Advance Received

Received advances are part of the Sales module documents. The book of received advances is used to issue advances to customers and their records.

Picture: The open menu of the Sales / Processing of Contracts - Advances received module

Advance amount and the VAT rate are entered on the Basic data tab by entering the document item. Additional VAT rates can be entered by entering another item.

Individual advances can be attached to the Contract, resp. You can create advance or even several advances for a specific Contract. Such advances we called Contract advances. Advances without this link are understood as advances to the customer.

Information on created advances for the given Contract is available directly on the Contract:

- on the Sales Items tab at the bottom by pressing the Received Advances button,

- in the ribbon by running the Received advances to contract or Received advances to customer option.

Advances can be switched to the Tax Document status, which is another significant difference between advances and other Sales documents. It is possible to switch the confirmed paid tax advance to this state and the advance in this state enters the Value Added Tax Return. The tax document cannot be edited, canceled, paid.

We match advances with payments in the same way as other Sales documents, ie we understand a paired cash receipt or bank statement as a payment; the payment is then a paired bank order. Advances can enter the Payment Calendar (if the Create payment calendar item client parameter is set).

The paid advance is ready to be drawn on invoices, where it is made on the Sales Items tab. At the bottom of the form is a table that shows the drawn advances on the current invoice. You can use the Insert key to add the drawing of another advance to the table, when IS K2 will offer the unused advance items that are available. Or it is possible to use the buttons Drawing advance for contract, Drawing advance to the customer, with which IS K2 not only offers unused advance items, but also offers amounts to be drawn up to the maximum possible amount.

Until the advance is switched to the Tax document status, it is drawn as non-tax, regardless of whether it is calculated on the VAT document and the VAT field is checked. When drawing this advance on the invoice, the advance is deducted with the VAT rate and tax type entered in the Client parameters on page 2 in the field VAT rate for deduction of non-tax advance and Tax type for deduction of non-tax advance.

If the Allow advance drawing only from the same book box is checked in the Client's Parameters on the 2nd page, only the advance issued in the same book can be drawn on the invoice. Otherwise, you can draw on the invoice the advance issued in any book.

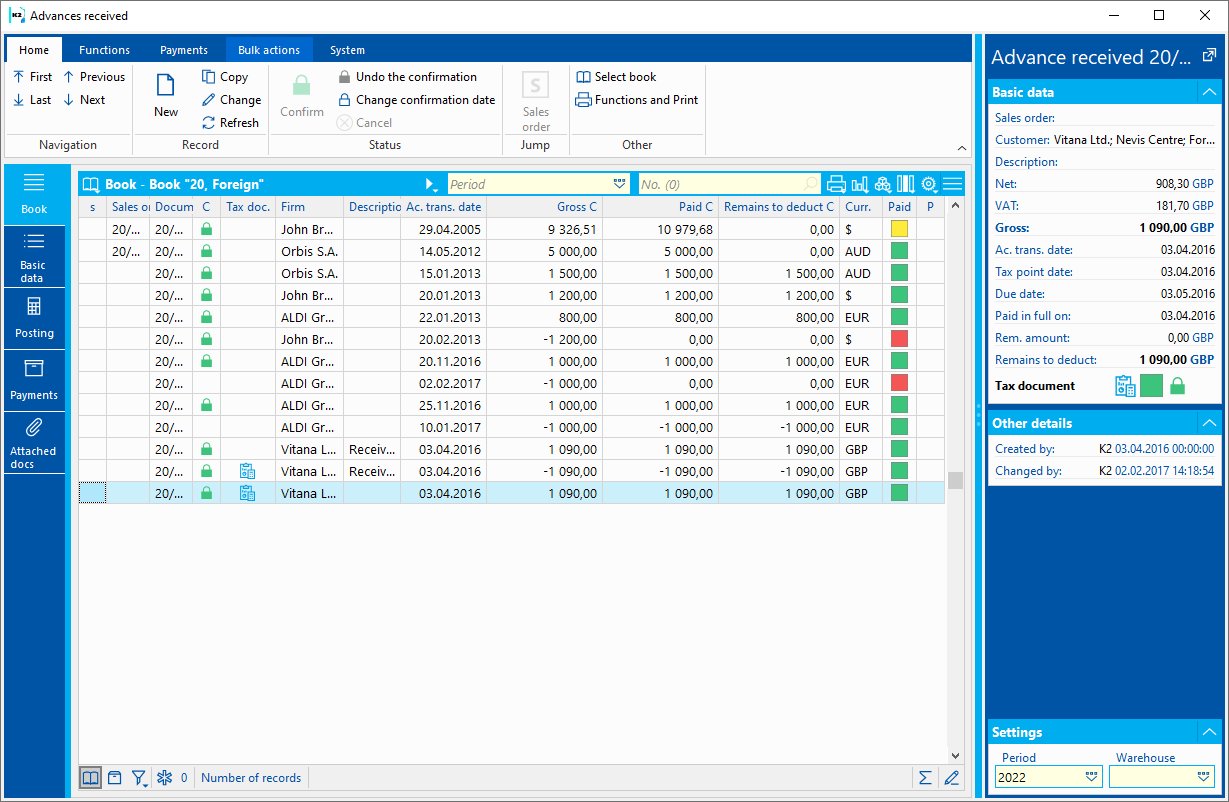

Book of Advances Received

Picture: The Book of Advances Received

Document Advance Received

Basic data of received advance tab is used for identification and basic data about an Advance, and some additional information such as payment method, date of issue, maturity date etc.

Picture: Advances received - Basic Data

Fields description in Basic data:

Document |

The book, business year, and the number of an Advance Received. |

Contract |

The field serves for the definition of the number of a Sales Order to which the Advance Received is created. If an Advance is issued to a customer only, the field remains empty. |

Customer |

A business partner's name that you insert by selecting it from Suppl./Cust. book. |

Comp. Reg. No. and VAT Reg. No. |

Button displays tax identification data. If it is not entered, the Comp. Reg. No./VAT Reg. No./Tax No. from the Customer card is applied. |

Status |

The field for selecting from a code list that enables filtering of documents according to the selected status. |

Description |

Further advance specification. |

VAT |

If the field is checked, it deals with a Tax Document. The field is preset according to the legislation of the document. |

Credit Note |

By ticking this field, we will mark the issued advance as a credit note. |

Gross |

The gross amount in the currency of the advance. |

Net |

The net amount in the currency of the Advance. |

VAT |

The VAT amount in the currency of the Advance. The field cannot be edited. |

Currency |

Advance currency. |

Exchange Rate |

Exch. rate for recalculation to the domestic currency. The rate valid to the date of issue is selected. If the Invoice Exch. Rate According to Acc. Trans. Date option is checked in the Client Paramaters, an exch. rate to the acc. trans. date is filled in. This field cannot be edited any more after you pay and reprice this document. |

Rate 2 |

Current rate for revaulation. |

Exchange Rate According to Date |

This button enters an exchange rate from the exchange list that is valid to the date depending on the Exchange Rate According to the Date of Accounting Transaction parameter. |

Exchange list |

This button opens the preview of exchange list of the given currency and sets the cursor on the rate valid to the date. |

Addresses |

Displays the recipient or superior companies. Closer description is in the chap. Addressee. |

Type of Tax |

Type of tax for inclusion of a receivable in the VAT return. |

Reference number |

The field for the reference number of an Advance Received. It can be created automatically according to the setting in the Books of Sale. The program notifies you of any eventual duplicities of variable symbols. |

External Number |

External number (text of 60signs). Used to identify a document from another system. |

