Methodologies - Shared Purchase and Sale Elements

Pricing in IS K2

In IS K2, it is possible to define a price system to reflect the company's pricing policy. Prices can be set for different currencies, price (dealer) groups, specific customers, graduated according to quantity, etc.

In the description, we will also look at purchase prices to make it clear what basis sales prices are based on.

Purchase Prices

In the K2 IS, we register purchase prices in Article cards. We make use of these prices for instance in temporary article valuation before an Invoice arrives. We may edit and update the prices in various ways.

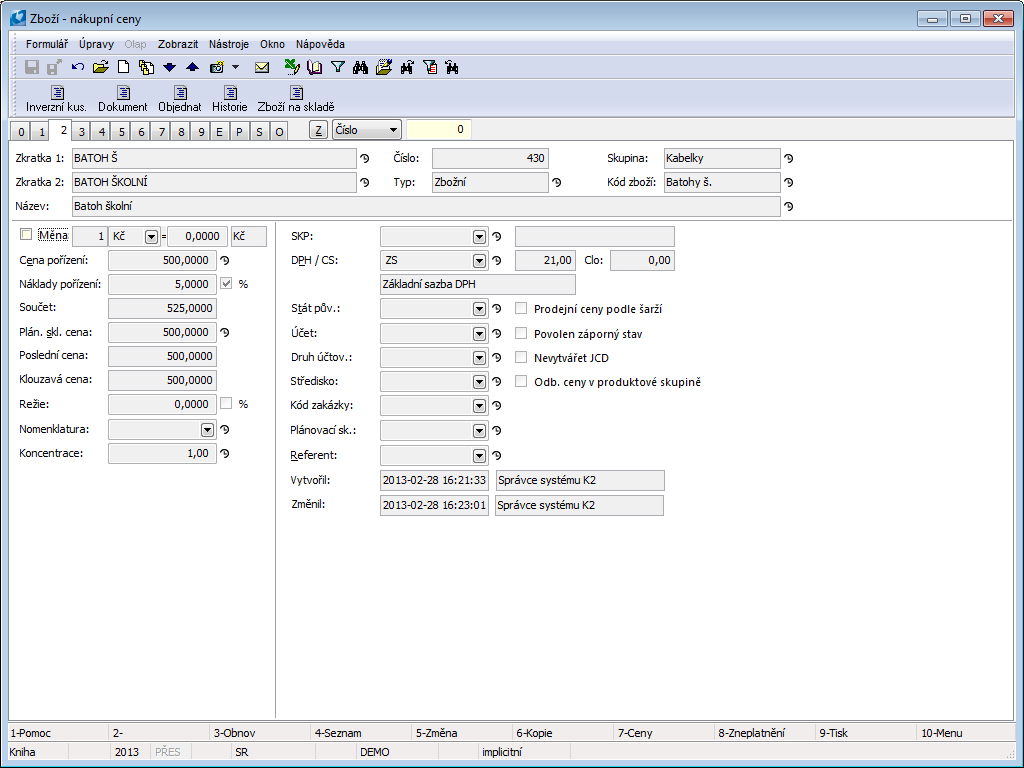

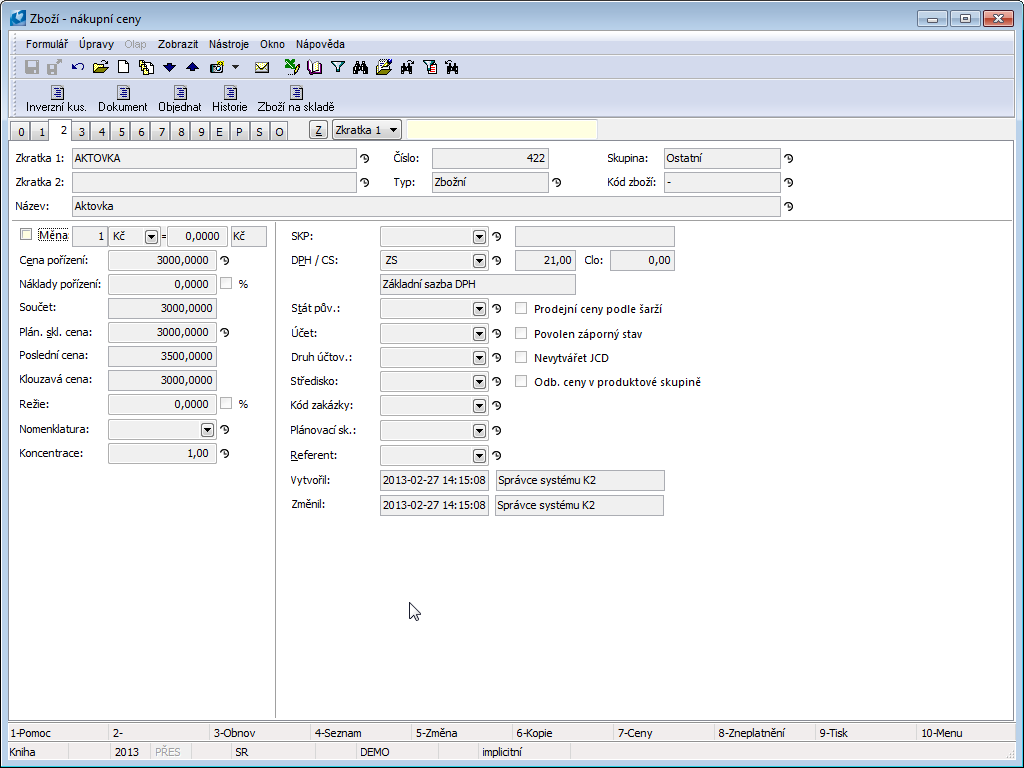

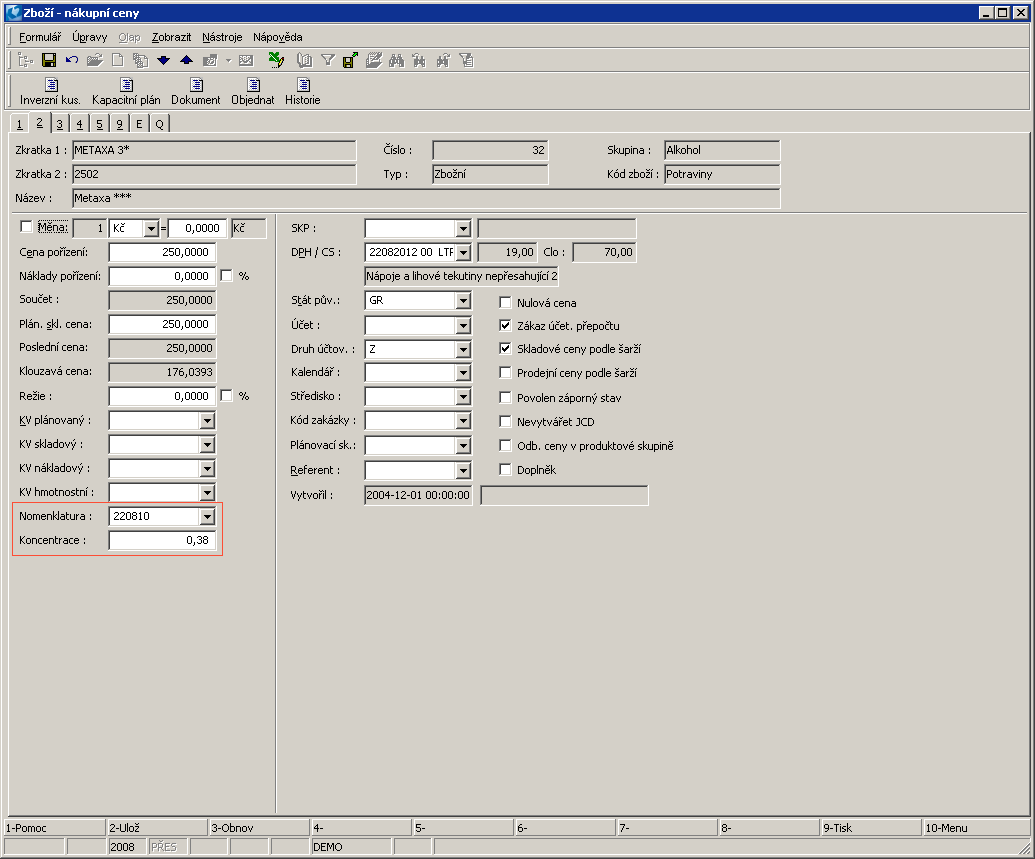

Purchase prices are defined on the 2nd page of Article card.

Picture: Article card - 2nd Page

Description of the fields on the 2nd page of Article card is defined in the User Guide of the K2 IS.

The purchase price, purchase cost, planned stock price and amount of overheads are defined there.

The meaning of purchase prices in IS K2.

There are several variants of setting the stock price in the purchase documents. The ideal case occurs when you have a confirmed Invoice to a received article firstly. This price from the Invoice is also the price of a receipt on stock (the price in the S field on the item of a Receipt Card).

If any of the items of a Receipt Card are not on the confirmed Invoice, it means that the Invoice price is not determined exactly; the Planned Stock Price from the Article card is entered into the stock price of the item. This entered price can be edited. If you confirm a Receipt Card earlier than an Invoice, the system notifies you and the receipt will be executed in a price that is defined in the S field on the Receipt Card item. Then the Invoice price will be saved only in the Invoice and it does not change the Stock price of the Receipt card any more. In this case, the stock price on a Receipt card will be edited later when Stock Recalculation. It can be run from the initial menu from the Module - Administrator - Recalculations - Stock Recalculation menu.

Pl. stock price from an Article card will be used in the Purchase documents if the price of the receipt article is not defined by the price from an Invoice In. This price is further used when pricing products with fixed prices.

Price entered in Field Purchase price field is automatically inserted into the order price (field O (net price / MJ) on the purchase item) and into the invoiced price (field F (net price / MJ) on the purchase item). If the Give the last price in purchase option is activated in the User Parameters, then the price from the Last price field is entered into the Order, it means the price from the last confirmed Invoice In. In the case, that the Supplier price lists are defined, the price defined in the Purchase price field is not entered into a price of Order (the O and I fields).

In The even that user wants to include the acquisition incidental costs in the article stock price, enter the actual amount of those costs into the C field (Net price / UM) on the purchase item. After executing the Stock Recalculation, these incidental costs are projected into the stock price. (In the Client Parameters is necessary to activate the option Stock Price with Incidental Costs).

Planned incidental costs related to the acquisition of articles and that are defined in the Purchase Costs on the Article card, will be inserted into the Purchase item into the field In (Net price/UM) in case that the Stock price with Incidental Costs. In the case when you allocate the real incidental costs into the Purchase item by means of the Allocation of Incidental Costs function, the value, that has been inserted from the Article card, will be deleted.

On the Article card there are lots of fields or columns that are necessary to be updated by means of recalculation.

The Sliding price filed is calculated as a current contribution of a value of Article on a stock and an amount on the stock. You can also update it by the Stock Recalculation function.

When pricing the stock by prices according to batches, the Sliding price field has no importance.

Example

A firm that prices with the sliding price has done the following stock movements:

1st February |

receipt |

1 pc |

per 5 EUR |

15th February |

receipt |

1 pc |

per 4 EUR |

16th February |

release |

2 pc |

per X EUR |

28th February |

receipt |

1 pc |

per 3 EUR |

10th March |

receipt |

1 pc |

per 6 EUR |

20th March |

release |

1 pc |

per Y EUR |

30th March |

receipt |

1 pc |

per 5 EUR |

By which price will be priced the releases from 16th February and 20th March and which will be the sliding price to the 31st March?

Solution:

The Release price of 16th February:

2 pcs are currently in the stock, 1 pc per 3 EUR and 1 pc per 6 EUR, it means the release price is calculated as (1pc * 3 EUR + 1 pc * 6 EUR)/2pcs = 4.5 EUR.

The Release price of 20th March:

2 pcs are currently in the stock, 1 pc Per 3,5 EUR and 1 pc per 7 EUR, it means the release price is calculated as (1pc * 3,5 EUR + 1 pc * 7 EUR)/2pcs = 4.5 EUR There is also the 1pc on the stock that is priced by a sliding price that is 4.5 EUR.

The sliding price to 31St March:

On the stock there are 2 pcs of articles, 1 pc per 4.5 EUR and 1 pc per 5 EUR. The sliding price is also (1 pc*4.5 EUR + 1 pc*5 EUR)/2 = 4.75 EUR.

It is necessary to remember that the Planned Stock Price on the 2nd page of the Article card does not have to correspond with a stock price on a purchase item and a stock card.

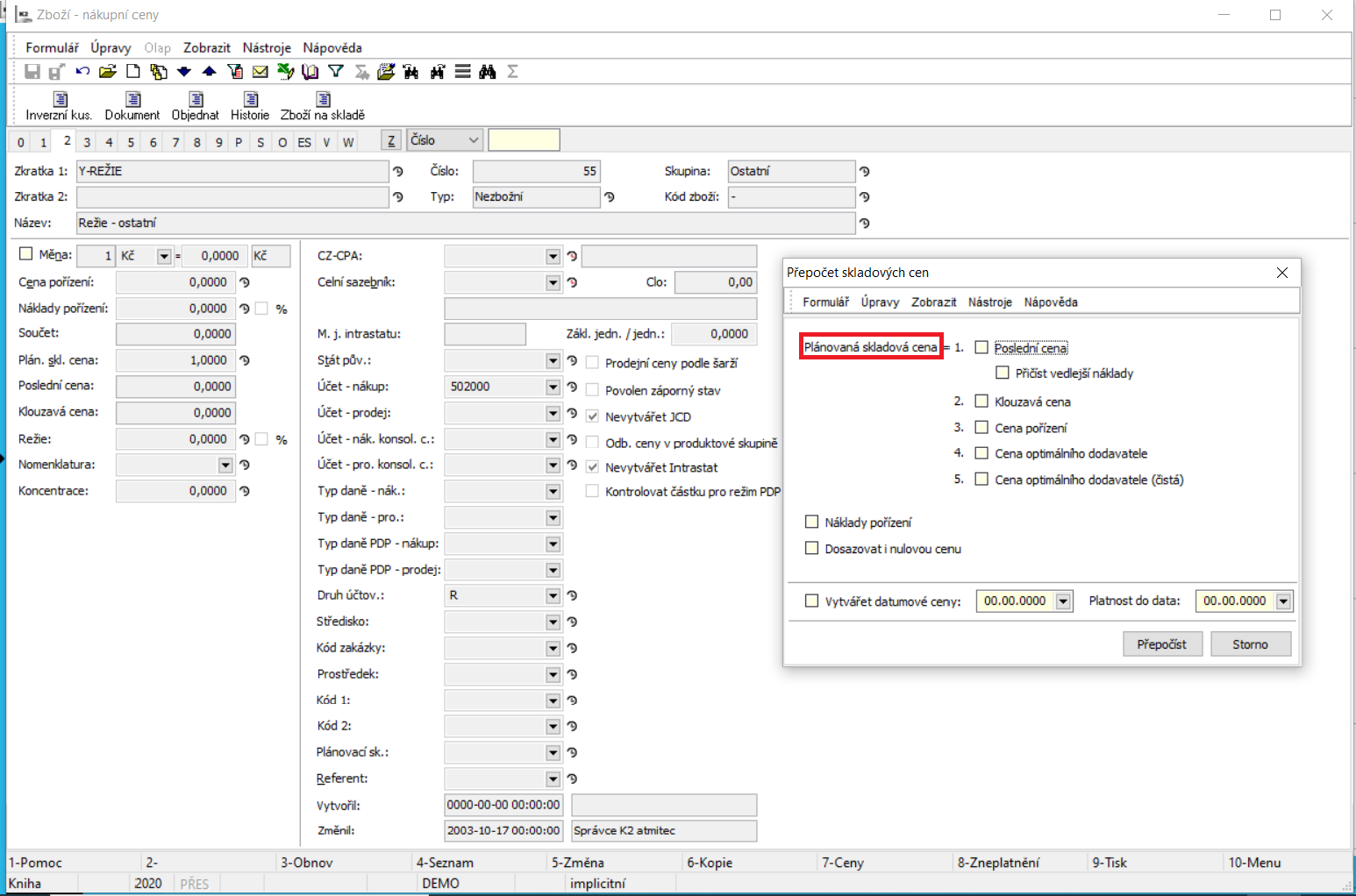

A Planned Stock Price on the 2nd page of an Articlecard can be updated via the Recalculate Stock Prices function. You can run this function either over a specific Article (i.e. over the 1st - 9. Th page of this Article card) or on Articles container from the Action - Stock price recalculation module menu.

It is necessary to update it regularly in the case when you use the stock price to define the selling price (see the Margin chapter).

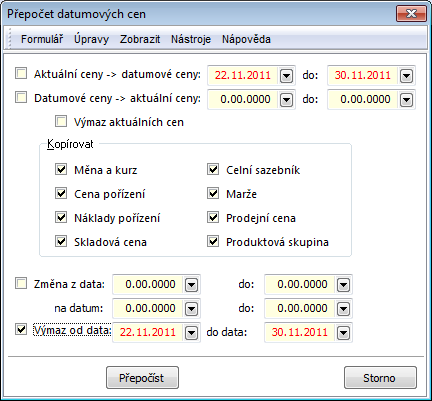

Picture: The Recalculate Stock Prices form

By means of the recalculation, the stock price is updated according to the last, a current, a sliding, a purchase price, a price of an optimal supplier or a net price of an optimal supplier, some of which of these values are displayed in the fields on the 2nd page of an Article card. The detailed description of this function is stated in the Basic manual in theForm - Actions - Articles chapter.

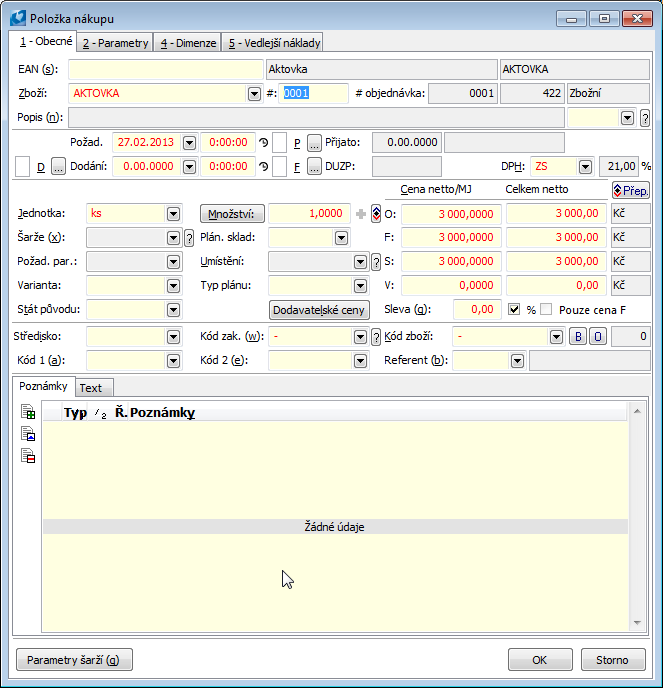

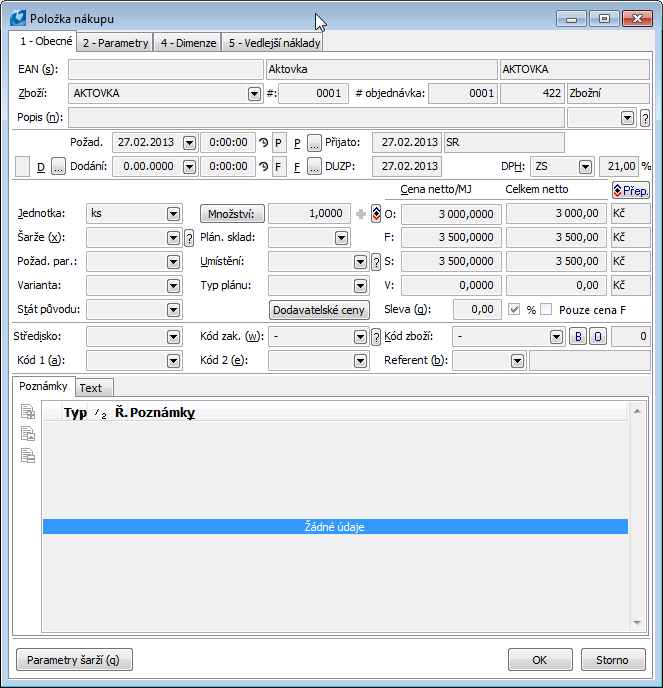

Example: You will buy a men's leather briefcase. Insert a new card for this article firstly. The supposed purchase price is 300 EUR. The incidental purchase costs are not supposed. The stock price will be also 300 EUR. Issue an Order for this article on the 300 EUR. Invoiced and Stock price is automatically predefined on 300 EUR.

