Bank

Bank code lists

Card of bank document

Code list Card of bank documentis predetermined for frequently used items. The data from the card is copied into the item of bank order and bank statement so that it is no longer necessary to enter them manually.

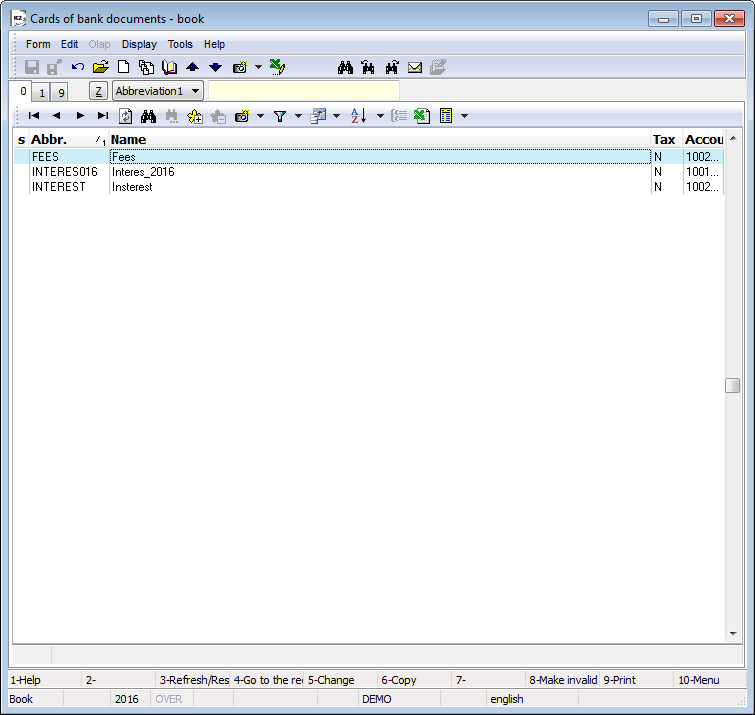

Picture: Cards of Bank Documents - Book

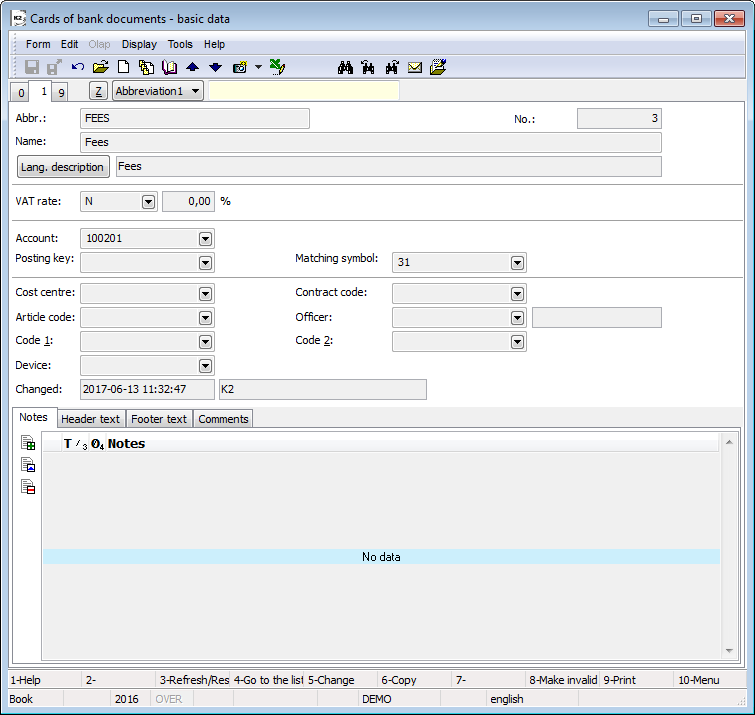

This page of a card of bank document is used to record basic data.

Picture: Cards of Bank Documents - 1st page (basic data)

Description of Fields:

Abbr |

Card abbreviation of bank document. |

Number |

This is the registration card number of bank document that is generated automatically when the card is first stored. The registration number is actually the serial number of bank document card. |

Name |

Card name of bank document. |

VAT Rate |

VAT Rate. |

Tax Type |

The type of the tax. |

Do not copy name |

If switched on, the Name will only copy from the card into the bank order / statement in case of the document item not having any name saved. |

Account |

Account from Chart of accounts. |

Posting key |

Posting key of a Bank Statement. |

Matching symbol |

The random numeric or text data used for sorting the activities of the company. |

Cost centre |

Cost centre which card of bank document concerned. |

Contract code |

The random numeric or text data used for sorting the activities of the company. |

Device |

Reference to the Device Book. |

Article code |

Article code. |

Officer, Code 1, Code 2 |

Fields allow to use the resolution or the link into the book Officers. For the further description see the Basic Code Lists - Code 1, Code 2, Officer chapter. |

On the 9th page card of bank documents it is possible to insert documents and to add links to documents within the K2 IS. Further work description with Documents is stated in the chapter Basic Code Lists and Supporting Modules K2 – 9th Page.)

Bank

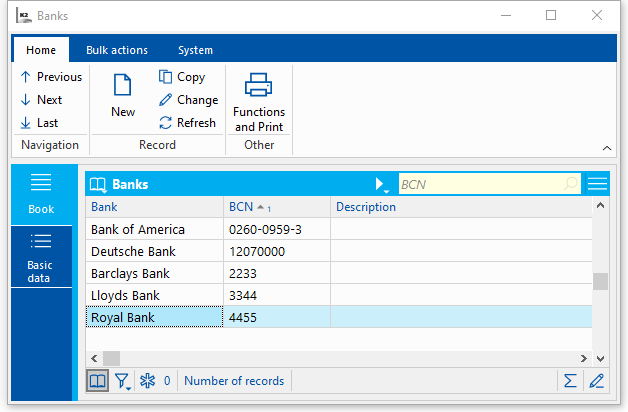

There is a list of banks in the Banks code list.

Picture: Code list Banks

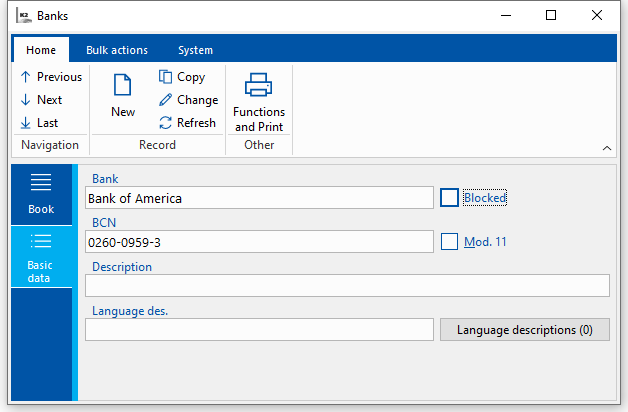

Picture: Code list Banks - 1st page

Description of selected fields:

BCN |

Bank code. While changing the bank code in this code list an automatic change of the BCN will not happen in the saved account numbers on the documents and Suppliers/Customers cards. |

Mod. 11 |

By marking the field a check of validity of the account number with the bank code will be activated. |

SWIFT code list

SWIFT code list is started from tree menu Finances - Basic data - SWIFT code list. SWIFT (Society for Worldwide Interbank Financial Telecommunication) is used particularly to international payments. Under the SWIFT each participating bank has its own unique code (BIC), which identifies.

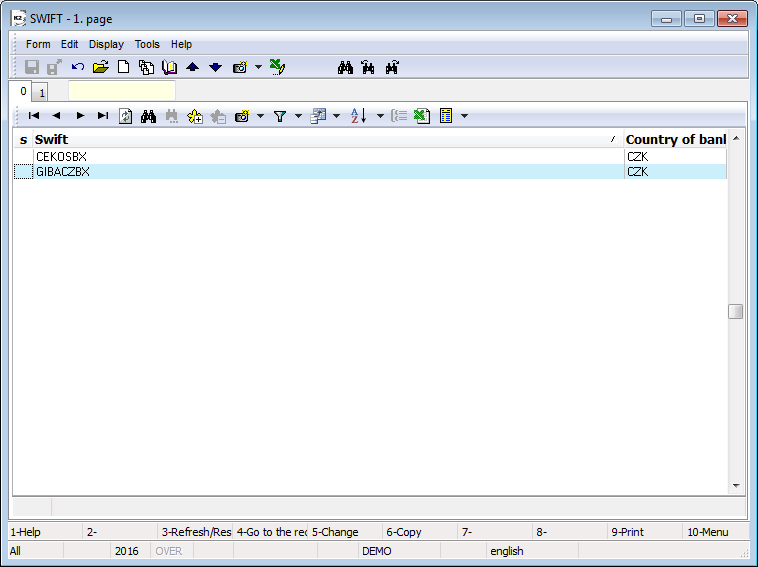

Picture: SWIFT - book

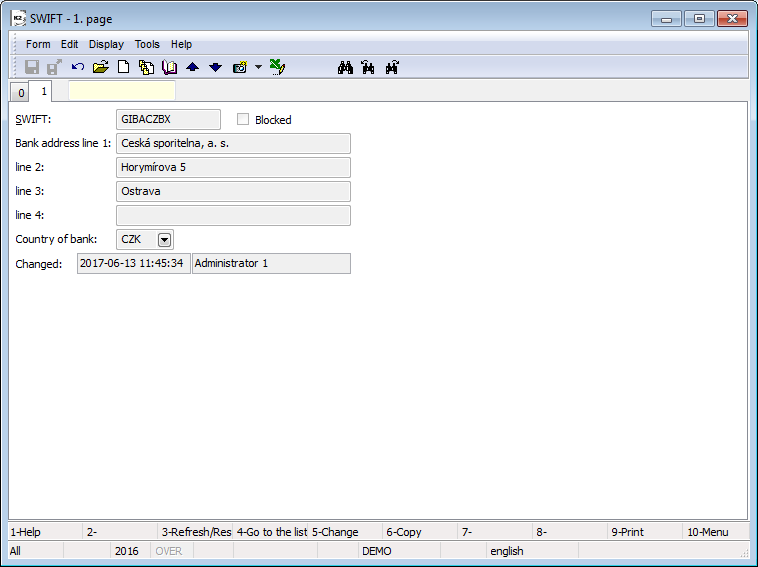

This page of SWIFT code list is used to enter basic code. If a bank address is even entered in SWIFT code list, a bank address will be copied to an account after you enter SWIFT.

Picture: SWIFT - 1st page

Description of Fields:

SWIFT |

SWIFT. |

Blocked |

Check box for blocking SWIFT. |

Bank address line 1 |

Bank address - you can use multiple lines to enter bank address. |

line 2 |

|

line 3 |

|

line 4 |

|

Country of bank |

Country of bank. |

Changed |

Date, time and name of the user, who the item in SWIFT code list last changed. |

Banker's orders

Banker's orders can be run from tree menu Finances - Bank - Banker's orders. The payment orders are created in the book of Banker's orders .

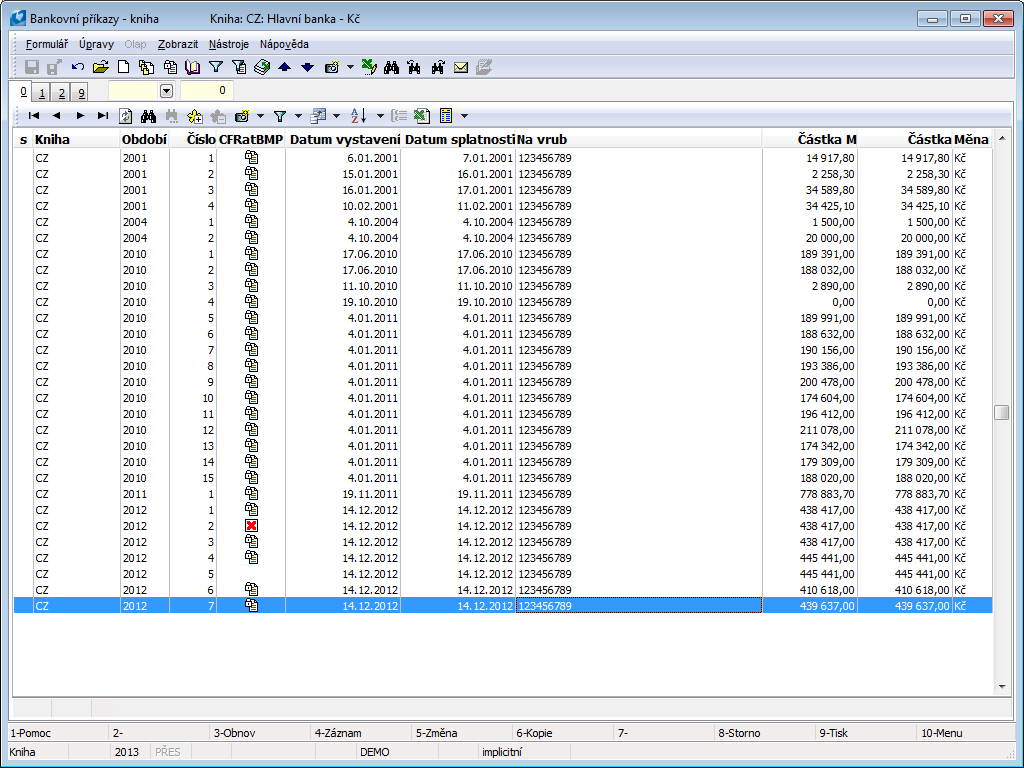

Picture: The book Banker's orders

In the book of Banker's orders you can switch among particular bank accounts by Alt+F10 keys (after switching the books cursor will be set on the last record in the book automatically).

Banker order can be created also in the

- Payment calendar (detail description is in the chapter Create banker's order in payment calendar),

- in the book Open Items (detail description is in the chapter Create banker's order in the book Open items).