Dr Account, Cr Account |

The Dr account and Cr account of an Advance. The field is automatically filled in with the account according to the settings in the Sales Book. If the fields are not filled in in the Book of Sale, the accounts are entered from the Suppl./Cust. card. |

VAT from Above |

Sets the Gross amount in items as default. The VAT is calculated by a coefficient set in the VAT Rates book, and Net is calculated as a difference between the Gross and the VAT amount. |

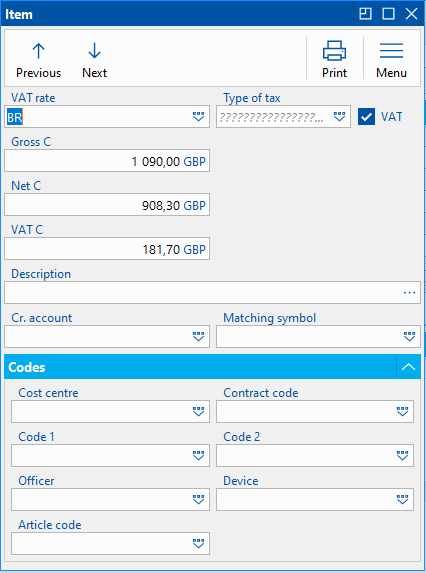

Item field description:

Is tax document |

Information about the Advance status from the tax perspective. If an Advance Received is confirmed and paid and the VAT field is checked, it is possible to switch it into the Tax Document status. Icon informs that advance is in tax document status. |

VAT Rate |

The VAT rate of the item of the Advance. We choose from Code list Taxes. |

Type of Tax |

Tax type of an Advance item. We choose from theTax Type code list. |

Gross C |

The gross amount in the currency of the advance. |

Net C |

The net amount in the currency of the Advance. |

VAT C |

The VAT amount in the currency of the Advance. The field cannot be edited. |

Remaining amount C |

Remaining amount gross in currency. |

Description |

Description of an item. It can be edited or selected from the Description code list. |

Account |

The account of an item. |

Picture Advances received - Basic Data - Item

Matching Symbol |

Selection from the Matching Symbol code list. |

Cost centre |

Selection from the Cost Centres code list. |

Contract Code |

Selection from the Contract Codes code list. |

Code 1 |

Selection from the Code 1 code list. |

Code 2 |

Selection from the Code 2 code list. |

Officer |

Selection from the Officer code list. |

Device |

Selection from the Device code list. |

Article Code |

Selection from the Article Codes code list. |

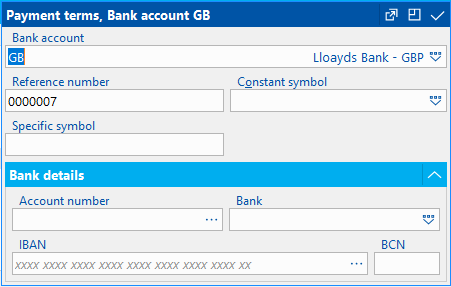

Conditions field description:

Payment Method |

The method of advance payment. Note: The Payment Method can influence the rounding of Invoices. For further description, see the Rounding of Advances chapter. |

Payment Conditions, bank account |

The button is used to set the payment terms. The detailed description is stated in the Purchase and Sale Shared Elements - Payment conditions chapter. |

Picture Payment Conditions, bank account

Payment Conditions field description:

Bank account |

Bank account of company to which the payment is to be sent. If the Uniform Bank Connection for IO client parameter is on, the bank account from the customer in the own company is entered, otherwise the bank account set in the Suppl./Cust. card is entered. |

Reference number |

The field for the reference number of an Advance Received. It can be created automatically according to the settings in Books of Sale. The program notifies you of any eventual duplicities of variable symbols. |

Specific Symbol |

A Specific Symbol for the payment. |

Constant Symbol |

The constant symbol added by selecting from a The menu. |

Account Number, Bank/SCB, IBAN |

The customer bank account number. It is possible to select the account entered in the Customer card (it is not filled in automatically), or enter the value manually. |

Terms field description:

Accounting transaction date. |

The date on which the document enters the accounts. |

Date of Issue |

The date of doc. issue. |

Due Date |

The due date of document. According to the settings in the Derive Due Date from Accounting Trans. Date client parameter, the Due date is automatically entered by adding the number of Maturity Days to the value of the Date of Issue field or to the Acc. Trans. Date field. If the Floating Maturity is checked on the Suppl./Cust. card in the Payment Conditions tab, the Due date is filled in according to the Month Shift and Days From The Beginning of Month values. |

Invoice Date |

The date of the taxable supply enters the VAT return. If the Invoice date is null, the document does not enter the VAT Return. |

Control Statement Date |

The date of the Control Statement. It is necessary to be filled only if it differs from the Invoice Date. |

Due date |

Number of maturity days. |

Codes field description:

Cost center, Contract code, Code 1,Code 2, Officer, Device, Article code |

The data used to sort the company's activities. Closer description is in the chap. the Basic Code Lists and Supporting Modules K2 – Notes. |

Buttons:

Accounting information, matching symbol |

After pressing the button, it is possible to enter the pairing symbol and posting key. |

Drawing advance overview |

After pressing the button, the invoices on which the advance was drawn will be displayed. |

Items of VAT Documents |

After pressing the button, the items of the VAT documents in which the advance received is listed are displayed. |

It is possible to assign random types and kinds of notes to Advances; eventually, it is possible to use the Header Text or the Footer Text. Further work description with The notes is listed in the Basic Code Lists and Supporting Modules K2 – Notes chapter

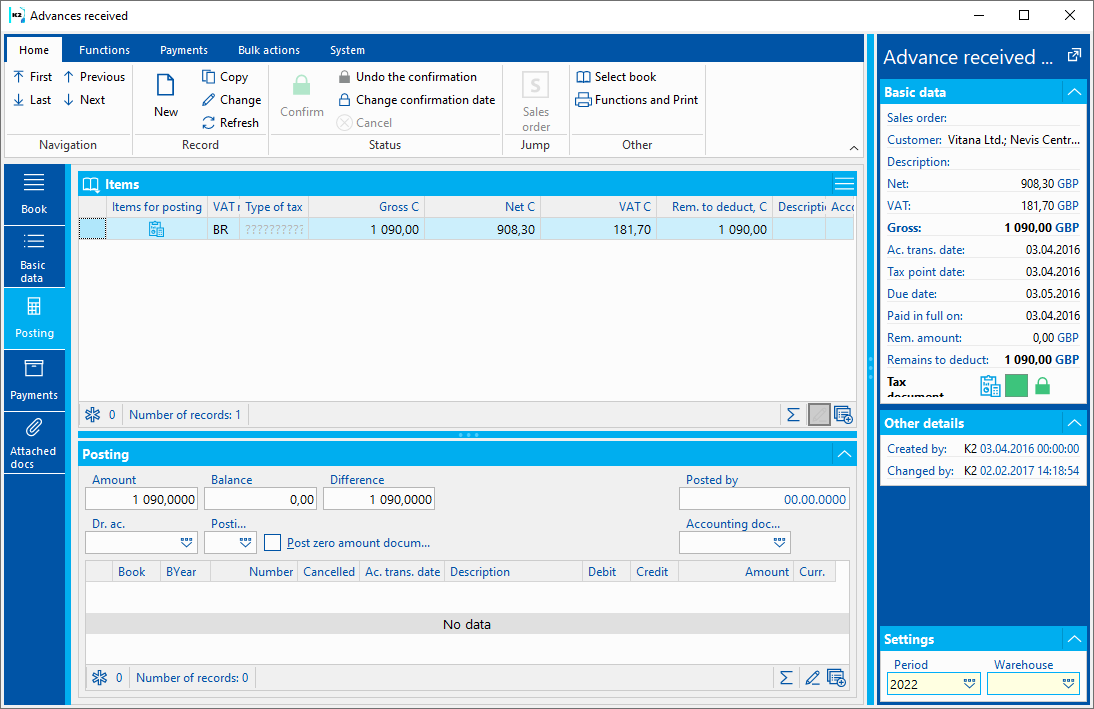

A Received Advance contains the Debit account and the Credit account directly in the header of the document. Both accounts can be predefined in the Books of Sale, which means you can ensure the inserting of Debit and Credit accounts into all newly created Advances Received in the book. For the pre-definition in the Books of Sale, select the most frequently used accounts for posting of Advances Received. If you record an Advance that should be posted to different accounts in the book, you can change the accounts immediately when creating the Advance, eventually later via the Change Posting Key bulk action (Form / Bulk Actions / Change Posting Key).