Picture: Purchase Order - Purchase item form

- The article will be received on the stock just before delivery the invoice. When confirmation the Receipt card, you will be asked whether you really want to confirm the Receipt card without a confirmed Invoice. Select Yes. The Briefcase is received on the stock in The price 300 EUR.

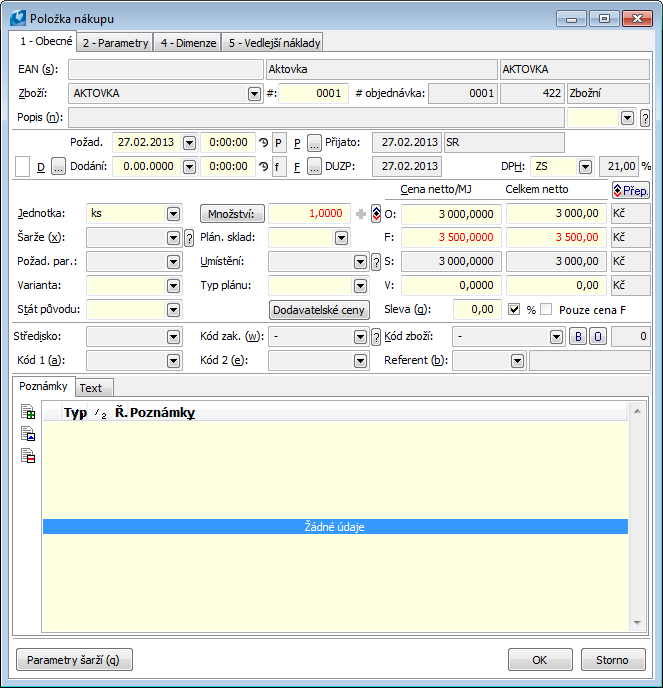

- On the Invoice from supplier, the price will be 350EUR per the Briefcase . In IS K2 we create an Invoice, edit the F price and confirm the invoice.

Picture: Invoice In - Purchase item form

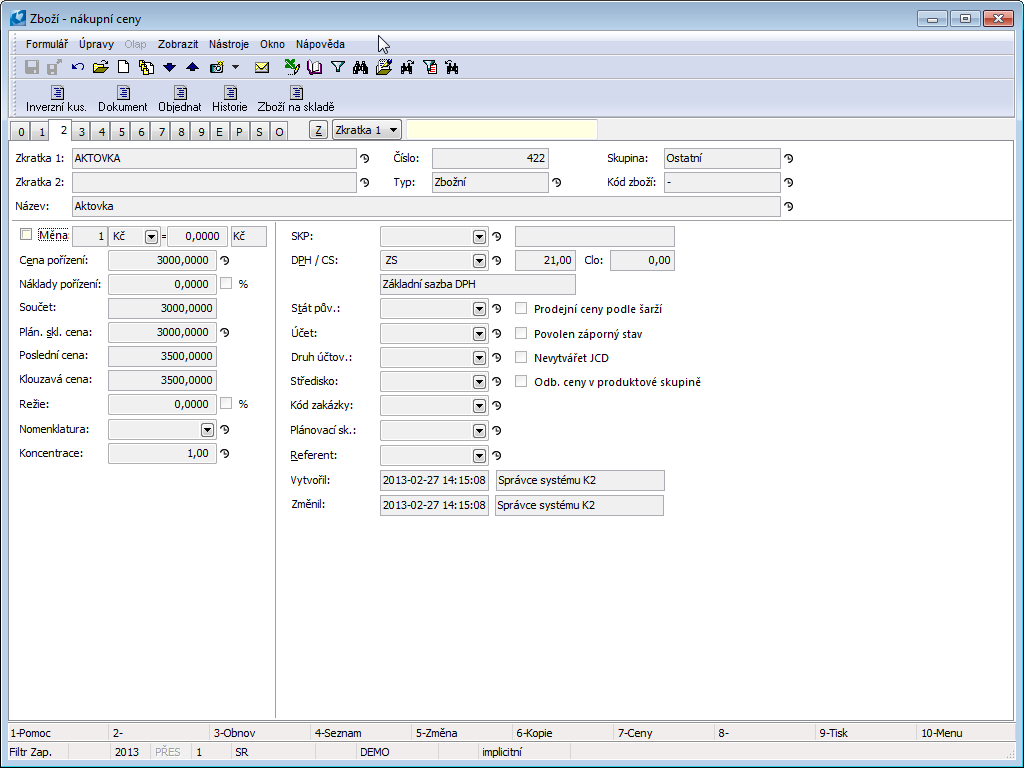

- Switch on the 2nd page on the Article card to find out the changes in individual fields.

Picture: Card Article - Purchase prices -2. Page

The Planned stock price has not been altered. The Last price is the price from the confirmed invoice. The Sliding price is calculated according the price in the Receipt card.

Neither the stock price has been changed in the Purchase item. Execute the Stock recalculation. It is necessary, to this stock price match the reality.

Picture: The Purchase item form after Stock Recalculation

The recalculation has updated the Sliding price on the Article card.

Picture: Article card - 2nd Page - after Stock recalculation

If you want to set the price as a Planned stock price, use the Stock price recalculation function. We run the recalculation in status Browse in card Article for briefcase from the Action - Stock price recalculation module menu.

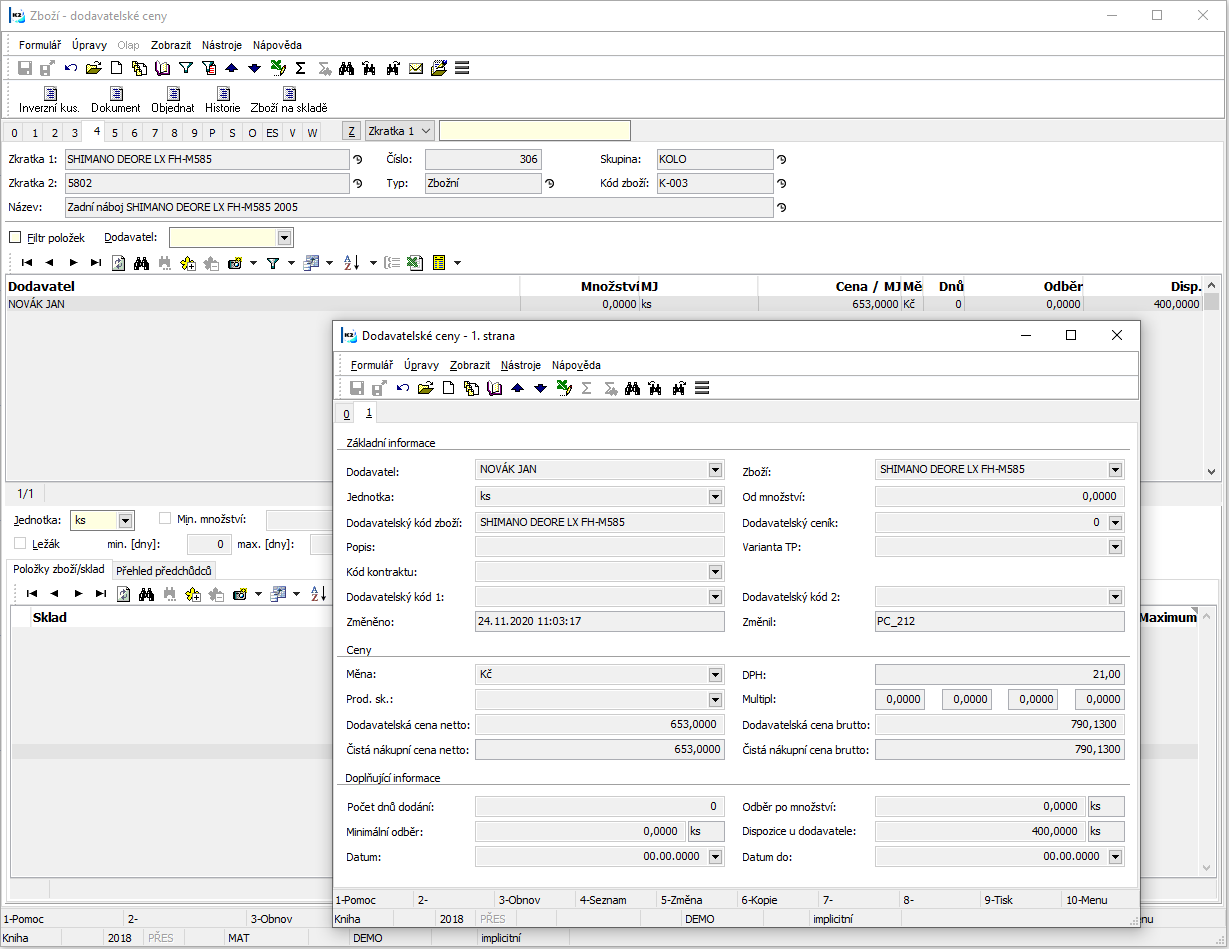

Supplier Prices

Supplier prices enable us to register fixed prices that were agreed on with concrete suppliers. These prices are then automatically filled in the Purchase Item when we select an article and a supplier corresponding to the set definition of supplier price. The using of supplier prices may be overridden by the user parameter Do Not Use Supplier Prices.

Defining of supplier Prices in IS K2 is used for the case when a business partner delivers goods by the system of fixed prices and its adjustments according to the product groups, multipliers and the codes of article. Supplier price is valid for the currency for which it is defined.

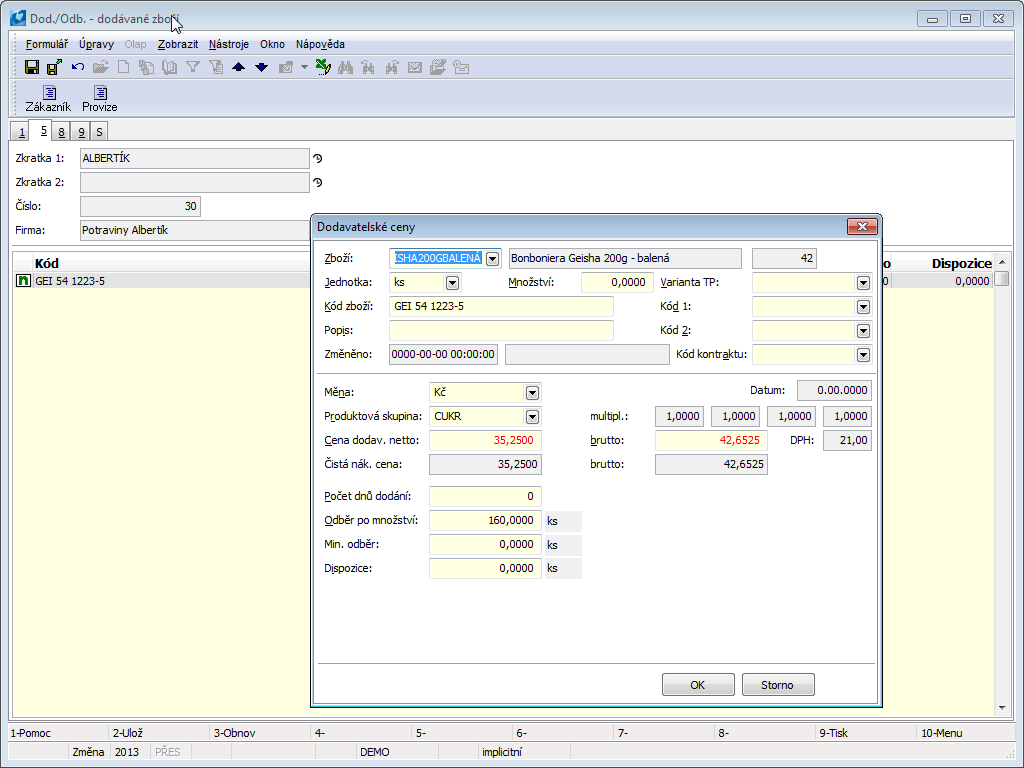

Supplier Prices are register on 4. Page of card Article or on 5. Page of Suppl./Cust. card (eventually, we define supplier date prices on the 8thpage of the Suppl./Cust. card).

If we add supplier prices on the 4th page of the Article tab, these prices will be displayed on the 5th Page of Suppl./Cust. card It is also true that if we define supplier prices on page 5 Page of the Suppl./ Cust. card, then these will be displayed on the 4th. page of an Article card.

Picture: Article card - 4thpage Page chapter).

This page of Suppl./Cust. card is accessible in the Changemode and in a New Record as well. By pressing the Ins key or the Insert button, we define new supplier prices to a card via the Supplier Prices form.

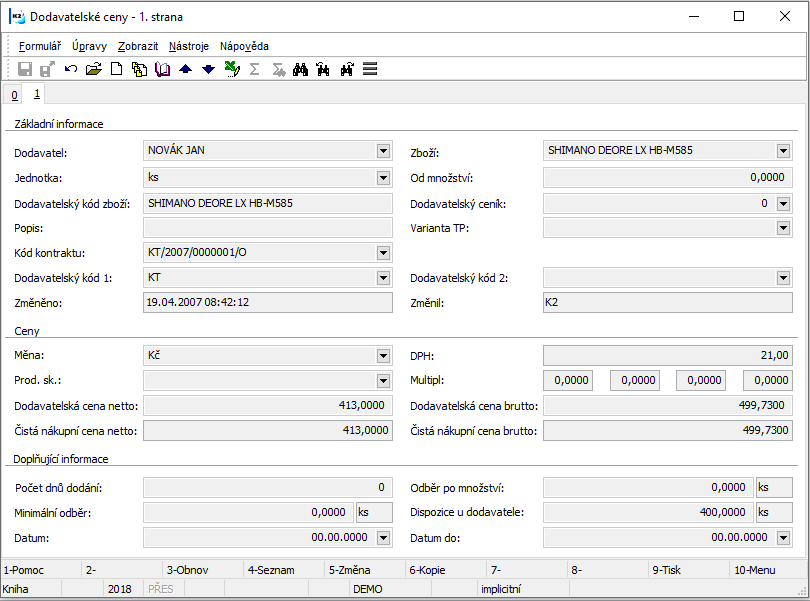

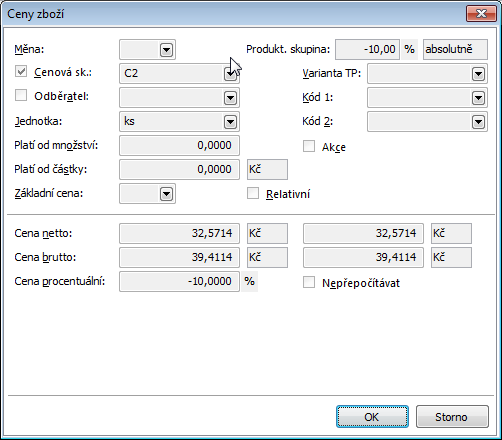

Picture: Form Supplier Prices - 4 page of an Article card

Descriptions of the individual fields of Supplier Prices form are stated in the User Guide of the K2 IS.

Complete the individual fields with the data from a supplier. A Supplier Product Group is always assigned to a given supplier. Select a product group from the table Supplier Product Groups. There you can define a new product group by pressing the F6 key (or Ins), or change (including multiplier values) whichever product group by the F5 key. We We have an option to set multiplier values and rounding within a Product Group, which will be applied to the calculation of net purchase price.

Multiplier is a figure that provides the option to take various variances of supplier prices into consideration (discounts,... - multiplier <1; transport, surcharges >1 etc.). You may assign 4 factors to each Product Group, which will further project into the net purchasing price of articles via multiplying all coefficients and the entered price. For instance, if we select one multiplier =0,5 and we do not enter the others, then after entering the price of 100 CZK the final net price will be equal to 100 x 0,5 = 50 CZK.

We can run the Overview of Supplier Prices report over the Article card/book. This report will show the overview of prices that have been defined for individual suppliers.

Example: We have a Purchase Order for a supplier for whom we have defined supplier prices. The currency of the Purchase Order is GBP, but the supplier prices are defined in EUR.

The supplier prices will not be completed into the Purchase Order, as the currency of the price is not identical with the currency of the document. In this case, the price defined in the Purchase Price field from the Article card (if set) will be completed into the Purchase Order. If we want the supplier prices to be completed also in the CZK currency, they must be defined in this currency.

Inserting supplier prices on the Supplier Card is similar; however, instead of choosing a supplier, we choose article to which the price is applied. Prices set in this way will then appear also on the Article card.

Picture: The Supplier Prices form from the Supplier card

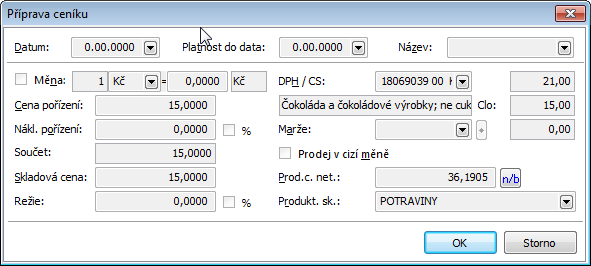

Selling Prices

Selling prices can be entered using Price Lists (they must be activated in the Configure Price Lists) or in the original way. The description of Price lists is stated in the chapter Sale / Basic data / Price lists. The following chapters deal with setting the selling prices in the original way.

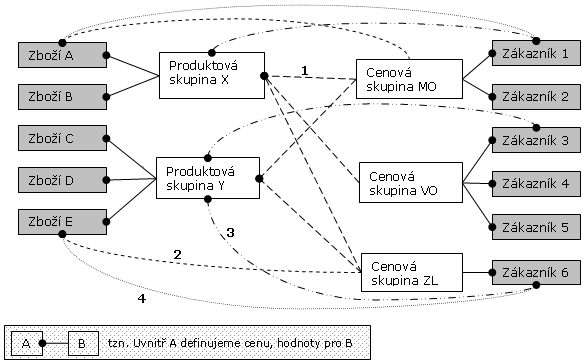

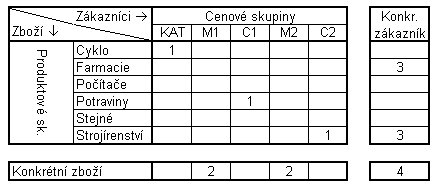

We have several means at selling prices that allow us to merge our customers into groups and correctly evaluate their sales orders according to their classification or contracts. Customer prices are the prices of certain groups of articles for specific customers (in the picture below the relation no. 3). Customer prices are determined by the direct relationship between the articles and the customer (relationship No. 4 in the picture).

Picture: Price Creation options

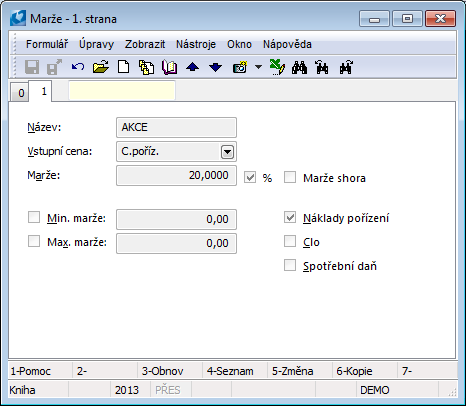

Among the important elements of a company's price policy of sale belongs margin, product groups and price groups. Following options offer various parameters and flags.

The selling price can be determined as the sum of the acquisition costs and the surcharge. The surcharge can be entered either in absolute terms or as a percentage of the acquisition cost. In addition to the term surcharge, the margin is further defined, which is given as the difference between the selling price and acquisition costs, or as the ratio between the selling price and the acquisition cost of the articles.

Note: IS K2 does not work with the term surcharge, but a bottom or top margin is used. Therefore, we will use the term margin in the next interpretation.

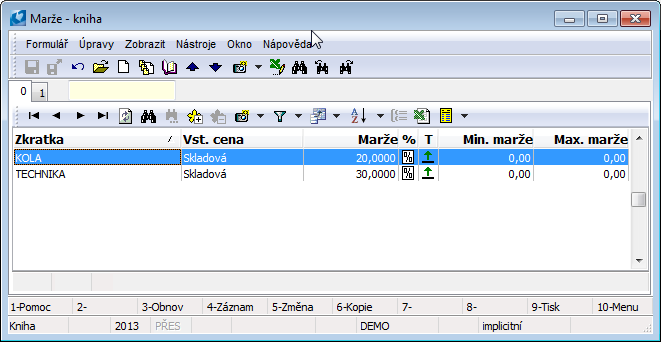

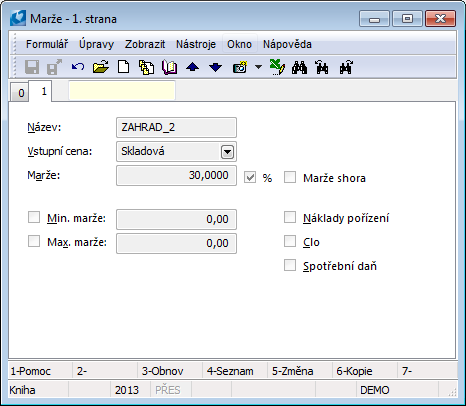

The margin can be entered either in absolute terms or as a percentage. Insert a new margin into the price list via the Ins key or the F6 key.

