Modules

Basic code lists and Supporting Modules K2

Suppliers/Customers

Suppliers/Customers book provides all needed data of suppliers and customers. Due to the fact that their data are similar they are recorded in one database.

When you create a new Suppl./Cust. card, in K2 system a number is automatically assigned under which each Suppl./Cust. is uniquely identified throughout the K2 IS. This means that the change of a partial data in the card does not break the connection between this card and documents. You can change only these data which do not question the identity of a Suppl./Cust. If there is any change in important data (e. g. because of a name, an address), you have to invalidate existing Suppl./Cust. card and create a new one, see bellow. If you only change the address on existing card, you can print the old documents with original data again. The correctness of the addresses is ensured by the Address History form described in more detail in the chapter Basic functions - Addresses chapter.

It is not possible to delete the card from the database Suppl./Cust. You can execute only its making records invalid namely by pressing of the F8 key. Making records invalid means that the cards aren't visible in the Book mode and it isn't possible to work with them. The inactivated cards are accessible only in Evaluation filter off/on. On the 1st page of the card a red check mark is visible in the top right part. By again the pressing of the F8 key you can make an appropriate record invalid again.

Note: For displaying of the inactivated records in the Book mode too it is possible to turn on the option Display inactive entries on the tab General in the Clients parameters.

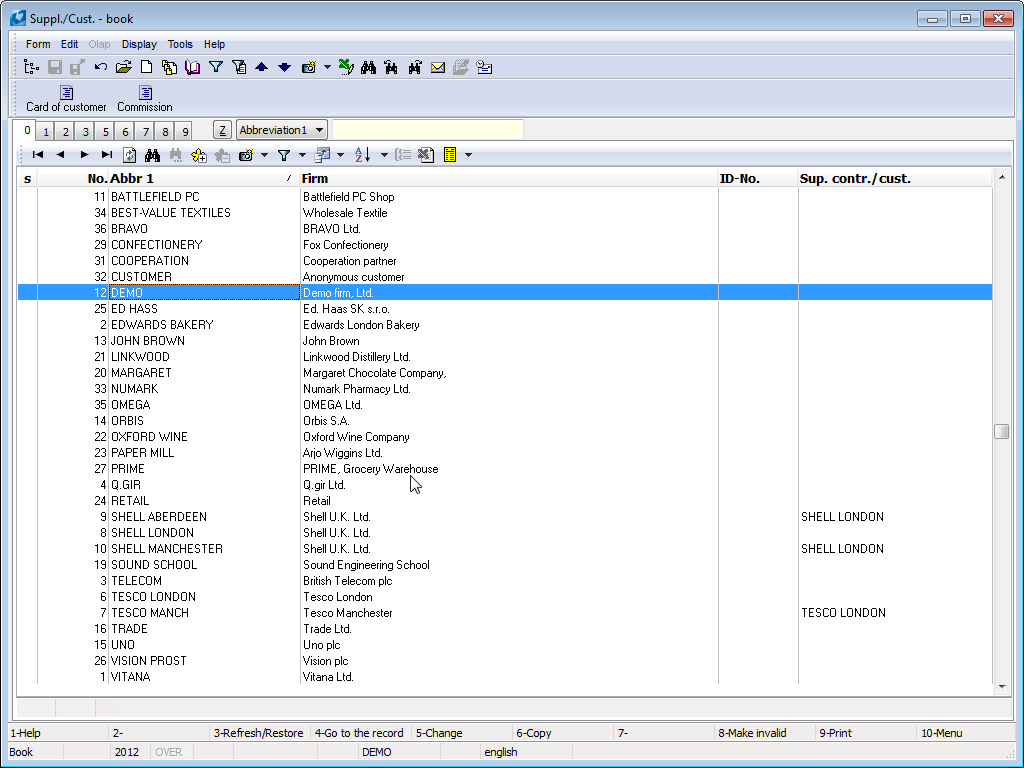

Suppliers/Customers book

Picture: Suppliers/Customers book

The Suppliers/Customers book is sorted by following options:

- No. - automatically assigned number. After checking the option Enter suppl./customer numbers in the Client parameters it is possible to enter this number. Search field is numeric.

- Abbreviation 1 - obligatory data of every card. Two cards cannot have the same abbreviation. Search field is character.