As well as the accounts, a posting key by which the Advance will be posted is inserted into a Received Advance. The Posting key of an Advance Received may be predefined in the Books of Sale. The predefined posting key can be naturally edited similarly as described above for the Credit and Debit accounts, i.e. via the Change Posting Key function (Form / Bulk Actions / Change Posting Key).

An Advance Received which has a Credit and a Debit side account and a Posting key defined, and which is also confirmed, is ready tobe posted. Posting: Only confirmed Advances should be posted. In ribbon we run Posting with Account assignment function.

The Posting on Document tab is used for posting. The bottom part of this page is designated to post the document.

Note: Closer description is in The Accounting– Account Assignment and Posting chapter.

Picture: Advance Received - Posting

It is possible to post Advances in bulk. Create a filter of the confirmed and paid Advances Received for a business year in which you want to post the Advances (by using the 'Unposted' filter), mark the records with asterisks, and post them in bulk (the Ctrl+F7 key combination).

If the Tax Document status is changed on a posted document, the Posting and Settlement signs are always removed. It is necessary to post the document again.

Post the Advance Received in the "Tax Document" status as follows:

Net price |

Debit account from the Advance Received / Credit account from the Advance Received |

the amount of VAT |

the Debit account from the Advance Received / 343 |

No tax advance received is posted as follows:

Gross price |

Debit account from the Advance Received / Credit account from the Advance Received |

On Payments tab, the user can monitor the facts related to the payment status of the advance - whether it is paid entirely or partially, due date, delay or information on concrete payments (in the lower part of the 6th page).

When paying an Advance received, the Acc. Trans. Date and the Invoice Date is changed according to the Date of Issue of the payment. If the Set "Tax Doc." Status on Advances When Paid In Full field is checked in the Book of Sale, the Tax Document status is automatically set when an Advance Received is paid in full.

If the Advance is in the Tax Document status, it is not possible to match next payment to the document. It is also not possible to undo the match of an already existing one.

If you insert an Advance to a Cash Voucher or a Bank Statement manually, and the Advance is in a different currency than the payment, the following message will appear: "Do you want to change exchange rate of the advance according to the document exchange rate?". After approving, the Exchange Rate on the Advance will be automatically changed according to the Exchange Rate of the Cash Voucher or the Bank Statement.

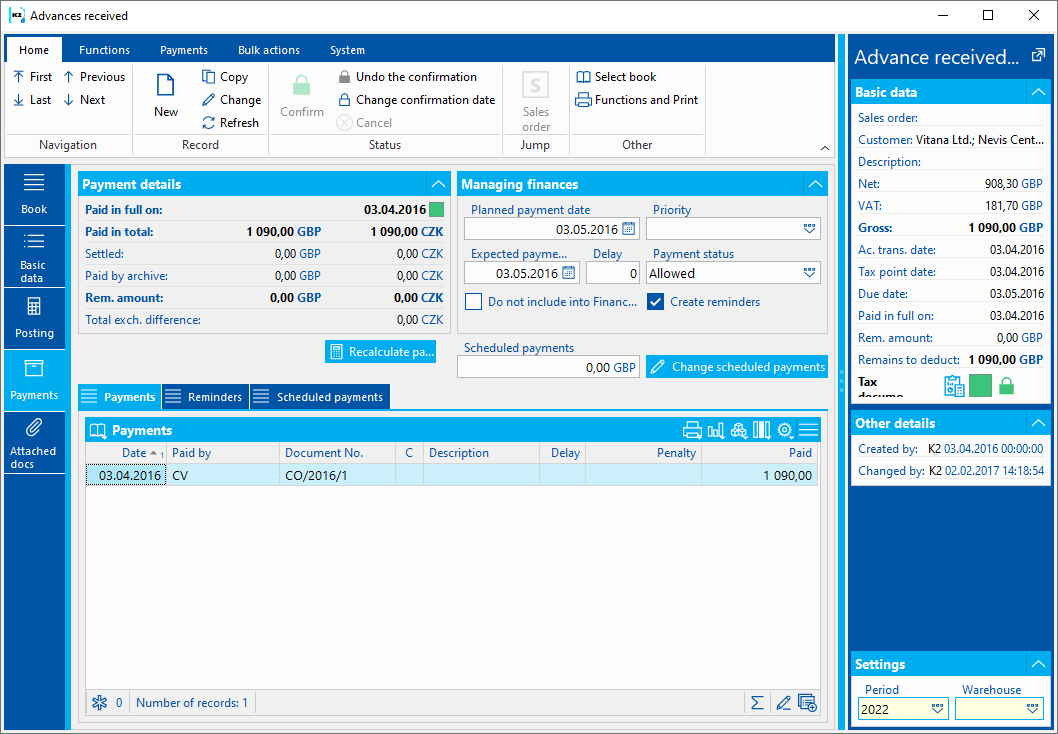

Picture: Advance Received - Payments

Description of Payment Details fields:

Paid in Full On |

Date on which the document was paid in full. |

Paid In Total |

The total amount that has already been paid. |

Settled |

Paid in the currency of the document. This is the amount on bank orders that have not been matched with bank statements. |

Paid by Archive |

The amount paid by the documents, which have been already moved to an archive. |

Remaining Amount |

The amount that remains to be paid. |

The total exchange difference. |

The total exchange difference. |

Payment Recalculations |

The Recalculate button recalculates the payments for the Invoice. If there is an exclamation mark next to the button, the payments are not counted correctly - it is necessary to run the payments recalculation. |

Fields description Financial Management:

Planned Payment Date |

The due date reflected by the delay from the customer's card at the date of document issue is automatically filled in. It is possible to change it. |

Priority |

Used to set the priority for a payment. |

Expected Payment Date |

Expected document payment Date. |

Delay |

Suppl./Custm. delay |

Payment Status |

A payment status that can be used to suspense a payment or completely block it. The payment status can take the values of Allowed, Suspended, or Blocked. You cannot add payments with the Suspended or Blocked payment status to a banker's order. |

Do Not Include Into Financial Management |

If this option is checked, the document does not appear in the Financial Management module. |

Create notification |

If checked, the documents will enter the reminder function. |

Scheduled payments |

The sum of planned payments in the currency of the company. |

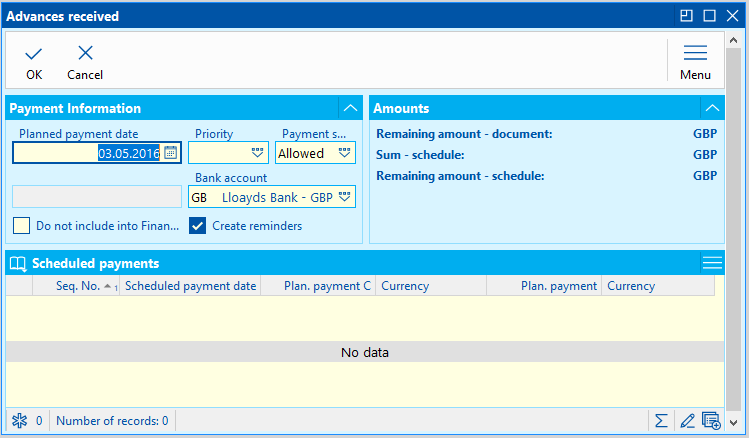

Change of scheduled payments |

Run Received Advances - Payment Information form, in which you can enter or change scheduled payments. |

Picture: Received advances - Payment information

Lower part of Payments tab is divided into 3 tabs:

- Invoice payment,

- Reminders,

- Planned payments.