Picture: Form Margin - 1. Page chapter).

The description of the fields is stated in the User Guide of the K2 IS.

The initial price is the basic price from which the calculation of the selling price is based. The offer displays the purchase price, net purchase, supplier (from the optimal supplier), sliding, last, sales, stock or actual.

Note: All types of prices are displayed in the offer, but not all of them make sense as basic. E.g. the selling price cannot be based on the "selling price" value, so we will not use this option.

In the database of Suppl./Cust., customers are divided into different price levels according to the so-called price groups. This enables the members of different price groups to assign various discounts or surcharges.

Insert a new price group via the Ins key or the F6 key.

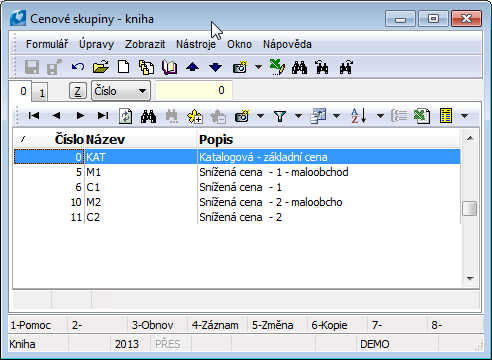

Picture: The Price Groups Code List

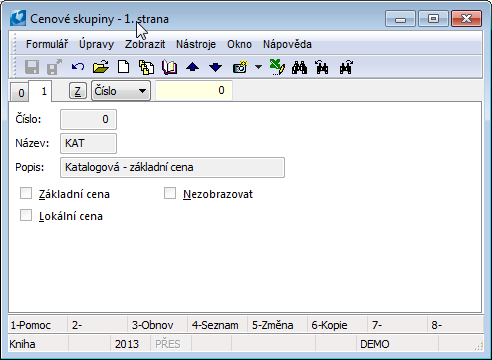

Picture: Price Groups - 1stpage Page chapter).

The description of the fields is stated in the User Guide of the K2 IS.

When entering the optimal number of a price group, we must consider whether these groups are sorted, and whether we work with their gradation or create them randomly. This affects the use of the Unsorted Price Groups Client parameter. This parameter affects the procedure for setting the selling price in case the price is not defined directly for the selected price group.

Example: We have the article 'Telephone' with a price defined only for the M1 and M2 groups (see the figure above: Price Groups Code List). We wish to sell the Telephone to a customer who has the C1 group. If we activate the Client parameter Unsorted Price Groups, basic price from the catalogue will be added automatically if the price for the C1 group is not found. If you turn off the parameter, the price with the closest lower number will be added, i.e. the M1 group price.

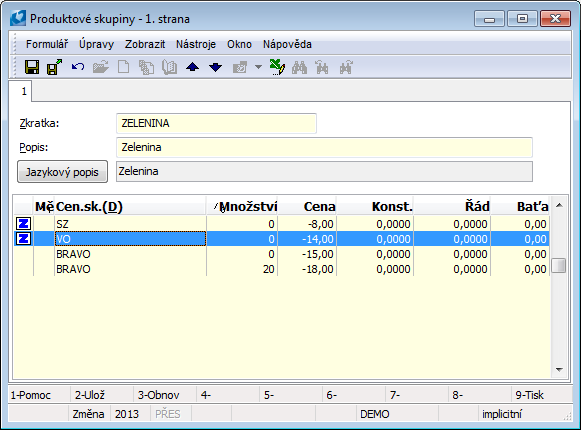

Product groups divide the Article database into groups and, from the viewpoint of pricing, we treat them identically.

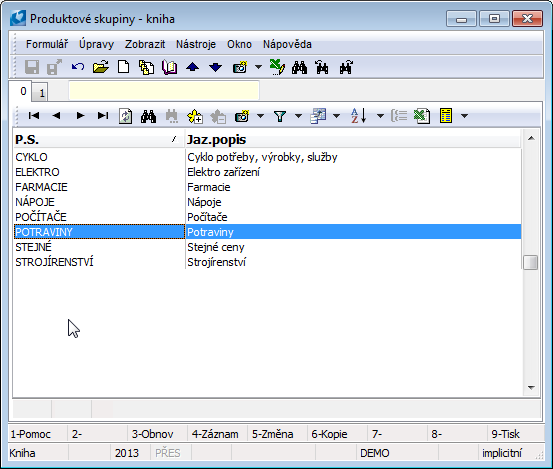

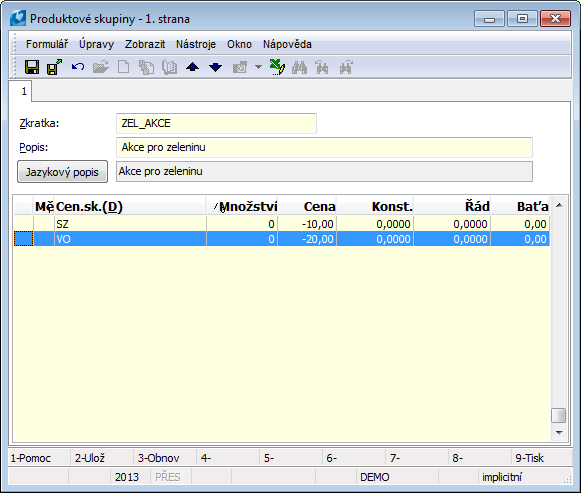

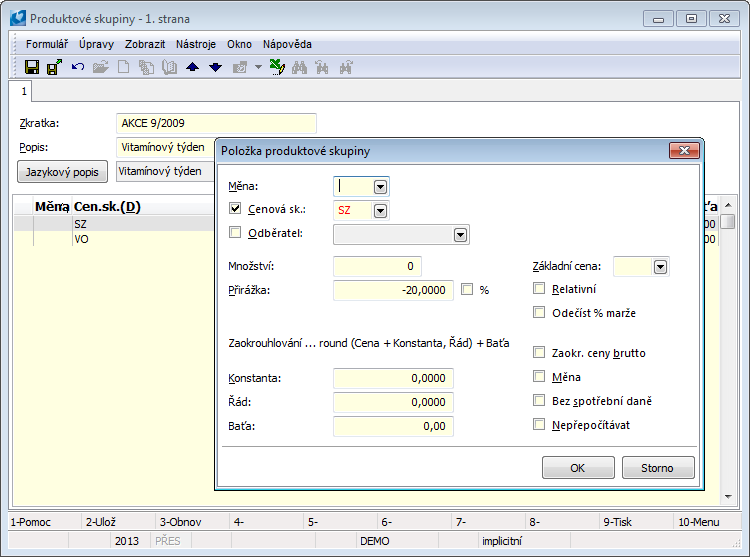

Picture: Product Groups Menu Table

Insert a product group to a menu table via the Ins key or the F6 key. You cannot delete a product group from the menu table.

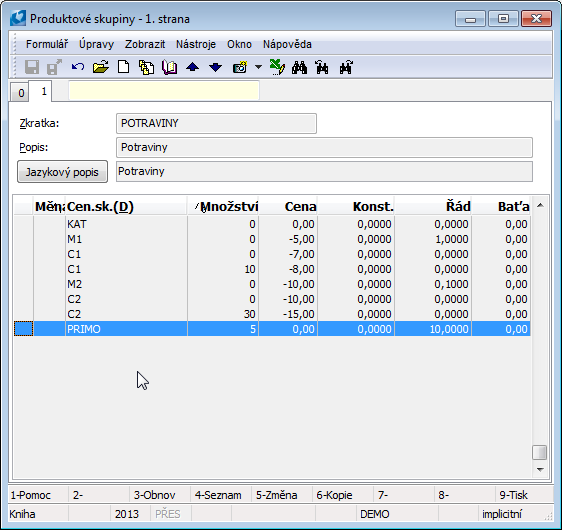

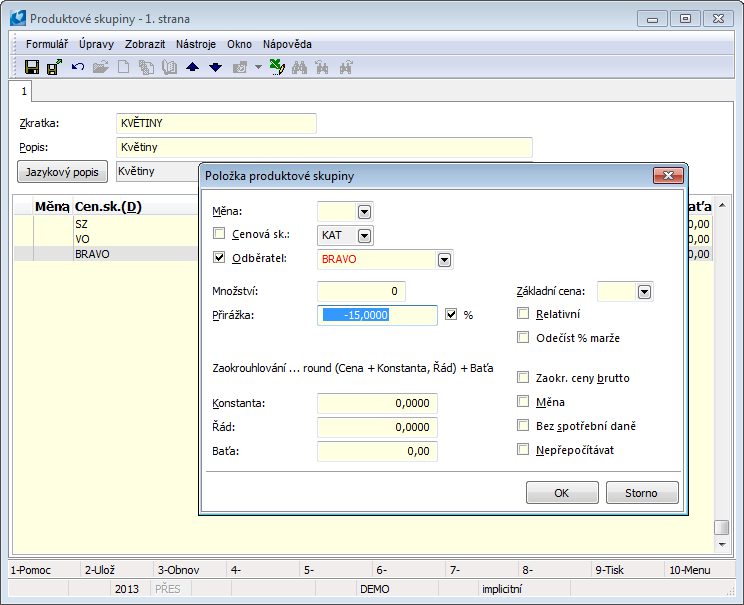

Picture: Product Groups - 1stpage Page chapter).

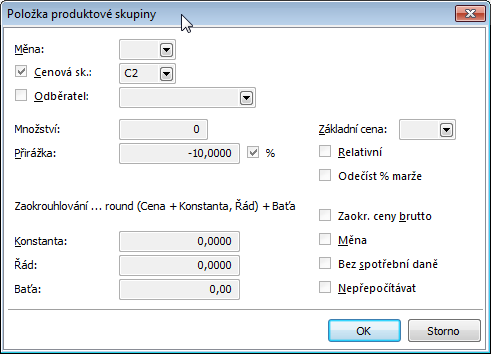

The items of the product group, which we enter on the 1st page with the Ins key, determine the discounts for price groups or specific customers.

Picture: The Product group item form

Descriptions of the individual fields of the Product Group Item form are stated in the User Guide of the K2IS. the User Guide of the K2 IS.

To delete a product group item, use the Del key in the Change mode.

In the case of Batch records, we may choose the option Selling Prices According to Batches on the 2nd page of the Article card. We can also select the flag Customer Prices in Product Group which will lower the number of records in selling prices on the Suppl./Cust. card, and the price will be numbered when it is used in accordance to a definition in the product group.

In the User Parameters, we may further set whether we wish to insert the price in the Sales Order according to the main customer or addressee (Customer Prices According to Addressee), whether the selected user even uses customer prices, or if it always should be derived from the basic selling price (Do Not Use Customer Prices). We may also override the display of stock and catalogue prices in Sale items (Display Catalogue (Price List) Price and Do Not Display Stock Prices in Sale). We can further choose whether we wish to copy the price group from the document header or a previous item into the items (Price Group on Item from Header). If we select a copy from the document header, we may specify whether we wish to keep the original price group in the item, or if we want to insert the resulting price group (Insert the Resulting Price Group). If we activate this parameter, it may occur that the Price Group field in the Sale Item will be empty - this is how the customer price or eventually the price written directly into the Sale Item manifests.

We may now take a closer look at the picture from the introduction of the chapter about Selling Prices - in the picture on Demonstration Data of K2: Link 1 defines the price of groups of Article (Product Groups) cards for the group of Customers (Price Groups). Link 2 values a specific Article card for the groups of Customers. Link 3, on the other hand, defines the price of the Article group for a specific Customer. The last relationship defines the price of one Article card for one specific Customer. There is one last option - writing the price directly into the Sale Item. However, with regard to the fully automatized process of price creating, this option is not essential.

Picture: Price Creating Options in Demonstration Data

Beside the Price Group field, there are icons displayed in the Sale Item. Both these elements facilitate orientation in the way in which the price has been defined. General description of these icons is provided in the User Guide to K2 IS. Here, we will list several particular examples.

Price group filled in, without icons |

The price is defined by a product group for a price group. |

|

The price is defined by a product group for a specific customer. |

Price group filled in, |

The customer has set a different price group than their own one from the Article card for the given product group. I.e. The price in the product group is defined as a basic price that is in fact a different price group; the price is not edited anymore. |

|

The price for a specific customer is written to a specific Article card. |

|

The price is written directly into a Sale Item. |

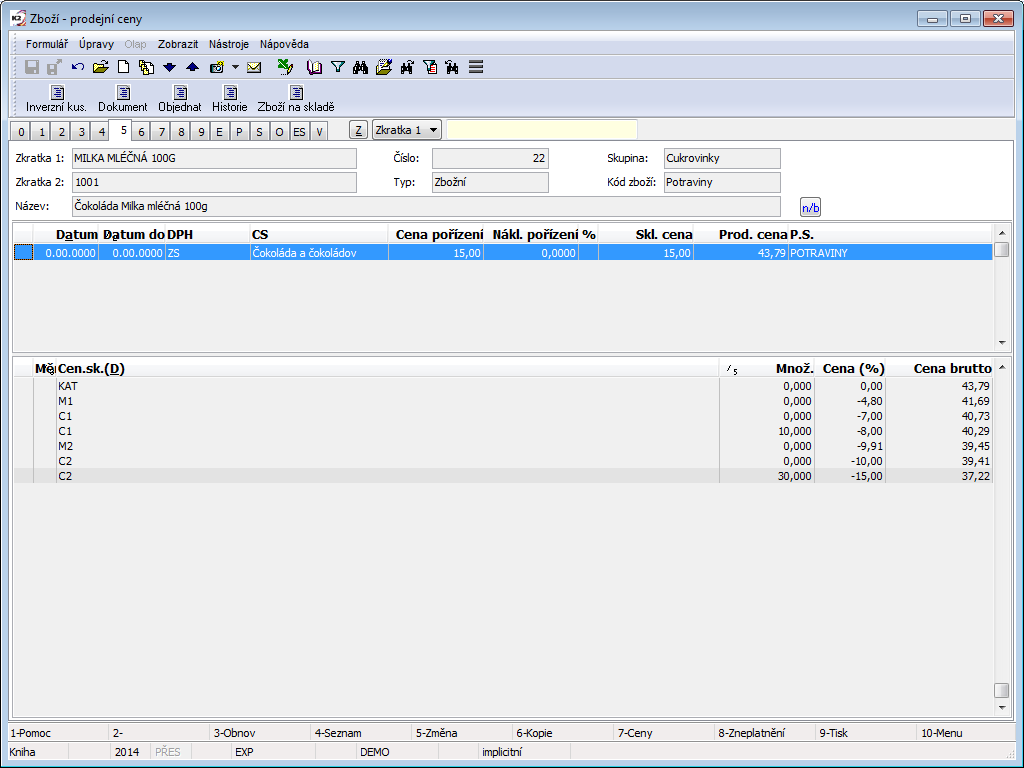

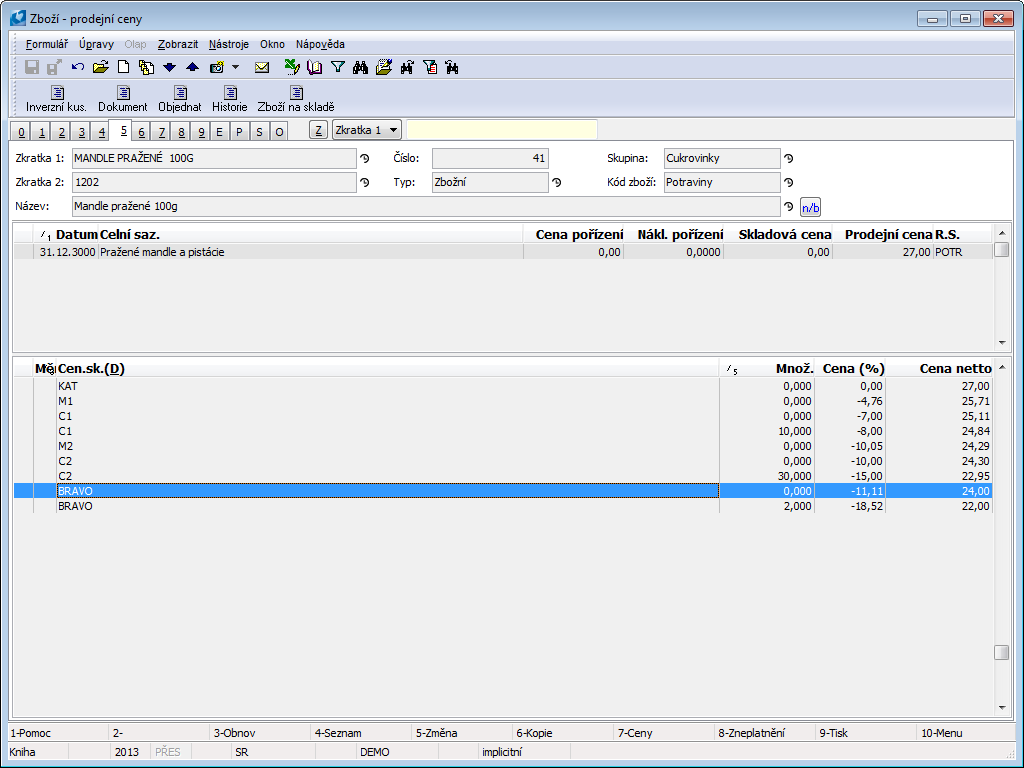

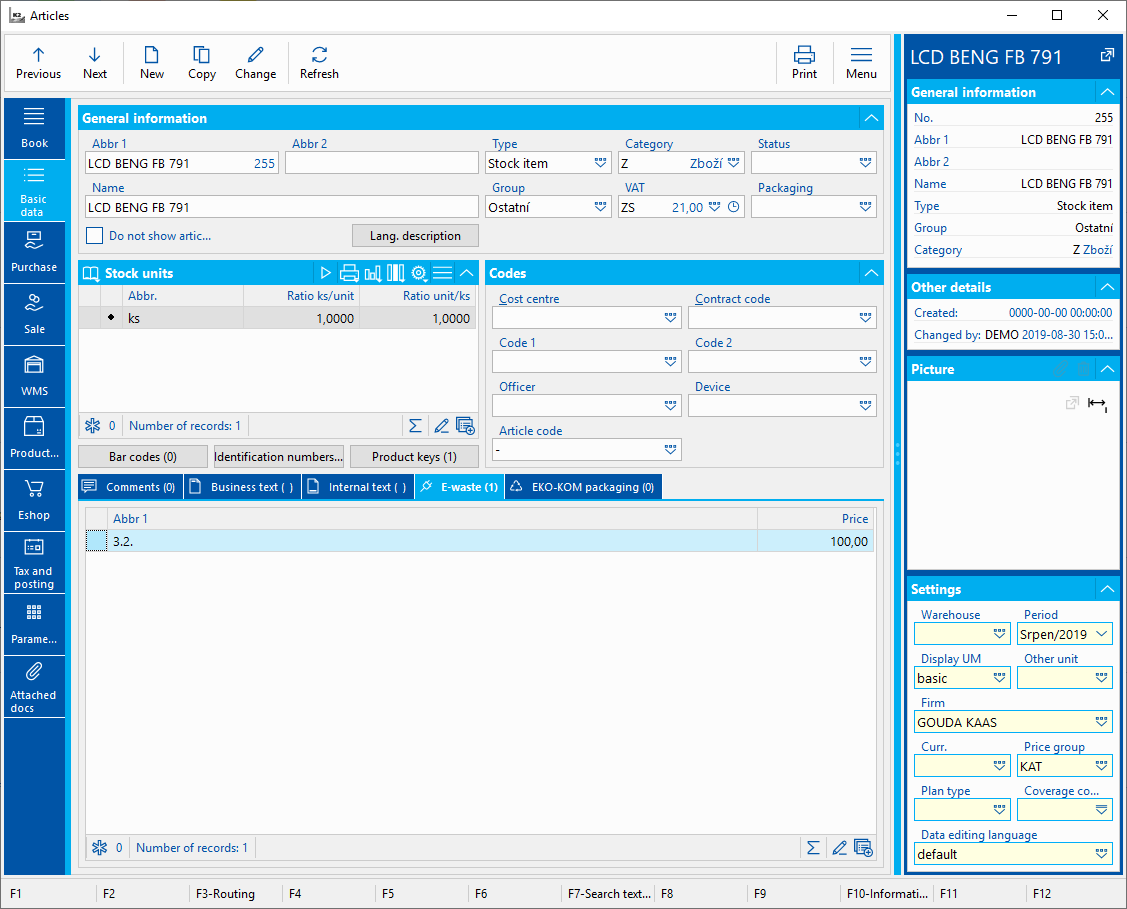

If the new price lists are not activated (for more details see Sale / Basic Data / Price Lists), then on the 5th page of the Articles card we define both permanent and date selling prices of the selected article.

