invoice - Credit Note. |

DateOfIssue_VF - Date of issue of an Invoice Out - CRN. |

EmptyInvoiceDate - No Yes - adds the null invoice date into a new Invoice. |

EnterRebate - No Yes - enters the discount on an item in price credit note; No - enters a new price of an item. |

IgnoreReceiptPrice_VY - No Yes - set the Ignore option to the income price when you value the sliding price or value by batches on the Release Note. |

IncidentalCost - Yes Yes - the items of price credit note will be marked as the Incidental cost on the Invoice in. |

InternalDocBook – Abbreviation of internal document book for offset. |

InvoicePostingKey Posting key abbreviation of an Invoice - Credit Note. |

LinkForOriginalInvoice - No Yes - the link to the original document will be inserted into items and to the 9th page of the created CRN. (Useful for repeated price credit notes.) |

Location_VF The internal number of Location for credited Release Notes. |

Messages - Yes Yes - after you agree on the initial form and the message, a query will appear. No - no query or message will display. |

NameOfReasonToDescr - No Yes - the reason of correction will be inserted into the Description of an Invoice - CRN (if a new one has been created). If the reason is saved into the code list, the Name from the code list will be inserted into the Description. |

NewAdvanceBook_PZ The setting of Books of Sale, where advances - CRNs will be created. |

NewAdvanceBook_VZ The setting of Books of Purchase, where advances - CRNs will be created. |

NewCommissionBook_PF The setting of Books of Purchase, where CRNs will be created. |

NewCommissionBook_VF The setting of Books of sale, where CRNs will be created. |

NewDocStatus The abbreviation of a Status that will be filled into newly created documents. |

NoInteractive - No Yes - the Corrective tax document will be created to all the invoice items without the form display. |

NoInteractiveXml The parameter is necessary for an internal programme usage. |

NoIntrastat - No Yes - the option 'Do not include to Intrastat' will be checked on an Invoice. |

OriginalStockPrice_VY - No Yes - the stock price from the original Release Note will be inserted into the Release Note in the case of a quantity credit note. |

PrintReport - No The parameter to pre-set the checkbox "Display the report". It is possible to display the report, even though the parameter "NoInteractive" is set to "Yes". |

ReasonForCorrection The parameter to pre-set the reason of correction - displayed in the Initial form. |

ReasonForCorrectionRequired - No Will require to fill in the reason for correction. Yes - if no reason for correction is created, a Credit Note will not be created. |

ReportNumber The parameter to enter the number of print report in F9 (to print the report with the set parameters). |

ReportPath_PF The parameter to print a special report of an Invoice In. It is necessary to enter the whole path to the saved report. |

ReportPath_PZ The parameter to print a special report of an Advance Received. It is necessary to enter the whole path to the saved report. |

ReportPath_VF The parameter to print a special report of an Invoice Out. It is necessary to enter the whole path to the saved report. |

ReportPath_VZ The parameter to print a special report of an Advance Provided. It is necessary to enter the whole path to the saved report. |

ShowOnlyToCreditNote - No Yes - only the items that can be credited will be displayed in the initial form. |

Stock_PF - 0 The parameter sets the stock number, where the Receipt Cards are being created. |

Stock_VF - 0 The parameter sets the stock number, where the Release Notes are being created. |

StockDocPostingKey - The abbreviation of the posting key of a Receipt Card / Release Note. |