- Abbreviation 2 - optional data of every card. Two cards cannot have the same abbreviation. Search field is character.

- ID-No. - obligatory data of a card. Two cards can have the same ID-No. Search field is character.

- Firm - name of company - obligatory data. Two cards can have the same name of company. Search field is character.

Switching between the particular sorting is done by Alt+Z keys. After the switching on other sorting if the fast filter was turn on, this filter will turn off. Listed above enumeration of the sorting is also accessible during the on evaluation filter (moreover here is enabled sort of data according to users sorting too).

Supplier/customer card

Supplier/customer card is divided to the nine pages. Detail information of Suppl./Cust. card you can see in Browse mode, if you select by the light indicator on it in the Suppl./Cust. book and you press the F4 key or Enter key or you switch mode to the Change mode by pressing of the F5 key.

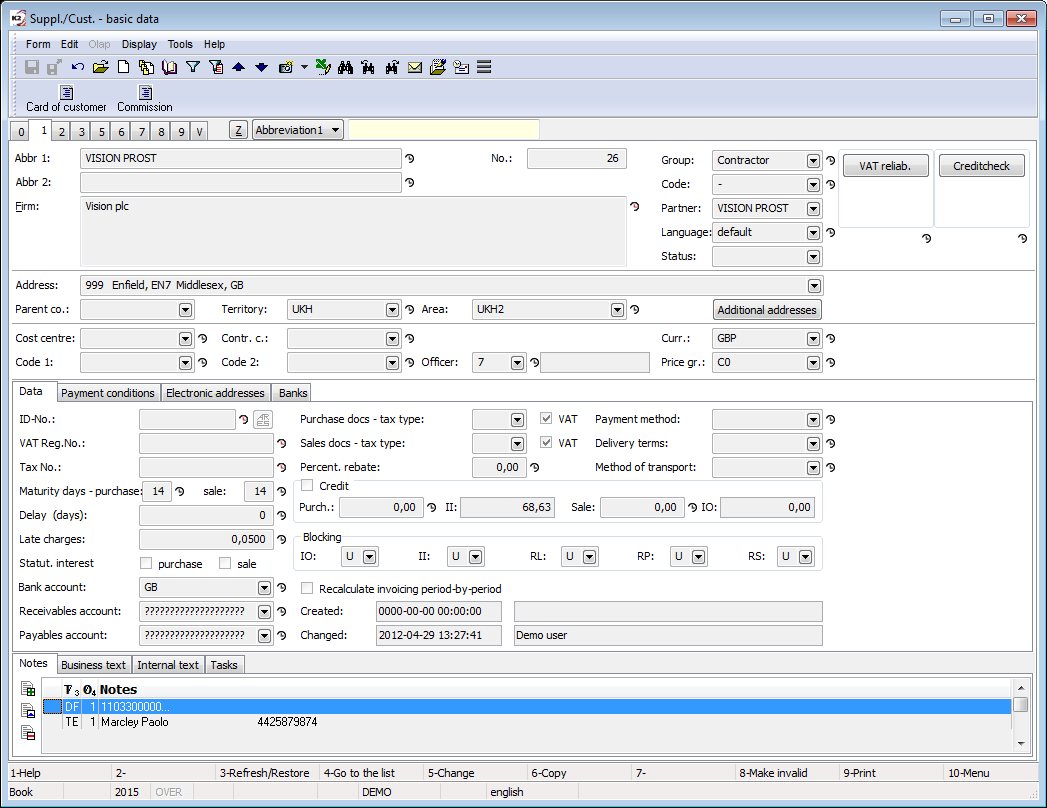

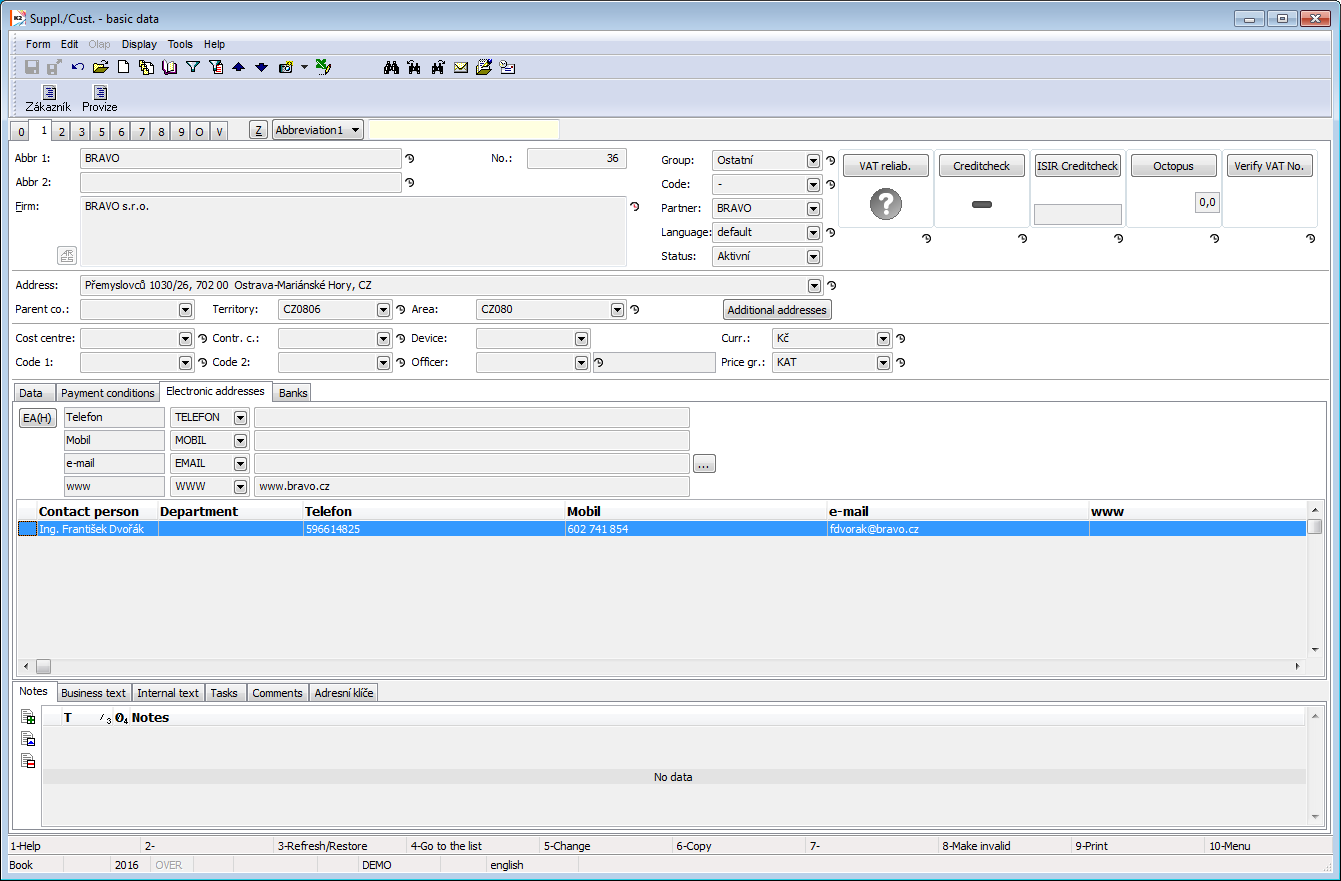

Basic data (1st page)

On the 1st page of Suppl./Cust. all important data about individual suppliers and customers are given. The field of headings (Abbr 1, Abbr 2, Firm) are displayed on the other pages of the Suppl./Cust. card.

Picture: Suppl./Cust. - 1st page

Description of Fields:

Abbr 1 |

Abbr 1 is name of a company, part of the name or random code (for example numeric). It serves for a quick searching of the firm. Obligatory detail. |

Abbr 2 |

The field serves as the second searching key. |

Firm |

The field serves for inserting of whole name of a company. The field is versioned. The ARES button is by the field Firm . When you create a new customer and fill in at least a part of the name in the Firm field (the whole word must be entered) and then pressing the ARES button, you can see the possible company names from the ARES database and the user can select a specific record (without filling in the full name of the company). After selecting the record, the ARES information is imported (see the chapter ARES in the part of Marketing). |