At the upper part of the screen is the header of the selected article, in the middle you can define selling and date prices. At the bottom of the screen, there is a list of prices for each customer or price group corresponding to the selling or date price, on which the cursor in the central part of the screen is placed.

Picture: Article card - 5thpage Page chapter).

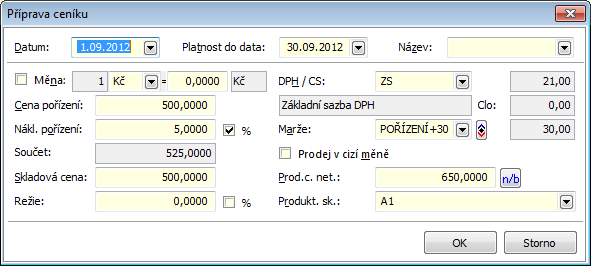

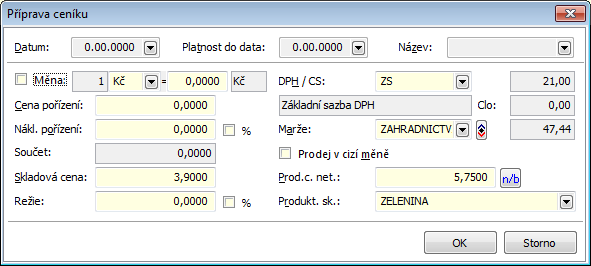

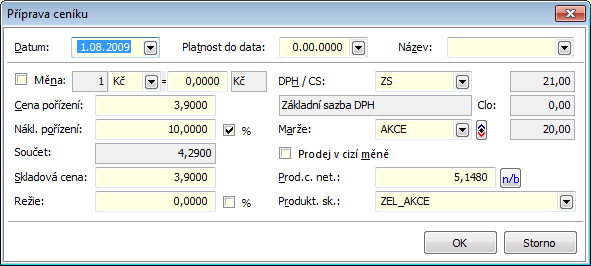

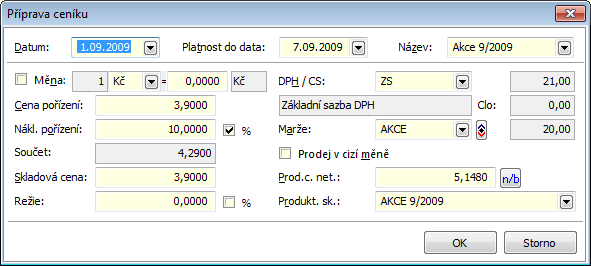

By pressing the Ins in the Change Mode in the middle part of the screen, we open the Price List Preparation form. In the 1st line the basic sales price is entered, in next lines the date prices.

We select respective margin (or eventually selling price) and a product group in the Price List Preparation form.

Picture: Form Price list preparation - 5 page of an Article card

Descriptions of the individual fields of the Price List Preparation form are stated in the the User Guide of the IS K2.

Upon leaving after a change in the field Margin, the user is asked whether the selling price stated on this form should be recalculated. The same goes with the query after leaving the Product Group field and finishing work with the form, where the user is asked whether they wish to recalculate price groups. In the bottom part of the 5th page of an Article card, the prices for price groups defined within the product group will be stated here after recalculation; that is, if the cross Customer Prices in Product Group is not ticked on the given Article card. In that case, the prices will not appear in the bottom part. The price will be enumerated when it is supposed to be used according to its definition in Sale. An advantage is the overview on the 7th page of the Supplier / Customer card, where the prices defined by a product group are stated in one part, while the customer prices defined directly by the Customer - Article relationship are stated in another.

The resulting selling prices derived from this form is also called Basic Selling Price. This selling price is then inserted in the moment of creating a new Sale item into this item as Catalogue Price. The user cannot influence its value or further recalculate it. If the Sale in Foreign Currency option is checked in the form and the currency of the document is identical, the Catalogue Price defined this way will be pasted into the document. If the currency of the selling price is different from the one on the document, the Catalogue Price will be transferred in the Client's currency and subsequently recalculated according to the exchange rate of the document.

In the bottom part of the 5th page of Article card there are displayed data that relate to price groups setting, alternatively to customer prices. You can set the prices in two ways:

- Fill the field Product Groups in previous form and by selecting recalculation of price groups, which will automatically write the prices,

- by pressing the Ins key, display the Article Prices form, where you can enter the appropriate data.

Picture: Form Article Prices - 5. page of an Article card

Descriptions of the individual fields of the Article Prices form are stated in the User Guide of the IS K2.

Selling prices may be browsed in several ways:

- 5th page of an Article card - the prices are defined there, so the listing is complete.

- table of Articles - function F7 - displays only general selling prices, i.e. date prices are not considered

- book of Articles - preview pane Article Prices - displays the price that would enter the document at the given moment, i.e. also date prices if they are valid at the moment.

- Report Article Price List - prints defined prices of selected Article cards.

- Report Article Price List for Customer - prints prices for a selected customer, who is eligible for the prices, including the way of how the price was defined (price type).

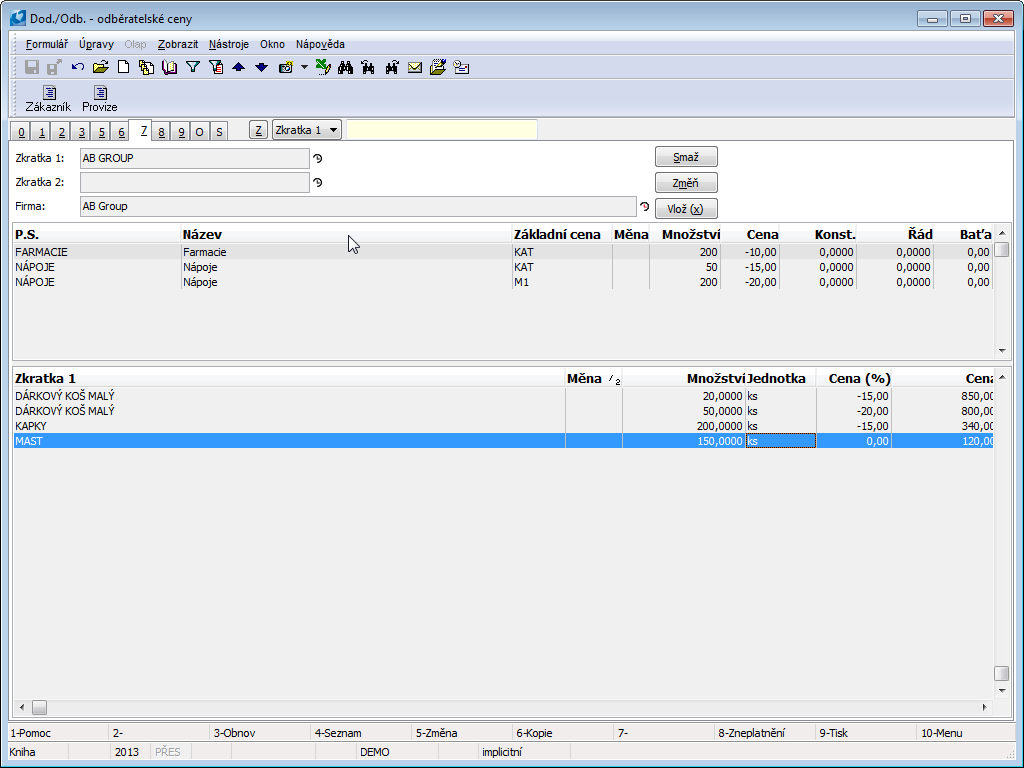

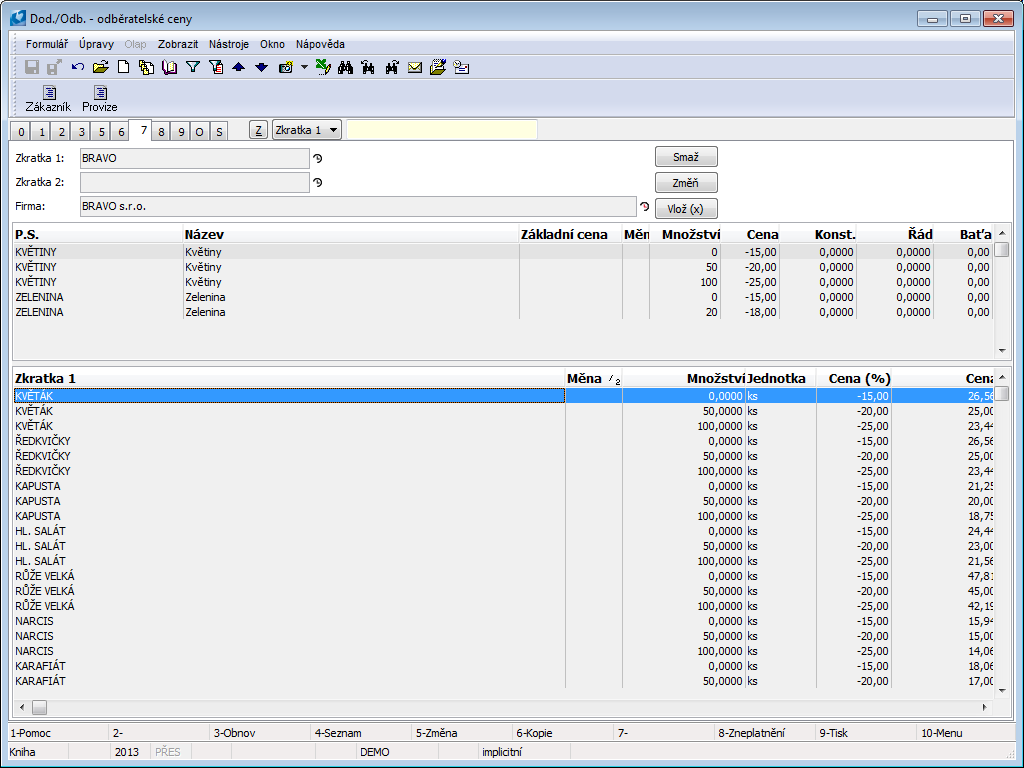

We understand Buyer Price as a selling price of group of Articles defined for a specific customer.

Customer Price is then the selling price of a specific article for a specific customer.

Buyer and customer prices we define on 5. Page of card Article or on 7. Page of Suppl./Cust. card

Picture: Buyer Prices - 7. The Suppl./Cust. card

On this page, we enter the records via the buttons Delete, Edit and Insert in the Browse mode. After pressing the button Insert or Edit, the form Product Group Item, or eventually Buyer Article Prices, is opened, according to the part in which we set the light indicator. In the upper table, we define buyer prices. We write in a new item of a product group. This method is an alternative to creating product group item from this group; the record is subsequently projected on both locations. Closer description and purpose is provided in the preceding chapter.

In the bottom part of the form, all prices defined for a specific customer are displayed, or only the customer prices (this depends on the features of the given Article Buyer Prices in Product Group).

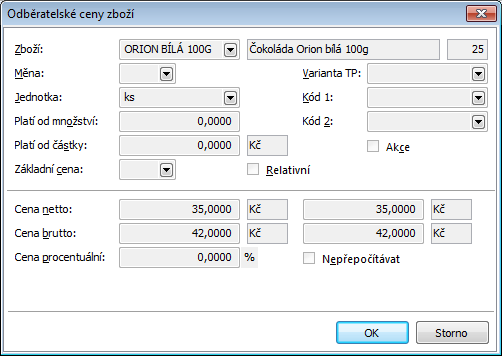

Picture: Customer Article Prices form

Descriptions of the individual fields of the Buyer Article Prices form are provided in the User Guide of the IS K2.

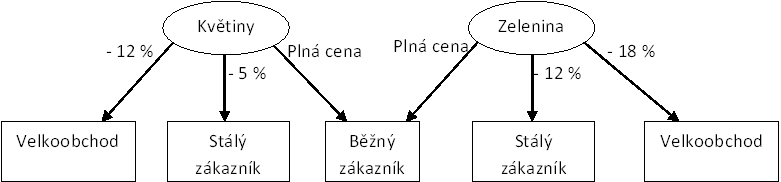

Example: A company produces and sales two kinds of articles: flowers and vegetables. These articles are sold to he retailers and wholesalers. Retailers and wholesalers can have defined various surcharge for various kind of articles.

Picture: Product and Price Groups

The basic selling price is based on the stock price to which a 25 % margin is added. Flowers and vegetables are sold to ordinary customers at this price. The firm sells to the permanent - registered customers flowers with 5 and vegetables with 12% discount. For wholesale, the price is 12 % lower for flowers and 18 % lower for vegetables.

Solution:

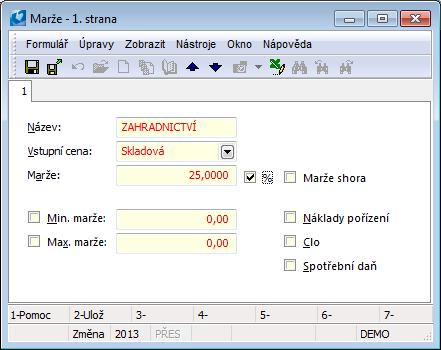

- First, create a new margin in the Margin code list. As an Input price, define a Stock price, type '25' into the margin field and check the %field.

Picture: 'Gardening' margin

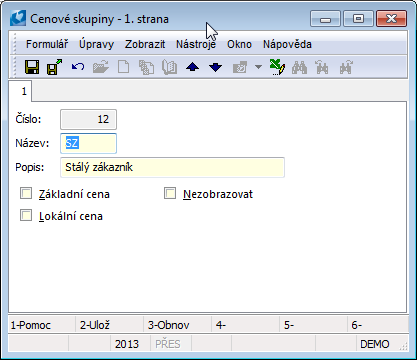

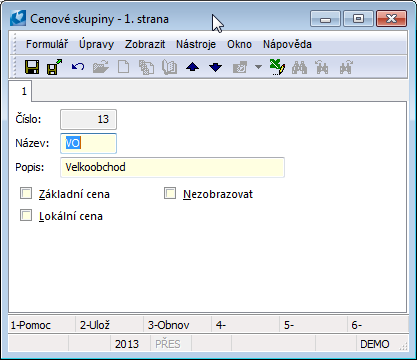

- Then define the price groups for wholesalers and the regular customers.

Picture: 'Regular Customer' price group

Picture: 'Wholesale' price group

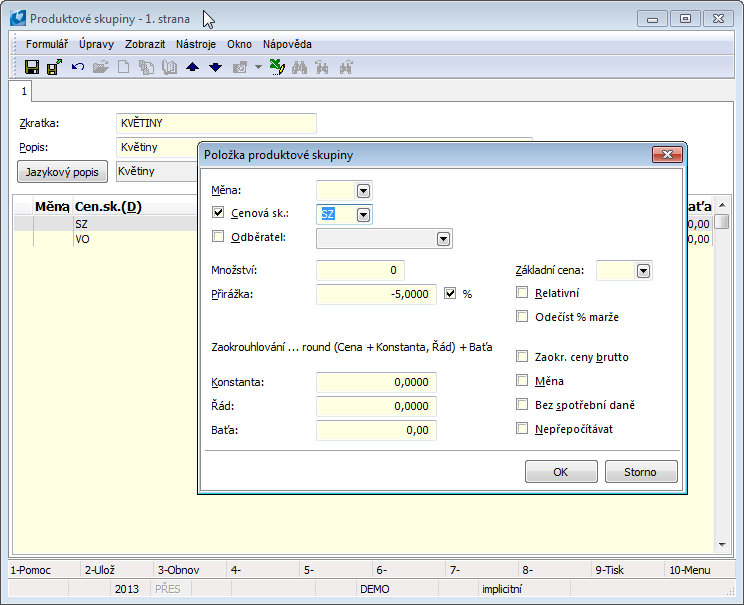

- Create product groups for flowers and vegetables.

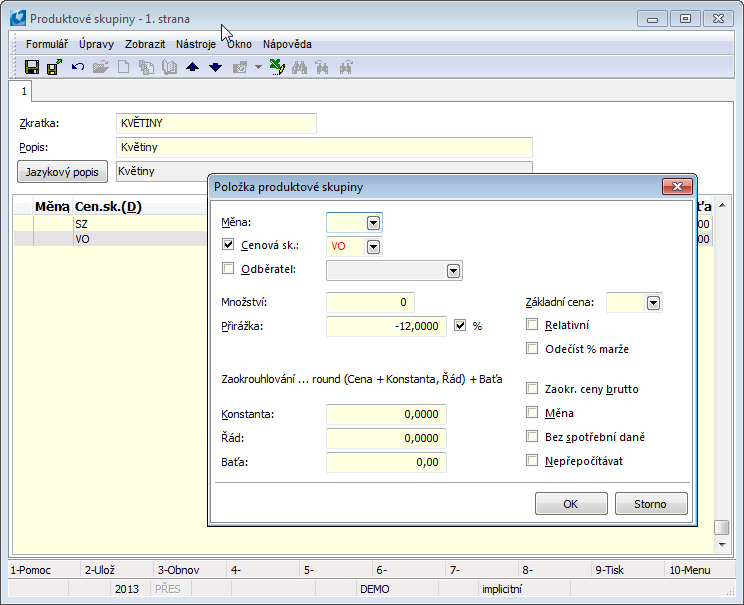

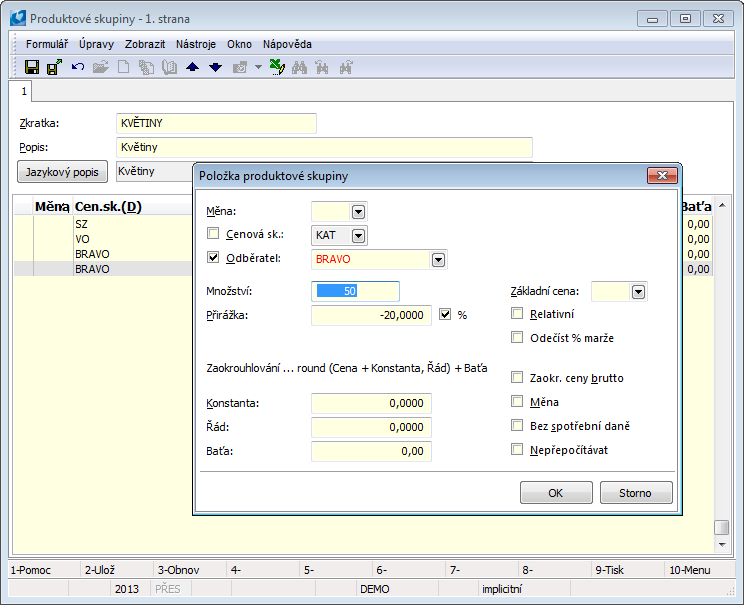

Picture: Form of "Flowers" product group item for "Regular Customers"

Picture: Form of "Flowers" product group item for "Wholesale"

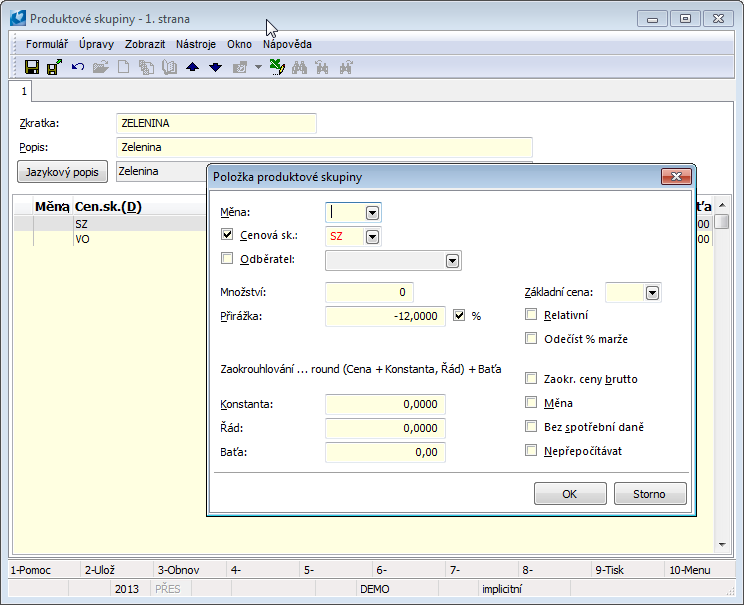

Picture: Form of "Vegetables" product group item for "Regular customers"