Document Banker's order

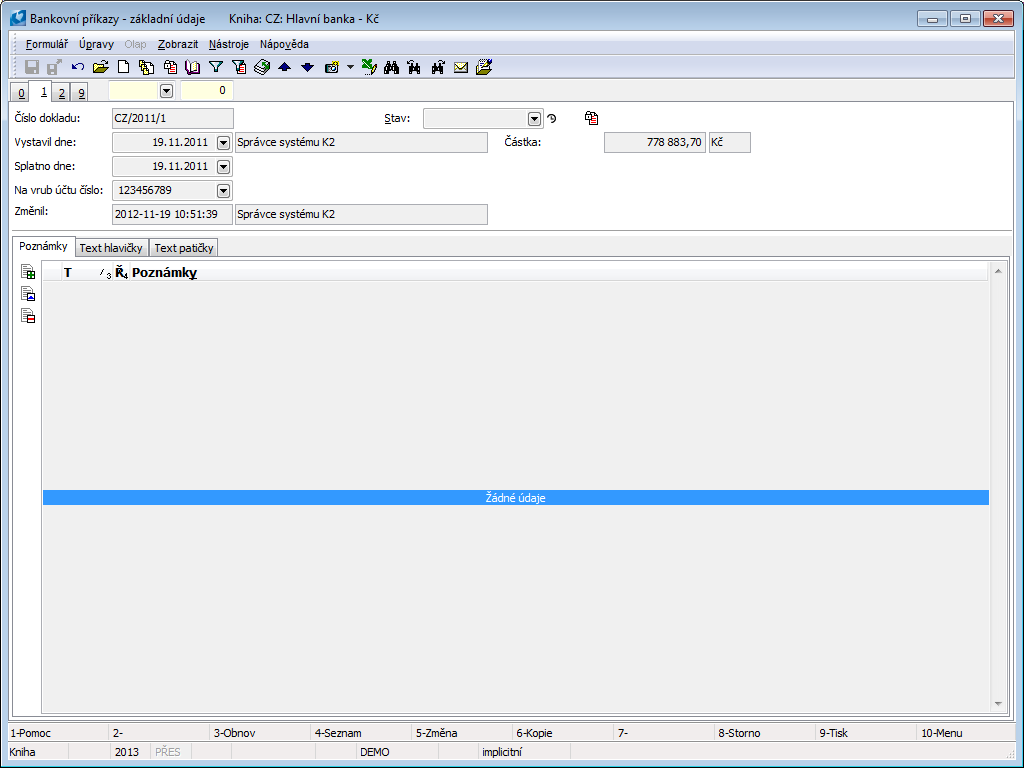

On The Basic data stated on the 1st page of Banker's orders refer to whole document.

Picture: Banker's orders - 1st Page

Description of Fields:

Document Number |

The banker's order number stated including the book of bank account. Upon a new banker's order saving, it will be pasted automatically. |

Date of issue |

The date of document issue and name of the user who issued the document. |

Due on |

The due date. |

Type |

The document type that will be settled by the banker's order. This field will display only in Change and in New record. The selected type will be set automatically when you insert a new item on The 2nd page. |

Debit account No |

The bank account number from which the payment is to be executed. |

Status |

Status of document. |

Amount |

The total amount of the order items in he basic currency. It is charged automatically. In case of foreign bank account the amount is displayed in client currency. |

Constant symbol |

Constant symbol. This field will display only in Change and in New record. The Constant symbol will be set automatically when you insert a new item on 2 nd page. |

Changed |

Date of last change and Name of the user who changed the record. |

It is possible to work with notes by using Notes and Header and Footer Text tabs. Further work description with Notes is stated in chapter Basic Code Lists and Supporting Modules K2 – Notes.

Notes have been replaced with comments in the universal forms. On the Basic Data card the fields Sent and Date of sending were added, in which the user and a date, when the banker's order was exported via the HB function - banker's order (HB_Order.pas), is filled in.

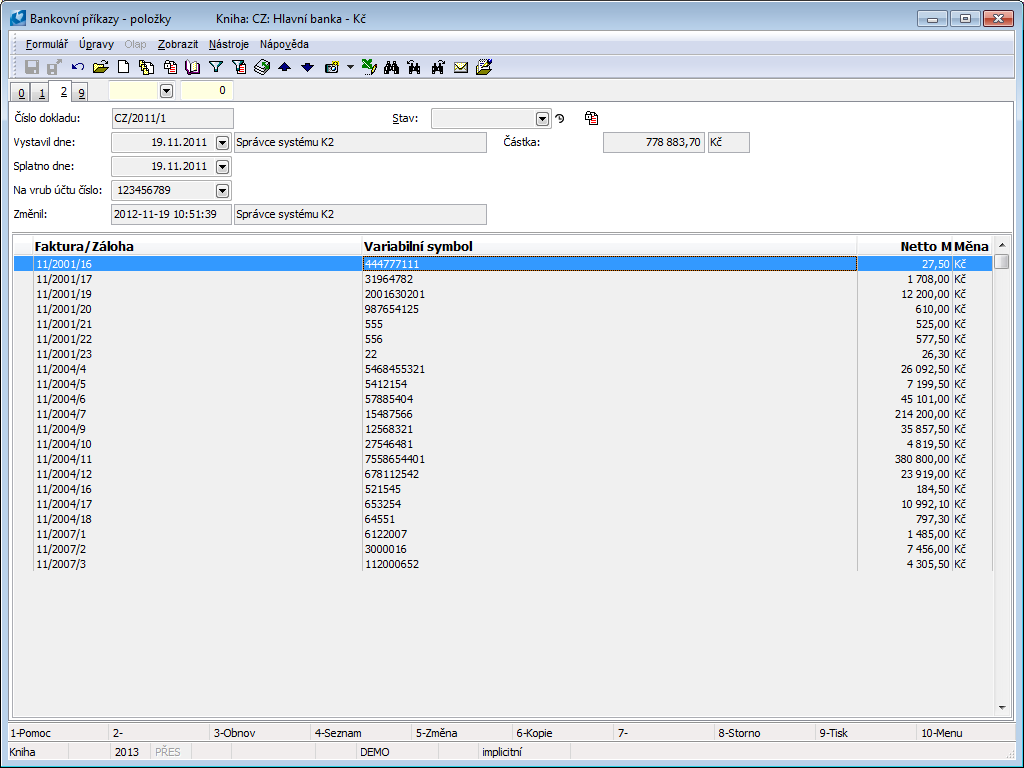

On On the 2nd page of the bank orders are given the basic data relating to the individual items of the bank order.

Picture: Banker's order - 2nd Page

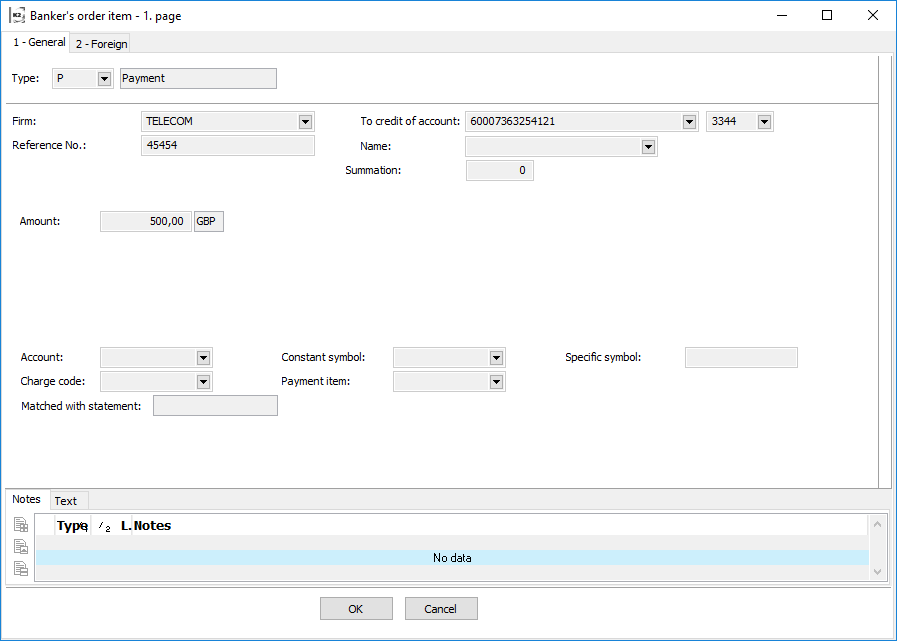

Items are put into Banker's order in a standard way using the Insert key. After its pressing displays a form Banker's order item.

Picture: Banker's order item - 1. page for item type Payment

Fields description of Release type :

Type |

Payment type - Release. |

Company |

Name of company. When entering anew item you can select the company from Suppl./Cust. book. |

Variable Number |

Variable symbol |

To credit of account |

Supplier/Customer bank account. Book Bank Order in client currency

Book Bank Order in foreign currency

In case of foreign bank account, except for data mentioned above, the other information from bank account will be copied as well. You can also write any account number into the field Credit of account. |

Name |

Field name. You can choose from the book Cards of bank document. |

Summation |

A Summing numeric identifier. It is used to group items into one payment. |

Amount |

Payment amount in currency of bank order. In the case of foreign currency is displayed amount in client currency too. |

Payment exchange rate |

Payment exchange rate in currency of bank order. |

Rate by date |

After pressing button is displayed exchange list |

Account |

Account from Chart of accounts. |

Constant symbol |

Constant symbol. |

Specific symbol |

Specific symbol. |

Charge code |

The number identifying the type of payment. |

Payment item |

Indication of the purpose of the payment. |

Matched with statement |

If in bank statement the link to bank order is filled Both documents are paired. This field displays the bank statement number and appears in the 'S' column on the 2nd page of the bank statement |

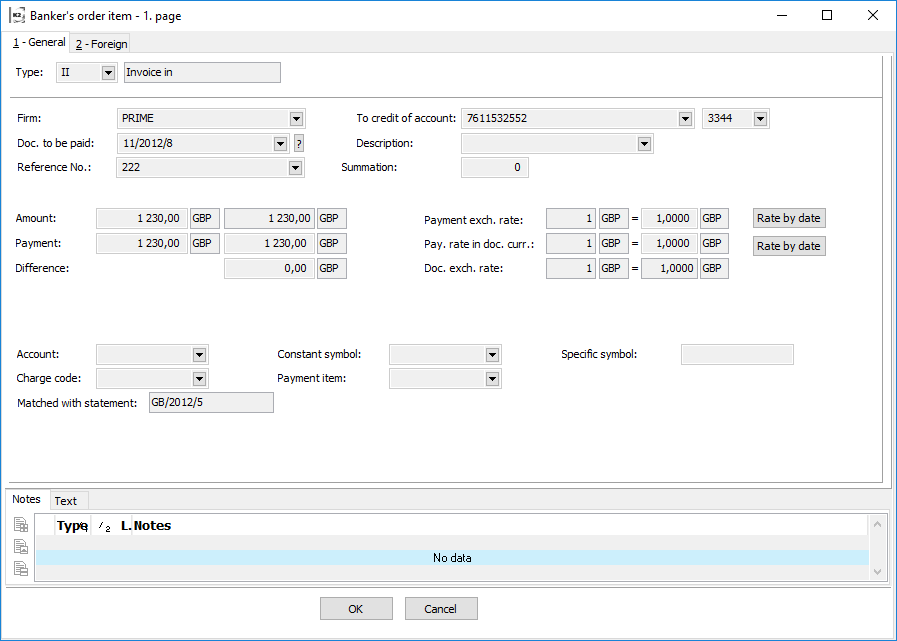

Picture: The Banks statement item - 1st page for type of item II, IO, AR, AP, PP

Description fields of type II, IO, AR, AP, PP, OR, OL:

Type |

Payment type - Payment Invoice In/Out, payment Advance Received/Provided, payment Payroll payables. |

||

Company |

Name of company. When entering anew item you can select the company from Suppl./Cust. book. If an invoice or an advance is included in the bank order, this field will be filled in automatically and can no longer be changed. |

||

Document to be paid |

Document to be assigned to a bank order - II, IO, AR, AP, OR, OL |

||

|

|

Selecting paid document which can also be done by pressing F12. Documents are always displayed in sorting according to the Number in this case. Setting of cursor in the book of paid documents is as follow:

|

|

|

|

A button of a Wizard is located behind the paid document number. In this case, you receive a selection unpaid documents in currency of bank account. |

|

Variable Number |

Variable number fill in automatically from document to be paid. |

||

To credit of account |

Supplier/Customer bank account. These alternatives can occur: Book Bank Order in client currency