No. |

It is a registration number of an company which is created automatically during the first saving of the Suppl./Cust card. Actually a registration number is an order number of entered company. Note: In the Client parameters on the 2nd page it is possible to check the option Enter suppl./customer numbers which enables to manually enter an article suppl./customer number on a new card. Obligatory data. |

Group |

A group is a random number or text. Every supplier/customer has got obligatorily assigned some group. You can divide the Suppl./Cust. database according to a group, e. g. to a supplier, to a customer etc. Obligatory data. |

Code |

With codes you can divide the Suppl./Cust. database to the smaller units, e. g. a customers group you can divide to retail and wholesale etc. If you doesn't want to use this division, you will fill dash. Obligatory data. |

Partner |

The field serves for quick switch from a Suppl./Cust. card to a Partner card. If a partner does not exist on the card Suppl./Cust., you can select him from the Partners book. |

Language |

Language, in which the documents for appropriate supplier/customer, will be printed. |

Status |

Status of a customer. Field history is available on the connected partner. |

VAT reliab. |

Button, after its pressing it is verified, whether the customer is not published as an unreliable payer. Verification is executed only at customers, VAT Reg. No. of which begins with abbreviation CZ. After verification, these information will be get into the button:

The service settings is executed in the tree menu Finance/Basic data/Configuration of reliability of VAT payer. |

CreditCheck |

Button for assessment of creditworthiness of the customer by using CreditCheckservice. After executing this assessment, the appropriate "semaphore", that shows us the result of this assessment, will be displayed here. For the further information about this function see the CreditCheck chapter. |

ISIR CreditCheck |

Button for customer assessment by using ISIR service. The further description of this function is stated in the ISIR CreditCzech system in K2 IS chapter. |

Octopus |

Button to start the analysis of the customer's system Octopus. The further description of this function is stated in the Octopus chapter. |

Verify VAT No. |

Button for verify the validity of the tax identification number (VAT Reg.No) allocated for the purposes of VAT in a member state of the EU. After verification, these information will be get into the button:

The service settings is executed in the tree menu Finance/Basic data/Configuration of the Verification of VAT number service - VIES. The further description in the Verification of VAT number by VIES systemchapter. |

Address |

The field for defining of a whole address. When you change the address (e.g. when the customer's physical address changes), it is necessary to fill in the date to which the change applies in order to preserve the address history. This affects the display of the correct address, e. g. in standard purchase and sales reports. Example: On October 10, 2018, you find out that as of October 5, 2018, the customer FIRMA XY changed its registered office and moved from Hlavní třída 15 to Ostravská 8. On the FIRMA XY customer card, change the street and set the date 5.10.2018 in the Valid from field (it will be available after editing the fields for the address). This step ensures that if we issue the document after October 5, 2018, you will have the correct address "Ostravská 8" in the (standard) press reports. If you print the document before October 5, the original address will be there. If the user changes the address due to, for example, a typo in the address, then it is enough to make a correction and the field Valid from is not filled in in this case. If you do not fill the date, the current address will be rewritten without saving to the history. It is therefore necessary to distinguish whether we make changes in the address due to, for example, moving the supplier / customer or due to a typo, a grammatical error. |

Parent co. |

You can use it for defining of a superior supplier/customer e. g. if you supply the articles to a customer who represents a branch, a warehouse, a shop, ..., and who belongs to a customer with a different registered office. |

Territory |

The field can serve for evaluating of suppliers/customers. By pressing Ins or F6 key you can insert a new Territory. |

Area |

The field can serve for evaluating of suppliers/customers. You can use the code list for dividing of a larger area (e. g. you can divide an area according to the territories). By pressing Ins or F6 key you can insert a new area. |

Additional addresses |

This button enables to enter to a certain Supplier/Customer the addresses that will be automatically entered in an Addressee in the purchase and sale documents. A detailed description of usage of these addresses is in the Purchase and Sale Shared Elements - Addressee chapter. |

Cost centre |

A cost centre of a firm. After selecting of a supplier/customer it will be copied in the purchase/sale documents. |

Contract code |

Field which can serve for evaluation. It enters into the accounting. Documents, that are related to an appropriate supplier/customer (invoice, sales order etc.), take up a contract code, that is entered on the Suppl/Cust. card. |