In the Payments tab, the individual payments of an Advance are displayed . After pressing the Enter key on a specific payment, the Basic data of the bank statement, cash document, internal document or of the bank order by which the payment was made are displayed. In the bank statement, (cash voucher, internal document or the banker's order) the light indicator is positioned on the item that corresponds to the Advance payment.

In the Reminders tab are the individual Reminders that have been issued on an Advance. Use the Enter key to switch to the Reminder Book to the Basic Data tab of the specific reminder.

The Scheduled Payments tab displays the items that represent scheduled payments. You can change or insert scheduled payment items using the Change scheduled payments button.

Define a Date, Currency and Amount that you want to pay at each Plan. The plans created will be displayed in the Financial Management book. It is also possible to change the scheduled payment date on the tab. If the user has set right the Finance / Financial Management / Change Scheduled Payments on the document in the blocked period, he/she can also change the data on the documents that are in the blocked period.

As in other modules of the K2 program, it is possible to assign documents to this tab. The further description of the work with documents is stated in the Basic Code Lists and Supporting K2 Modules - Attachment chapter.

There are also the Tasks, Activities and Processes tabs. A closer description of work with the folders is stated in the Tasks - Document Folder and the Activities - Document Folder chapters.

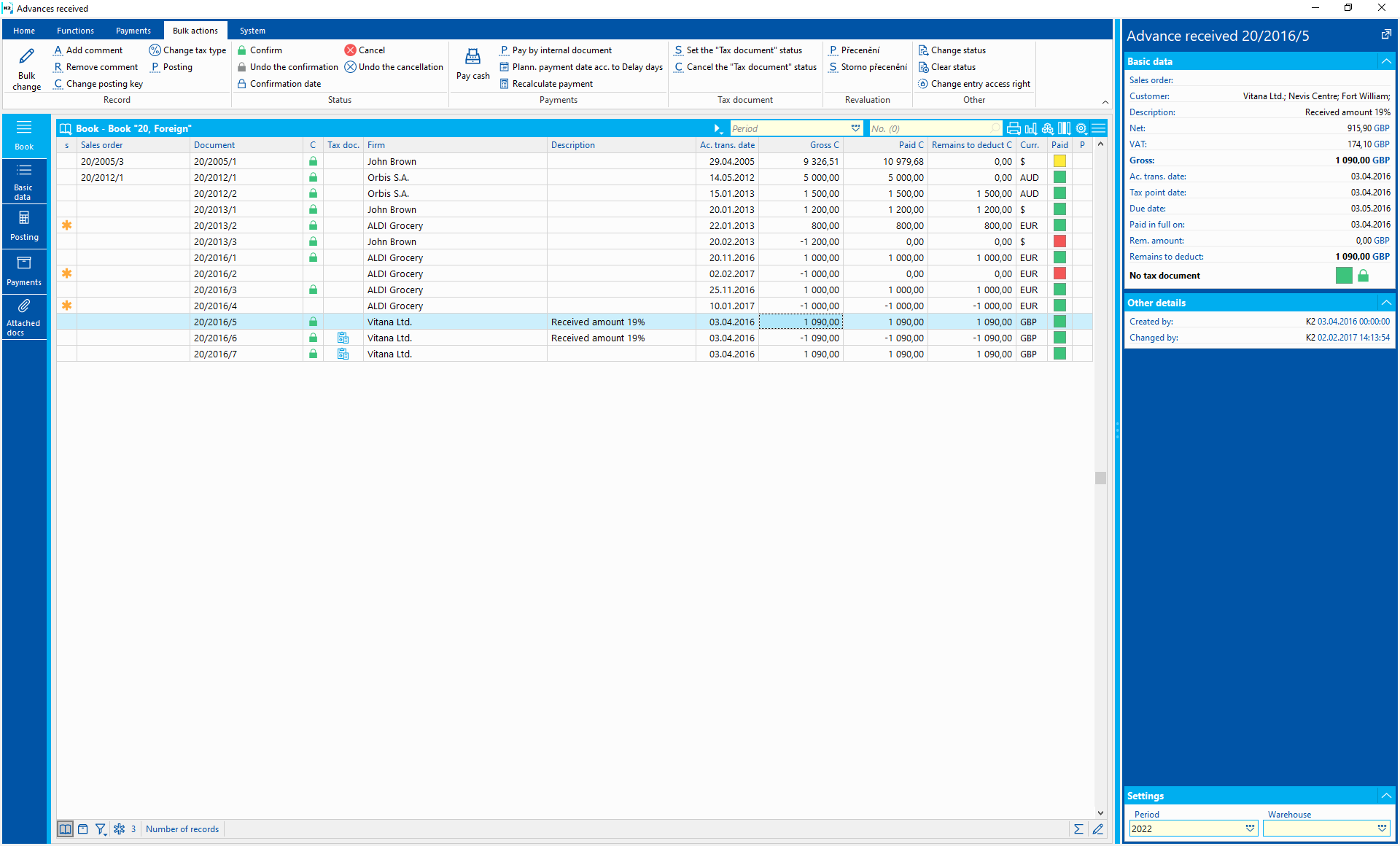

Bulk actions can be run on the records marked with asterisks or on the records in container.

Picture: Functions of Advances received module menu

Description of actions:

Posting key change |

For all marked documents in the container, it changes the values in the posting key field. |

Change Type of Tax |

The function for the bulk change of a tax type on unconfirmed documents. The change is reflected in the document header and in the items in which the same tax type was entered. |

Posting |

Bulk posting with account assignment |

Payment by Cash Register |

It executes automatic payment of advances by cash register. Closer description is in the chap. chap. Invoice Payment - Automatic Payment by Cash Register and Internal Document . |

Payment by Internal Document |

It executes automatic payment of advances by internal document. Closer description is in the chap. chap. Invoice Payment - Automatic Payment by Cash Register and Internal Document . |

Scheduled payment date according to Delay |

Update of the Scheduled Payment Date according to Suppl./Cust. Delay |

Payment Recalculations |

Function for mass recalculation of payments of advances received. |

Set the "Tax Document" status |

The function sets "Tax document" status on the paid advances with the checked VAT flag. |

Cancel the "Tax Document" status |

The function cancels "Tax document" status on advances that are not deducted. |

Revaluation to the Date of Balance |

This revalues Invoices on the date of balance by an internal document. Closer description is provided in the Accounting - Revaluation to the Date of Balance. |