Book Bank Order in Foreign currency

In case of foreign bank account, except for data mentioned above, the other information from bank account will be copied as well. You can also write any account number into the field Credit of account. |

||

Description |

Order's description. |

||

Summation |

A Summing numeric identifier. It is used to group items into one payment. |

||

Amount |

Payment amount in currency of bank order. |

||

Payment |

Payment amount in currency of paid document. You can set an amount of payment in this line in a foreign currency or in a client currency. The amount is entered into Total field on 6th page of Invoice. |

||

Difference |

It displays exchange rate difference in client currency. |

||

Payment exchange rate |

Payment exchange rate in currency of bank order. |

||

Rate by date |

This button inserts exchange rate from exchange list valid by issue date of Banker's order. It is possible to use it just in Change mode. If in Client parameter the Invoice exchange rate is set accordingly to accurate transaction date, exchange rate will be inserted according to value in Accounting transaction date field there. |

||

Payment exchange rate in currency of document |

Payment exchange rate in currency of paid document. It is used in cases of mode currencies presence e.g. a document in USD, an order in EUR. |

||

Document rate |

Exchange rate stated on paid document. |

||

Account |

Account from Chart of accounts. |

||

Constant symbol |

Constant symbol. |

||

Specific symbol |

Specific symbol. |

||

Charge code |

The number identifying the type of payment. |

||

Payment item |

Indication of the purpose of the payment. |

||

Matched with statement |

If in bank statement the link to bank order is filled Both documents are paired. In field displays the bank statement number and appears in the 'S' column on the 2nd page of the bank statement |

||

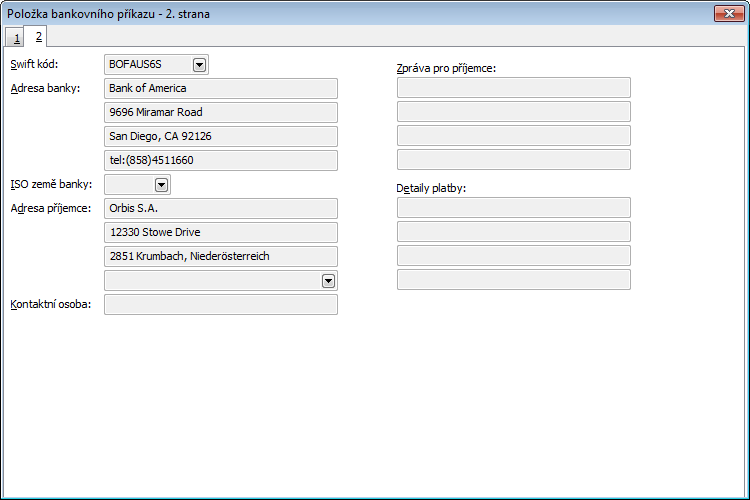

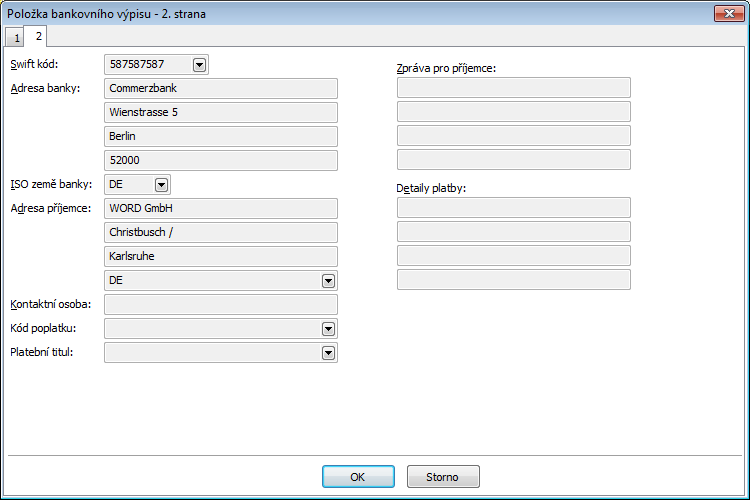

On On the 2. nd page of bankers order items are displayed information about foreign bank. These are automatically copied from the 'Banks' tab, located at the Supplier/Customer card. Data about foreign bank can be inserted into a form from stated information after you check Foreign account type.

Picture: Banker's orders form - 2nd Page

If a bank order is paid for an invoice in, the amount of the bank order is indicated into the invoice at 6th page in the Settled field. At the same time, a new entry with the date, payment amount, and with a bank order number will be placed into a lower window on the 6th page of the invoice. This way you can follow either if the invoice has been paid, or if the order for paying has been issued for it. If you issue and match bank statement with banker's order, the amount in Settled field will get zero and the amount in Remaining amount field will be decreased in banker's order. In the lower window on the 6th page the item of banker's order will be changed to bank statement.

On the 9th page , any attachments and documents can be assigned to the Delivery order. Further work description with attached documents and ext. documents is stated in the the chapter Basic Code Lists and Supporting Modules K2 – 9th Page.)

Functions over Banker's Orders

All functions mentioned below can be used on the 2nd page of banker's orders in Change mode and in a New record (if it is not mentioned different).

Overview of functions over items:

F4 |

Selection from the the Invoices out items. |

F5 |

Selection from the menu of Advances Provided. |

F7 |

Pairing a bank order item to item of payment calendar. |

F8 |

Un-pairing a bank order item from item of payment calendar. |

Shift+F2 |

Selection from the menu of Other Liabilities. |

Shift+F3 |

Selection from the menu of Payroll Payables. |

Shift+F4 |

Bulk Insert Items from Container the Invoices out. |

Shift+F5 |

Bulk Insert Items from Container of provided advances. |

Shift+F6 |

Bulk Insert Items from Container payment calendar. |

Shift+F7 |

Inserts the items from thePayroll Payables container in bulk. |

Shift+F8 |

Inserts the items from theOther Liabilities container in bulk. |

Ctrl+F4 |

Selection from the menu of Invoices Out. |

Ctrl+F5 |

Selection from the menu of Advances Received. |

Ctrl+F6 |

Selection from the menu of Other Receivables. |

Ctrl+F7 |

Selection from the The type of an item of payment calendar. |

Ctrl+Shift+F4 |

Inserts the items from theInvoices Out container in bulk. |

Ctrl+Shift+F5 |

Inserts the items from theAdvances Received container in bulk. |

Ctrl+Shift+F6 |

Inserts the items from theOther Receivables container in bulk. |

Alt+F4 |

Creating a direct debit order from container of invoices out. |

Alt+F5 |

Creating a direct debit order from container of received advances. |

Alt+F6 |

Creating a direct debit order from container of other receivables. |

Ctrl+Enter |

In the Browse mode using these keys, we'll display a paid document. |

Alt+F3 |

Set default item sorting (can be re-sorted in all states). |

Functions upon confirmation of banker's order:

If the Service of determinating reliability of VAT instalments is activated in the Setting of reliability of VAT function, by marking the Check of payment on unregistered account while confirming the banker's order, the following will happen:

- it checks whether payments of invoices and provided advances, which has Gross > 540.000 Kč, have been done. And a Supplier or a company stated in Invoice address have been checked in Register of VAT payers (VAT Reg. no. of the company, starts with CZ...) - it checks whether the account, which is stated on the order item, is published in payer register,

- - it checks whether the company from paid order or Company from banker's order item does not have the status an unreliable payer.

In case there is a problem, the question "There are payments on unverified accounts in register of VAT payers ." will be displayed on the banker's order. "Do you want to confirm it?" and a text file with error list will be displayed.

You may see errors in the text file:

- The account is not registered in a register of VAT payers - VAT companies start with "CZ...", the account from banker's order is not registered in a register of VAT payers,

- The control if account is registered in a register of VAT payers - VAT companies start with "CZ...", has not been done for the account. Bank account is not entered on a Supplier/Customer card,

- Company is determined as a unreliable payer - company has a status of an unreliable payer.

Note: Upon banker's order confirmation the information saved in Suppl./Cust. card will be checked. (there is no actualisation from Register of VAT payers).

Functions over Banker's Orders

Bank statements

Bank statements can be run from tree menu Finances - Bank - Bank statements.

The Bank statements book is important for making, assignment and for posting. Information are entered into K2 IS according to statements from accounts from a bank manually or by means of Homebanking function automatically.

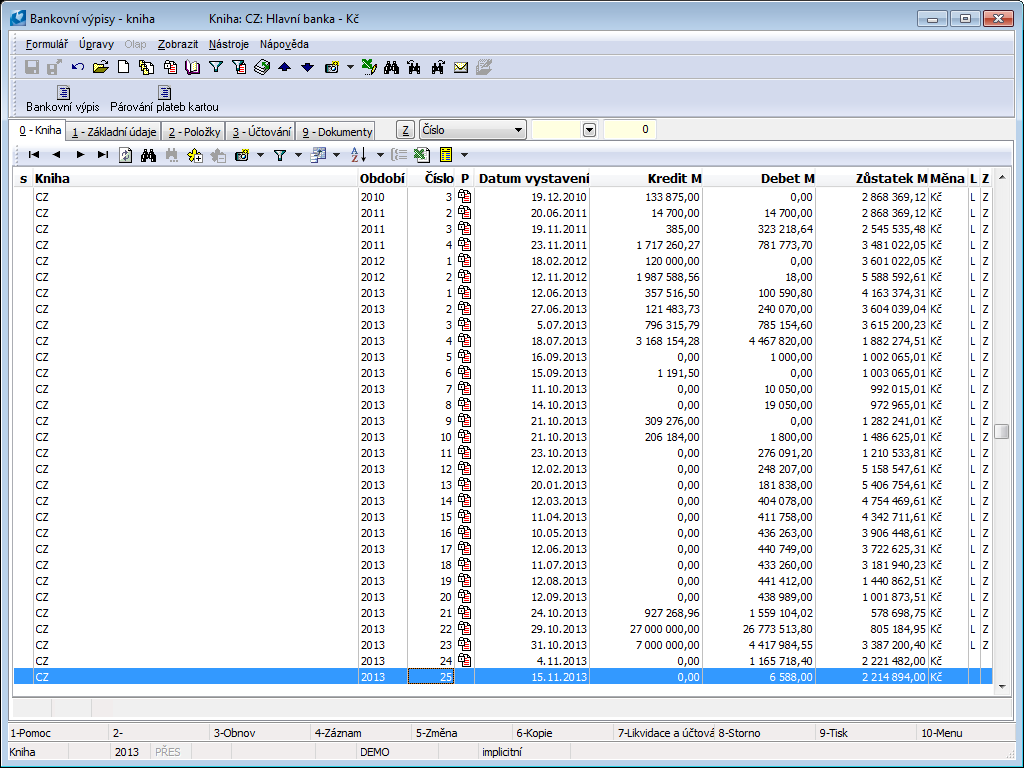

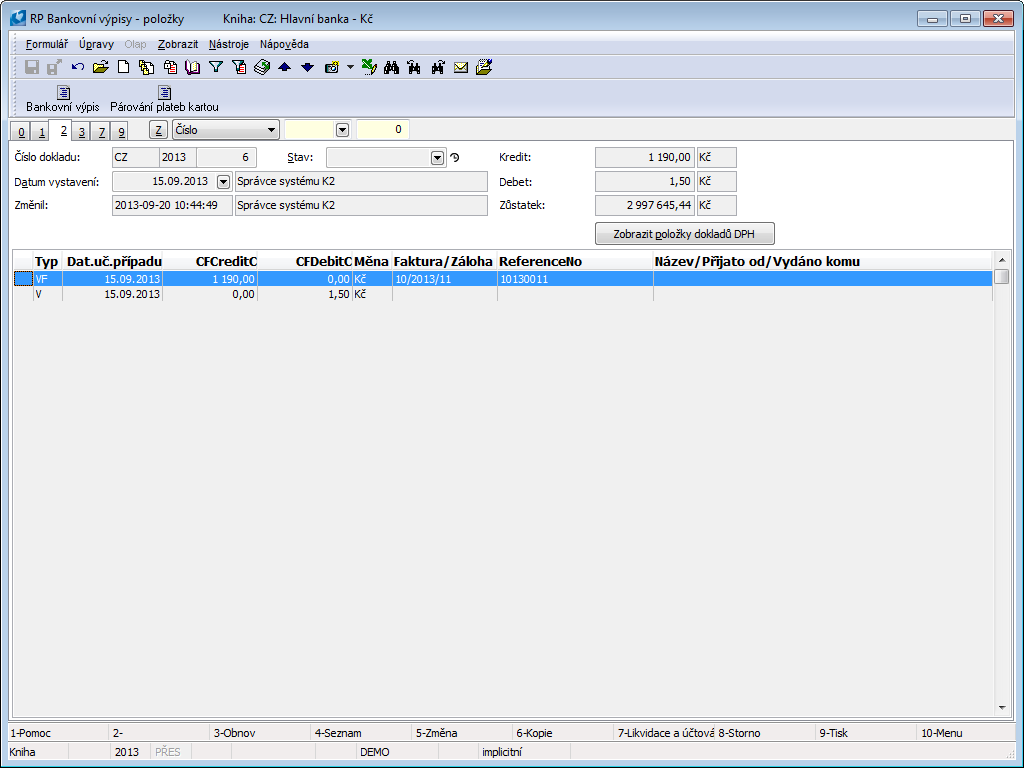

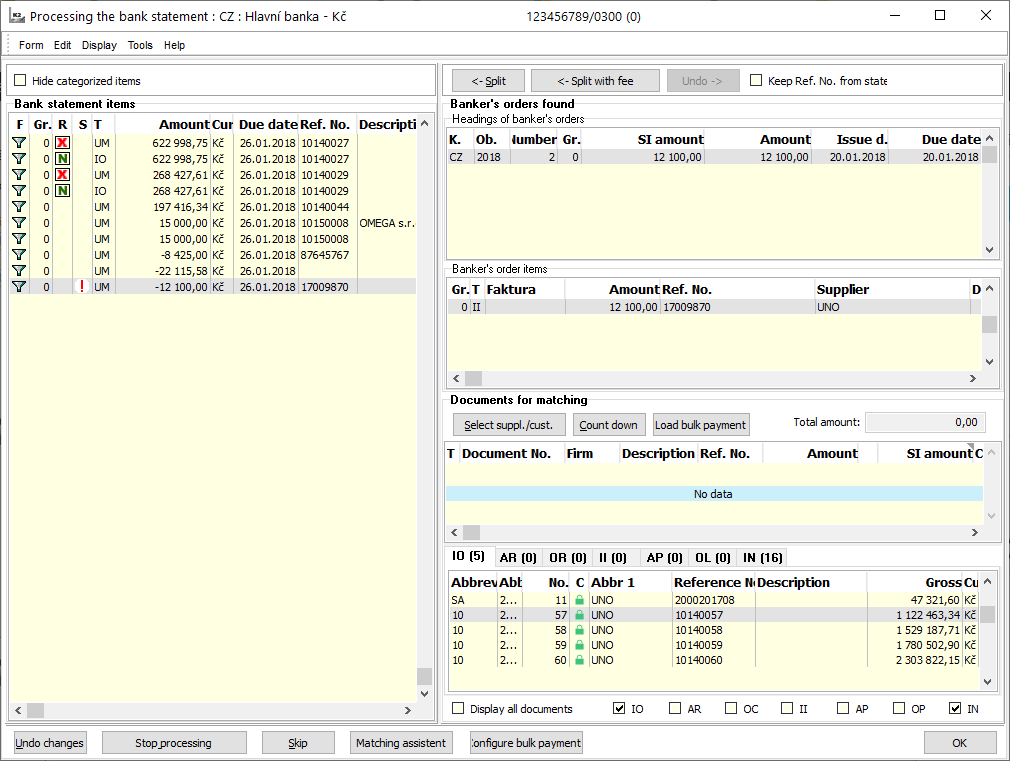

Picture: The Bank statements book

In the Bank Statements book, use the Alt + F10 key to switch between individual bank accounts (after switching the books cursor will be set on the last record in the book). There Is a Book and a Currency of a bank account in the upper blue bar on the screen.