Device, Code 1, Code 2. |

It serves for user identification. Data are copied to the purchase and sale documents. |

Officer |

It enables to assign a responsible person from the Officers book. Detail is copied to the purchase and sale documents. |

Currency |

Currency in which you deal with supplier/customer. By pressing F12 key the Currency book with list of the currencies displays (see the chapter Currencies). |

Price gr. |

Field Price group indicates to which price group is customer sorted. Price group is, next to the fields Code and Group, one of the resolution criterion for division of the Suppl/Cust. database to the smaller units. Price groups are mutually different by size of price surcharge or discounts in the sale of articles. IS K2 enables to define even 255 price groups (see the chapter Articles - Selling prices - Price groups). Obligatory data. |

Branches |

The list of Suppl./Cust. branches from the Branches book. The button is available only in Universal forms. |

There it is possible to work with notes by using the Notes, Business text and Internal text tabs on the 1st page of the Suppl./Cust. card. As Business text, the note (supplement) of DH type will be inserted. This note can be parametrically printed on the purchase and sale documents. The same tab is displayed on the 1st page of a Sales order, but it is not possible here to change the content of a note. As an Internal text is inserted the DF note (supplement), that is determined for an internal information and is not set to a print anywhere. On Sales order and Purchase order documents is Internal text only displayed in the Customer´s internal text, espec. Supplier´s internal text tabs. The further description of the work with notes is stated in theBasic Code Lists and Supporting Modules K2 – Notes chapter.

The tab Address keys is used for work with discount coupon. In Change mode, you can assign address keys to customer or delete existing ones. By pressing Ins you get to the Address Keys list. Here you can create additional keys, edit existing, confirm or undo confirm records. If customer is assigned to the Address key then the customer appears on the 1st page of the given key in the list of customers.

In the Activities tab you can add, edit and delete activities. Activities tab on the Cust./Suppl. card is the same tab as on the Partner (technically speaking, it is the display of the Partner's activities on the Cust./Suppl. card), therefore the work with activities will be reflected on the tab of the same name on the Partner's card and vice versa.

The check box Employ employees with disabilities means, that this Supplier employ more then 50% disabled employees. Based on this check box, on the purchase item of document with this supplier is default ticked by the Document for deduction. Check boxes are used to create an attachment to substitute fulfilment in the framework of the Fulfilment of the obligatory share PWD.

The Basic data tab contains the basic information about the doc.

Fields description:

Comp. Reg. No. |

Identification number of an organization. The field can be automatically created on the basis of another number (see the chapter Setting of pre-filling of the tax numbers). |

|

|

Before starting, it is necessary for the user to get acquainted with the rules for using this service (see the pages of the Ministry of Finance or the ARES chapter in the Marketing section). If the conditions are violated (especially in terms of the number of queries (one query = one record from the book Suppl./Cust.), the service may be blocked for the given user! The button activates the function ARES for filling the company data according to ARES database. According to the defined ID-No, it searches a company in the database and fills the company name and address into the Suppl./Cust. card. Updated records are saved into the history of fields with a current date. For a more detailed description, see the ARESchapter in the Marketing section. The button is not displayed if specified in the ARES Service Parameters. |

|

|

ISDS (data box information system). Note: the button is only available in the universal user interface. The button starts the ISDS function and searches the company for a company in the database and adds it to the Suppl./Cust. tab. company name, address and data box identification. Updated records are saved into the history of fields with a current date. For a more detailed description, see the ISDS chapter in the Marketing section. The button is displayed if it is enabled in the ISDS Parameters. |

|

VAT Reg. No. |

Tax identification number of an organization. The field can be automatically created on the basis of another number, see the chapter Setting of pre-filling of the tax numbers. After changing the VAT number, all fields related to the reliability of the VAT payer will be deleted upon saving. The field is versioned. |

|

Tax No. |

Tax No. is used only in some countries (not in Czech Republic). The field can be automatically created on the basis of another number (see the chapter Setting of pre-filling of the tax numbers ). The field is versioned. |

|

Bank account |

Your bank connection determined for payments with business partner. The bank account will get to the Suppl./Cust. card from the Customer in the Administration of own companies. Obligatory data. |