Cancel Revaluation to the Date of Balance |

It cancels the revaluation to the date of balance. Closer description is provided in the Accounting - Revaluation to the Date of Balance. |

Functions over Received advances

Function description:

Alt+F3 |

Switching advance to the Tax Document status. Advance can be switched to this state, which has the VAT field checked, is confirmed and paid and has not yet been used on the invoice. |

Ctrl+F3 |

Cancel the Tax Document status This status can only be canceled if advance has not been used on the invoice. |

Shift+F2 |

Automatic Payment by Cash Register |

Shift+F3 |

Automatic Payment by and Internal Document |

Shift+F4 |

Create documents in bulk - repeated received advances. |

Shift+F5 |

This opens the form for creating reminders in the book. |

Alt+Shift+F2 |

Runs the form for changing the Invoice date above the corrective tax documents. Executable only on corrective tax documents. |

Alt+Shift+F3 |

Runs the function that processes a partially paid or overpaid advance - reduces or increases the amount of the advance according to the payment or divides the advance into two. More detailed description of this function is given in the chapter Partially paid / overpaid advance. |

Ctrl+Alt+F5 |

The function enables to choose the document Status. |

When confirming advance, it is checked whether only the types of taxes that may occur on advance are on the document. If there is another type of tax on the document, the message "There is a type of tax on the document that cannot be used on advance" is displayed.

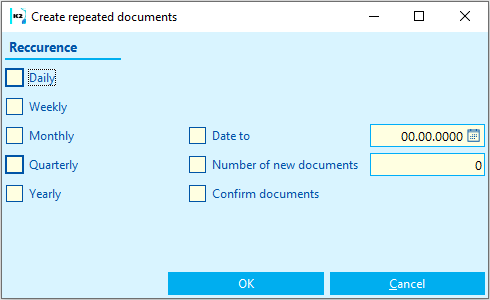

Create Repeated Advances Received

This function is designated for automatic generation of documents by "copying" the current document, when new documents differ from the current one only in the date. It is useful e.g. for creating a prescript of regular Advances.

After activating the function (Shift+F4), the input form of the function will appear:

Picture: The form of the Create Advances Received function

In the initial form:

- specify the frequency of repeating - set the option Daily, Weekly, Monthly or Yearly,

- check and specify the Date To (Acc. Trans. Date to which the documents should be created) or check and specify the Number of New Documents,

- you can check Confirm Documents.

New documents, the Acc. Trans. Date of which will be set according to the selected frequency of repeating, will be created after pressing the OK button. Due Date will be set according to the number of maturity days in the default document.

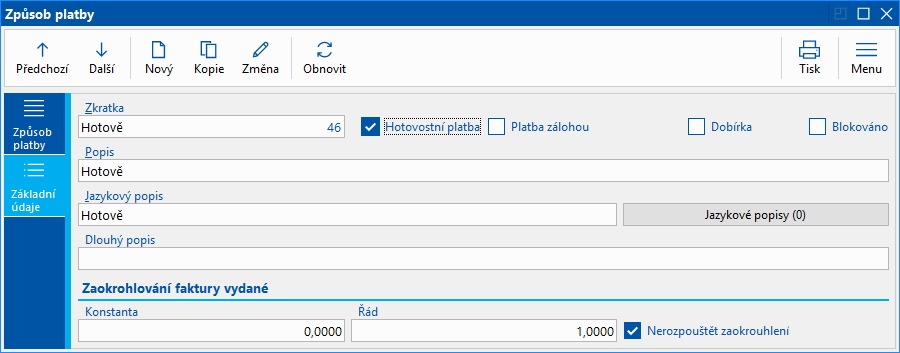

Rounding of Advances

When creating Advances Received in the domestic currency from a Sales Order, it is possible to set the rounding of the Gross amount depending on the entered Payment Method. Rounding is set in the 'Payment Method' code list. In the Constant field, enter the value to be added or subtracted to the rounded number before rounding itself (allows rounding up or down). The value that is to be rounded can be entered into the Order field.

Picture: The Setting of Rounding in Payment Method form

When setting the rounding according to the picture, the Gross amount will be rounded to the integer units. The Net amount and the VAT are rounded according to the Client Parameters.

If the rounding is not defined in the Payment Method, the Gross, the Net amount, and the VAT of a domestic Advance are rounded according to the Client Parameters.

The Gross amount of an Advance in a foreign currency (the Currency option is checked) is rounded depending on the settings of rounding of the entered Currency. The Net amount and the VAT of an Advance in a foreign currency are not rounded.

Rounding is executed during the issuing of the Advance Received, or during changing the Payment Method. The rounding difference will be allocated into the first item.

Methodologies to Advances Received

Process of Receiving an Advance From a Customer

We will now introduce you to the work with Advances Received within a business transaction step by step.

You can enter the payment as a cash voucher in K2 IS. If you need to make a cash payment immediately when creating a request for payment (see chapter Call for payment), we will use the Payments function on the received advance in the ribbon, select Payment by cash. Run the function with the Shift + F2. In displayed form, choose the cash register, set the payment date, enter the '100 %' amount and check the field Amount - remains to pay. The function creates a Cash Voucher for the amount that equals the Advance amount automatically, and that Cash Voucher will be matched with the Advance.

If the payment in cash preceded the time of the Call for Payment in the Advances Received book, you have an already existing Cash Voucher for the amount received (the Cash Voucher has to have the 'AR type - Advance Received'). Payment matching for an Advance is done by editing the particular Cash Voucher, when you enter the book, business year, and the number of a new Advance Received.

If the payment for the Advance is affected by the bank transfer, the payment by Call for Payment will be done by matching with the particular bank statement with the Advance Received. During automatic pairing (using the Ctrl + F3 keys above the bank statement in the Change), the deposit is automatically selected according to the variable symbol entered in the bank statement item, or at the same time according to the amount of Pay. If the appropriate Advance Received is found, the bank statement item changes the 'AR type - Advance Received' and the number of the AR will be added to the bank statement item. This way, the payment will be matched with the Advance Received.

You can do the matching manually, i.e. Change the type 'AR type - Advance Received' and select the particular Advance Received in the Change mode of a bank statement.

After you save the Cash Voucher or the bank statement which is matched to an Advance Received, the Advance will be fully paid and the field Set "Tax Doc." Status on Advances When Paid In Full will become checked in the book of Sale. The function is activated after you switch the Advance Received into the Tax Document state. After you save the payment of the Advance, the Invoice date is saved according to the date of payment automatically.

Each payment of the Advance increases the amount, which is able to be deducted on Invoices (Remains to Deduct field the Advance Received).

The filters for searching Advances are Unpaid Advance - For One Customer and Unpaid Advances - For All Customers. Select the range in which the Accounting Trans. Date on the documents will be taken into consideration at both filters. Moreover, you can select the books which the documents will be taken from.

A filter called Advances Not On TD helps to find the Advances which have been fully paid, have the VAT flag checked, and that are not switched into the "tax doc.". You can select the range in the filter, from which the Accounting Trans. Date on the documents will be taken into consideration.

The currency of an Advance and the payment is identical

The method of Advance payment in own company currency is the same as the one described in the Payment Received chapter.

In the payment form, there is a check box Set the advance rate according to the payment. If you want to pay an Advance with an exch. rate that is different than the Set Exchange Rate of Advance Acc. To Payment checkbox:

- - if the checkbox is checked - the exch. rate will be overwritten according to the exch. rate of the payment,

- - if the checkbox is not checked - the exch. rate will not change and an exchange rate difference will be created.