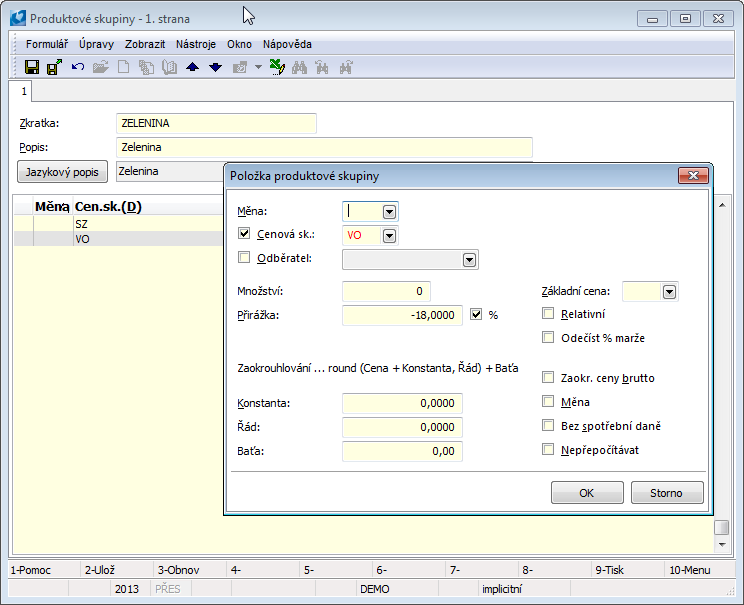

Picture: The Item of product group 'Vegetables' form for 'Wholesale'

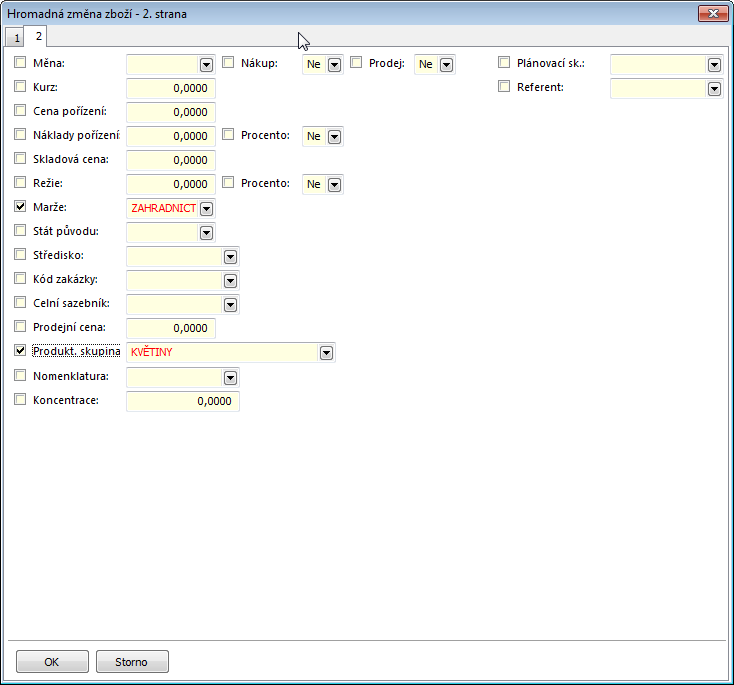

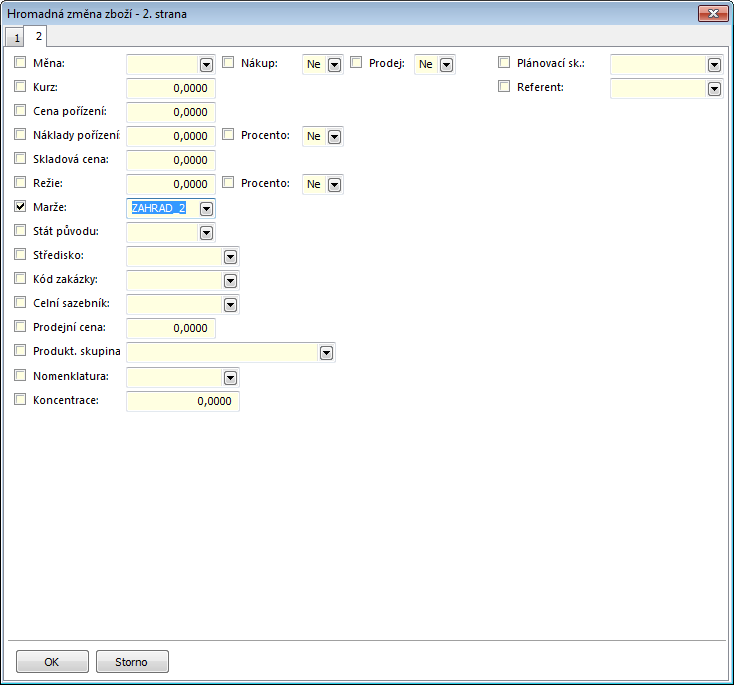

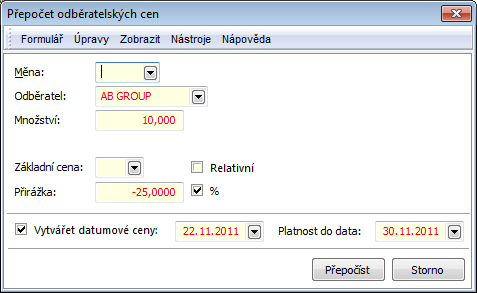

- Insert all cards that you want to price as Flowers into the Article filter and run the function from the Form - Bulk Actions - Change record module menu. Enter the 'Gardening' margin and the 'Flowers' product group on the 2ndpage of the Bulk change of Articles form.

Picture: The Bulk change of articles form - 2. Page chapter).

- In the same way, fill in margin and a product group into the Article cards for Vegetables.

- Then run the function from the Actions - Recalculate Article Prices module menu on the filter of the Articlecards for the groups Flowers and Vegetables.

Picture: The Recalculate Article Prices form

The function calculates a selling price according to a defined margin and a product group on the individual Article cards for both price groups.

This function is also used for a regular update of a selling price on an Article card.

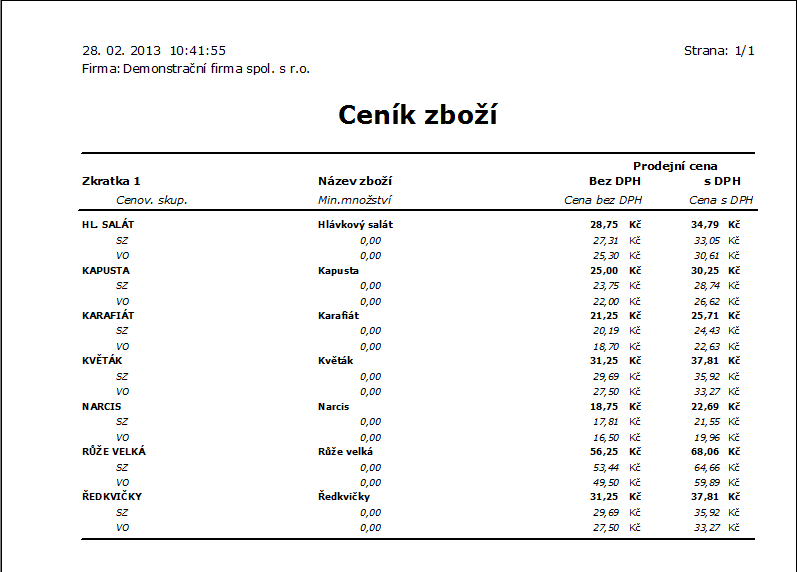

After defining the selling prices in IS K2, you can print the Article Price List. Above the filter of the Articles for flowers and vegetables cards, print the report Price list of article.

Picture: The Article Price List report

Selling prices that are defined on the 5th page of the Article card are displayed in the report. In other words, it is an input price adjusted for margin or a directly defined selling price.

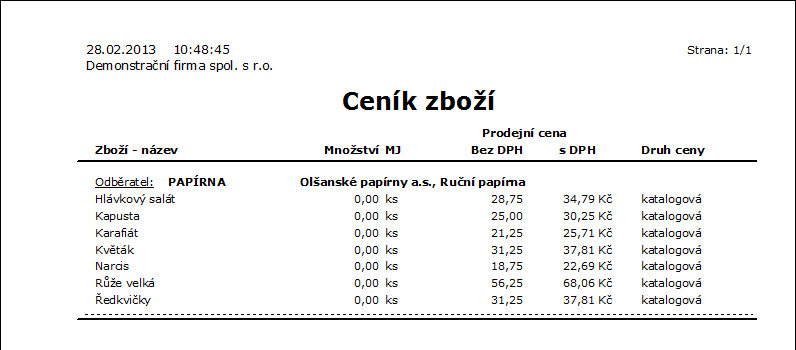

If you want to display also the prices that have been adjusted according to a defined surcharge (discount) for the selected price group or for the supplier in the price list, print the Price List for Customer report over the selected customer or over the filter of customers.

Picture: The Price List for Customer report

The selling prices for a specific customer are displayed in the report. Category of prices (e.g. Catalogue, Supplier - a price group is displayed) displays a way how the result price has been determined.

Date prices are not taken into account in the reports.

Example: A company and its greatest Buyer (i.e. Bravo company) have agreed on the following trade conditions:

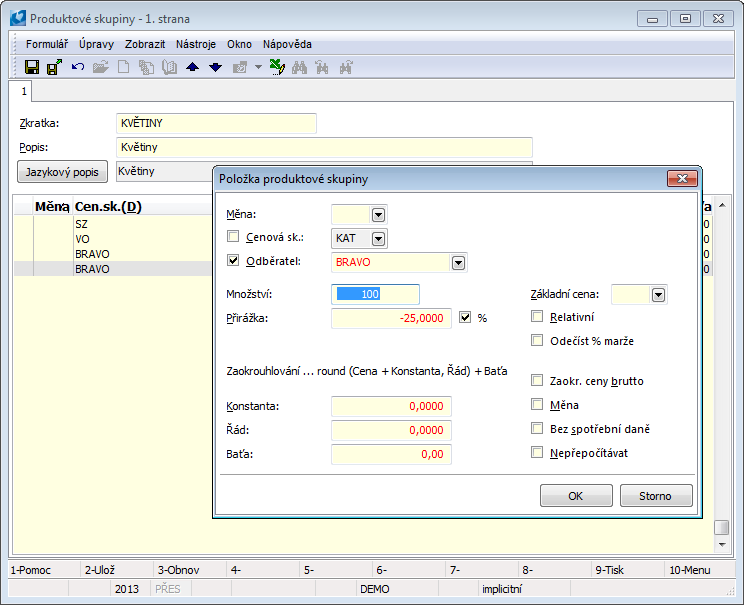

1. The Buyer is granted a 15% discount on flowers. . When purchasing more than 50 pc of the same article, the Buyer will achieve a 20 % discount; with purchase over 100 pc, a 25% discount will be provided to the Buyer .

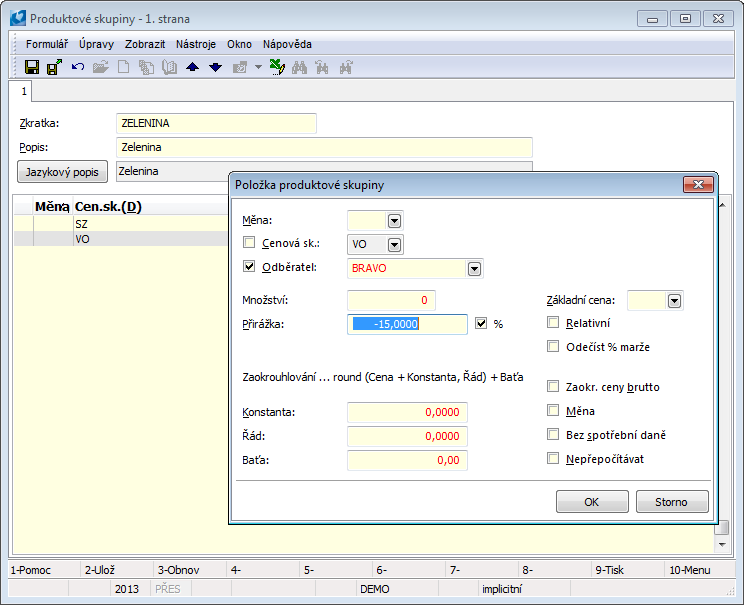

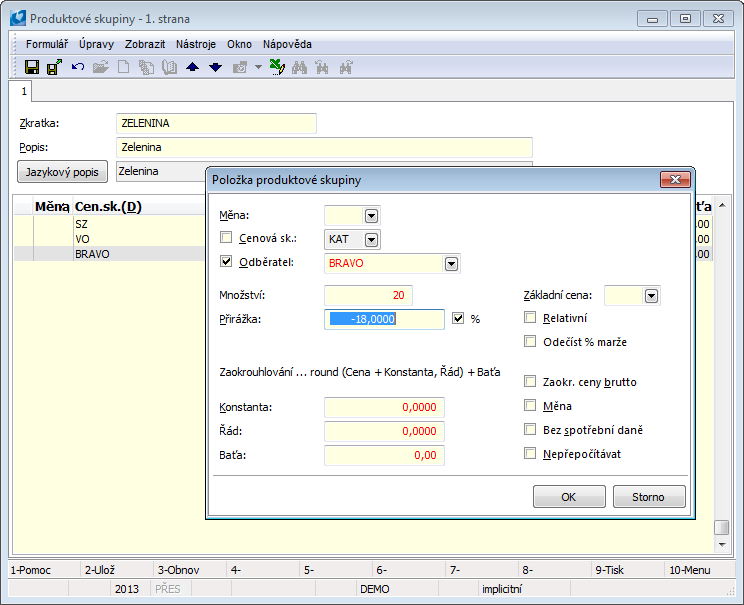

2. The Buyer is offered a 15% discount on vegetables . If the Buyer purchases more than 20 pc, he/she will get an 18% discount .

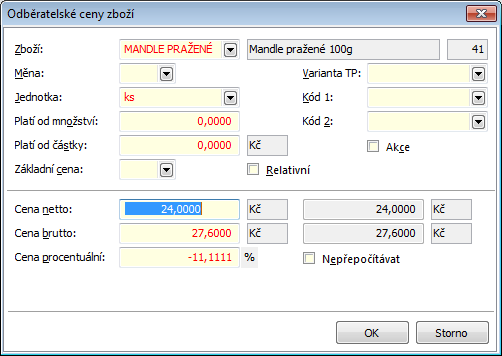

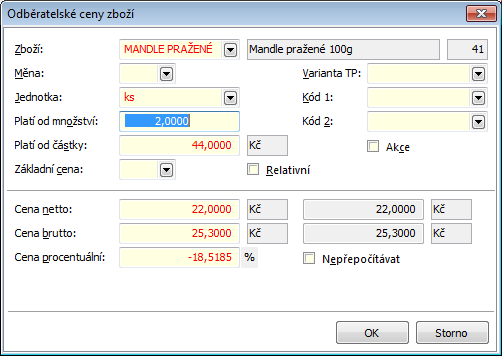

3. The 'Fried almonds' article is provided to the Buyer for the selling price of 24 CZK . When purchasing 2 pcs, the price for 1 pc will be 22 CZK.

Solution:

Point 1 and 2 are filled in by a buyer price. Point 3 means to define a customer price.

Customer Price:

In the previous examples, we defined selling price for flowers equal to a stock price + 25 % margin and the product group 'Flowers'. Now we add three more items with buyer prices to this product group for the Bravo company.

Picture: Product Group Itemfor buyer price for purchase up to 50 pc

Picture: Product Group Itemfor buyer price for purchase over 50 pc

Picture: Product Group Itemfor buyer price for purchase over 100 pc

We proceed similarly with Vegetables. We add two more items for buyer prices into the 'Vegetables' product group.

Picture: Product Group Itemfor buyer price for purchase up to 20 pc

Picture: Product Group Itemfor buyer price for purchase over 20 pc

We Recalculate Article Prices over the Article filter in which are the Article cards with the product group 'Flowers' or 'Vegetables'; there, we also Recalculate Buyer Prices.

Picture: The Recalculate Article Prices form

We can see the defined prices on the 7th Page of Suppl./Cust. card If the cross Buyer Prices in Product Group is checked on some of the Article cards, this article would not have its records in the bottom part of the form. During its sale, the definition directly from the product group would be applied.

Picture: The Suppl./Cust. card - 7. thpage - Buyer Prices

Customer Price:

What remains to do is to define a Buyer Price for 'Fried Almonds'. We enter it on the 7 Th page of the Suppl./Cust. card in the bottom part of the screen via the button Insert(x); we can do the same on the 5th page of an Article card in the bottom part of the form.

Picture: Buyer price for 'Fried Almonds' when purchasing up to 2 pc

Picture: Buyer price for 'Fried Almonds' when purchasing up to 2 And more pcs

Defined prices are completed on the 5th page of the Article card as well.

Picture: Article Card - 5th Page chapter).

Example: The company changes the pricing policy for vegetables. So far, the selling price has been calculated as stock price + 25% margin, the company sells vegetables to steady - registered customers with a 12% discount, for wholesale, the price is 18% lower.

Newly the firm wants to create a selling price with a margin of 30 % to the stock price. The company will then provide a discount of 14 % for wholesalers and 8% for steady customers .

Solution:

- Define a new margin in the Margin code list. Enter a stock price as an Initial cost, into the Margin field type the value 30 and check the field %. If we do not use the original margin for any other product groups and therefore do not want to keep the margin, it is not necessary to create a new margin, but we can only adjust it. In our case, however, a margin of 25% surcharge remains valid for flowers, so we can not modify it.

Picture: Margin 'STOCK+30%'

- Search for the 'Vegetable' product group inthe Product groups code list. Change percentages of surcharges for the price groups 'VO' and 'SZ' on the1st page.

Picture: The edited items of the 'Vegetable' Product group

- Save the 'Vegetable' product group.

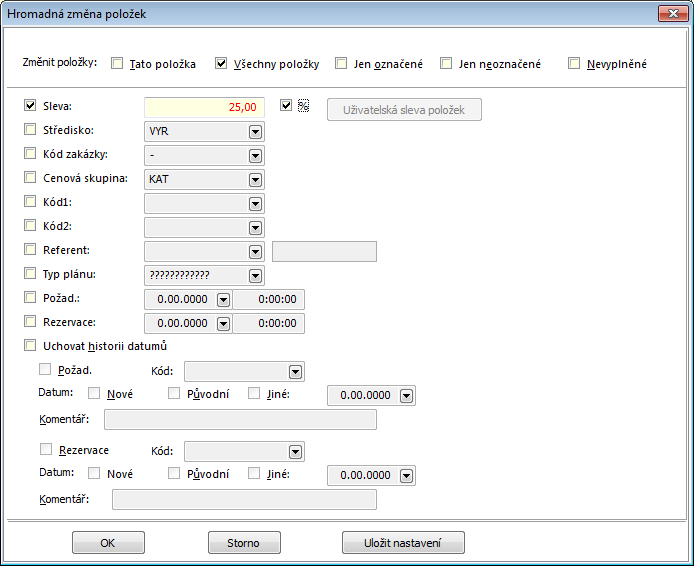

- Insert the article cards with the 'Vegetables' product group into the filter, mark the records with asterisks and run the function from the module menu Form - Bulk actions - Change record. Enter the just now created margin on the 2nd page of the Bulk change of articles form. By this way add a new margin into the appropriate Article cards.

Picture: The Bulk change of articles form

- On the same articles filter run the function from module menu Actions - Recalculate article prices to update a selling price saved on the Articles cards.

Picture: The Recalculate Article Prices form

Date Prices

The so-called Date Prices are another tool of price policy. Its are prices whose are valid at concrete date. Date prices are defined in the same way as sales prices on the 5th page of an Article card with difference that in the Price list preparation form we state the date from - until which the price is valid, ie the period of validity of the price.

Picture: Date Price in the Price List Preparation form - 5th page of an Article card

Outside this set interval, permanent prices are valid, i.e. basic selling price and prices derived from it, to which there is no date defined (i.e. it is in the format '0/0/0000' or eventually '31/12/3000').

In order for the date price to be automatically inserted into the items of the order and invoice out, it is necessary to have the Use online prices of article item field checked in the Client's Parameters.

We methodically recommend not to overlap the date prices. When evaluating a valid price, the price whose Date From is newest will be found, i.e. the price which started yesterday takes precedence over a price that started three days ago. The evaluation will decide whether the price is still valid (meets the Date To). If the price is not valid anymore, a general price will be used regardless of the fact that there could be another existing date price. At the same time, if there are more existing prices starting on the same day, the price that is valid and ends the earliest is used. If none of the date prices is valid, a price with no entered end date will be used.

Example: A company has defined current price for the article 'Radishes' (the date is in the format '0/0/0000'), which is derived from the set selling net price 5,75 CZK; the discount of 14 % is granted to wholesalers, 8 % discount is granted to regular customers (product group 'Vegetables').