|

Bank Account - purchase |

Bank Account for payment |

|

Receivables account |

Receivables account of customer. The field is used in case when you use more analytical accounts e. g. for inland customers. In setting of the Books of sale in this case you won't fill the field Account. When the documents is issued, an account from the Suppl./Cust. card fills to the invoices out, not from setting of the Book of sale. On the new Suppl./Cust. card will automatically fill out an account entered in own company. |

|

Payables Account |

Payables account of Supplier. Field is used in case when you use more analytical accounts e. g. for inland suppliers. In setting of the Books of purchase in this case you won't fill the field Account. During the documents issuing an account from the Suppl./Cust. card fills to the invoices in, not from setting of the Book of purchase. On the new Suppl./Cust. card will automatically fill out an account entered in own company. |

|

Accounts for advances received |

Customer accounts DR and CR. Fields are used in case when you use more analytical accounts e. g. for inland customers. In the Books of sale settings, then we do not fill out the Dr account for advances and Cr account for advances. During the documents issuing an account from the Suppl./Cust. card fills to the advances received, not from setting of the Book of sale. On the new Suppl./Cust. card will automatically fill out an accounts entered in own company. |

|

Accounts for advances provided |

Customer accounts DR and CR. Fields are used in case when you use more analytical accounts e. g. for inland customers. In the Books of purchase settings, then we do not fill out the Dr account for advances and Cr account for advances. During the documents issuing an account from the Suppl./Cust. card fills to the advances provided, not from setting of the Book of purchase. On the new Suppl./Cust. card will automatically fill out an accounts entered in own company. |

|

Purchase documents - Tax Type, VAT |

If the Tax type is filled in, it has priority over the Type of tax in the Purchase book. By checking of the field VAT you determine that you create purchase documents with VAT to a supplier. |

|

Sale documents - Tax type, VAT |

If the Tax type is filled in, it has priority over the Type of tax in the Book of sale. By checking of the field VAT you determine that you create sale documents with VAT to a customer. |

|

Payment Method |

Supposed way of financing with an appropriate supplier/customer. It is then automatically copied to the purchase and sale documents. |

|

Delivery terms |

Delivery terms of article. It is then automatically copied to the purchase and sale documents. |

|

Method of transport |

Supposed way of transport which automatically copies to the purchase and sale documents. |

|

Percent. rebate |

Here you enter percentage rebate which then is offered for application on inserting documents of purchase/sale (see the chapter Purchase and Sale Items (2nd Page)). |

|

Priority |

To set the priority for payment. It is then automatically copied to the purchase and sale documents. |

|

Credit |

By checking the field Credit you define that you will watch credit of customer. During the confirmation of an invoice out the IS K2 will control if the credit isn't exceeded in the entered field Purchase. During the excess credit the IS K2 will warn. |

|

|

Purchase |

Field doesn't enter, it hasn't practical meaning. |

|

Sale |

Maximal extent of the credit (obligation) for customer. |

|

II |

Current state of your payables towards supplier displays in this field. By paying of invoice in the amount decreases, by confirming of invoice in the amount increases. |

|

IO |

Current state of your receivables towards customer displays in this field. By paying of invoice out the amount decreases, by confirming of invoice out the amount increases. |

Blocking |

By blocking you can avoid undesirable issuing or confirming of the key documents (IO- Invoice Out, II - Invoice In, RL - Release Note, RP - Receipt Card and RS - Reserving Card). The set blocking can be cancelled for selected users by setting the right Purchase / Invoice (or. Receipt Card) / Break blocking of creation (confirmation) for Suppl., in case of sale then with the right Sale / Invoice (or Release Note, Reserving card) Break blocking of creation (confirmation) for Cust. |

|

|

N |

Not blocked. |

|

V |

Block to create a new document. During the try Issuing of the document a report will display: "Creation of document is blocked in customer card.". |

|

P |

Block the confirmed document. During the try confirmation of the document a report will display: "Confirmation is blocked for this supplier/customer." E. g. an unconfirmed release note does not allow the release from the warehouse, but its creation enables blocking of the articles on the warehouse for this customer at least. The user who has an appropriate right can break the confirmation blocking. |