When paying an Advance in a foreign currency, if the Advance exch. rate differs from the exch. rate of the Cash Voucher and the bank statement, the following situations may occur:

- When manually selecting advance on a cash receipt or bank statement, you will be asked: "Do you want to change exchange rate of the advance according to the document exchange rate?". If you agree, the exchange rate on the Advance will be changed automatically according to the payment exch. rate. If you choose "No", a new exch. difference will be created during the payment.

- Automatic Matching - a new checkbox "Exch. Rate of Advance Accor. to Payment Exch. Rate" is on the form "Automatic Matching" of a bank statement. If the field is checked, the exch. rate on the Advance changes according to the exch. rate on the bank statement. If the field is not checked, a new exch. rate will be created during the payment.

- Upon homebanking matching via the HB - Bank Statement script, the exch. rate will be overwritten according to the payment exch. rate.

The advance is in own company currency and the payment is in a foreign currency

- When manually pairing an advance, when changing the amount or rate of payment, you will be asked: "Do you want to change the amount of the advance accor. to the document exchange rate?" If you agree, the Advance in own company currency and the Gross Advance will be counted according to the payment (i.e. the payment amount in the currency * payment exch. rate); the Net and VAT of the Advance will also be counted. If you choose "No", the payment will be matched, but the data on the Advance will not change.

- Automatic matching - if the field "advance rate according to the rate of payment" is checked, the advance will remain in the currency of your own company and the gross advance will be calculated according to the amount of the payment (ie the amount of the payment in currency * payment exch. rate). The Net and VAT of the advance will be calculated as well. If the field is not checked, the payment will be matched, but the data on the Advance will not change.

The advance is in the Client currency and the payment is in a foreign currency

If you match a payment to the Advance, the data in documents will not change. In the case of automatic matching, the Set Exchange Rate of Advance Acc. to Payment flag does not work and it is necessary to correct the Advance manually (an Advance from item payment has to be undo-matched, then change the rate in the Advance and match it again).

Note: Exchange difference cannot be created upon the Advance payment. Exception is advance - corrective tax document.

You have received a specific amount as the Advance payment from a customer. Realize and invoice the Sales Order. The Result Tax Document will contain the deduction of the already paid amount.

The following situations may occur:

- the Advance Received is equal to the invoiced amount for a complete Sales Order,

- the Advance Received is higher than the invoiced amount for a complete Sales Order,

- Received Advance is lower than the Invoiced amount for a complete Sales Order.

In the K2 IS, we solve the Advance accounting with the so-called Deduction of the Advance on the Invoice. Drawing on the advance will reduce the total amount of the invoice by the amount drawn from the advance, thus adjusting the tax recapitulation and ensuring the correct values in the VAT return, provided that the tax rate and type of tax were correctly filled in the received advance.

Firstly, search for the Invoice Out. For faster orientation, whether there is a down payment for the given invoice, bitmaps are displayed for the invoice in the panel on the right, which inform about the existence of paid undrawn advances:

informs the user about the existence of a paid undrawn advance for the contract / customer.

informs the user about the existence of a paid undrawn advance for the contract / customer.