Picture: The Price List Preparationfor basic price

In addition, a date price is defined for 'Radishes' that is valid from 1/8/2009. Its validity to date is not set. This date sale price is defined as the acquisition price including acquisition costs + 20 % margin ,wholesalers - the discount of 20 % and for steady customers 10 %. The Purchase price of the article is 3,90 CZK and it is necessary to add 10 % of purchase costs.

Thus, the 'Hot Deal' margin and 'Veg_deal' product group are activated.

Picture: Margin 'Hot Deal'

Picture: Product group 'Veg_deal'

Picture: The Price List Preparation form for a date price valid from 1/8/2009

A company has decided to organize a 'Vitamin Week' event at the start of the school year - Radishes will be reduced from 1/9/2009 to 7/9/2009 from their special offer to regular customers and wholesalers with a discount of 20 %. As the default price we use special offer, i.e. the 'Special Offer' margin.

Solution:

- We create a new product group 'Hot Deal 09/2009' as a copy of the 'Veg_deal' product group, in which we only edit the price for regular customers.

Picture: Product Group Item'Hot Deal 09/2009' for 'Regular Customers'

- On 5. page of the 'Radish' Article card, select the date price via the Ins key that is valid from 1/ 9 to 7/ 9/2009.

Picture: The Price List Preparation form for a date price valid from 1/ 9 to 7/ 9/2009

- After pressing the OK button, a query asking whether we wish to recalculate price groups will appear. Select Yes.

Define a hot deal for radishes. This date price will be valid from 1/ 9 to 7/ 9/2009 and temporarily cancels the validity of date price set from 1/8/2009.

Discounts

During Sale, we may also grant a one time discount for a specific Sale item, for selection or for every item of a given document. We may enter an absolute discount or a percentage discount. An absolute price is always entered as a unit one. This means that if we sell 5pc and enter a discount of 10 CZK, the result discount on the item will be 50 CZK.

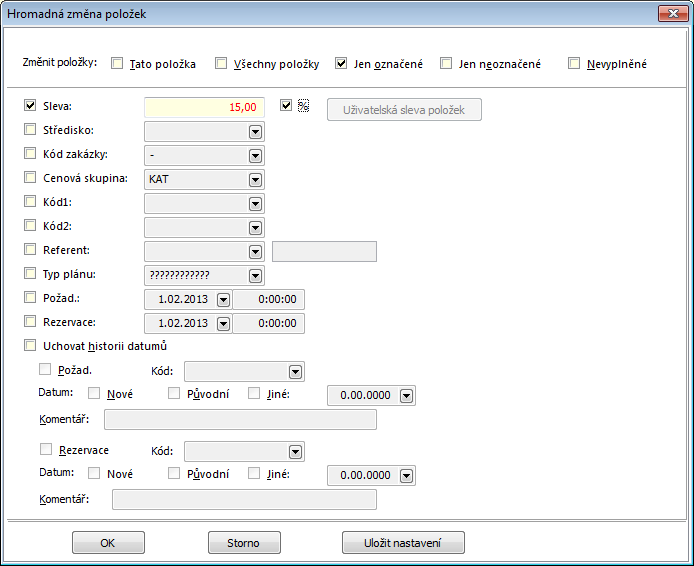

We can also enter a discount directly in the Sale Item in the Discount field and eventually by checking the % flag, or do so in bulk on more items via the Bulk Change of Items button, which is available in the Change Mode on the 2nd page of all Sale documents. After pressing this button, a form for bulk change of data in items will appear. Check the 'Discount' cross, write in the value of the discount and eventually check the '%' flag. Here we may also choose whether we wish to apply this change to the current, marked, unmarked, non-filled in items (i.e. without discounts), or to all items. Finish the change via the OK button. The discount will appear in the Discount field in the Sale Item and also in the S column with the flag ![]() or

or ![]() in case of surcharge.

in case of surcharge.

Data about the discount may be entered also in the field Change of Discounts of Items next to the Edit button; in this case, they will be pre-completed into the open form.

Picture: The Bulk Change of Items form - entering a discount

Closer description of the form and the discounts is provided in the User Guide to the K2 IS in the chapter 'Purchase/Sale Items'.

A discount defined this way may be highlighted (individually numbered) in printed documents at individual items.

Note: There is also a button called User Discount of Items in the form. This becomes active if a special script called UsrReduction.pas exists. This button enables to consider various specifications of the individual firms and users of K2.

The discount is applied on both Sales Order and Invoicing prices. The option of applying a discount is subject to the same rules as the manual edit of Sale prices in the Sale Item. If a Sales Order price is unavailable (e.g. due to confirming a subordinate document), the price will be applied only to the Invoice price and the flag F Price Only will be checked. In that case, the Sales Order price will differentiate from the Invoice price. A repeatedly entered discount does not load, it is overwritten. If we set a discount of 10 % and later decide to change it to 15 %, we enter the result value into the Discount field, i.e. '15'.

If we want to apply such discount for a customer regularly, we can set the discount rate on the 1st page of a Suppl./Cust. Card in the Discount field. In such case, the value from the Suppl./Cust. Card will appear in the documents in the Change mode. The user then decides whether or not to apply the discount. Only after applying the discount (i.e. via the Edit and following OK button) the change will manifest in the prices of documents.

The whole methodology can be used analogically also in Purchase to mark a received discount, if we wish to e.g. numerate it individually.

Example: A company has decided to grant a discount of 20 % on a Sales Order that is being processed (1000pc of big roses).

Solution:

No preparation is needed for granting a discount. We create a Sales Order with the item 'Big Rose', to which we wish to apply a discount of 20 %. We write in the discount into the Discount field.

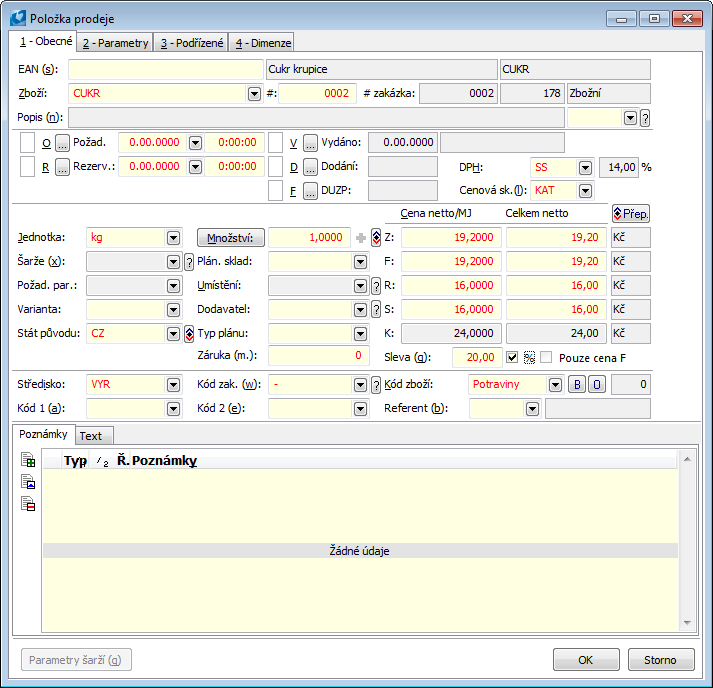

Picture: The Sale Item form for 'Big Rose'

Continuation: The customer has decided to expand the Sales Order - add also 500pc of Blue Roses. As the customer expanded the Sales Order, the company has decided to raise the discount on all items to 25 %.

Solution:

In the Sales Order, we create a 2nd item for the requested article. This time, we will not enter the discount directly in the item, but will use the option of bulk correcting the discount on all items.

Into the Change Discounts of Items field, we enter the value '25' and check the % field. Next, we click on the Edit button. A form with the entered data will appear. We leave the variant All Items checked and press the OK button. The discount of 25 % will be inserted into all items of the given document.

Picture: The Bulk Change of Articles form

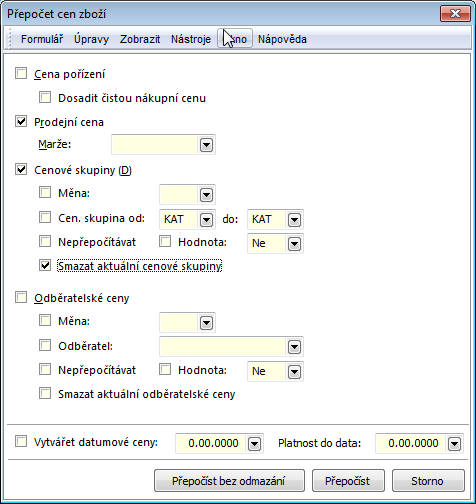

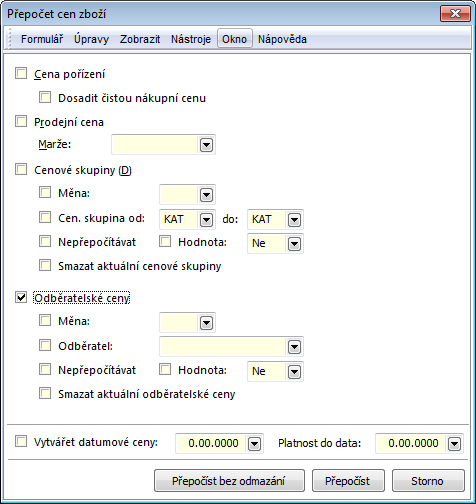

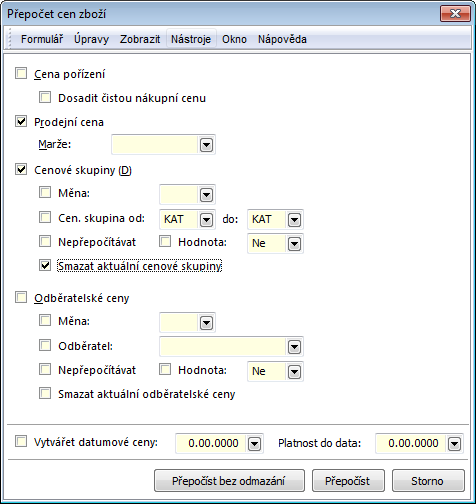

Recalculate Prices

Price recalculation enables the user to manipulate with prices in bulk. To run them, you will need the right Run Price Recalculation in Articles in Administrator - part General.

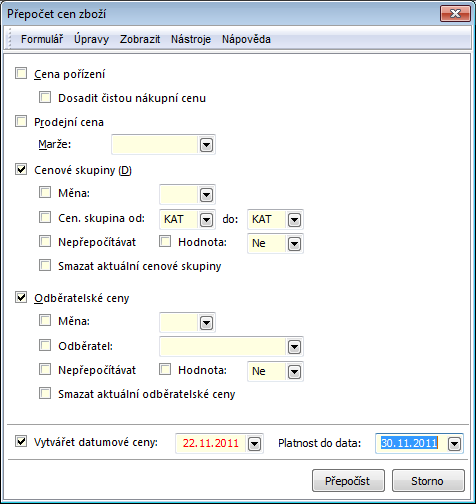

This offers an update of article prices, i.e. of purchase prices and basic selling price, as well as price groups and customer prices. It also allows you to create a date price based on the calculated values.

The function is run over one Article tab (i. e. over a page other than 0 .) or over the Article container from the menu of the Action - Recalculation of article prices module.

Picture: The Recalculate Article Prices form

Descriptions of the individual fields of the Recalculate Article Prices form are provided in the User Guide of the IS K2.

This function enables the user to recalculate customer prices of one specific customer for all the Article cards in a container. It is possible to change the method of the calculation of the customer prices by means of the recalculation (edit min. purch. quantity for this price - the Quantity field, the default price - the Base price field, percentage of a surcharge or discount - the Surcharge field).

The function is run over one Article tab (i. e. over a page other than 0 .) or over the Article container from menu of the module Action - Customer price recalculation and recalculates the prices of the selected customer according to the set parameters in the Customer price recalculation form. These changes are reflected in the bottom part of the page 5 of the Article card, no into the Product groups.

Picture: The Recalculate Customer Prices form

Descriptions of the individual fields of the Recalculate customer prices form are stated in the User Guide of the IS K2.

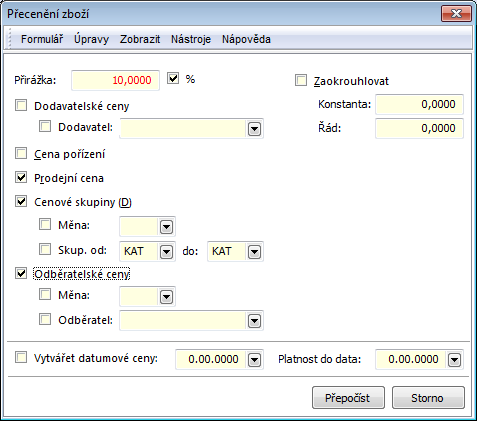

It executes the change of prices of articles selected into the container. This change (percentage surcharge) is offered for Supplier Prices (according to the selected supplier), Purchase Price, Selling Price, Price Groups (it is possible to define an interval of the price groups that should be corrected), as well as Customer Prices (again for the selected customer).

The function is run over one Article tab (i. e. over a page other than 0 .) or over the Article container from the menu of the Action - Repricing of article module. It is also possible to create date prices there. The prices can also be rounded according to a defined order and constant.

Picture: The Articles repricing form

If you run the recalculation by using the Recalculate button, the prices of the articles in container are recalculated and the articles will be removed from the container.

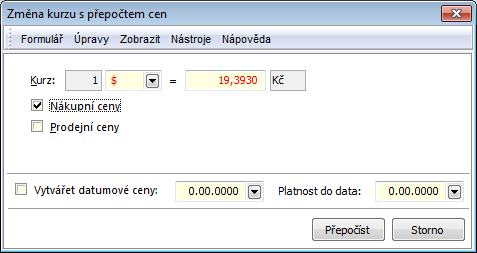

This function enables to change purchase and selling prices of each articles in container, prices of which are defined in the selected currency (article that uses the other currency for pricing, remains in the original prices).

The function is run over one Article tab (i. e. over a page other than 0 .) or over the Article container from module menu Actions - Change exch. rate and Recalculate Prices

Picture: Form Change Exch.Rate with Recalculate Prices

When the Purchase Prices or Sales Prices fields are checked, the function recalculates prices in the base currency according to the exchange rate entered in the form Change rate with price recalculation. If these fields are not checked, only prices in the selected foreign currency will be recalculated.

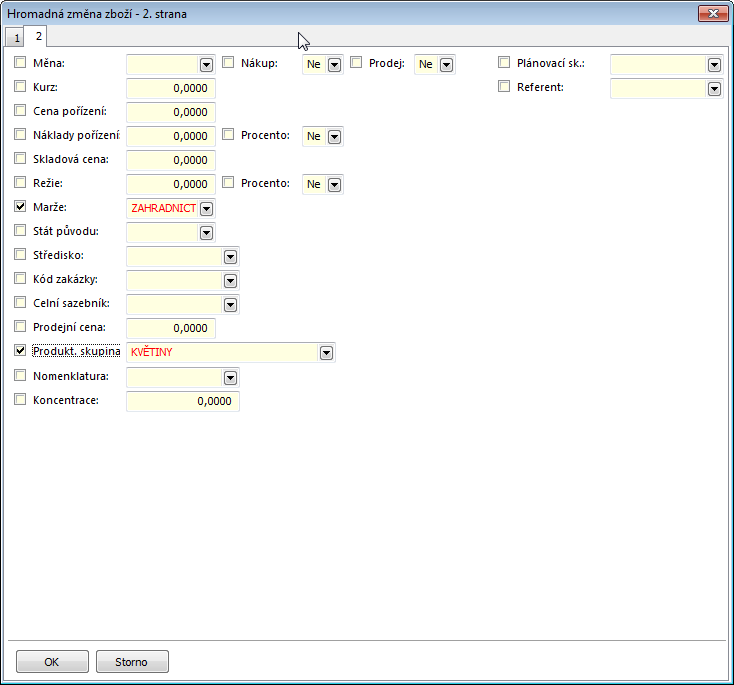

The function is run from the module menu Form - Bulk actions - Change record on the Articles container or on the records indicated by asterisks. It serves to the bulk changes on the selected articles.

The fields important for pricing are stated on the 2nd page of The Bulk change of articles form

Picture: Form Bulk change of articles- 2. Page chapter).

By checking the fields Currency and Exch. rate, prices according to the selected currency and exch. rate will be recalculated. You can choose whether the change relates to purchase or sales prices.

Note: Unlike the Change exch. rate with recalculate prices function, this function may also change a currency.

Further, it is possible to change all data, related with a price making, in bulk for the Article container, whereas a selling price will be edited after running the Recalculate article prices function.

To change current prices to date prices, or to change date prices to current prices, use the Recalculate Date Prices function that is activated from Module Menu - Actions - Recalculate Date Prices. This function may also be used to change the date of a date price (i.e. both borders of the action), or it is also possible to delete the date price set for a given interval.

Picture: Recalculate data prices form

Descriptions of the individual fields of the Recalculate Date Prices form are stated in the User Guide of the IS K2.

Overview of parameters and selected fields that relate to the price creation of the K2 IS

This chapter involves the useful flags and parameters that can influence behaviour of the K2 in the price creation. It is not the complete list and simultaneously you cannot find here an exact description. For detailed studying use this methodology or User Guide of the K2 IS - the Basic modules, Shared Purchase and Sale Elements and Administration - User parameters and Client parameters section.

Purchase

User parameters

- Enter last price in purchase - prices of last purchase will be loaded into the purchase price

- Do not use supplier prices - the supplier prices will not be loaded from 5th page of Suppl./Cust. card in purchase, but only Purchase prices from 2nd page of Article card will be loaded.

- Suppress stock price in Reserving cards: the stock price will not be displayed in the reserving card.

Client Parameters

- Stock price with secondary costs - it enables to involve secondary costs from an individual field into stock price of a purchased article.

Sale

Article Card

- Selling price acc. to batches - according to settings on a card, the identical flag will be filled on a batch.

- Customer prices in product group - it enables to count the selling price in the time of usage, it also enables to divide customer prices on the 7th page of the Suppl./Cust. card.

User parameters

- Show Catalogue (price list) Price - the K price is displayed in the Purchase item form. It is a value of a base Purchase price in the time of the creation of the item.

- Do Not Display Stock Prices in Sale - suppresses the field with the S (stock) and R (reserving) prices in the Purchase item form. It is used in shops where the customer can look at the screen - it is not desirable to get noticed the stock prices.

- Do Not Use Customer Prices - the selling prices form the 7th page of a Suppl./Cust. card will not be loaded in Sale, only the prices from price groups will be loaded.

- Customer Prices Acc. to Invoice Address - enables to use the prices that are defined for customer who is entered in an Invoice address. Attention - the Price group is not loaded, it is only dealt with customer prices.

- Price Group on Item from Heading - each new item will have a price group that is to be set on a value from heading of document.

- Insert the resulting price group. - if any other price group is used as a Basic price for calculation of selected price group, this final price group from which the price is really counted will be entered in the item.

Client Parameters

- Unsorted price groups of articles - differs which price group will be used as a replacement if the price is not defined for the specified price group.

Date Prices

Client Parameters

- Use data prices of articles on-line - it influences whether the date prices (purchase and selling) are considered as a preparation and they will be copied into the current prices at the right time or whether they are a part of definition and they should be automatically used if the current date corresponds with the term of validity of the date price.

EKOKOM - Records of packaging materials for the report on packaging production

Components of the Contract on Joint Performance between the Authorized Packaging Company EKO-KOM, a.s. and the company selling the packaging or packaged article (or the liable person) is a quarterly report on the production of packaging.

The filled statements are used to:

- calculate the remuneration for ensuring the joint fulfillment of the obligations of take-back and use by the authorized packaging company EKO‑KOM, a.s. This calculation is performed using the so-called remuneration structure, which sets the amount in CZK per unit of measure (1 ton). The remuneration structure is also part of the contract.

- In consolidated form for statistical purposes of the Ministry of the Environment of the Czech Republic (MoE). These data are sorted by material to demonstrate the required recovery and recycling rates.

The report consists of two parts:

- The first part of the report consists of tables:

- Report of Paid Packaging (1-1)

- Report of prepaid packaging (1-2)

- Report of unpaid packaging (1-3)

- Report on exported packaging (1-4)

- Second part of the report consists of tables:

- Reports on reusable packaging (2-1, 2-2, 2-3, 2-4)

- Report on discarded packaging (3-1)

- Statistical records (4-1)

Based on the procedures set out below in IS K2 it is possible to prepare documents for filling in the report on packaging production.