Document Bank Statement

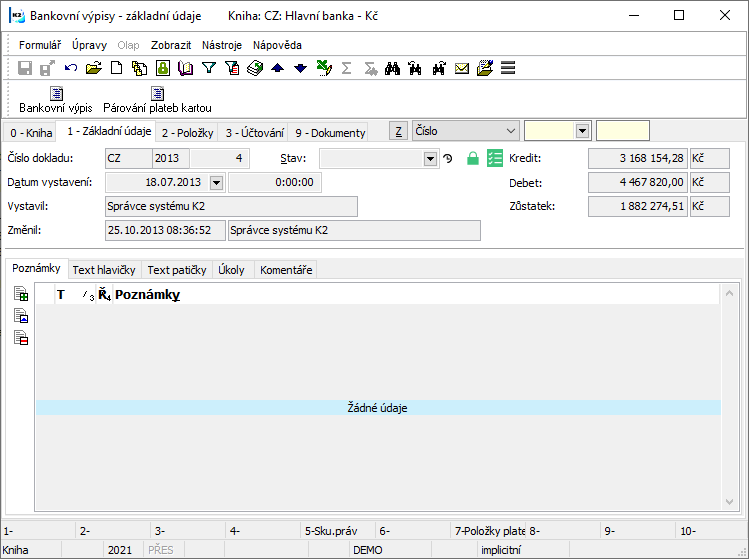

On On the 1. page are stated basic data related to the whole document.

Picture: Bank statements - 1st Page

Description of Fields:

Document Number |

The bank statement number including the book of cash. It is filled automatically after pressing Insert key. |

Date of issue |

The date and time of document issuing and the name of a user, who has issued the document. |

Changed |

The date of the last change and name of the user who has made the last change. |

Status |

Field for selection from a code list. This field enables to filter a document according to the selected status that the user has selected. |

Credits |

Total credit amount of a statement. If an account is in foreign currency, it will be displayed in client currency as well as the field next to Credit field. |

Debits |

Total debit amount of a statement. Regarding the account in a foreign currency, debits in a client currency appears next to the debits. |

Balance |

Bank balance. If it is an account in a foreign currency, a balance in a client currency also appears next to the balance. |

In This book it is possible to work with notes by using Notes and Header and Footer Text tabs. Further work description with Notes are stated in chapter Basic Code Lists and Supporting Modules K2 – Notes.

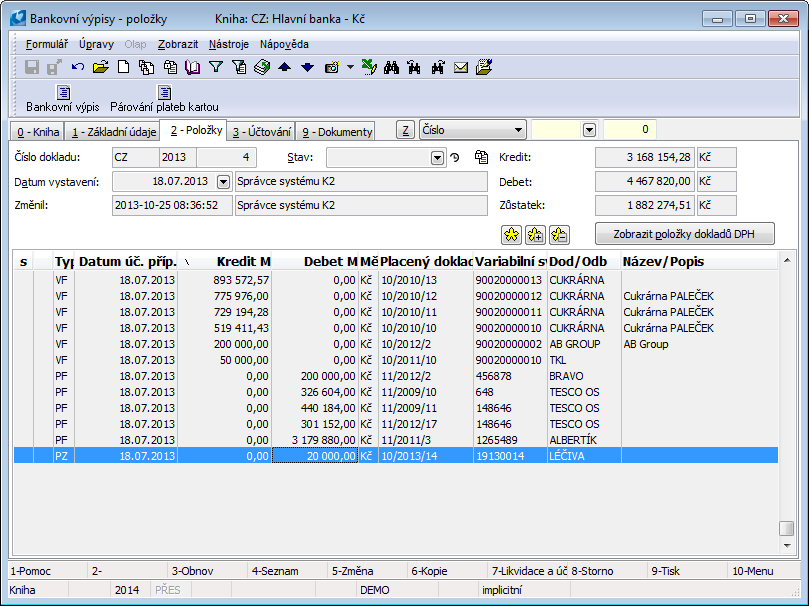

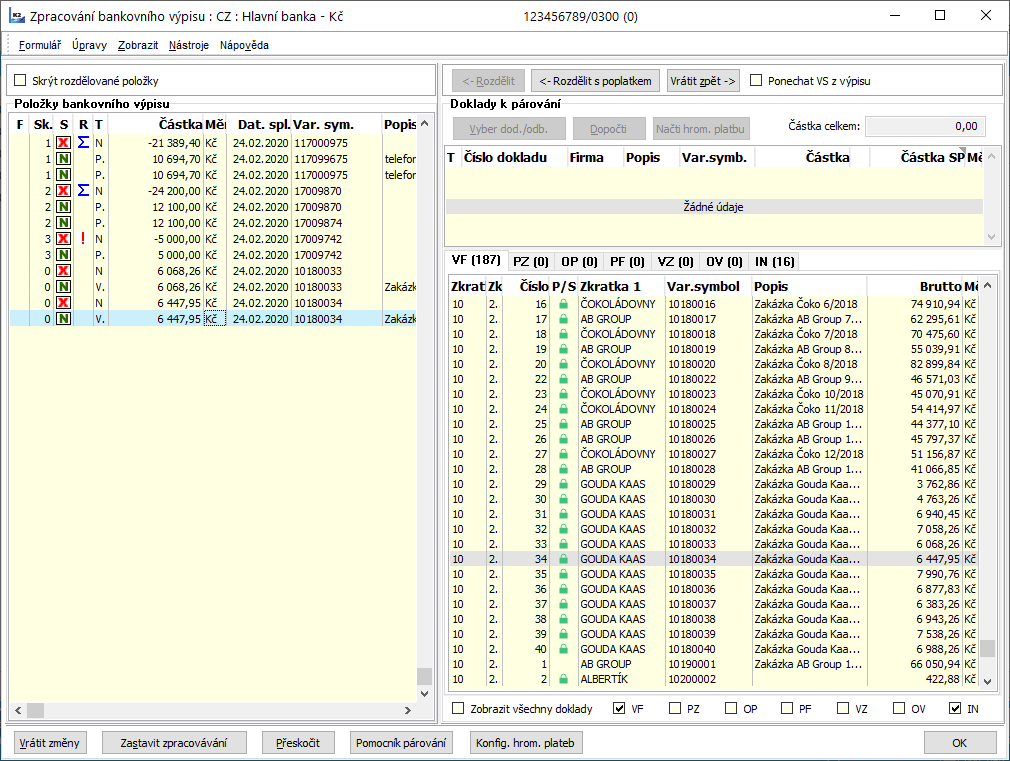

On On the 2. page of the banker's orders are given the basic data relating to the individual items of the banker's order.

Picture: Bank statements - 2. Page

Items can be inserted by Insert key. After pressing this key, a form Banker's order item is displayed.

In the Bank accounts book, it is possible to set, whether bank statements with VAT can be created for the given bank account (the Documents with VAT check box). When you enter an item bank statement of R/P type, then slightly different forms for entering an item depending on the check box Documents VAT will be displayed in the book of bank accounts.

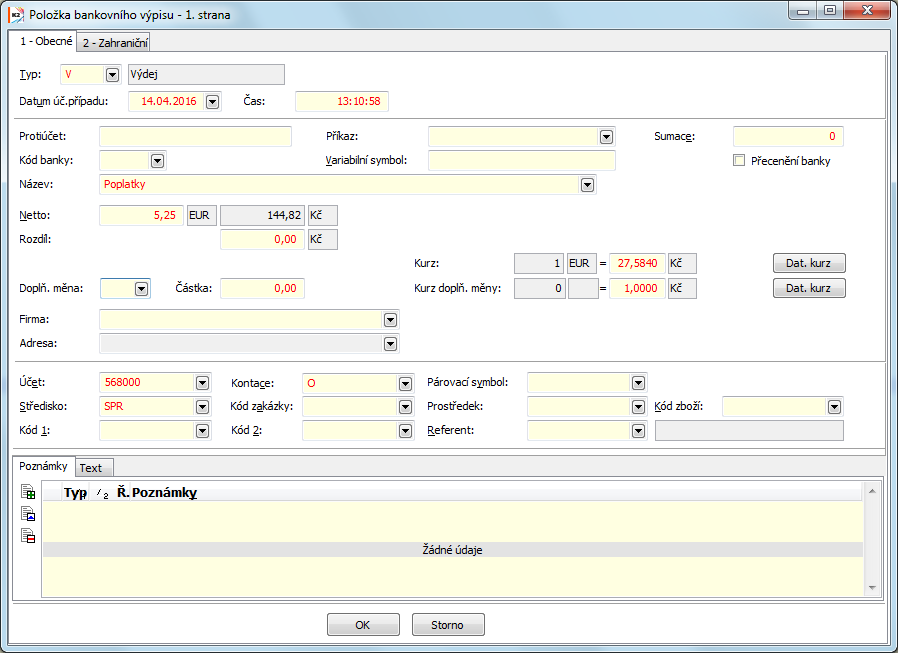

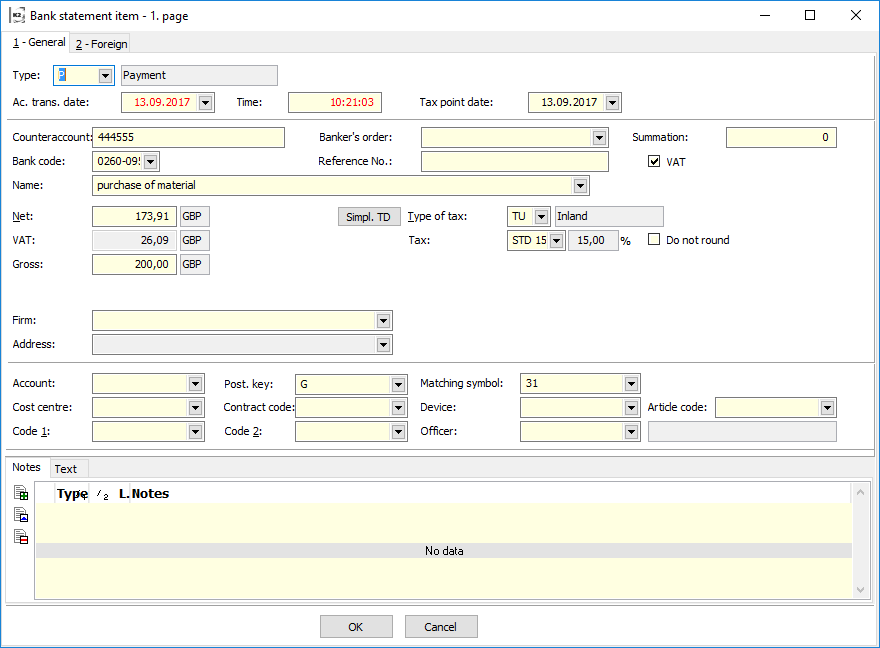

Picture: Item of Bank Statement form 1stpage for items of the types R, P (the Documents with VAT check box is not checked in the book of bank accounts)

Field description item type Receipt/Payment( in the book bank accounts is not checked Documents with VAT):

Type |

Item type bank statement (Receipt, Payment). |

Accounting transaction date |

Accounting transaction date enters into the accounting. |

Time |

Time accounting transaction. |

Counter Account |

A Number of bank account of Supplier/Customer. |

Order |

Link On an item of a banker's order. |

Summation |

A Summing numeric identifier. It is defined in items that were grouped into one payment. |

Bank code |

A Bank Code Number of Supplier/Customer. |

Reference Number |

A reference number of a bank statement item - it can be automatically created according to the setting in the Books of Documents. |

Bank re-evaluation |

Field is displayed only for bank accounts in foreign currency. If the box is checked, it is a bank revaluation. It is used to bank accounts in foreign currency for revaluation of balance in your bank account. |

Name |

Field name. You can choose from the Bank cards documents, where can be redefined some settings (tax, account, posting key, cost centre, article code, matching symbol, officer, Code 1, Code 2). |

Net |

The net amount in the currency of the document. If an account is in foreign currency, even amount Net appears in client currency. |

Difference |

Exchange difference that is defined in client currency is displayed here. |

Exchange Rate |

If the document has been issued in foreign currency, document currency and exchange rate for conversion will be added into local currency. |

Rate by date |

After pressing the button the exchange list will be displayed and the cursor is set at the valid rate on the Date of account transaction statements item. |

Complementary currency, Amount, Complementary currency exch. rate |

Possibility to enter an amount in different currency. The Difference field will be re-calculated after you enter these fields. |

Company |

Selection from the Suppl./Cust. book. |

Address |

The option to specify a single address. |

Account |

An account from the chart of accounts. |

Posting key |

The Account Distribution of a Bank Statement. |

Matching symbol |

This symbol is used for matching in the accounting. |

Cost centre |

Cost centre. |

Contract code |

The random numeric or text data used for sorting the activities of the company. |

Article code |

Article code |

Device |

Reference to the Device book. |

Code 1 |

You can set here a code. |

Code 2 |

You can set here a code. |

Officer |

Reference to the Officers book. |

Picture: Item of Bank Statement form Field description item type Receipt/Payment( in the book Bank accounts is checked Documents with VAT):

Field description item type Receipt/Payment( in the book Bank accounts is checked Documents with VAT):

It contains the same fields as item type R/P (without checking Documents with the VAT in the book bank accounts), furthermore are fields:

Invoice Date |

Invoice Date enters into the VAT Return. If the Invoice Date is zero, the document does not enter into the VAT Return. |

VAT |

Checking field for distinction tax document. |

VAT |

The VAT amount in the currency of document. In the bank statement in currency is displayed amount VAT also in currency of client. |

Gross |

The amount Gross in the currency of document. In the bank statement in currency is displayed amount Gross also in currency of client. |

Tax Type |

We can select from the codebook types of taxes. |

Tax |

Determining the percentage of tax. |

Do not round |

If the amounts of Nett and VAT on VAT document are rounded differently then in K2 IS, the fields will be marked. On the item bank statement the field Gross and VATis filled. The Nett amount is automatically recalculates. |

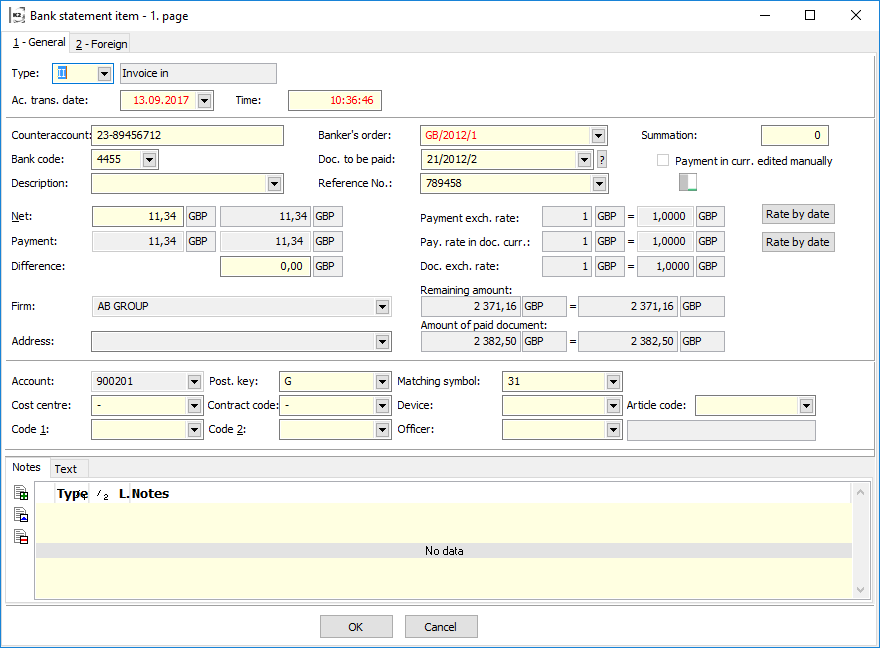

Picture: Item of Bank Statement form 1stpage for the type of items II, IO, AR, AP, PP

Fields description of type items Invoice in, Invoice Out, Advance Received, Advance Provided, Payroll Payable, Other Receivables, Other Liabilities:

Type |

Item type bank statement. |

|

Accounting transaction date |

Accounting transaction date enters into the accounting. |

|

Time |

Time accounting transaction. |

|

Counter Account |

A Number of bank account of Supplier/Customer. |

|

Bank code |

Bank code Supplier/Customer. |

|

Description |

Text description on Bank statement. |

|

Order |

Link On an item of a banker's order. |

|

Document to be paid |

Document to be placed on an item bank statement (invoice out/invoice in, advance received/provided, payable from payroll). For selection of paid document, you can use these signs: |

|

|

|

Selection from the documents. You can execute this selection also by pressing F12 key. Documents are always displayed in sorting according to the Number in this case. Setting of cursor in the book of documents is as follow:

|

|

|

A button of a Wizard is located behind the paid document number. In this case, you receive a selection unpaid documents in currency of bank account. |

Variable Number |

The Reference Number of an paid document. The Reference Number is important for automatic matching. |

|

Summation |

A Summing numeric identifier. It is defined in items that were grouped into one payment. |

|

Payment in currency edited manually |

The field is not manually edited. It will be checked, if the amount of the payment in the currency of a client manually to adjust the set point. |

|

Net |

Amount from Bank Statement in currency of Bank Account. Exchange Rate of a payment is used for recalculation of payment. The payment is recalculated on a basic currency Amount of a statement in a basic currency enters into the accounting. |

|

Payment |

An amount of payment. You can set an amount of Payment in this line either in a foreign currency or in a basic currency. The amount is entered into the Paid in total field on the 6th page of paid document. |

|

Difference |

An exchange difference that is defined in a basic currency is displayed here. If you change one of these amounts (payment in a currency of an invoice, payment in a basic currency, an exchange rate), the others values will be calculated. |

|

Payment exchange rate |

Payment exchange rate in currency of bank statement. |

|

Rate by date |

After pressing the button the exchange list will be displayed and the cursor is set at the valid rate on the Date of account transaction statements item. |

|

Payment exchange rate in currency of document |

Payment exchange rate in currency of paid document. |

|

Document rate |

Exchange rate stated on paid document. |

|

Company |

Supplier/Customer Of who the payment is received or to who you pay by this item of a bank statement. It fill in from paid document |

|

Address |

A field for entering simple address of the supplier/customers. |

|

Remains to pay off |

The amount remaining to be paid in the currency of paid document and in the client currency. This amount can't be changed. |

|

Amount of paid document |

Gross of paid document in the currency of paid document and in the client currency. |

|

Account |

An account from the chart of accounts. |

|

Posting key |

The Account Distribution of a Bank Statement. |

|

Matching symbol |

This symbol is used for matching in the accounting. It fill in from paid document. |

|

Cost centre |

Cost centre. It fill in from paid document. |

|

Contract code |

The Contract code. It fill in from paid document. |

|

Article code |

Article code. |

|

Code 1 |

You can set here a code. It fill in from paid document. |

|

Code 2 |

You can set here a code. It fill in from paid document. |

|

Officer |

Reference to the Officers book. It fill in from paid document. |

|

When calculation of above mentioned amounts, the following rules are valid:

- All automatic calculations are executed from top to bottom. It is also valid that what has been changed, this has been recalculated from this place to bottom. The movements are not changed above this place.

- The amount in foreign currency in the Payment line is important for value of Balance in foreign currency.

If the Amount of underpayment or overpayment of an Invoice that is paid in a foreign currency (in recalculation of a basic currency) is less than a rounding error that is set in the Client parameters, the Amount of payment in a currency in the Payment line is equal to an amount of an Invoice, the Invoice tobe paid.Foreign currency

On 2. nd page of bank statement items are displayed information about foreign bank. These are automatically copied from the Banks tab, located at the Supplier/Customer card.

Picture: Bank Statements form - 2nd Page

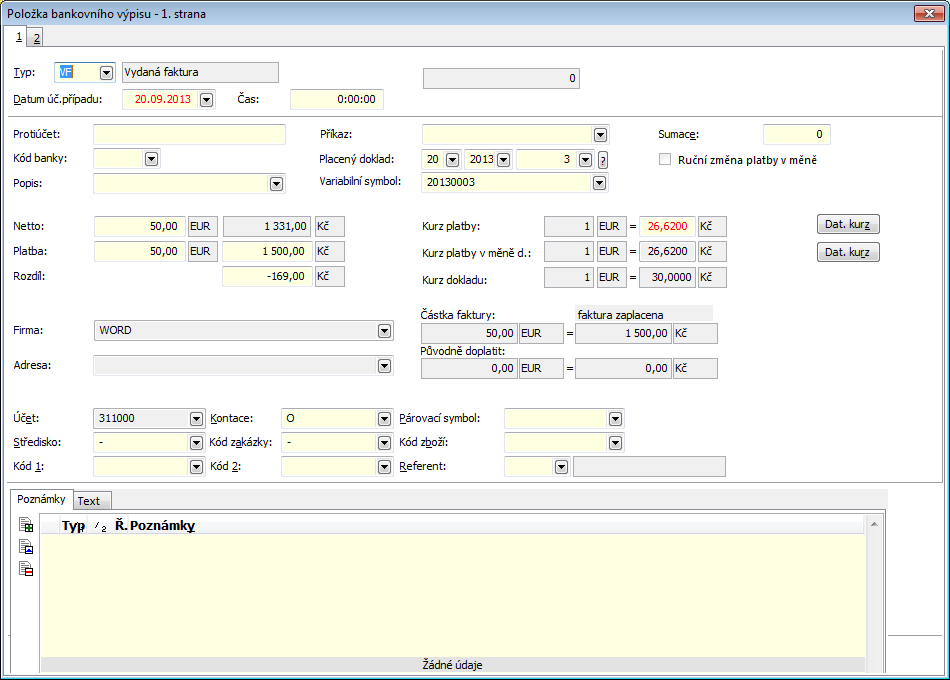

Example: Invoice is issued for 50 EUR in exchange rate 0.73 GPB / EUR. A customer has paid 50 EUR, the exchange rate is 0.86 EUR /CZK.

Enter Type of "IO" on bank statements item and choose the invoice.

Into the field Payment Exchange Rate on On Statement amount line, we write "0.86", which is the current exchange rate of bank account in rate by date. Amount In basic currency is 43 GBP.

Into field Payment Exchange Rate On Invoice currencyline just write "0.86" (if it is not in exchange rate), which is the current exchange rate of bank account in rate by date. Value of invoice in Payment line will be calculated as a part of Payment value in basic currency and this exchange rate.

In Payment field there is 50 EUR, which is 36.5 GBP in original invoice rate. Difference is 6.5 GBP.

Picture: The Bank Statements form - Payment of Invoice out in Foreign currency

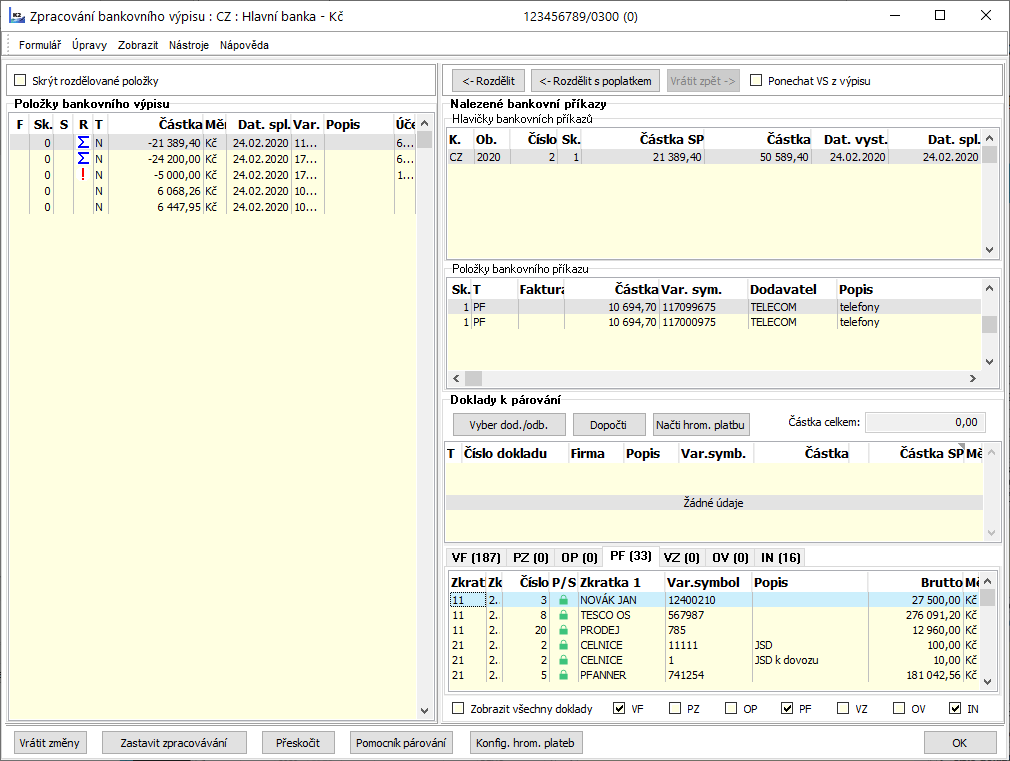

Note to Invoice payments:

- The amount that is listed on the single line of the bank statement is after saving of document added to the invoice into the Total paid item.

- If more than one invoice has been paid one line at a time, it is necessary to divide the amount into lots and split the payments into the corresponding invoices.

- If the fee for transfer is deducted in payment of the right amount, we recommend you to enter two lines instead of one. In the first one there will be full payment of an invoice and in the second one the appropriate fee will be entered as Expenditure. This way you can aim that the invoice does not look as unpaid and the fee will be charged separately as cost.

Example: Issue an invoice for the total 1,190 CZK. The customer will pay by post 1,196 CZK. Six to cover the cost of postage. The post office takes the amount of 7.50 CZK so the account will be credited to1,188.50 CZK.

Enter 2 items on a bank statement:

Invoice out |

1,190 CZK |

Expenditure |

1.50 CZK |

We charge only the amount of 1.50 CZK for costs because the customer paid 6 CZK.

Picture: Example - Bank Statements - 2nd Page

To Account assignment and posting we use 3 rd page of Bank statement. This issue is described in details in the chapter Accounting - Account Assignment and Posting.

On the 9th page , any attachments and documents can be assigned to the Delivery Confirmation. Further work description with attached documents and ext. documents is stated in the the chapter Basic Code Lists and Supporting Modules K2 – 9th Page ).