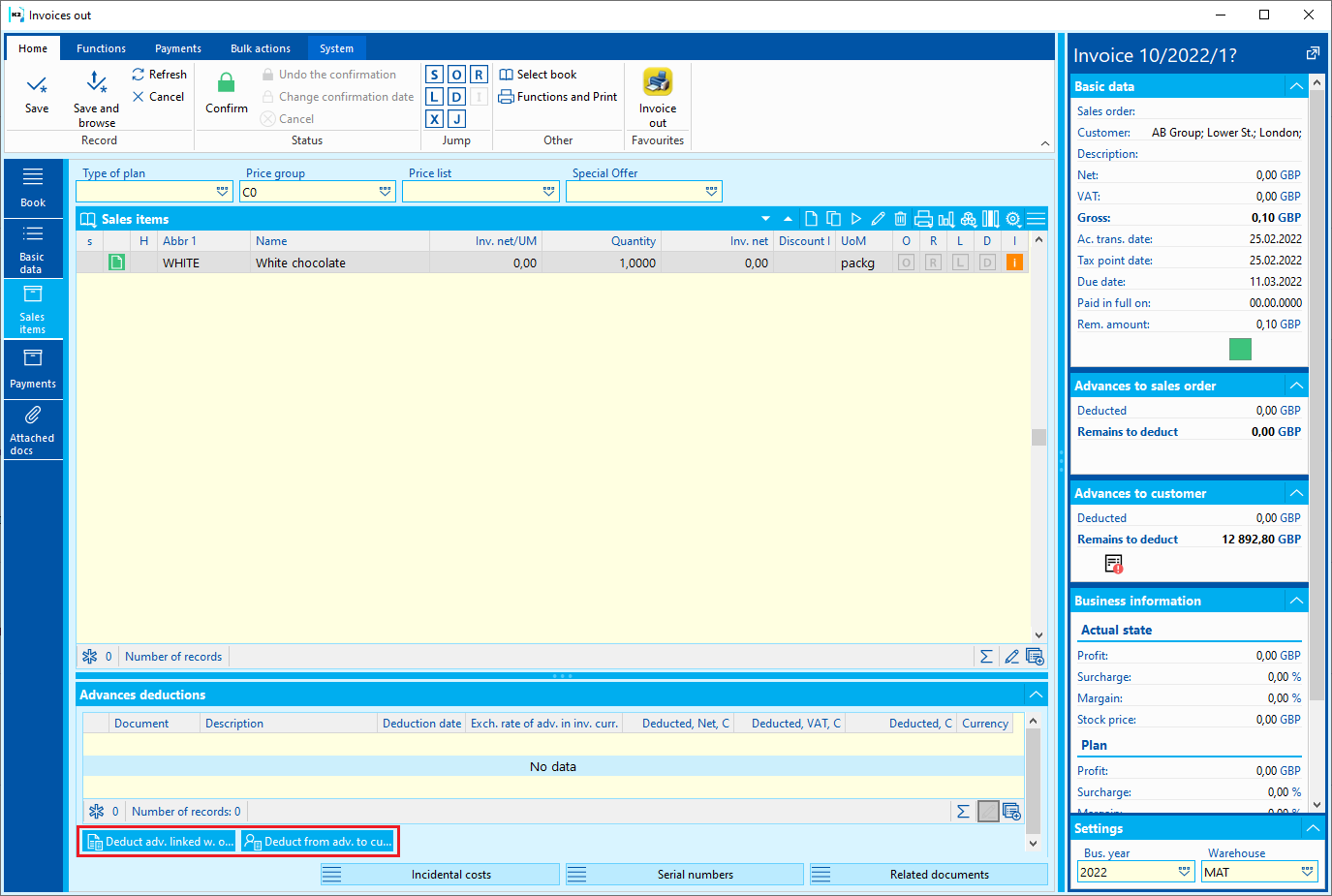

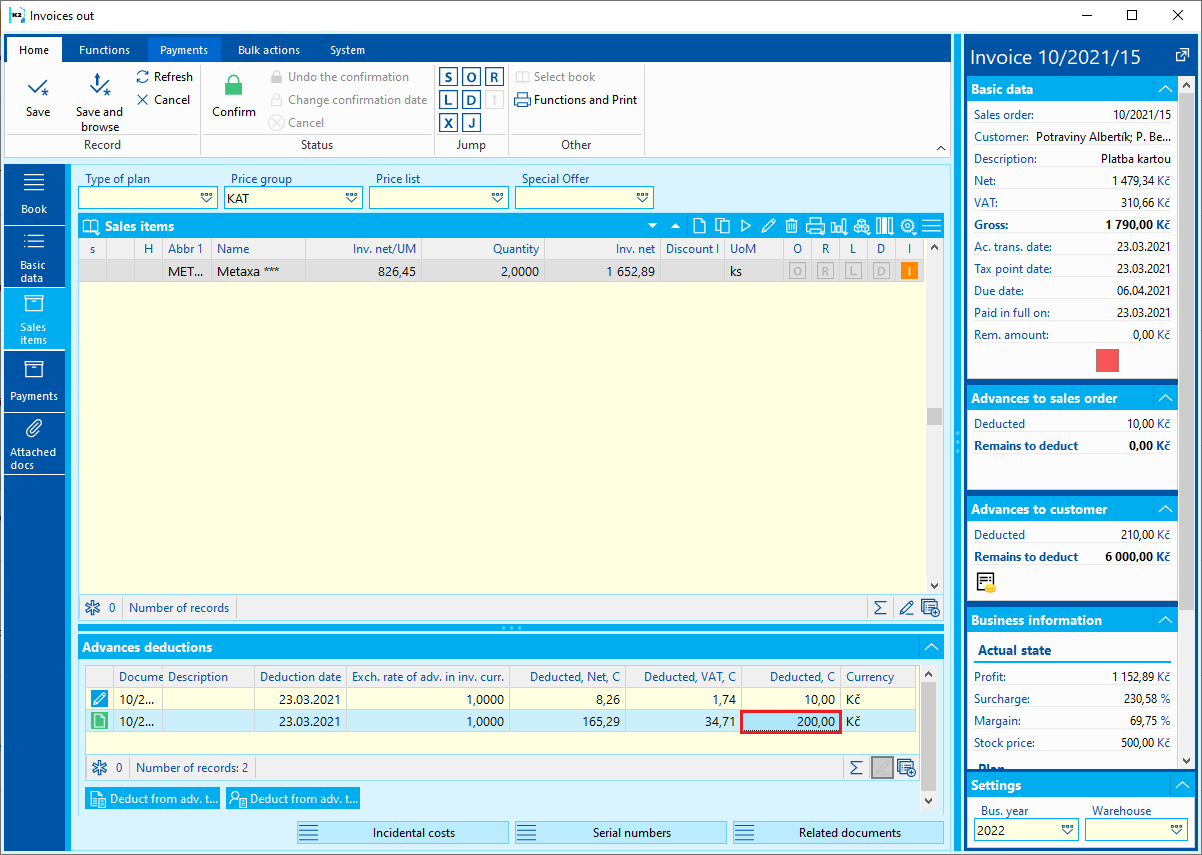

Switch the Invoice Out to the Change mode. On the Sales Items tab, we will either use the Draw of advance for the contract button or Drawn of advance to the customer. The difference between the buttons is that the Deduct Advance Linked with Sales Order is used with an assigned Invoice Out (it contains a superior document - a Sales Order) and after pressing the button, the Advance will be offered to the identical Sales Order. In multi-documentation Invoices, all Advances are displayed to all Sales Orders on the Invoice. Use Drawn of advance to the customer button with an Unassigned Invoice (it does not have a superior document - Sales Order). After pressing this button, the Advances linked with the Customer from the Invoice are offered. In both cases, you will have the options to deduct the amounts of Advances up to the maximum amount.