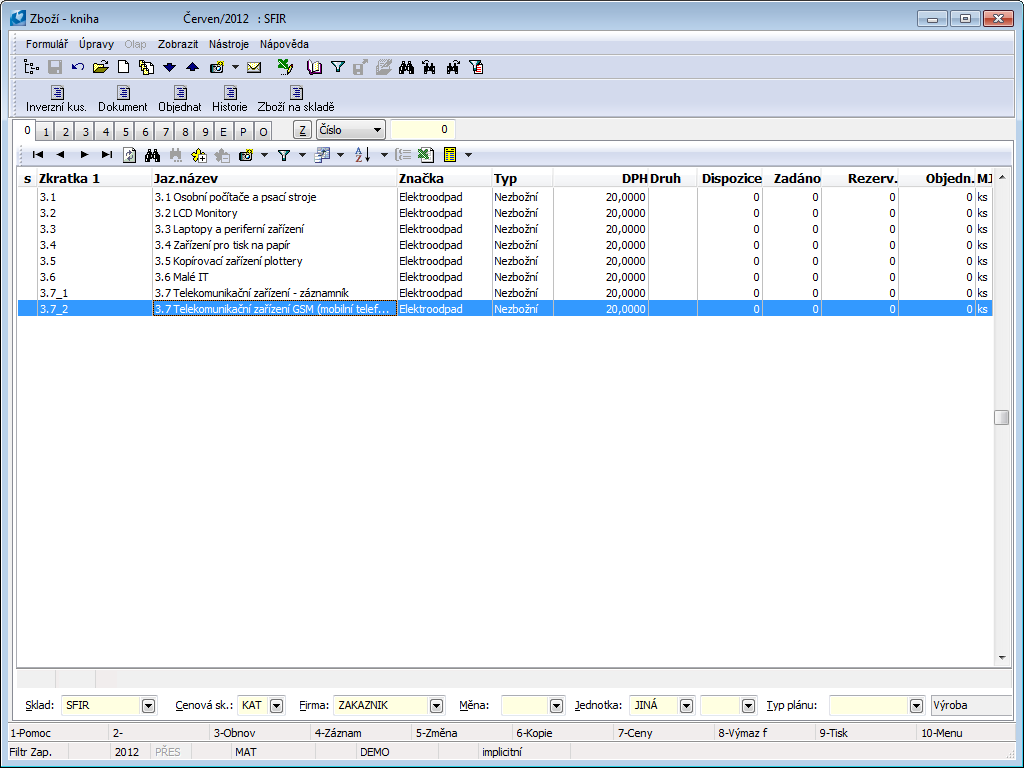

The principle of the tool used for the registration of packaging in IS K2 is a list of packaging (type, quantity) on the Article card, which is linked to the sale or purchase of these article. The function that processes invoices out (or release note) on the sales side or then received invoices (receipts) on the purchase side, then calculates the data for each type of packaging. The Ekokom - Export to Excel function (launched from the Scripts and Reports book) will then allow the export of the calculated data to the current Excel file, which is published by EKOKOM every quarter.

Financing of E-waste collection - recycling fees

According to the amendment to the Waste Act, producers have been obliged to ensure the take-back, treatment and disposal of old electrical appliances since 13 August 2005. The cost of this system is to be covered by the recycling surcharge, which will be listed separately on the receipt for the purchased product.

In IS K2, information on the amount of the fee is provided on the Article tab in the universal forms in the Basic Information on the Electrical Waste tab. Based on the entries in this tab and the registered function, an additional purchase/sale item with the enumerated recycling fee value will be automatically created for the item with an article requiring the recycling fee in the purchase documents (purchase orders) and the sales documents (sales orders).

Recycling fee registration works in IS K2 under the following conditions:

- The recycling fee per one product type is the same for each producer/seller, regardless of which company it is registered with (Rema, Retela, Elektrowin, Asekol, Ekolamp…).

- The surcharge is charged separately and so that it follows the item to which it belongs.

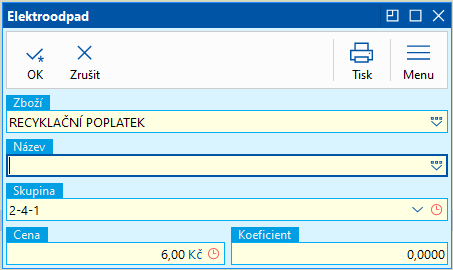

E-waste Tab

Information on the existence and amount of the recycling fee is stated in universal forms on the Article card in the Basic Data on the E-waste tab. It is therefore necessary to insert a record representing the waste on the E-waste tab on the article card (electrical appliances).

Picture: The E-waste tab on the Article card

Picture: The E-waste form

Field Description:

Abbr 1 |

The article card of non-stock items type, it has a 21% VAT rate, the E-waste brand and further in abbreviation it carries information about the group of electrical equipment that it represents. The following pictures show how these cards can look like. (It is not necessary to follow the proposed structure of the abbreviation, as well the cards could be named EO_3.1, EO_3.2, EO_3.3, ...). This field is obligatory. |

Additional name |

If we select only one card for the group (in the example, these are cards 3.1 to 3.6), then it is possible to specify the item on the invoice by means of an additional name. (Or you can choose the way, as cards 3.7_1 and 3.7_2, when the card carries detailed information about what type of electrical appliance it belongs to, and the additional name is then unnecessary.) It is also possible to choose the path of a single article card (non-stock items type) and then insert it into the document items. However, this can cause reporting problems, when it is necessary to report the sum of the groups specified in Annex No. 7 of the Act. |

Price |

Recycling fee in CZK, price excl. VAT. If the price is not specified, then the script inserts in the sale the selling price of the article card listed in the Abbreviation 1 field. In the Purchase, the price entered in the Purchase price field of the article listed in the Abbreviation 1 field. |

Coefficient |

Multiplier of a fee (e.g. for a luminaire that has 3 bulbs). If it is blank (0 is displayed), it does not enter into the calculation. |

Picture: Demonstration of cards for recording recycling fees

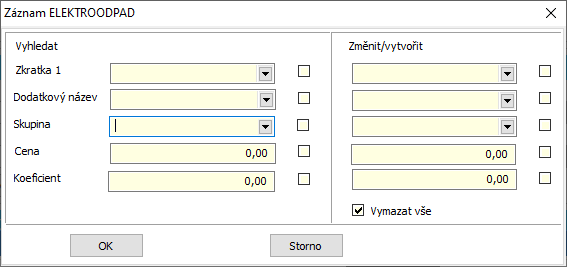

Bulk Adding/Editing of the E-waste Records

To facilitate insertion of E-waste record onto the Article cards, the Bulk Adding/Editing of the E-waste script was created (the technical details are stated below).

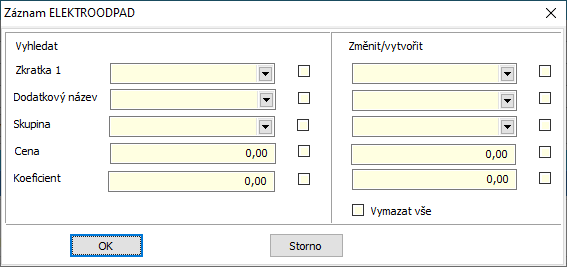

Picture: The form for bulk inserting, changing or deleting an E-waste record

1. Bulk creation of records:

In the Article container, fill in the right part of the form. Define the field values and activate it by ticking the field.

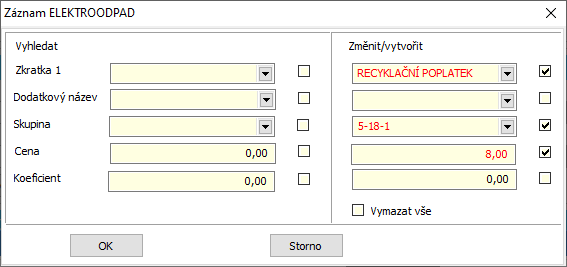

Picture: Using the script for a bulk insertion of E-waste records

2. Bulk change:

Fill in and activate a selection criterion in the left part of the form, then activate the fields that should be changed by the entered value in the right part. If you run the script in the Article book (in the 'Book' mode), then all the Article cards that contain an E-waste record complying the left part of the form,will be inserted into a container and they will be changed according to the definition in the right part of the form. If the script runs on the container of articles, then only those records from the filter which correspond to the left side of the form will be changed. Values are changed according to the right part of the form.

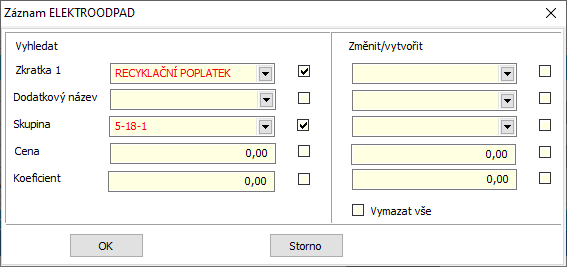

Picture: Using the script for a bulk change of E-waste records

3. Search and filter:

If you run the script in the Articles book in the 'Book' mode and you use only the left part of the form, then all the article cards, that contain the E-waste record complying the left part of the form, will be inserted into container.

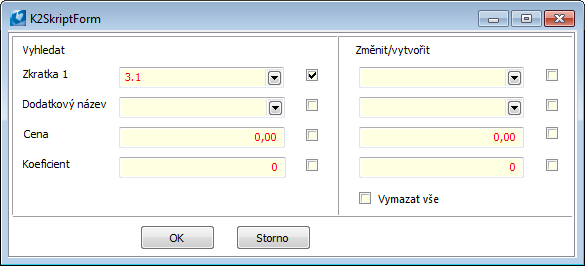

Picture: Using a script to search for E-waste records

4. Delete all E-waste records:

The Delete All field works only in the Container mode. It removes all the E-waste records from the articles cards in container.

Picture: Using a script to delete E-waste records

Adding a fee to a sales order

Adding the fees to sales orders is ensured by a registered function that runs the script Adding fee to sales order - E-waste. The script can be run separately without registered function. The technical details are stated below.

Registered Functions in the sales order book adds an additional sales item (or items, if there are multiple entries) to all new sales items, article cards of which have record in E-waste. The article, specified in the E-waste record, with price and name will be added. The price shall be multiplied by the coefficient and the quantity sold, taking into account also sales in alternative units. However, the charge is given for the quantity in the base unit. If the price in the E-waste record is zero, the selling price from the E-waste card is taken.

If the item of the type Stock item is on an UNCONFIRMED invoice, then the created fee will be inserted on the same invoice.

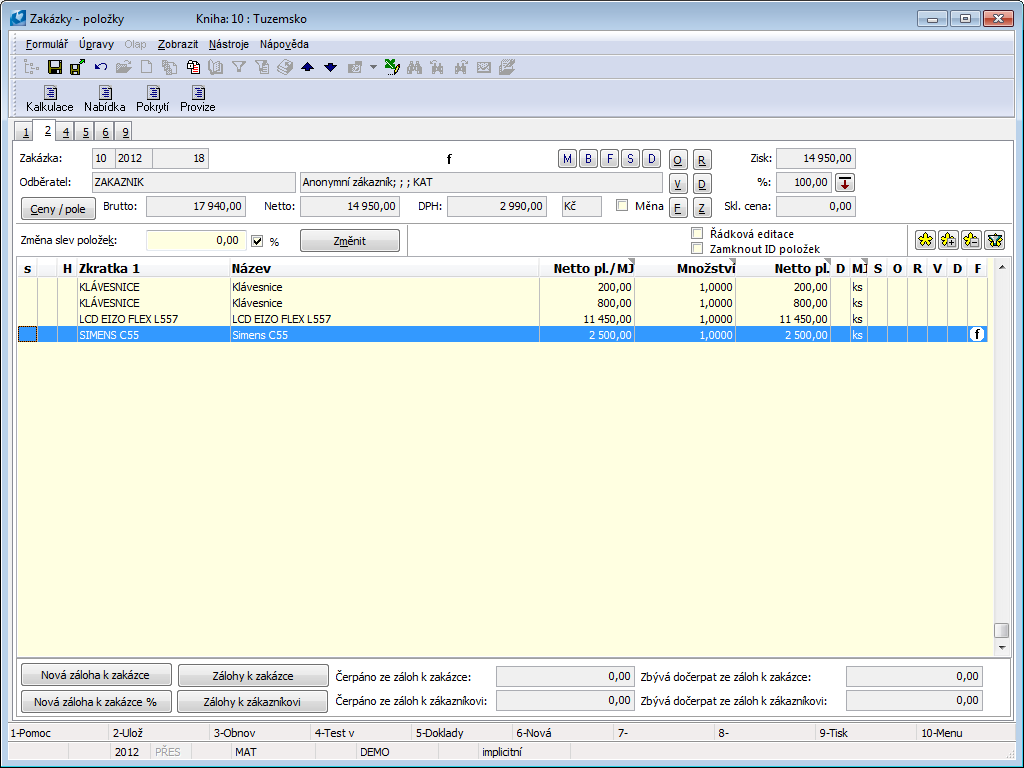

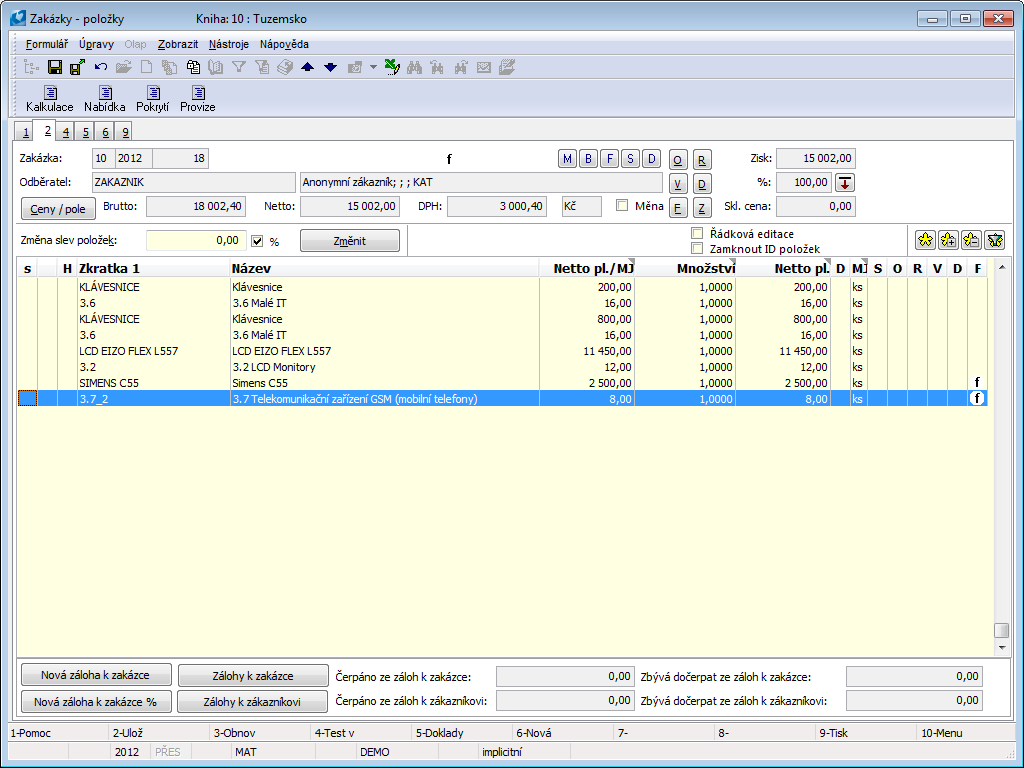

Example:

- First create the sales order in the standard way.

Picture: The Sales order created in the standard way

- Once saved, the registered function will ensure the creation of appropriate fees on the sales order.

Picture: A Sales Order after saving

The Sales Order items:

- Water - the article card has no record in E-waste, therefore it has no fee

- Keyboard - 1 pc - 16 CZK fee

- Keyboard - 1 pc - 16 CZK Fee because the package includes 4 pieces

- The Siemens C55 was on an unconfirmed invoice, so the fee was also inserted on the same invoice

If the fee is deleted after saving the order, the registered function will not complete it (E-waste is added to new items only). If you change the sold quantity, the amount of fees does not change. This change must be handled by the user. After inserting fees on sales order, these fees are not checked any more.

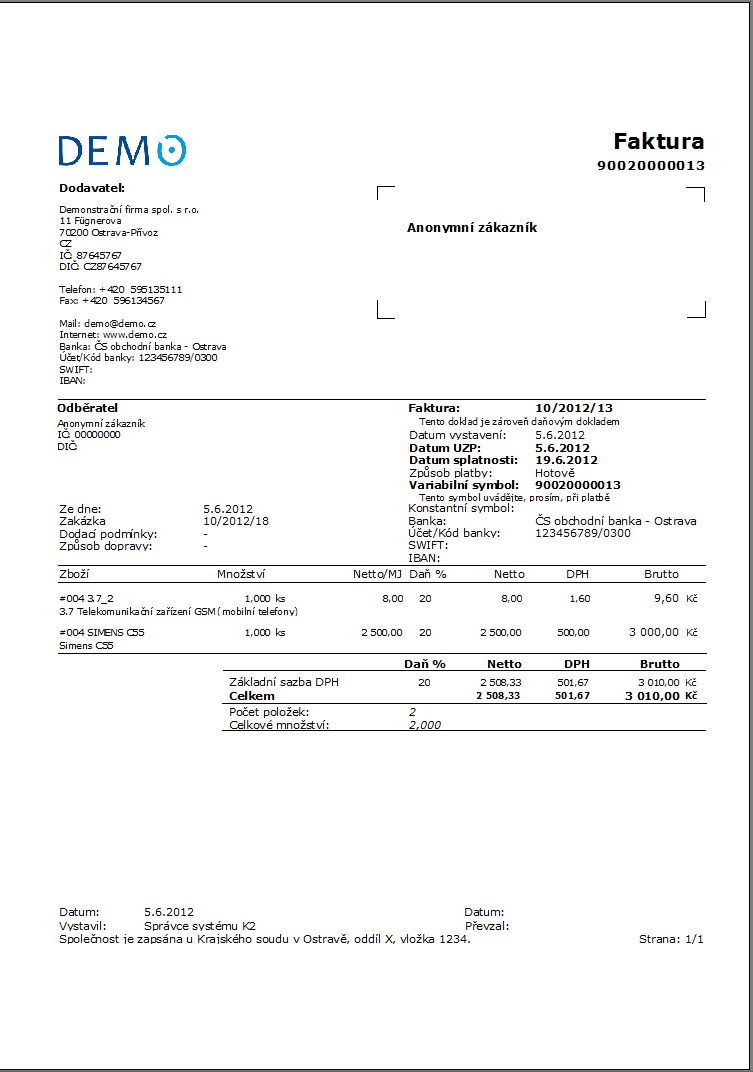

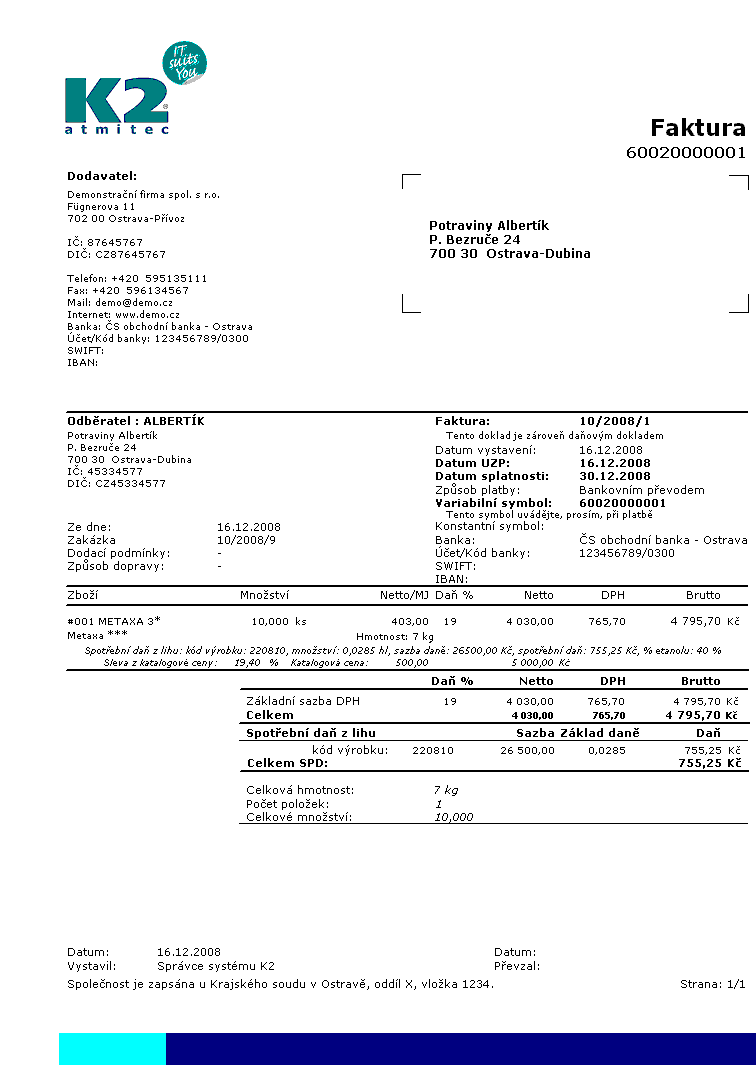

Picture: Print of an Invoice Out including a fee

Adding Fee to a Purchase Order

Adding fees to Purchase Orders is ensured by a registered function that runs the script Adding Fee to Purchase Orders - E-waste. The functionality in the Purchase module is the same as in the Sales module. The script can be run separately without registered function. The technical details are stated below.

