Round Documents

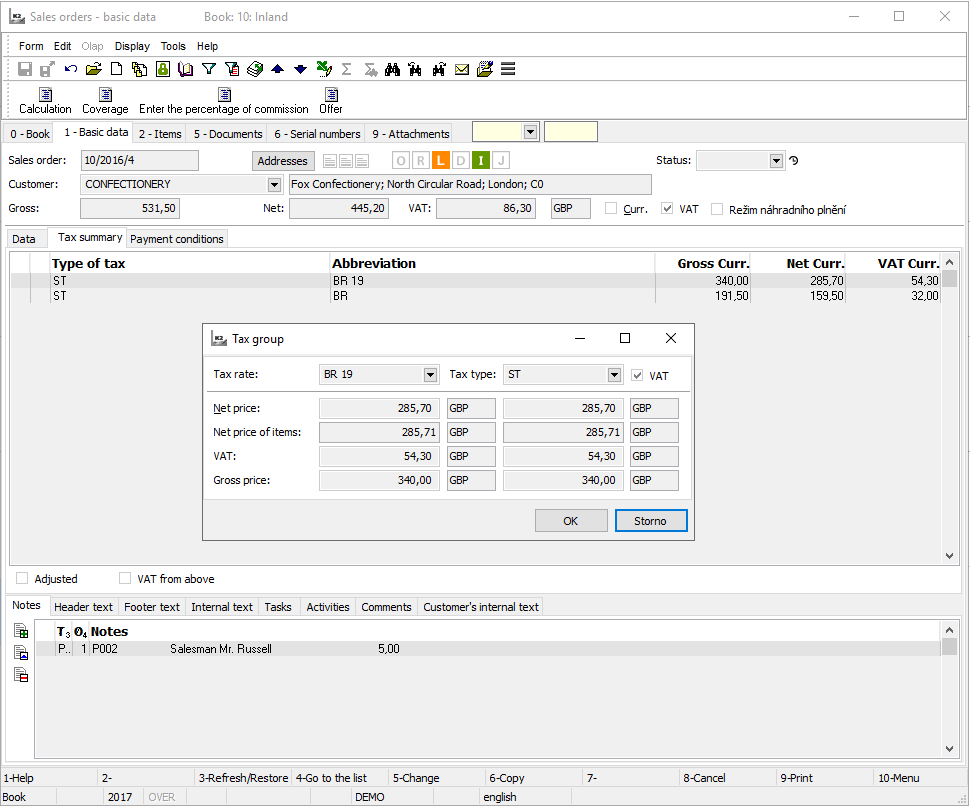

On the Tax summary tab on the 1st page of a document, it is possible to consult the table of tax group totals. A list of all the VAT rates, that were used in this document, is displayed in the upper part of the document. There are VAT amount, Net amount and of course Gross amount in each row. These values are rounded off according to the setting in the Client parameters. If you press the Enter key on the row marked by the light indicator (the Adjusted checkbox under this part of the form is automatically checked in the Browse mode), a table of tax groups in total is opened. You can edit the values there.

Picture: Sales order - the Tax summary tab with the open form Tax group

We can also round off the Gross value on Invoices Out in the client currency depending on the method of payment used in the selected document. E.g. we may want to round out the invoice paid in cash in a different way than the invoice paid by a bank transfer. When using this functionality, which is further described in the Rounding of Domestic Invoices in dependence on Payment Method methodology, the document will be rounded during saving. If the Do not allocate rounding field is off on the payment method, the rounding difference will be allocated into the Net and VAT in order to the summation being correct.

If you need to change Gross in an Invoice in to a value different from Net + VAT, use the Gross button, which is more closely described in the chapter Purchase - Invoices In - Invoices In Book - Basic Data (1st page).