Picture: Invoice Out - Sale items - buttons for Advance drawning

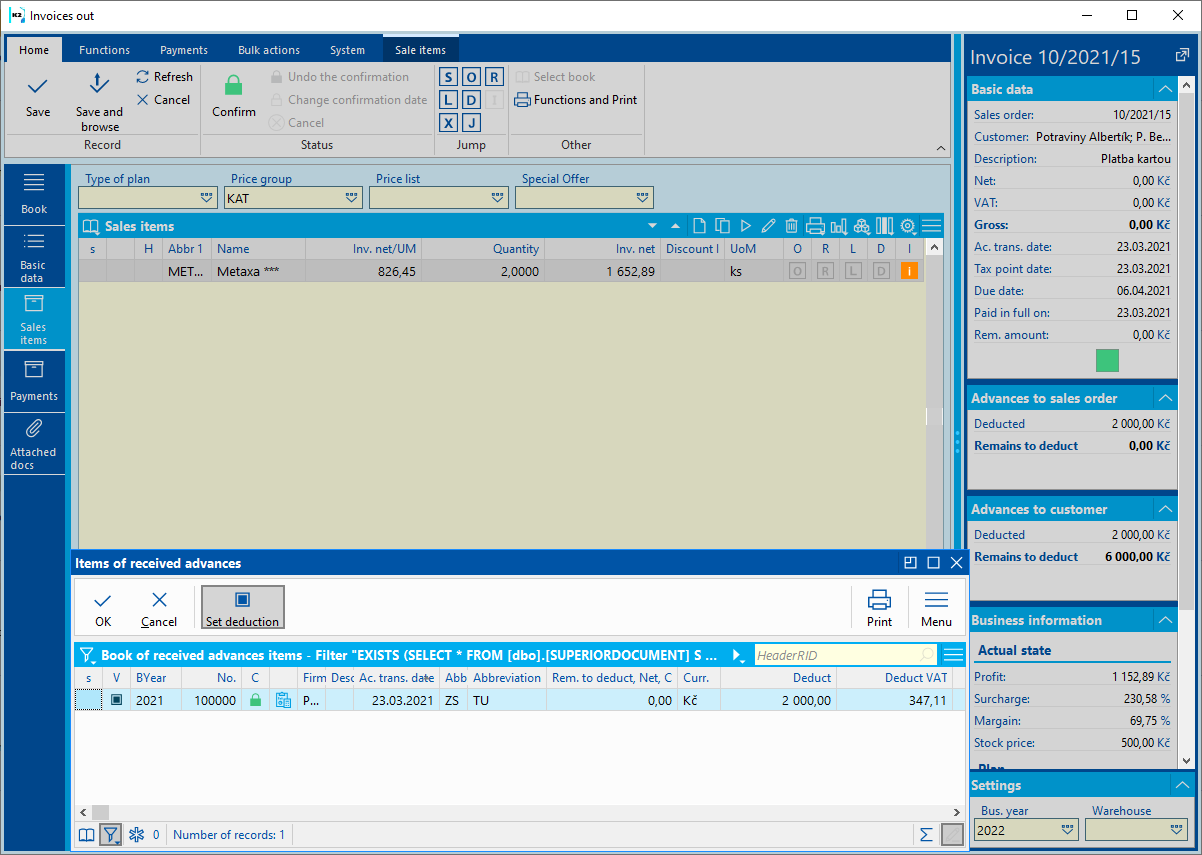

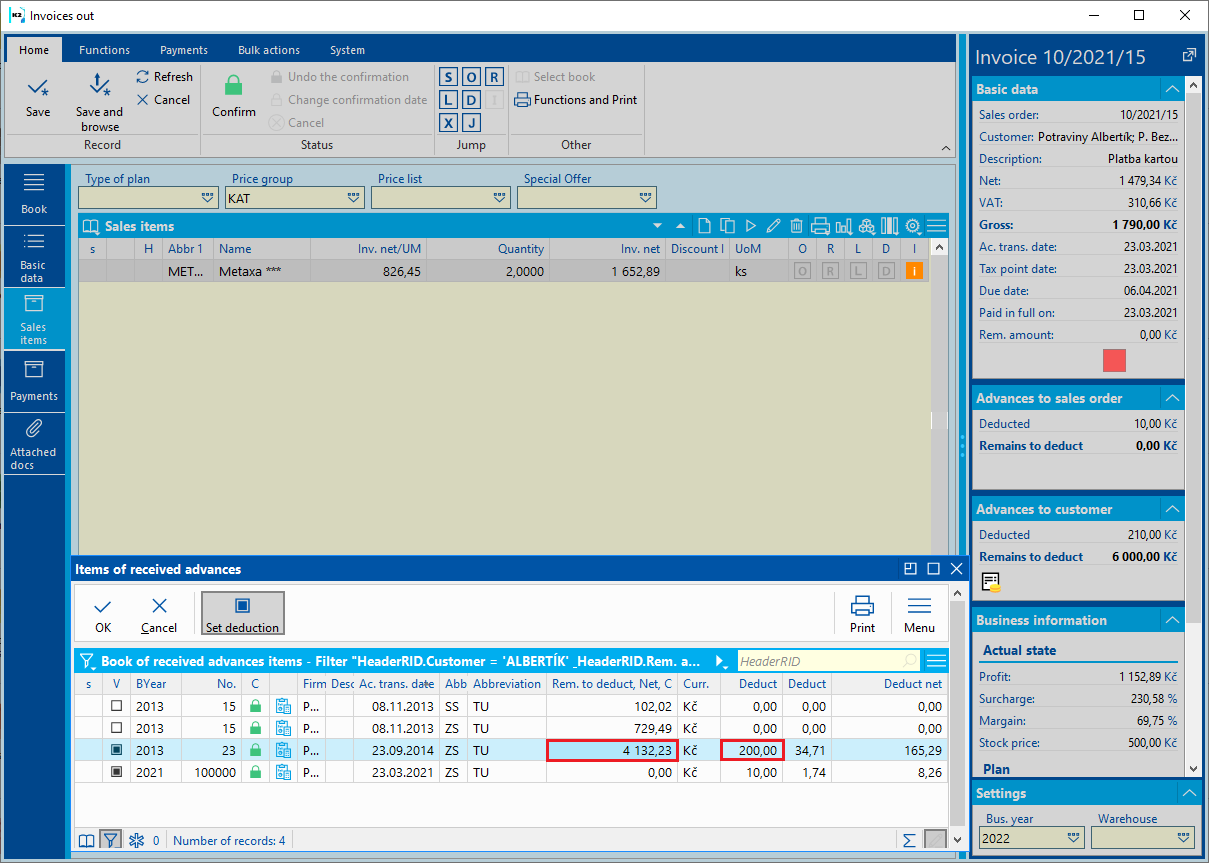

In the displayed list of Advances, the Advances are indicated with a black square in the V column. The amount to be deducted is specified there (the Drawn column). The user can change the deducted amounts, cancel the selection of the Advance, or select another Advance. When the selection of Advances and deducted amounts is executed, the deduction is added to the Invoice by the OK button or by pressing the Ctrl+Enter keys.

Picture: Setting of the deducted amount

If the amount of an Advance Received equals the total invoicing amount, the result amount of the Invoice after the deduction will be zero.

Picture: The deduction of an Advance with the amount identical to the amount of the Invoice

If the amount of the Advance Received is lower than the invoiced amount, you can deduct the whole Advance on the Invoice. When indicating such an Advance, the K2 IS will offer the whole amount of the Invoice. In that case, it depends on the specific situation whether the user will leave the deducted amount in this amount, or they will decrease it. In the case of decreasing, the whole Advance will not be deducted.

After saving the deduction, the amount will remain to be paid off on the Invoice.

Picture: Deduction of an Advance with the lower amount than the Invoice value

You can change the list of deducted Advances on an Invoice easily:

- by pressing the Ins key, you can add other Advance deductions,

- by pressing the Del key, you can delete the Advance deduction,

- or change the amount drawn directly in the column Deduct C. after pressing the Enter key (the changed amount is then confirmed by pressing the Enter key again).

In the list of deducted Advances, you can also simply switch to a particular Advance with the Enter key, or by "double clicking" on the left mouse button.

In the table with the offer of advances for drawing, you can also enter the amount of drawing in the Draw net column. The user enters any Net amount, and the Gross amount will be calculated by the VAT coefficient (and by the VAT cross and Tax doc. marking). The VAT, which is rounded by the Client Parameters, will be calculated from the Gross amount. The calculated VAT will be added to the Net amount that is entered by the user and the sum is used as "Deduct". This means that what the user has entered along with the VAT results in entering the Net amount. Net amount can be entered only if there is no "Calculation Vat from Above".

You can deduct the Advances that have been paid off in various currencies. If the currency of the Invoice is different from the currency of the deducted Advance, the amount of deduction will be recalculated according to the currency of the Invoice. The Exchange rate of deduction (i.e. the exchange rate of the Invoice) is entered from the Exchange list according to the date of the Advance. If the exchange rate list is not regularly updated and the exchange rate is not specified in the given date, it is necessary to adjust the drawing rate manually, on the invoice in the Sales items tab in the Advance drawing form in the Exchange rate column in I currency.

To search for invoices on which a deposit has already been drawn, use the filters Invoices with applied advance - for one supplier (in K2 we can find it under the name Applied advances-for 1 supply) and Invoices with applied deposit - for all suppliers (in K2 we can find it under called Advances paid-for all deliveries.) . Select a range, in which the Date of Execution on the documents will be taken into consideration at both selections. Further, you can select the books from which the documents will be taken from.

A Received Advance contains the Debit account and the Credit account directly in the header of the document. Both accounts can be predefined in the Books of Sale, which means you can ensure the inserting of Debit and Credit accounts into all newly created Advances Received in the book. For the pre-definition in the Books of Sale, select the most frequently used accounts for posting of Advances Received. If you record an Advance that should be posted to different accounts in the book, you can change the accounts immediately when creating the Advance, eventually later via the Change Posting Key bulk action (Form / Bulk Actions / Change Posting Key).

As well as the accounts, a posting key by which the Advance will be posted is inserted into a Received Advance. The Posting key of an Advance Received may be predefined in the Books of Sale. The predefined posting key can be naturally edited similarly as described above for the Credit and Debit accounts, i.e. via the Change Posting Key function (Form / Bulk Actions / Change Posting Key).

An Advance Received which has a Credit and a Debit side account and a Posting key defined, and which is also confirmed, is ready tobe posted. Posting:

An Advance Received is always posted after it has been paid off. Create a filter of the confirmed and paid Advances per the business year in which you want to post them, and post them in bulk (the Ctrl + F7 keys over the selected Advances).

If the Tax Document status is changed on a posted document, the Posting and Settlement flags are always removed. It is necessary to post the document again.

The standard way in which you can charge a Tax Advance Received is as follows:

Net price |

Debit account from the Advance Received / Credit account from the Advance Received |

100,000 GBP |

the amount of VAT |

the Debit account from the Advance Received / 343 |

20,000 GBP |

In standard way, you can charge a Non-Tax Advance Received as follows:

Gross price |

Debit account from the Advance Received / Credit account from the Advance Received |

120,000 GBP |

In standard way, you can charge an Invoice Out with the deduction of tax Advance as follows:

the Net amount - supply |

the account from the Invoice Out / Revenue Account |

200,000 GBP |

the Net amount of the deduction of the Advance |

the Debit account from the Advance Received / the account from the Advance Received |

100,000 GBP |

the amount of VAT |

the Debit account from the Invoice Out / 343 |

20,000 GBP |