Functions over Bank Statements

Functions description:

F7 |

Account assignment and posting of the bank statement. The account assignment and posting functions are described in details in the chapter Accounting - Account Assignment and Posting. |

|

Matching of the bank statement item type Payment / Receipt to item of payment calendar- on On the 2. nd page in Change and in a New record. |

F8 |

Un-pairing bank statement items from item of payment calendar ( on 2. nd page in Change and in in a New record. |

Alt+F3 |

Executes recalculation of the account balance in the book (from the item that the cursor is positioned on it recalculates the balance). |

Alt+F3 |

On the 2nd page set original sorting of the item. |

Ctrl+F3 |

Pairing of bank statement items (on 2. nd page in Change and in a New record. This function is described in more detail in Matching Payments in Bulk chapter. |

Ctrl+F7 |

Bulk ac. assignment and posting of the bank statements. |

Ctrl+L |

In The book Change mode it executes posting of bank statements and jump to the appropriate item in the accounting journal. In the case of statements that have not been booked the cursor is in the accounting journal positioned on the first item. This action can be also activated from the Module Menu – Form – Actions – Documents – Accounting Journal. |

Ctrl+P |

On 2. nd page in Change and in New mode the items can be loaded directly from Banker's order. |

Ctrl+Enter |

On the 2nd page in Browse mode using these keys, we'll display a paid document. |

Ctrl+Shift+F7 |

On the 2nd page in Browse mode using these keys, we'll display a paid document. |

For revaluation of the bank accounts balance you can use the Revaluation of bank accounts and cash registers listed in the Tree menu Accounting - Revaluation on the date of balance - Revaluation of bank accounts and cash registers. Closer description with this function is state in the chapter Revaluation of bank accounts and cash registers.

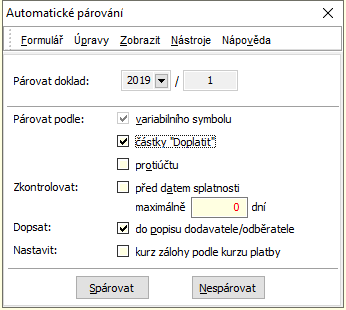

The matching deals with the bank statement items that have been set with the type of N – Unmatched. If the amount is positive, K2 IS will be searching the payments among invoices out and credit notes in; on the contrary, in the case of negative amount, the payments will be searched among invoices in and credit notes out.

Function Bulk pairing of payments can be run in Change on 2. Page of bank statement by Ctrl+F3 keys. Here you select the matching conditions.

Picture: Automatic Matching Form – Ctrl+F3

Description of Fields:

Match according to Reference No |

Match bank statement to Reference No field. |

Match according to "Remaining Amount" |

Matches the bank statement on the base of amount in the field of Remaining amount. |

Pair according to counter account |

Pairs bank statements according to counter account filled in in the document: - if there is a bank code filled in on the bank statement item, the counteraccount will be compared with a bank code on the bank statement item with a bank code on paid document, - if the bank code remains blank on the bank statement item, the counteraccount will be compared with an bank statement item with an IBAN document. |

Check prior to maturity date |

Enables to define maximum number of days before the maturity date of invoice for the check of matching. |

Write suppl./cust. into the Description field |

After matching the payment it writes up on the item of bank statement the name of supplier/customer to the field of Description. If an item is matched with a banker's order, Description from an order item will be added. |

Set copy exch. rate of payment into adv. |

If the field is activated, during the matching a rate on an advance (which is on a bank statement) is changed according to the course on a bank statement. If the field is not activated, the rate will not change on the tab and a new difference will be created. |

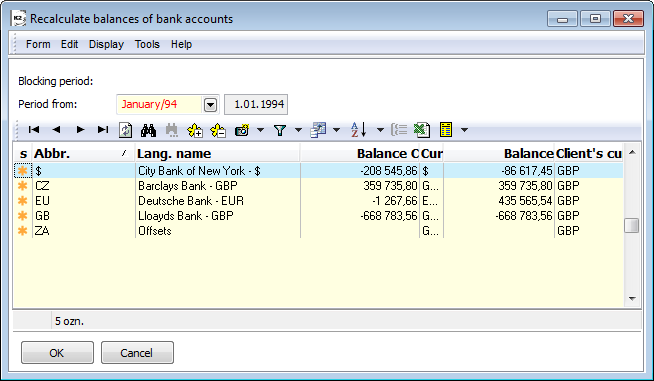

Recalculate bank accounts balances is function, which allows on the selected bank accounts to recalculate their balance. The function is included in the tree menu Finance - Bank - Recalculate bank accounts balances.

Picture: Recalculate bank accounts balances form

A form is opened after starting this function, where is stated:

- Blocking period - period, which is stated in Blocking of periods for Financial closing,

- Period from - the period that follows the blocking period is displayed. This period can user edit.

In addition, all banks accounts list is displayed in the entry form. The following columns are displayed:

- s - (selection) columns for marking, if the bank account should be recalculate. All bank accounts will be asterisk after opening the form;

- Abbreviation - abbreviation bank account;

- Lang. name - verbatim name of the bank accounts;

- Balance in currency;

- Bank account currency;

- Balance - cash register balance in client's currency;

- Currency - client's currency.

You can mark with asterisk bank account for recalculate (manually or using buttons with asterisk).

After you agree with the OK button, execute Recalculate bank accounts balances in the client currency and in currency of bank account on the documents with the Date of issue from the date indicated in the Period from.

The function sends a request to the bank's API and displays the current account balance.

The function is only available in the book state, provided that a link to the banking API is set for the current book. If not set, the function will be hidden.

The function downloads the movements on the account linked to the current book for the selected period and creates entries in the bank statements for them.

- Logic of creating statements - a bank statement is created (or found unconfirmed) for each day. The movements for the given day are loaded in this statement.

- When the action is completed, the function for automatic pairing of items is started.

- If the function starts a change, it always finishes the items in the currently changed statement and leaves the statement unsaved.

The function is only available in the book state, provided that a link to the banking API is set for the current book. If not set, the function will be hidden.

Reports over Bank Statements

Homebanking

Homebanking function allow user to:

- group items on a bank order,

- export a bank order to a file,

- import a bank statement from a file, group and match items.

Export banker's order

For creation banker's order is available script HB - banker's order (HB_ORDER.PAS). It allows to create banker's order for these systems:

- Multicash 3 home and foreign banker's order,

- Best home and foreign banker's order,

- Compatible media home banker's order,

- Citi home banker's order,

- Commercial bank Slovakia foreign banker's order,

- Best home and foreign banker's order,

- Citi home banker's order,

- ČS foreign,

- Systems 24 (Service 24, BusinessBanking 24),

- Deutsche Bank home banker's order.

You must set the parameters before using the script. Some script parameters are general and others only apply to the appropriate system. The script at start-up checks whether the parameters are specified and where it is possible their validity. If the initial parameter check passes successfully, a banker's order file is created. In the universal forms, after creating the file, an icon ![]() will appear on the Basic Data tab, which means that the bank order has already been sent. If the user needs to export the banker´s order again, the Finances/Banker´s order/Repeated sending of banker´s order must be set.

will appear on the Basic Data tab, which means that the bank order has already been sent. If the user needs to export the banker´s order again, the Finances/Banker´s order/Repeated sending of banker´s order must be set.

This function allows to export more banker´s order marked wth an asterisk into one export file.

Some banking systems as format "Best KB" support also SEPA payments. However it is needed that a payment order created in the BEST format meets the SEPA payment criteria (Single Euro Payment Area – uniform payment Area in the framework of EU):

- type of charges SLV,

- currency EUR,

- bank number SWIFT,

- account in shape IBAN,

- partner bank is SEPA compliant.

Parameters' description:

AccOrder |

The parameter specifies from which field a bank account is to be added to the statement:

|

Backup |

If this parameter is set to "YES", the output file is backed up. Default parameter setting is "Yes". |

ClientID |

Client Identification. ClientId can be used in FormatFilename using %l. A similar parameter is CM_ClientNr. |

CompanyName |

If this parameter is filled in, the value is put in place of the name of own company. If it is not filled in, the company name is inserted in the row. Applies to formats that contain a company name. |

Counter |

Counter - the initial counter number for creating files. So far only works with 23 and 24 types. |

DateForFilename |

The date to be taken if it is used in the file name.

|

DiffFilenames |

Test whether a banker's order has already been created with this name. Default value is "No" (the file is overwritten). If the parameter is set to "YES," the message will be displayed if you want banker's order connect to the file or create a new one. |

EnabledBooks |

It checks to run the HB_Order.pas script above listed the banker's order books. Banker's order books are entered into parameter separated by a semicolon CZ; EU. |

ExExpPay |

Parameter for pre-setting fee. |

ExPayTit |

Parameter for pre-set payment item. |

ExportItemDescr |

The parameter specifies what will be fill in the description (from the parameter order):

|

ExportItemDescr2 |

The parameter specifies what will be fill in the description (from the parameter order):

|

FileEncoding |

Selects the character set encoding of the input file:

Other coding values can Be found: http://msdn.microsoft.com/en-us/library/dd317756%28VS.85%29.aspx |

FileNameMaxLen |

To set the length of the file name. If a longer file name is to be created according to the FormatFilename parameter, a message is displayed to modify the FormatFilename parameter. |

CompanyAdr |

The path starts in the company directory. Default parameter setting is "Yes". If the parameter is set to No - the HBPath parameter needs to write the entire path. |

FormatFilename |

File name format. The formatting string of the file name is the same as the Format function, but has other characters to distinguish values. Meaning of formatting characters:

Example:

|

HBPath |

This parameter related with parameter CompanyAdr. If the parameter CompanyAdr is set for the Value "YES", then only the name of the directory, e.g. "HB", can be specified in the HBPath parameter. Default value is "Homeban". If the companyAdr parameter is set to "NO," it is necessary to enter the entire path in the HBPath parameter, for example:/K2/DEMO/HB. |

HBPathAr |

Subdirectory from HBPath with files for homebanking archive. Default parameter setting is "ARCH". |

HBType |

Type of banker's order. Default parameter setting is "0". Values:

|

Header |

Adds a header to the file. Default parameter setting is "No". |

Modulo11 |

Check your account on Modulo11. Default parameter setting is "Yes". |

OnlyConfirmed |

If the parameter is set to "YES", only the confirmed banker's order can be exported. Default parameter setting is "NE". |

OutputBatch |

Output batch that runs after the script ends, including the path. The default value is an empty string. |

PaymentType |

The parameter specifies the currency in which the amount of the banker's order is exported. The default value is "0". Values:

|

ReplaceExMess1ByVS |

If the parameter has the value "YES" and the descriptions from the 2. nd page of the item (data for foreign relations) are exported to the bank order, then a variable symbol is added to the first field of the Message for the recipient or the Payment Detail. It mostly fills in the Message for recipient. Default parameter setting is "No". |

Parameters' description:

GroupItems |

If the parameter is set to “YES”, the banker's order will take the sorting of the items into account. Default parameter setting is "No". |

FillVS |

If not filled in in the banker's order item, in place for description of the order a grouping of symbols will fill in the reference number. Default parameter setting is "No". |

FieldNameCurrency |

For grouping items according to own currency (intended for special editing). |

Parameters' description:

A1 |

Sorting fields in recipient address. Default value - "1" |

A2 |

Sorting fields in recipient address. Default value - "2" |

A3 |

Sorting fields in recipient address. Default value - "3" |

A4 |

Sorting fields in recipient address. Default value - "4". |

In “A1 - A4” parameters it is possible to choose, which line from the address of the bank or the recipient will be filled in into the according fields in text file. Depending On the system it is necessary to properly define these parameters. Each line of the address on the 2 Nd page of the banker's order are set in different fields of text file by the systems.

Example: If there is Line no. 3 written e. g. Diego, CA 92126, then after setting the A1 parameter to the value of “3”, text will be filled in into the A1 field of the text file. San Diego, CA 92126.

Parameters' description:

MC_AD |

If the parameter is set to “Yes”, the home order will display AD. Default parameter setting is "No". |

MC_CfaEmFirstLine |

If the parameter is set to “Yes”, the foreign order will display a blank first line. Default parameter setting is "No". |

MC_Collection |

This parameter determines what type of data will be exported in the order. Default parameter setting is "No". NO - payment, YES - collecting. |

MC_Field_72_3 |

This parameter is connected with foreign banker's order and allows to externally fill in the 3 field on the 72 line in the newly created banker's order. |

MC_F01_SWIFT |

This parameter determines whether the F01 will be filled in with SWIFT or SCB. (If “YES” - SWIFT, if “NO” - SCB.) Default parameter setting is "No". |

MC_F07_Filename |

Parameter will fill in foreign order multicash into the heading of the file into the name of the file field. Some banks demand this, UCB so far, some do not. Default remains blank. |

MC_ZD |

If the parameter is set to “Yes”, ZD will add to the order. Some banks demand this, some do not. Default parameter setting is "No". |

The creation of description on the foreign order multicash:

- If the FillVC parameter is set, reference number/s of the payment will fill into the description,

- If the ExDetPay1-4 field (details of payment from the 2nd page of banker's order item) remains blank, the value will fill in from the 1st page of the item according to value of the ExportItemDescr,

- If at least one field of ExDetPay1-4 is filled in, these fields will be filled in the description.