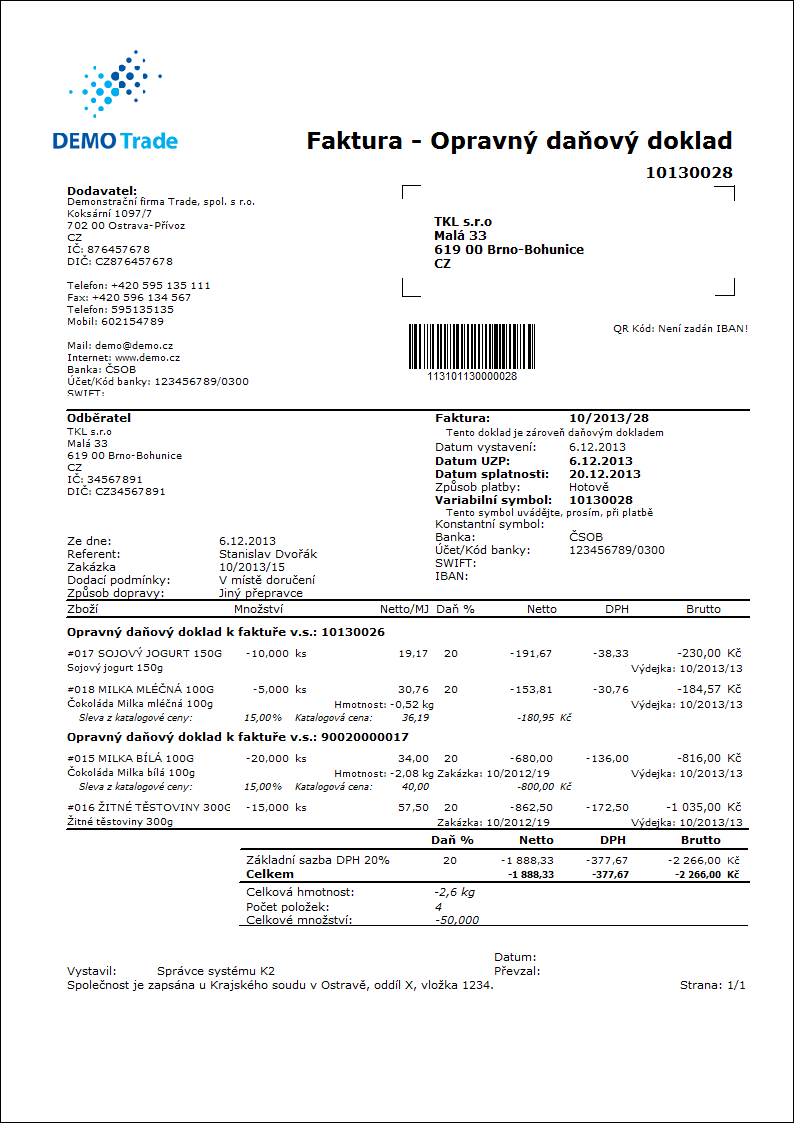

Reports - Invoices Out

Invoice Out

Process No.: EXP009 |

Iden. Report no.: SZAK009 |

File: VF_DOK01='AM' |

Report description: Invoice Out |

||

Address in the tree: [Sale / Processing of Contracts] [Invoices Out] [Print Documents - Lists] |

||

Report parameters:

Assignment - No Yes - displays document posting (data from the 3rd page of the document). |

BankContacts - 3 0 - information about a bank connection is not displayed; 1 - information is displayed only in the header; 2 - only in apart for items; 3 - information about a bank connection is displayed in the header and also in the part for items; 4 - 6 values correspond to the 1 - 3 values; just instead of a bank abbreviation the name of a bank is displayed. |

BarCode - Yes Yes - a bar code is displayed. |

Batch - No Yes - batches for an item are displayed. |

BatchAttr - 1 0 - nothing is displayed; 1 - batch parameters are displayed; 2 - required batch parameters are displayed. |

BusinessRegister - 1 Information about the Business Register from the Own Company Settings is displayed. 0 - does not display information about the Business Register, 1 - displays a maximum of two lines of text about the Business Register, 2 - displays a maximum of four lines of text about the Business Register. |

CataloguePrice - Yes Yes - catalogue prices for items are displayed. |

CodeAndCentre - 0 The cost centre and the code are displayed according to the settings: value 0 - nowhere, 1 - in the header, 2 - in items, 3 - in both places. |

CodeOfCurrency - No Yes - the code of currency is displayed (e.g. USD). No - the sign of currency is displayed (e.g. $). |

CombineOrigItem - Yes Yes - merges the items with the same "OrigItemF" (if it is not different in price and other attributes). |