More Settings

Correcting Already Created Fees:

Considering the fact that registered functions create fees for E-waste only to new items and the additional quantity adjustments of items are not being taken into account, the Change Fee in Sales Order/Purchase Order - E-waste script has been created. If the user is on the 2nd page of a Sales Order (Purchase Order) and the document is not in the Change mode, the E-waste items that are not assigned to subordinate documents or that are on unconfirmed subordinate documents will be deleted and created again.

Posting Key:

It is possible to be set in the unity U_RegGlobalVarEO.pas; the template of the unit may be found in the directory K2\SESTAVYW\STANDARD\K2R under the name XU_RegGlobalVarEO.pas. This unit will be copied and pasted into the directory K2\SESTAVYW\STANDARD with the name U_RegGlobalVarEO.pas and will be filled in with rows with posting keys for Posting keys of Sale and Purchase. The posting keys identified by their own unique ID will be automatically inserted into the Sale (Purchase) Items.

|

Posting key_EO_ZAK = 0; |

|

Posting key_EO_OBV = 0; |

Restrain Creating of Fees in Books of Purchase or Sale:

Fees do not necessarily have to be inserted into Purchase or Sale documents in all books (rows), the creating may be suppressed in particular books. This may be set in the unity U_RegGlobalVarEO.pas in a way similar to posting keys.

Note: If it is the case of selling articles from e-shops, E-waste are by default inserted into documents from values of books in the variables Rada_EO_ZAK and Rada_EO_OBV. The support of these variables for e-shop requires the assistance of a consultant.

|

Rada_EO_ZAK = ''; //books into which the fees are not to be inserted |

|

Rada_EO_OBV = ''; //separate the books by a semicolon, e.g. '10;20' |

Technical details

List of files:

- Scripts: Pozn_Elektroodpad.pas, Vloz_EO_Zak.pas, Vloz_EO_Obv.pas, EO_Updata.pas, XU_RegGlobalVarEO.pas

- Forms: F_Elektroodpad.dfm

Registered Functions:

- Form Functions:

- RFSAdd('RF_Provize.PAS', False, 102, 2, 0, 3); // After saving in the form SO

- RFSAdd('RF_Provize.PAS', False, 85, 2, 0, 3); // After saving in the form IO

- Date Functions:

- RDSAdd ('Vloz_EO_Zak.PAS', false, DmIdToNum('TD_Zak'), 2, 0, 3); // After saving after the beginning of transactions on the date module SO

- RDSAdd ('Vloz_EO_Obv.PAS', false, DmIdToNum('TD_Obv'), 2, 0, 3); // After saving after the beginning of transactions on the date module IO

EDI - Sale

EDI.PAS - import / export of messages for electronic data exchange

The script works in Xml format

InHouse format is not supported

The script is used for:

- import of orders from the ORDERS message to IS K2 (supports EDIFACT D96A and D01B specifications (but only identical fields with D96A), supports X11, 2012 format, but also older 2003 format)

- export of invoices to INVOIC message - (supports EDIFACT specification D01B, XML format (version number) version 2012).

- export delivery advice to the IFTMANE message - (supports EDIFACT specification D96A, XML format (version number) version 2003).

- export the delivery note to a DESADVE message - (supports EDIFACT specification D96A, XML format (version number) version 2003).

- export stock status to INVRPT message - (supports EDIFACT specification D96A, XML format (version number) version 2003).

- Import confirmation of receipt from the RECADV message - (supports EDIFACT specification D96A, XML format (version number) version 2003).

- export of Order confirmation( to ORDRSP message )- (supports EDIFACT specification D01B, XML format (version number) version 2012)

Installation

- The script can be executed from F9 from the book of article or orders, the customer can save it in the tree menu.

- In IS K2 is necessary to add the EDI option in the Order Form book. Book is available e. g. on 1 st Page Sales order.

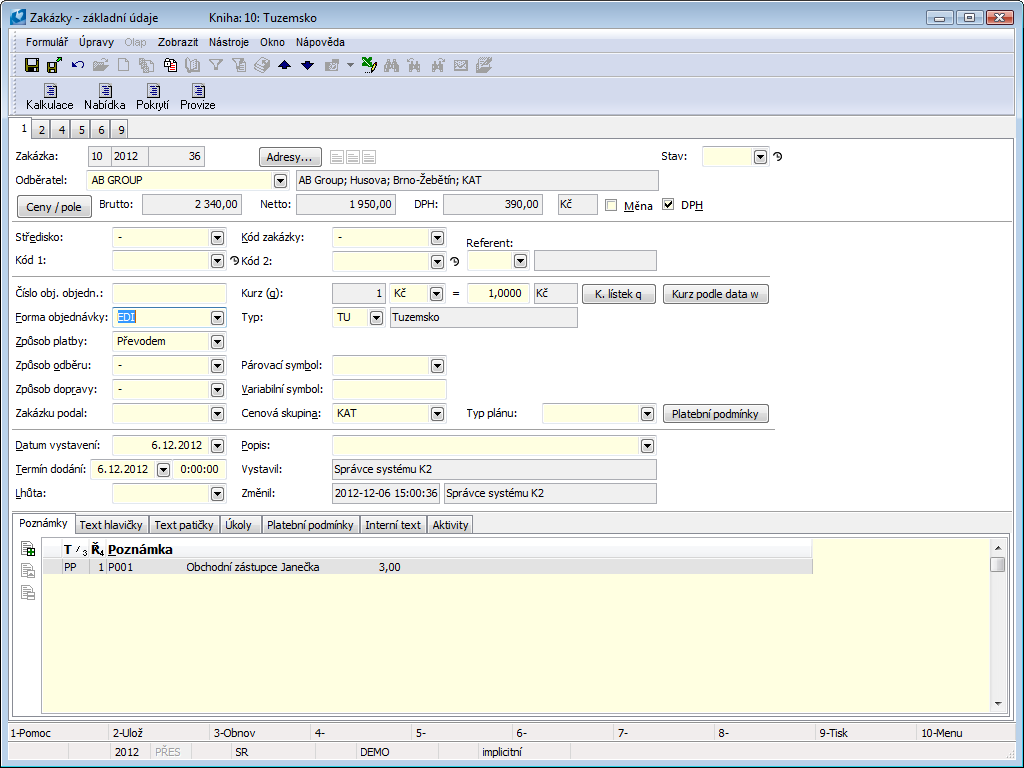

Picture: Settings of Order form in IS K2

- When starting for the first time, you must be logged in IS K2 as user "K2ATMITEC" or "K2".

- Set the script parameter myEANCode on right value.

Setting the path to files:

The path consists of the period specified by the Edi_Dir parameter and the postfix with which the script works. The directory structure is created when the script is run for the first time.

The directory structure for the default settings will look like this:

C:\K2EDI\XML\IN\Orders |

Directory from which xml orders are imported into IS K2 |

C:\K2EDI\XML\IN\IMPORTED |

Directory where successfully imported xml orders are stored. |

C:\K2EDI\XML\IN\RecAdv |

Directory from which xml confirmation of receipt are imported into IS K2. |

C:\K2EDI\XML\IN\BadAddr |

Directory where incorrect xml orders are stored. |

C:\K2EDI\XML\OUT |

Directory in which all exported xml messages are stored. |

Entering EAN codes in IS K2 for K2 – EDI:

Customers |

enter the EAN code on the 1. st page of the Suppl./Cust. card to field Abbreviation 2. EAN can also be entered in a special field. In this case is necessary to set the parameter BuyerEANField. |

Articles |

The EAN code can be entered either in the Abbreviation 2 field on the 1. st page of the Article card, or as a “bar code” on the 1. st page of the Article or on the 4th page of the Article in Supplier Prices as a supplier code. EAN can also be set in a special additional field, both on the 1st page of the Article card and on the 4th page. The parameter GoodsEANField is use for that. EAN usage priority: If the parameter of the SupplierCode script is set to True (by default it is False), then the EAN, which is entered in the supplier codes for the given supplier on page 4 of the Article card in Supplier Prices, is used. If the GoodsEANField parameter is set, it is taken from the corresponding additional field. If no EAN is entered in the supplier codes, the EAN from the bar codes is used, if it is not entered here either, then the EAN from Abbreviation 2 is used. If the EAN is entered in the barcode grid (multiple codes can be entered), the one with the EAN flag checked is used in EDI (and at the same time the warehouse unit is equal to the one on the document). If more than one EAN tag is checked, the first one is used, which meets the condition that the storage unit is equal to the one on the document. |

Script parameter:

Parameters description:

Parameter name |

Data type |

Description |

Default value |

AllowSameOrderNo |

Boolean |

True - Add to order number 001.002.... |

False |

autoGen |

Boolean |

If it is True,then messages INVRPT will be created automatically. |

False |

AutomaticFill |

Boolean |

True - Automatic filling with appropriate invoices, delivery notes and stock levels |

True |

basicRate |

Integer |

The standard VAT rate. According to the abbreviation SR from the code list Periods and taxes. When exporting a document with a different basic tax rate than the implicit (SR), it is necessary to enter this tax in the parameters (numerical value). |

|

BatchPath |

String |

Initial batch for data preparation |

‘‘ |

bookOrd_from_delivery_ean |

Boolean |

The order import range is searched for CDo or CD1. |

True |

BuyerEANField |

String |

Parameter for specifying the field from the Suppl./Cust. tab, in which the EAN code is entered and from which this code will be read. |

Abbr1 |

CDoToBuyer |

Boolean |

If the value is True, then the buyer is CDo, otherwise CD1. |

True |

CDoToDelivery |

Boolean |

If the value is True, then delivery spot is CDo, otherwise CD1. |

False |

CDoToInvoice |

Boolean |

If the value is True, then invoice spot is CDo, otherwise CD1. |

True |

CDoToOrderer |

Boolean |

If the value is True, then customer is CDo, otherwise CD1 |

True |

ContractCode |

String |

Contract code. |

- |

CostCentre |

String |

Cost centre |

- |

ChangeCdoCd1 |

Boolean |

If it is False, then the CDo belongs to the customer from buyer_ean. If it is True, then the CD1 belongs to the customer from buyer_ean. |

False |

CreateBookingNote |

Boolean |

True - Create a reserving Card. |

False |

DeleteOldLogFiles |

Boolean |

True - Each time you run the script, all previously created and saved log files are deleted (sales log files only). |

False |

DeliveryNoteOnInvoice |

Boolean |

True - Exports the delivery note number on the invoice. |

False |

DeliveryTerms |

String |

Shipping method. |

- |

DeliveryTime |

String. |

Time of delivery. |

- |

DisableEANFormatCheck |

Boolean |

True - Checking the EAN format for articles is suppressed. |

False |

Edi_Dir |

String |

Path to Exported and imported files. |

‘C:\K2EDI\' |

EDITEL_tag_interchange |

Integer |

Data in XML file header |

0 |

EDITEL_tags |

Boolean |

If the value is True, then EDITEL_tag_interchange is added to the header |

False |

Export_VarS |

Boolean |

True - Exports a variable symbol (for invoices) instead of the invoice number in K2 form. |

False |

FillOrderLineNumber |

Boolean |

True - the "order_line_number" element in the ORDRSP message is being filled. The value from the OrigItemZ field from the invoice items is filled here. |

False |

foreign_ex |

Boolean |

If True, then the currency is taken according to the customer. |

False |

genTime |

TTime |

The time when INVRPT messages start to be generated. |

23:59:59 |

GoodsEANField |

String |

Parameter for specifying the field from the article card from which the EAN code will be read (eg in the case of using a special field). |

|

idTypeGoods_G |

Integer |

Item type number |

1 |

idTypeGoods_P |

Integer |

Item type number - Packaging |

4 |

impPrefix |

Integer |

Prefix |

0 |

ItemPlaceOfDeliveryFromReleaseNote |

Boolean |

Yes - some fields are filled in from the release note when exporting the invoice; No - the field is filled in from the delivery note. These are the fields Delivery note number, Delivery note issue date, Delivery date and Delivery place. |

False |

MyEANCode |

String |

My EAM code. |

999999999999. |

MergePackaging |

Boolean |

True - Turns on the function of merging articles and packaging into one item |

False |

ModeOfTransport |

String |

Type of transport. |

- |

NoGoodsEANItemsSearch |

Boolean |

If the parameter is set to True, the script ignores (during import and export) the barcodes set on the 1st page of the article card (in the table). |

False |

OldAddressFillingLogic |

|

False - the invoicing and delivery address is always exported exactly according to the settings of these addresses in the IS K2 documents. Also during import, these addresses are filled according to the addresses specified in the imported "* .xml" file. If the addresses are not listed in IS K2 or in the imported file, they are not filled in. If the parameter is set to Yes, the address filling logic does not change. |

True |

paymentMethod |

String |

Payment method on sales orders |

“Transfer” |

PoznCiDLV |

String |

The type of note in the book that defines the format of the delivery note number. E.g. the format KKYY @ CI (NXX) is inserted into the CD type note (Note type "description for 60 characters"), where the characters 'KK' serve as the book identifier (eg series '10'), the characters 'YY' represent the prefix (eg . '10' for the year 2010), XX is a number in the form eg '06', which defines the number of places for the document number. Example: If a CD note in the format 1010 @ CI (N06) is inserted on the sales book for the relevant prefix, then the delivery note number 10/2010/234 will be in the EDI format 1010000234. If the parameter is not filled in or the note does not exist, the format in EDI will be 10/2010/234. |

‘‘ |

PoznCiFAV |

String |

The type of note in the book that defines the format of the invoice number. (See parameter PoznCiDLV description) If the format for the invoice is to be different than for the delivery note, it is possible to define another note on the sales book, eg 'CV' |

‘‘ |

Price4DecPlaces |

Boolean |

Display prices to 4 decimal places in "* .xml" documents. |

False |

radaDok |

String |

Document series |

‘10,20‘ |

radaZak |

String |

Series for sales orders import |

‘10‘ |

reducedRate |

Integer |

Reduced VAT rate. According to the abbreviation RR from the code list Periods and taxes. When exporting a document with a reduced basic tax rate than the implicit (RR), it is necessary to enter this tax in the parameters (numerical value). |

|

rounding |

Boolean |

Undissolved |

False |

RoundQuantity |

Integer |

Rounding of the quantity on the invoice determines the number of digits for rounding (-3 = 3 decimal places). |

-3 |

RozsireniAdresati |

Boolean |

If the value is True, then fill the extended recipients when creating the order |

False |

StorehouseEAN |

String |

Explicit EAN code of the supplier's distribution warehouse |

‘‘ |

SupplementAbbrBI |

String |

Parameter for entering the abbreviation of the client's addition with the file mark. |

OR |

supplier |

Boolean |

If True, then in creating an INVRPT message they are taken in consider only those customers who are suppliers. |

False |

SuppressUnitControl |

Boolean |

True - Restricts the check of the unit of measure when importing to EAN (when the parameter is switched off, it searches further according to the unit abbreviation) |

False |

UnitDescription |

Boolean |

True - When importing an order, the unit of measure is set according to the description of the EAN (it must contain the abbreviation of the set unit, the quantity does not change) + export of the description of the EAN as a unit of invoices and delivery notes |

False |

UseICDPH |

Boolean |

True - For SVK use IČDPH from the client's supplement instead of DIČ |

False |

setEncoding |

String |

Encoding xml messages. Other alternatives are:

|

'UTF-16' |

showXmlLog |

Boolean |

A value of True displays the log after importing and exporting xml messages. |

True |

SloucitPolozkyFAV |

Boolean |

When loading invoices out, it summarizes items with the same item number C_Zbo. |

False |

SloucitPolozkyDLV |

Boolean |

When loading delivery notes, it summarizes items with the same item number C_Zbo. |

False |

SupplierCode |

Boolean |

True - Takes the EAN from the Code field on the supplier prices on the 4th page of the articles. |

False |

ZobrazLogCen |

Boolean |

True - Show log prices |

False |

Description of individual pages

K2 – EDI contains a tab for importing orders and confirming receipts into IS K2, as well as tabs for exporting notifications of delivery, invoices, delivery notes and stock status. Last tab is K2–EDI settings. The user sees only those tabs that are allowed on the Settings page. You can switch between the individual tabs by clicking the left mouse button on the respective tab, or by using the Alt + keyboard shortcuts the first letter of the tab name:

Purchase Order |

Alt+O |

Receipt confirmation |

Alt+P |

Notification of delivery |

Alt+A |

Invoices |

Alt+F |

Delivery notes |

Alt+D |

Stock levels |

Alt+S |

Settings: |

Alt+N |

EDI - (Purchase)

Import / export of messages for electronic data exchange Purchase

Edi._K2_Purchase.pas

The script works in Xml format

InHouse format is not supported

The script is used for:

- export of orders issued to xml edi to ORDERS message - (supports EDIFACT specification D01B, XML format (version number) version 2012).

- export of Receipt Card to RECADV message - (supports EDIFACT specification D96A, XML format (version number) version 2003).

- Invoice in import from export of xml edi to INVOIC message - (supports EDIFACT specification D96A, XML format (version number) version 2003).

Settings:

In IS K2 is required to have the order form set to EDI for orders issued and invoices in. It is also necessary that all EAN codes of customers (in the field Abbreviation 2) and article (in the field Barcode or Abbreviation 2 or on page 4 of the Article in Supplier Prices). The first time you start, you must be logged in as user "K2ATMITEC" or "K2". Then it is possible to add in Tab Settings other users and their rights. Set the script parameter MyEANCode on right value.

Setting the path to files:

The path consists of The period specified by the Edi_Dir parameter and the postfix with which the script works. The directory structure is created when the script is run for the first time.

The directory structure for the default settings will look like this:

C:\K2EDI\XML\LOG\ |

For log files. |

C:\K2EDI\XML\IN\Invoice |

For files which will be imported to IS K2 |

C:\K2EDI\XML\IN\NotImported\ |

For files which will be imported to IS K2 |

C:\K2EDI\XML\IN\Imported\ |

For files imported to IS K2 |

C:\K2EDI\XML\OUT\ |

For files exported from IS K2 |

Script parameter:

Parameters description:

Parameter name |

Data type |

Description |

Default value |

AutomaticFill |

Boolean |

Yes - documents suitable for export are loaded automatically. No - documents are loaded only after switching to a specific tab in the form. |

True |

BatchPath |

String |

Initial batch for data preparation |

" |

BookDocExp |

String |

The book from which the documents for export will be loaded. |

11/21 |

BookDocImp |

String |

The book from which the documents for import will be loaded. |

11. |

BuyerEANField |

String |

Parameter for specifying the field from the Suppl./Cust. tab, in which the EAN code is entered and from which this code will be read. |

|

DeleteOldLogFiles |

Boolean |

True - Each time you run the script, all previously created and saved log files are deleted (purchase log files only). |

False |

DisableEANFormatCheck |

Boolean |

True - Checking the EAN format for articles is suppressed. |

False |

Edi_Dir |

String |

Path to Exported and imported files. |

‘'C:\K2EDI\XML\' |

ExtendedLogging |

Boolean |

Mode of extended logging. |

False |

GoodsEANField |

String |

Parameter for specifying the field from the article card from which the EAN code will be read (eg in the case of using a special field). |

|

GroupOrderItems |

Boolean |

True - when exporting an order, its items are grouped by item number (C_Zbo) and unit. |

False |

ImpPrefix |

Integer |

Default documents prefix. |

0 |

MyBuyerName |

String |

If the parameter is specified, its value overwrites the name of the buyer when exporting the order. |

|

MyEANCode |

String |

My Ean code EAN - buyer code |

999999999999. |

NoGoodsEANItemsSearch |

Boolean |

If the parameter is set to True, the script ignores (during import and export) the barcodes set on the 1st page of the article card (in the table). |

False |

NoVATFillForForeignInvoices |

Boolean |

True - when importing an invoice (for invoices from abroad), the VAT rate is not overwritten. The condition is that the Suppl./Cust. status whose invoice is imported, is different from the country set in the client's parameters. |

False |

OldAddressFillingLogic |

Boolean |

False - the invoicing and delivery address is always exported exactly according to the settings of these addresses in the IS K2 documents. Also during import, these addresses are filled according to the addresses specified in the imported "* .xml" file. If the addresses are not listed in IS K2 or in the imported file, they are not filled in. If the parameter is set to Yes, the address filling logic does not change. |

True |

SetEncoding |

String |

Type Encoding xml messages. |

'UTF-16' |