Example of a file:

HD:11|080131|2700|1|0300

RF:MCFDI2008013114184500000000100000000

KC:4005006000|000000|CZK

UD:100001|2222222222|ACCOUNT1

DI:ORDERER|DESCRIBTION|1

UK:|7777777777|ACCOUNT1

AK:0

DI:CONSIGNEE|DESCRIBTION|1

EC:0

ZK:1122334455

AV:PAYMENT|PURPOSE1

|||PAYMENT|PURPOSE2

|||PAYMENT|PURPOSE3

|||PAYMENT|PURPOSE4

:S1:000000001/4005006000

:S3:000000000/000

Parameters' description:

Best_AccFees |

Parameter can be used for fees. |

Best_Client |

Name of the client. The default value is an empty string. |

Best_CurrFees |

Parameter for setting the account for fees. |

Best_ForceExpPay |

For foreign order. If the parameter is set to “YES”, and on the item of the order the filed for Fees is not filled in, a dialogue box will display for setting the type of the fee. Default parameter setting is "NO” - SHA tzpe of fee will fill in automatically. |

Best_FOREX |

Foorex payment. |

Best_FOREX_ID |

ID Forex. |

Best_CheckPayment |

Payment by cheque. |

Best_MoreAccounts |

Parameter determines whether the sequence number will contain an order book. Default parameter setting is "NE". |

Best_Refund |

It is possible to determine with this parameter, whether to create a settlements file (1501) or collectings file (1502). Default value - "1501". |

Best_Security |

A key set by the bank will save into the file. |

Best_StationNr |

Number of a station assigned in the contract. |

Example of a file:

HI000000000010604 0000000000

01000002001060420010604CZK000000000056700000000000000308 0100000019027378021707206100330000000000 0100000000006930676107206100330000000000

01000012001060420010604CZK000000000015120000000000000308AV all set 0100000019027378021700005254540000000000debet description set 0100000000001190429100005254540000000000

01000032001060420010604CZK000000000053220000000000000308AV + debet set 0100000019027378021740012065230000000000 2700000000003083000540012065230000000000credit description set

01000042001060420010604CZK000000000053220000000000000308AV + credit set 0100000019027378021740012065230000000000 2700000000003083000540012065230000000000

01000052001060420010604CZK000000000053220000000000000308 0100000019027378021740012065230000000000 2700000000003083000540012065230000000000Only credit description set

01000062001060420010604CZK000000000053220000000000000308 0100000019027378021740012065230000000000Only debet description set 2700000000003083000540012065230000000000

01000072001060420010604CZK000000000053220000000000000308 0100000019027378021740012065230000000000Credit and depet description set 2700000000003083000540012065230000000000Debet and credit description set

TI000000000010604000007000000000000337920 00000

Parameters' description:

CM_Client |

Name of the client. |

CM_ClientNr |

Number of the client. |

CM_IntervStart |

Beginning of accounting file, assigned by the bank. Default value - "0". |

CM_IntervEnd |

End of accounting file, assigned by the bank. Default value - "999". |

CM_Refund |

Type of data:

This parameter is set on “1501” by default. |

CM_Branch |

Name of the branch office. |

CM_MaxLines |

Maximum of lines in accounting file. The default value is "1000". |

CM_MaxGroups |

Maximum of groups. Default value - "98". |

CM_MaxGroupLines |

Maximum of lines in a group including the heading and the heeling. This parameter is set on "20" by default. |

CM_MaxGroupChars |

Maximum of characters in a group. Default value - "992". |

CM_UseAV |

Whether the AV constant should be used. Default parameter setting is "No". |

CM_CheckDescr |

If the parameter is set to “YES”, a check will run, to check if following characters are in the description %,<,>,$,../,/..,',". |

CM_DescrSubFields |

Parameter determines, how long the description on 2 nd page of the item can be. For example: Česká spořitelna can add only 1 line of the description, while Komerční banka can add longer description - up to 4 lines. Default value - "4". |

CM_VSLocation |

Parameter is regarding statement for “CM”, which contains foreign items. Reference Number appears in the fields of description of bank statent in the line 078, or 079 on 1st or 2nd position - in line 078 it is position 0781 or 0782, in the line 079 it is the position 0791 or 0792. This reference number will fill in the reference number field on the 1 1. page of the bank statement. "0781", "0782", "0791" a "0792" are the values of the parameter. Parameter is empty by default. |

Example of a file:

UHL1040601TRIAL CLIENT - 1201509797100120

1 1501 100068 0100

2 00000005201 070102

1107160287 500005-2267100237 5201 1 0101000558

3 +

2 00000005201 070102

5000052267120297 1107160287 5201 1 0901000558 2 AV: Electricity payment for January.|Invoice number 89aj456

3 +

5 +

Parameters' description:

SXP_BankFormat |

Parameter determines, for which bank is the sepa formate used. 4 character bank code (BIC) or SWIFT is assigned in longer or shorter form. This parameter is yet only adjusted for Komerční banka. |

SXP_EndToEndId |

Byte, that ensures the filling out of the EndToEndId withe SEPA and XML payments. Paramater can have following values: 0 - VS - description (originally E2EIdVSSSKS = No) 1 - formate /VS1234567890/SS1234567890/KS0308 (originally E2EIdVSSSKS = Yes) 2 - VS. |

SXP_CheckIban |

Parameter determines, if it should check the IBAN, during the export order. Parameter can have the YES and NO values. Default parameter setting is "Yes". |

SXP_PmtInfOnce |

Parameter edits the export an dshape of the final XML document. Parameter can have the YES and NO values. Default parameter setting is "No". When setting the value to: NO - one PmtInf element for each item will create, thus creating a PmtInf collection of elements. YES - one whole PmtInf element (collection) will create for all items and each item has its own element CdtTrfTxInf. |

SXP_UsePstlAdr |

Parameter can have the YES and NO values. Default parameter setting is "No". YES - PstlAdr element will fill in - post office address. |

If while exporting banker´s order via the HB function - banker´s order (HB_order.pas) set HBType=24, that is ČNB formate, file of signed exported file is required on the bank side. This can also be done through external application or by using libraries of I. CA. company. (I. Certification authority). For the file to be able to be signed, it is necessary to have a signature in main file in K2 library (AdvIcaSigner.dll, libiconv.dll, ICAUniLicVerifyCInterface, dll), that are not delivered by K2, but by I. CA. File for exporting has to be accompanied by another signature, that will allow to run the HB script - signing the order I. CA (HB_SignIca.pas) over exported order. This script must be run by a different user under a different login into the Windows.

Pathways to licensed files from the I. CA. can be set via the function Setting of electronic signature (no. 1261). According to way of using the licensed file, it is possible to distinguish license for customer and for user.

1,"001","2501234567","2040000765","29112004",30000.00,"","2671500267","0100","0008","0

020040676","","KRIZ LADISLAV”

1,"002","2501234567","2040000981","29112004",30000.00,"","0420923389","0800","0008","0

002004129","","BRUNI CARLA”

1,"003","2501234567","2040000607","29112004",30000.00,"","0650445271","0100","0008","

1000004564","","NOVAK JAN”

1,"004","2501234567","2340000889","29112004",13242.00,"","0047443191","0100","0308","0

000013304","","SUPPLIER”

1,"005","2501234567","2440000201","29112004",46707.50,"","2500020103","2600","0308","0

111067504","","CONNECTIONS “

1,"006","2501234567","2340001009","29112004",11662.00,"","9391320247","0100","0308","0

000131991","","COMMUNICATION”

1,"007","2501234567","2340001020","29112004",3145.17,"","9391320247","0100","0308","00

00132449","","COMMUNICATION”

1,"008","2501234567","2340001030","29112004",11662.00,"","9391320247","0100","0308","00

00132389","","COMMUNICATION”

1,"009","2501234567","2340000988","29112004",11662.00,"","0391742561","0100","0308","00

00533804","","VYLISKY”

9,"010",272486.17

000001110209036800 0800 000000000010000 00000003080000000009000035943400000030600286660000001031621568

Account assignment and posting of the bank statement

Script HB - bankovní výpis (HB_STATEMENT.PAS) in K2 IS serves the purpose of importing the bank statements from all systems in use. Base of the chosen parameter we set the system, that is used by the bank, that meaning which statement should import int the K2 IS.

Parameters' description:

AccNum |

Bank account number (if left bank in imported file). |

AllowMinusAmount |

When setting the parameter to “YES” we can enter the negative numbers while dividing. This parameter is set on “NO” by default. |

ArchiveCondition |

Determines the method of activation of initial file. The default value is "0". Parameter can have the values: 0 - always, 1 - never, 2 - when there is no error while loading the account. |

AvailableAccounts |

Parameter for possibility of banker´s order with big amount of accounts that are in K2, choose just some accounts. Accounts are separated by semi-colon. Parameter is empty by default. |

BCN |

Bank Code Number. Best must be filled in, Compatible media,Citibank. |

BookAbbr |

Defines into which book the report should save. In bank accounts several books with same bank accounts can appear. This parameter can be used for searching in books of bank accounts and checking other data the same way as setting this parameter. |

CARD_InterCompBooks |

Books of internal documents. Parameters are only meant clarification of search of possible internal documents for pairing, without setting those the script does not work. |

CARD_ProviderBankAcc |

Account number of card transactions operator. Parameters are only meant clarification of search of possible internal documents for pairing, without setting those the script does not work. |

CARD_ProviderBankBcn |

Account number of card transactions operator. Parameters are only meant clarification of search of possible internal documents for pairing, without setting those the script does not work. |

CurrencyCodes |

Is filled in in case that the abbreviation of the currency in K2 does not correspond with the international code, e. g. EU|EUR (abbr. in K2|international code). |

DecodeAccount |

In some cases bank account numbers in the report can be re-coded, that is have a different order of numbers. If K2 IS reports”Account not found”, setting the parameter to “YES” is appropriate. |

DocInfoAdvancePrv |

Advances provided field, that will be displayed documents in info. |

DocInfoAdvanceRec |

Advances received field, that will be displayed documents in info. |

DocInfoInterComp |

Internal documents field, that will be displayed documents in info. |

DocInfoInvoiceIn |

Invoices in field, that will be displayed documents in info. |

DocInfoInvoiceOut |

Invoices out field, that will be displayed documents in info. |

DocInfoOtherLiab |

Other liabilities field, that will be displayed documents in info. |

DocInfoOtherRec |

Other receivables field, that will be displayed documents in info. |

E2EIdVSSSKS |

Parameter can be used for payment contact with Slovakia. Parameter can have the YES and NO values. SEPA formate does not make the difference between our symbols (VS, SS, KS) but only "Referenciu platiteľa". If the user wants these symbols to enter the order in form, on which the Slovakian banks have agreed in SBA (Slovenská banková asociácia), the parameter must be set to Yes. |

FieldK2SpecSym |

String, K2 field, where a specific symbol should be filled, if this field is entered and found in list of fields of report item, then then SS will be filled in, it can be existing field, e. g. description, message for recipient, details of payment etc. |

FileEncoding |

Selects the character set encoding of the input file. Further description of the parameter in Jointly parameters for orders. |

Filemask |

Deafault name of the report or a mask. |

FilemaskOriginal |

Mask of the file for splitting on accounts (SplitStatementFile). |

CompanyAdr |

The path starts in the company directory. Default parameter setting is "Yes". |

GetExtendedDescr |

Parameter for importing long descriptions, will convert the description onto the 2nd page of bank statement item. |

GroupedItems |

It is possible to define parametrically whether to display the group items. Default parameter setting is "ANO". |

HBPath |

This parameter related with parameter CompanyAdr. If the parameter CompanyAdr is set for the Value "YES", then only the name of the directory, e.g. "HB", can be specified in the HBPath parameter. Default value is "HOMEBAN". If the FirmAdr parameter is set to "NO," it is necessary to enter the entire path in the HBPath parameter, for example: “C:/K2/DEMO/HB”. |

HBPathAr |

Subdirectory from HBPath with files for homebanking archive. Default parameter setting is "ARCH". |

HBType |

Item type bank statement. Default parameter setting is "0". Value:

|

HeaderDateToItem |

When the parameter is sat to “YES”, the describtion from the heading will be added to bank statement. Default parameter setting is "NE". |

IDFromStatement |

When the parameter is set to “YES” a number from text file will be filled into the bank statement.text file. If this parameter is set on “NO” number will be add from K2. |

IgnoredBooks |

List of books separated by semi-colon, that should not be searched while importing bank statement. |

ImportItemDescr |

When the parameter is sat to “NO” the scrip won§t count in description of items. Default parameter setting is"Yes”. |

InputBatch |

Initial batch, that will be ran before running the script. |

KeepOriginalRefNo |

Keep reference number with “invoices out” (does not cropp additional zeros). |

KeepStaDescr |

If the parameter is set to “YES”, the script will keep the description from report when distributing the items.currency of Default parameter setting is "No". |

KeepStaRefNo |

Keep reference number from statement when distributing the items. |

LoadDocsAdvancePrv |

Load advances provided. |

LoadDocsAdvanceRec |

Load advances received. |

LoadDocsInterComp |

Load internal document. |

LoadDocsInvoiceIn |

Load invoices in. |

LoadDocsInvoiceOut |

Load invoices out. |

LoadDocsOtherLiab |

Load documents of other liabilities. |

LoadDocsOtherRec |

Load documents of other receivables. |

MakeCheckSum |

The check of items summary. Checks, if the summary of items is the same as difference between final and initial state of the bank statement. This parameter is involuntary and deafault setting is “NO”. |

Modulo11 |

Check your account on Modulo11. Default parameter setting is "Yes". |

OrderItemDayLimit |

The parameter specifies the number of days to find unmatched items from today to the past. It is possible that universal reference number is used for several payments that will not pair in the order. Default parameter setting is 40. |

RemapFields |

Before saving item from text report marked field will fill in value of a different field. It can be used when sending reference numbers abroad via several fields for message for receiver or sender. If the filled in field is reference number: Example: description=cfMessageForRecipient1 - will fill the 1st line of the message for recipient into the description ReferenceNo=cfMessageForRecipient1 - will fill the 1st line of the message for recipient into the reference number. |

SaveEmptyStatement |

When set to “YES” no bank statement is imported. Default parameter setting is"Yes". “YES”. |

SelectSource |

If this parameter is set to “YES”, it is possible to select a file at the beginning of the script. |

ShortDateFormat |

Short date formate e. g. yyyy-mm-dd h:nn:ss. |

ShowBooksOtherLiab |

Books of other liabilities (separated by semi-colon), from which documents for pairing are suggested. If not set, documents from all books of current clients firm will be suggested. |

ShowBooksOtherRec |

Books of other receivables (separated by semi-colon), from which documents for pairing are suggested. If not set, documents from all books of current clients firm will be suggested. |

ShowBooksPurch |

Books of purchases (separated by semi-colon), from which documents for pairing are suggested. If not set, documents from all books of current clients firm will be suggested. |

ShowBooksSale |

Books of sales (separated by semi-colon), from which documents for pairing are suggested. If not set, documents from all books of current clients firm will be suggested. |

SortByApplication |

If set to “Yes” data will be sorted, according to bank application. So far this parameter can only be used for Compatible media Default parameter setting is "No". |

SplitStatementFile |

Splits documents according to mask on each document. |

StaCurrency |

Statement of currency. |

SXP_BankFormat

|

For setting bank number or SWIFT. Import then reads VS and KS according to Komerční banka formate. |

SXP_StatementDate |

Parameter allows to change the element for loading data for creating report. It is regarding bank statement 14" = Sepa .xml formate. The default value is "0". Parameter can have the values: 0 - CreDtTm (date of creating the file), 1 - FrDtTm (interval since), 2 - ToDtTm (interval to). |

TestOnly |

0 - standard behaviour, 1 - only loading of report without saving or loading the right book, 2 - saves loaded text report into AktDM in changed. |

VSInExMess1 |

Is connected to "ReplaceExMess1ByVS” parameter. Only for sent payments! We must set the parameter so we know, that the reference number is saved in the Message for receiver field (or Payment details) on the 2nd page of bankers order, then this reference number will come back in the field on 2nd page of the bank statement. Default parameter setting is "No". |

VSSkipFrontLetters |

Skip letters at the beginning of reference number. |

WarnBadAccNum |

Some bank statements can contain items from non existent account. If this parameter is set to “YES”, the script will display a warning with a non existent account. Default parameter setting is "Yes". |

Tips for users when the account is not found:

1. The same numbers in different order then actual number are displayed in the report: Change the DecodeAccount parameter to an opposite setting.