Contacts - 1;Addr;TaxNum;Tel1;Fax1;Email1;WWW Number of days by which the confirmation is to be returnedThe parameter has a total of 10 positions, the first three are fixed: 1. position: a user whose contacts from the user card (telephone, mobile, fax, email) are printed. Options: 0 - no user contacts, 1 - the user who has issued the doc., 2 - the currently logged in user, who prints the documents. 2. position: "Addr" - if it is specified, a company address is displayed. 3. position: "TaxNum" - if specified, the ID-No. and VAT Reg. No. are displayed. 4th - 10. position: listed types of electronic addresses of the own company (i.e. there may be up to 7 types). Example: (Contacts - 1;Addr;;TEL1;FAX1;WWW1): The Company Address will be displayed, behind which are the contacts from the user card, (tax numbers are skipped by an empty string on the 3rd place), then there are electronic addresses with Tel1 type, Fax1, WWW1. Note: If one piece of data is suppressed, there is no vacancy. Nevertheless, the default order in the report is always as follows: address, Tax No., user contacts, entered electronic addresses of own company. |

DefaultExport - No This is described along with other export parameters in the Report Parameters for Bulk Sending via E-mail chapter. |

Description - No Yes - information from the Description field from the 1st page of the document is displayed. |

DescriptionFromItem - Yes Yes - a supplement that is entered into the Description field in a document item is displayed. |

Discount - Yes Yes - a discount entered in item is displayed. |

DraftLabel - Yes Yes - if a document is not confirmed, "DRAFT" text is displayed in the background of a report. No - "DRAFT" is not displayed. |

EUCertificationDays - 10 Number of days by which the confirmation should return. |

EUCertificationDeliveryTerms - EXW;FCA Delivery conditions for which the Delivery confirmation of article to the EU is printed. |

EUCertificationTyxTypex - PM;PO;VA;VE Types of taxes for which the Delivery confirmation of article to the EU is printed. |

ExemptSupplies - Ano Yes - lines are displayed. tax summary. No - does not display tax recapitulation lines for invoices that do not have the VAT flag checked. It is used for invoices that are sent abroad. |

Export_... - various parameters The report also includes export parameters described collectively for all documents in the Report Parameters for Bulk Sending via E-mail chapter. |

FormerInvoice - 1 It displays a reference to the original invoice in the form: 0 - reference number, 1 - number, 2 – number and reference number when printing an invoice as a Credit note. |

Interactive - No No - an initial form to enter parameter values is displayed. |

ISDOC_AccountsBetweenPartners - Payment methods in K2 for posting payment between partners (separated by a semicolon). |

ISDOC_CurrentCompany - 0 Identification (company number) in customers. |

ISDOC_DeliveryNoteType - 1 Which link from the invoice item to export: 1 - Delivery Note; 2 - Release Note. |

ISDOC_DocSupplementType - ALL Document type to be exported. |

ISDOC_NonTaxedType - N Abbreviation of the tax type in K2, for the type "Do not include in the return". |

ISDOC_Path - C:\ Path for file export. |

ISDOC_PaymentsByCreditCard - Payment methods in K2 for card payment (separated by a semicolon). |

ISDOC_PaymentsByCheck - Payment methods in K2 for payment by check (separated by a semicolon). |

ISDOC_PaymentsInCash - Payment methods in K2 for payment in cash (separated by a semicolon). |

ISDOC_SaleRefNo - No Yes - the reference number of invoice is added to the registration number in ISDOC. No - complete the document number |

ISDOC_SuppressPicture - Yes No - does not display a bitmap in header for ISDOC. |

ISDOC_TransferToAccount - Payment methods in K2 for payment by transfer (separated by a semicolon). |

Items - Yes It does not hide all items of the document. Instead of items, the user can then print his text defined, for example, in the customer's supplement. Tax recapitulation is not affected by this parameter. |

JCKindItem - A list of kinds that are printed in a tree of Job Cards (you have to separate more kinds by a semicolon). |

JCTreeLevel - 1 0 - all the levels of Job Cards are displayed for items, 1 - without Job Cards 2,3,4... - number of levels. |

K2Info - Yes Yes - displays an informative text about the document issued by the K2 system. |