Allowed methods of transport |

You can enter a record in the field that has the Method of transport entered in the items, which may appear on the Sales documents of this customer. If such a record is entered on the Suppl./Cust. tab, only permitted methods of transport are offered on the sales documents, and if another methods of transport is specified on the document, a message is displayed when the document is confirmed and the document can / cannot be confirmed depending on the "Confirm documents also in case of unallowed method of transport". |

|

Allowed payment methods |

You can enter a record in the field that has Payment Methods entered in the items, which may appear on the sales documents of this customer. If such a record is entered on the Suppl./Cust. tab, only authorized methods of payment are offered on the sales documents, and if another method of payment is specified on the document, a message is displayed when confirming the document and the document can / cannot be confirmed depending on the "Confirm documents also in case of unallowed method of transport". |

|

Company of consolidation unit |

The fields can be marked on the Suppl./Cust. tabs, which represent the companies of the consolidation group, and then used in the Posting Key settings (condition for the company of the consolidation group) or when posting purchase/sale documents according to the account on the Articles tab. |

|

Recalculation invoicing period - by - period |

If it is enabled, then when you run the Recalculation of invoicing function, the documents of these Suppl./Cust. they load after periods (it is advisable to turn it on on the Suppl./Cust. cards, which are used for invoicing to anonymous customers). |

|

Employs disabled persons |

The check box means, that Suppl./Cust. employ more then 50% disabled employees. If checked on Suppl./Cust. the Document for deduction check box is pre-filled in the purchase item. The check mark is used to create an attachment to cure within the frame of the Fulfilment of mandatory proportion of PWD. |

|

Created by |

Date, time and the name of an user K2 who has created the record. |

|

Changed by |

The date and name of the user who has made the last change. |

|

Processing restricted |

The flag indicates that this customer's data processing is restricted. |

|

Natural person |

The flag indicates that this customer is a natural person. |

|

Group VAT Reg. No. |

Flag indicating that the customer has a group VAT Reg. number. The flag is manually editable. If ARES registers the VAT Reg. number as a group, then the execution of the ARES function in K2 will check this flag. If the flag is checked, ARES will not import bank accounts. If ARES does not register the VAT Reg. number as a group, running the ARES function in K2 will tear off this flag. |

|

In the universal forms we also find the following fields:

Data boxes |

Identification number of the customer's data box. The field is linked to the same field on the partner. |

PAP Partner |

This is the identification in the PAP statement. Companies that do not use PAP statements can use the field as an additional identifier (e.g. to identify a customer from other software). |