2. The same numbers in right order are displayed in the report: Check the bank account number in Bank Accounts book in K2 (if there e. g. was not a typo) and then check the banks SCB. There should be one active (not blocked) bank with said SCB in the bank code list.

3. The same numbers in right order are displayed in the report: Check the StaCurrency parameter and the account currency.

4 The report displays the same numbers in right order: Check the setting of Periods in Bank Accounts nook. If the firm distinguishes Periods, it is necessary to check settings in current period.

5. An account that is not in K2 is displayed in report: Some formates allow sending several statements in one file, this account may not belong to current customer or is not in K2 at all.

Parameters' description:

FilemaskOriginal |

Parameter for mask name. It is used with the "SplitStatementFile" parameter. By default, it is empty. |

MC_AccBank |

The field for bank code of counteraccount. It is used when the account number is "bank code / account number" eg "0800/000000 1234567890". In this case the bank code is given in 86 line in another field that must be entered into this parameter. |

MC_AccNumb |

The field for number of counteraccount. It is used in case the account number is in a shape of "bank code / account number" eg "0800/000000 1234567890". In this case, the account number is listed in 86 row in another field. It is necessary to determine this field by parameter. |

MC_Account |

The field for a counteraccount. If entered, parameters MC_AccBank and MC_AccNumb are not taken into account. |

MC_AccPrt1 |

An expanded counteraccount field. It is used when the account has more characters than can be entered in the field containing the account (MC_Account). The field contains the rest of the characters that did not fit into the MC_Account field. |

MC_Concat86 |

Whether line 86 has to be joined before processing. Default parameter setting is "Yes". |

MC_Delim86 |

Separators subfields in line 86 in Multicash. |

MC_Descr86 |

The parameter specifies which fields from line 86 are imported into IS K2 description. |

MC_Empty86 |

Empty subfields in line 86 in Multicash. |

MC_FieldKS |

Constant symbol field. |

MC_FieldVS |

Reference No field. |

MC_FieldV1 |

Alternative reference No field. In certain circumstances it is necessary to load VS from different fields, than those stated in MC_FieldVS It is a home order, where the payment is in the K2 identified VS longer than 10 characters and the VS is then handed over to payment details. With foreign payments only payment detail hands over to the VS. Parameter MC_FieldV1 value is most often the same as payment details field. That does not apply to foreign SEPA payments. |

MC_FldSEPA |

The parameter identifies the Reference No, Specific and Constant symbols on line 86. If the parameter is specified, the symbols are first searched for in this field where they are stored in the / RNxxx / SSyyy / CSzzz format. If the Reference No is not found, it searches for MC_FieldVS and, if it is not found, is also in MC_FieldV1. If In the MC_FldSEPA field, constant symbol is not found, it is searched for in the MC_FieldKS field. For bank statements loading you still need to enter the MC_FieldVS and MC_FieldKS fields because not all items contain the above SEPA description. However, they become optional fields when the MC_FldSEPA parameter is filled. |

MC_ItemMustHave86 |

Default parameter setting is "No". If the parameter has YES value, valid item of statement must also have 86 detail. |

MC_OpAddr1 - 4 |

Parameter for import of address on the 2nd page bank statement item. In these parameters there are written sub fields numbers from the field: 86, which should be places into address fields. |

MC_Typ86 |

It is entered if different types are found behind line 86, and for each applies other setting of related parameters (eg parameter value is "020;010", the parameter MC_FieldVS can be "23VS;22"). If this is REF type, the parameter is not set. |

SplitStatementFile |

With the "Yes" value, the files are automatically divided by the specified mask in the "FilemaskOriginal" parameter to the individual accounts and they are called "(book 2 characters) _" (the 5-digit number).(suffix according to the original file)". |

If the bank register more than one currency on one account, the Multicash format can also distinguish the account by currency. In Information system K2, a single account is created for each currency.

PayPal format properties:

- PayPal is an import of a CSV file in which some value columns are pre-set by the script. These columns can be changed by setting the appropriate CSV parameter to a different value, column name,

- may include invoice payments in different currencies, so you need to have the StaCurrency parameter set to import only those items that have the currency same as the currency of the statement (the HB_Bank statement function can therefore be listed multiple times per currency),

- In the PayPal format is not your account number, so the "PayPal" text is written into the account number for each bank statement item,

- When you import this "csv" file, you will always create two items, the amounts paid by the customer and the fees,

- when importing the PayPal format, it is necessary to set the following parameters:

Parameters:

AccNum |

123456789 |

BCN |

0300 |

HBType |

13 |

IDFromStatement |

No |

StaCurrency |

GPB |

Parameters:

GEM_ChargeDesc |

Description of fee item. This value can be used in pairing helper. Default value is “Charge”. |

A CSV file may sometimes contain a row of field descriptions - a "header", sometimes missing this line. If There is a line with "header", then the field name from file name is listed in the parameters below. If there is no line with a "header" in the file, enter the number instead of description into parameter. Enter the number, where the field is currently stated and the numbering starts with the number 1. The first row of the field descriptions can be sometimes quite long, and then it breaks. For function it is still taken as one line.

Parameters' description:

Control parameters:

CSV_Delimiter |

Field separator. |

CSV_DescrLine |

Fields description in file. |

CSV_LineLeft |

The number of rows from the end that should not be read. |

CSV_LineStart |

Initial line of statement. |

Parameters for fields description:

CSV_AccDate |

Date of account field. |

CSV_AccTime |

Time of account field. |

CSV_Amount |

Amount field. |

CSV_BankAccNumber |

Counteraccount field. |

CSV_BankAddr1 |

Bank address field 1. |

CSV_BankAddr2 |

Bank address field 2. |

CSV_BankAddr3 |

Bank address field 3. |

CSV_BankAddr4 |

Bank address field 4. |

CSV_BankBic |

Counterbank field. |

CSV_BankCountry |

Bank country field. |

CSV_ConstantSymbol |

Constant symbol field. |

CSV_Currency |

Payment currency field. |

CSV_Description |

Description field. |

CSV_Fee |

Fee amount field. |

CSV_MsgForRecip1 |

Message field for recipient 1. |

CSV_MsgForRecip2 |

Message field for recipient 2. |

CSV_MsgForRecip3 |

Message field for recipient 3. |

CSV_MsgForRecip4 |

Message field for recipient 4. |

CSV_PaymentDetail1 |

Payment detail field 1. |

CSV_PaymentDetail2 |

Payment detail field 2. |

CSV_PaymentDetail3 |

Payment detail field 3. |

CSV_PaymentDetail4 |

Payment detail field 4. |

CSV_ReceiptAddr1 |

Recipient address field 1. |

CSV_ReceiptAddr2 |

Recipient address field 2. |

CSV_ReceiptAddr3 |

Recipient address field 3. |

CSV_ReceiptAddr4 |

Recipient address field 4. |

CSV_ReferenceNo |

Reference No field. |

Example of CSV file with "header":

Date, Time, Time Zone, Name, Type, Status, Currency, Gross, Fee, Net, Reserve, From Email Address, To Email Address, Transaction ID, Counterparty Status, Address Status, Item Title, Item ID, Shipping and Handling Amount, Insurance Amount, Sales Tax, Option 1 Name, Option 1 Value, Option 2 Name, Option 2 Value, Auction Site, Buyer ID, Item URL, Closing Date, Escrow Id, Invoice Id, Reference Txn ID, Invoice Number, Custom Number, Receipt ID, Balance, Address Line 1, Address Line 2/District/Neighborhood, Town/City, State/Province/Region/County/Territory/Prefecture/Republic, Zip/Postal Code, Country, Contact Phone Number,

30.04.2016,22:52:05,GMT+02:00,Rolling Reserve,Reserve Hold,Placed,EUR,"-4,07",...,"-4,07",,,,0LA6551656484690X,,,,,,,,,,,,,,,,,,6A576693C87315920,,,,"1781,95",,,,,,,,

30.04.2016,22:51:57,GMT+02:00,Torben Kuemmel,Express Checkout Payment Received,Completed,EUR,"41,79","-1,06","40,73",,t-kuemmel@gmx.net,mike.frontzeck@brasty.de,6A576693C87315920,Non-U.S. - Verified,,,,0,,0,,,,,,,,,,,,,,,"1786,02",,,,,,,,

30.04.2016,22:49:23,GMT+02:00,Rolling Reserve,Reserve Release,Released,EUR,"11,24",...,"11,24",,,,3HY312879R1551503,,,,,,,,,,,,,,,,,,5WA068437P8852916,,,,"1745,29",,,,,,,,

30.04.2016,22:26:37,GMT+02:00,Rolling Reserve,Reserve Release,Released,EUR,"2,31",...,"2,31",,,,56A15936VT491523W,,,,,,,,,,,,,,,,,,42B8963137759014J,,,,"1734,05",,,,,,,,

30.04.2016,20:54:57,GMT+02:00,Rolling Reserve,Reserve Release,Released,EUR,"4,4",...,"4,4",,,,9WG22690GS042062J,,,,,,,,,,,,,,,,,,04K96564B1557242H,,,,"1731,74",,,,,,,,

30.04.2016,19:49:25,GMT+02:00,Rolling Reserve,Reserve Release,Released,EUR,"12,75",...,"12,75",,,,4Y753675498739008,,,,,,,,,,,,,,,,,,1HU063098L323754L,,,,"1727,34",,,,,,,,

30.04.2016,19:43:32,GMT+02:00,Rolling Reserve,Reserve Release,Released,EUR,"2,41",...,"2,41",,,,7PW50919YD956411S,,,,,,,,,,,,,,,,,,7GG21219FH8710426,,,,"1714,59",,,,,,,,

30.04.2016,19:16:25,GMT+02:00,Rolling Reserve,Reserve Hold,Placed,EUR,"-3,82",...,"-3,82",,,,9PE08580K2284460T,,,,,,,,,,,,,,,,,,26D992963T1752523,,,,"1712,18",,,,,,,,

Parameters' description:

KM_AccountLocation |

Placement of account number counterside in description lines 078, 079 |

KM_AmountCode |

Field 075/6: 1 - KB, 2 - ČS |

KM_DescrLocation |

Placement of description in description lines 076, 078, 079 |

KM_Length078079 |

Length of subfield or 078 or 079 line |

CM_VSLocation |

Placement of VS in the 078, 079 description lines |

{1:F01BACXCZPPAXXX0000000000}{2:I940BACXCZPPAXXXN 020}{4:

:20:UNO CZECHIA.

:25:0300/12345678

:28C:6/1

:60F:C070713CZK331925,94

0707160713C134488, 5FTRF20070713700006

//00147655756

:86:051?00S-TUZ-DOSLA/DOM-STNDTRNSF-I?20000000-0516086001/2400?21KS 0

000000008?22VS 0006700081?23SS 0000000000?302400?31000000 0516086

001?32HANAK s.r.o.?33HANAK s.r.o.

:61:0707160713C7194,3FTRF20070713700006

//00147655757

:86:051?00S-TUZ-DOSLA/DOM-STNDTRNSF-I?20000000-0516086001/2400?21KS 0

000000008?22VS 0002701390?23SS 0000000000?302400?31000000 0516086

001?32HANAK s.r.o.?33HANAK s.r.o.

:61:0707160716D264477,5FTRF20070716700010

//00147744615

:86:020?00S-TUZ-VYSLA/DOM-STNDTRNSF-O?20000000-1000427308/3500?21KS 0

000000008?22VS 0000270609?23SS 0000000000?24UNO ESK REPUBLIKA

SPOL.?25S R.O.?303500?31000000 1000427308?32OMEGA SECURITY CZ,

S.R.O.

:61:0707160716D197553,1FTRF20070716700015

//00147819172

:86:020?00S-TUZ-VYSLA/DOM-STNDTRNSF-O?20000019-3152790287/0100?21KS 0

000000008?22VS 0000012107?23SS 0000000000?24UNO ESK REPUBLIKA

SPOL.?25S R.O.?300100?31000019 3152790287?32BRAVO, S.R.O

...

:62F:C070716CZK11578,14

:64:C070716CZK11578

-}

Lines 20, 25, 28 and 60 are used for the heading of the bank statement. In Line 20 is stated name of company and in Line 25 company bank account number. Account numbers can have different formate. In this case the account number is in the “bank code/account number” formate. In line 60 the initial state on bank statement is stated.

Lines 61 and 86 are bank statement items. In line 86 it is visible that each record is separated by a question mark. It must set it as a field separator via the MC_Delim86 parameter.

The value “32” must be set into the MC_Descr86 parameter, that will determine that the name of company will be filled into the description from field 32 in line 86.