KeepEnvelopeFormat - No No - the blank space under a place for envelope window is hidden. The saved place is multiplied, if the "ShowBarCode" parameter is set on "No". Useful if the user does not use the window envelopes and does not want to fold the printed document into an envelope according to the cam line guide of a document. Yes - the place is not hidden - the line between items and the address part will always be in one third of the page. |

LangAccordToParams - No If the report has to be printed in a language that is set in the "Field Language" and "Report Language" parameters, you have to set the value of the parameter to "Yes". |

LeftEnvelopeWindow - No Yes - the address of a customer is printed on the right side (determined for sending documents by mail in abroad where a window for envelope is on the left side); No - the address of a customer is on the left side. |

LeftShift - 5 By how many mm the edge of the report is shifted to the left (sets the print on a printer). |

LineBetweenItems - No Yes - separates individual items with a dashed line. |

LogoPictureFooter - 0 Parameter adjusts the footer logo display. If the parameter is empty, the footer logo is displayed according to the parameter settings Picture in Footer in the function Administrator - Administration of Own Companies. 0 - nothing is displayed, but a place is kept vacant (for a header paper), 1 - neither picture nor free place. File name with png suffix - specific picture in the Pictures directory of the given company. |

LogoPictureHeader - The parameter corrects the logo header. If the parameter is empty, the header logo is displayed according to the parameter settings Picture in Header in the function Administrator - System - Administration of Own Companies. 0 - nothing is displayed, but a place is kept vacant (for a header paper), 1 - neither picture nor free place. The condition is to have the KeepEnvelopeFormat parameter set to No File name with the png extension - a specific picture in Pictures directory of the given company. |

LoyaltyProgramOverview - Yes Yes - displays the status of customer loyalty programs. |

Notes - Enter the comment type from the document header, which is to be displayed in the report into the parameter. To display more comment types, it is necessary to separate the individual types by using the semicolon (e.g. MAIL;CMR). If multiple comments of the same type are found, all of them are displayed. |

NumberOfDocOnItem - 1 0 - nothing is displayed, 1 - a Release Note number is displayed for an item, 2 - a Delivery Note number is displayed for an item. |

NumberOfItem - 1 0 - no number is displayed, 1 - the number of a Sales Order item is displayed; 2 - the Purchase Order number is displayed. Always in the "#001" format. |

NumberOfOrders - 0 0 - the order number appears only in the header, 1 - the order number is both in the header and in the items, 2 - the order number appears only on the item, 3 - the order number is displayed in the header and only on the items linked from another sales order. |

OneLineItem - No Yes - the document item is always displayed on 1 row. |

OwnCurrency - 0 0 - does not display information on tax recapitulation, 1 - displays only exchange rate, 2 - displays tax recapitulation recalculated to company currency, 3 - displays tax recapitulation and recalculation rate, 4 - displays tax recapitulation in the document currency. If the tax recapitulation is not in a currency other than the company currency, no conversion or exchange rate will be displayed regardless of the value of the parameter. |

Payment - 0 0 - no added print, 1 - displays the line "Deferred installments" below the tax recapitulation, 2 - displays the line "Pauses" below the tax recapitulation, 3 - displays the text "Paid". |

PaymentInfo - No Yes - payment document numbers and amounts are displayed, for payments subject to electronic sales records all data related to EET are displayed. |

ProportionalFont - Yes Yes - supplements are displayed in the Verdana font type, No - CourierNew font type. |

QRCode - 1 QR code display. The code contains values: account number, amount, currency, reference umber, constant symbol, due date, message for the recipient. If any value is missing, it will not be inserted into the code. Values: 0 - QR code does not display. 1 - displays the Slovak QR code, if the country is from the billing address Slovakia, otherwise displays the QR Invoice. 2 - always displays QR Invoice. 3 - always displays Slovak QR Code. |

RefNoAsInvoiceNo - 01/01/2999 If the invoice date of a document (if the invoice date is zero, then acc. trans. date) is greater than or equal to a value in the parameter, then a value of a reference number instead of a document number is displayed in the report in the Registration number field. |

SerialNumber - No Yes - displays the serial numbers at the items. |

Sign - @Vyst;;; The parameter contains 5 positions: 1st position determines the person whose signature should be displayed. It may be a picture named according to the Logname of the user who has issued the document (@Vyst) or who prints the document - i.e. according to the current login (@akt) or the current Logname.

The value entered in the Stamp field in Administration of Own Companies is used by default. The path and the name of the file is entered here. The path may be entered by using the alias. Instead of entering the specific file name, it is possible to use %s. The picture must always be in the xxx.png format. If it is not filled in the Administration of Own Companies, the file will be searched in the Picturesdirectory.

An example of an entered task in the Stamp field in Administration of Own Companies: via alias: k2*DEMO\Pictures\stamp.png (searches the picture in the Client's path. The file stamp.png in the Pictures directory) via %s: k2*DEMO\Razitka\%s.png (the value entered this way enables to display signed bitmaps to all users who issue documents or are currently logged in and have the file in the PNG format in the directory (in this case the user created Stamp directory).

2nd position: picture height. 3rd position: distance from the left edge. 4th position: distance of a picture from the upper edge of the given section. 5th position: picture width. Example: (Sign - @vyst;27;47;0;83) prints the signature of the user who has issued the document, height is 27 points, left indentation of 47 points, by the upper corner. The picture is 83 points wide.

If the parameter is set to 0, the stamp will not appear. |

SortBy - The field is filled with the value of the field from Sale items (e.g. C_Zbo;Zkr or CF_CeJePlM). Items on a document will be sorted according to the parameter value. Parameter is empty by default. If the value of this parameter is specified, the items are not combined even if the CombineOrigItem parameter is set to Yes. If it is a credit note (the Corrective CN flag is checked on the 1st page of the IO), then the invoice items are grouped according to the number of the original invoice (or their reference number). The SortBy parameter then sorts these items according to the value from the parameter only for items within the group. |

StateOfOrigin - No Yes - a code of tariff and a country of origin are displayed for the items. If it is filled on a batch, information from the batch are displayed; otherwise the data from the Article card are displayed. |

SupplFromArticles - 0 - Nothing is displayed, Empty value - a Business Text from an Article card is displayed. If the parameter is filled in, and if there is an existing comment type on the Article card that is identical to the parameter value, the text of this comment is displayed. If the given comment type does not exist, the entered type of supplement from the notes on the Article card will be displayed (e.g. the DB type). If both comment and supplement type are identical, the comment has priority over the supplement. |

SupplFromCustomer - DZ 0 - Nothing is displayed, Empty value - a Business Text from a Customer card is displayed. If the parameter is filled in, and if there is an existing comment type on the Customer card that is identical to the parameter value, the text of this comment is displayed. If the given comment type does not exist, the entered type of supplement from the notes on the Customer (e.g. the DZ type). If both comment and supplement type are identical, the comment has priority over the supplement. |

SupplFromItem - 0 - Nothing is displayed, Empty value - displays the entered text from the Text tab from the document item. If the parameter is filled in, and if there is an existing comment type on the document item that is identical to the parameter value, the text of this comment is displayed. If the given comment type does not exist, the entered type of supplement from the notes on the document item will be displayed (e.g. the TX type). If both comment and supplement type are identical, the comment has priority over the supplement. |

SupplFromClient - TEXT The TEXT value displays information from the General information field from an own company. Otherwise it displays supplement type from the Client parameters. |

TaxCreditNoteConfirmation - No Yes - a confirmation of receipt of a Credit Note will be displayed. |

Title - The entered value of the parameter is displayed as a report title. If the parameter is empty, the original name of a document is printed (e.g. Invoice). |

TotalAmount - No Yes - information about the total amount is displayed. |

TotalItems - No Yes - information about the total number of items is displayed. |

Warranty - No Yes - the number of months of a warranty from an item is displayed. If there is the value '999' entered in an item, the text "Lifetime" is displayed. |

Weight - No Yes - the weight of individual items and the total weight of a "document" are displayed. |

next to the Method of transport field is mainly related to eshop. If there is an article where the

next to the Method of transport field is mainly related to eshop. If there is an article where the