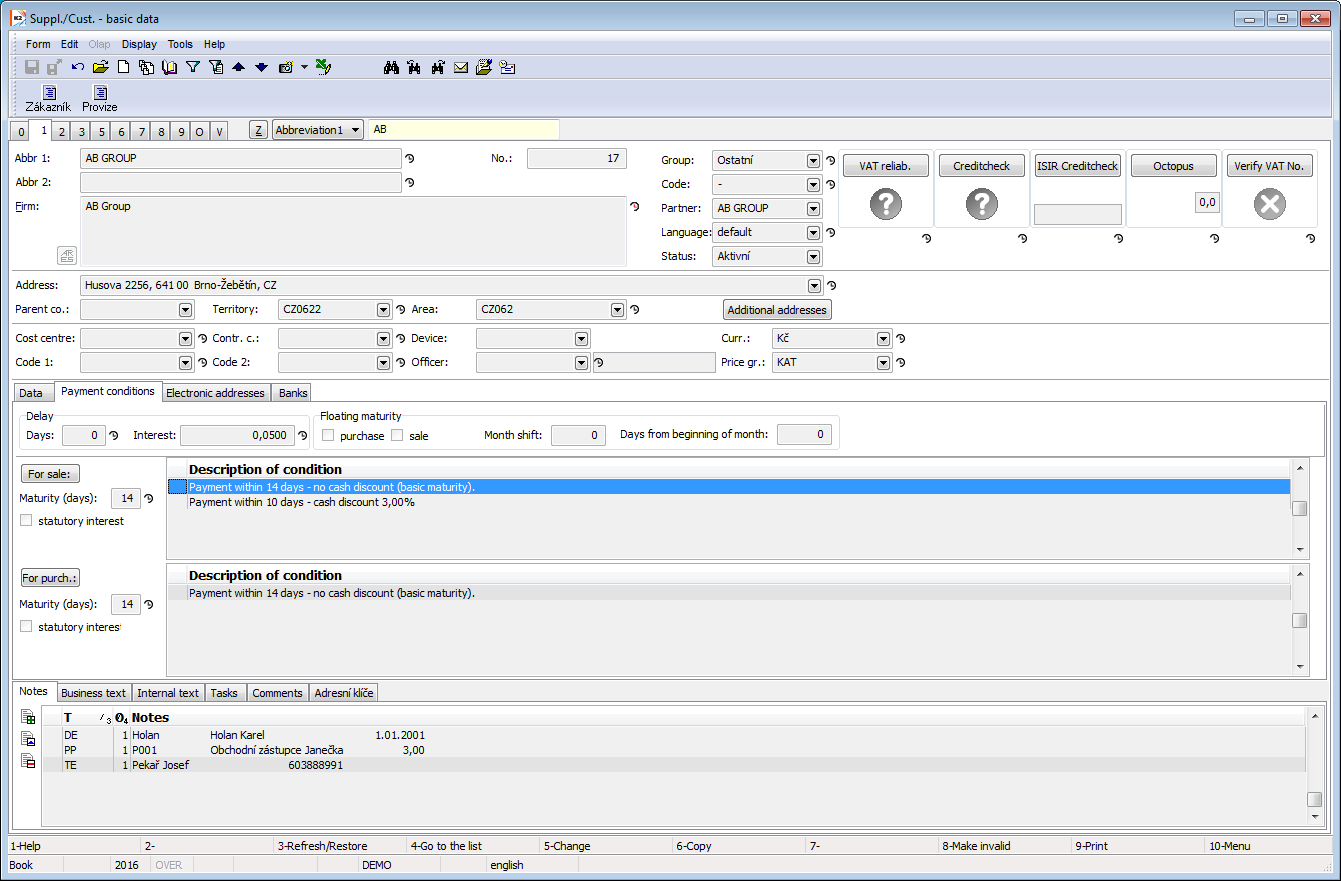

On the Payment Conditions tab, you can enter data related to maturity and delay.

Picture: Suppl./Cust. - 1st page with payment conditions

Description of Fields:

Delay (days) |

In this field it is possible to enter a delay with that the customer pays issued invoices. When you create a new IO, a new item is created in the Payment Calendar module, in which the Expected payment date is shifted by the specified number of days of delay. |

|

Interest |

Penalty is an amount of money that has to pay by debtor for every day of delay of payment. It is expressed as a percentage of the total Outstanding amount. The interest entered in your own company is filled automatically. |

|

Floating maturity |

It is set if the maturity is always on a specific day, e.g. the following month. |

|

|

Month shift |

Month shift (1 - next, 2 - second next, etc.) |

|

Number of days since the beginning of the month |

Number of days since the beginning of the month (e.g. 5,10, 30) including non-working days. |

Example: We have agreed with the customer that Invoices will always be due on the 20th day of the following month.

CreditCheck in the K2 IS: On the Suppl./Cust. card just check Floating maturity - sale, Month shift = "1", Number of days since the beginning of the month = "20". If the Date of Issue is entered on the Invoice Out, e.g. 10.11.2015, it will be filled in by the Maturity Date 20.12.2015.

Maturity (days) |

The number of maturity days, on that you agree with a supplier/customer. It is different separately for purchase and separately for sale. |

Statutory interest |

If checked, it is pre-filled in Invoices - the percentage of interest (annual) is added from the table Statutory Interest for Late Payment. It is different separately for purchase and separately for sale. |

For sale |

The button for entering payment terms (Cash discount) for sale. The form, which enables to enter a maturity and the conditions of the first and the second discount at once, will display. |

For purchase |

Button for entering payment terms (Cash discount) for purchase. The form, which enables to enter a maturity and the conditions of the first and the second discount at once, will display. |

On the Payment Conditions tab, you can enter a discount condition separately for Sale and Purchase. Entered conditions for sale copies to sales order and invoice out issued on an appropriate customer, the payment conditions copy to purchase order and invoice in issued at this customer. In the sales orders, orders and invoices it is possible to change these conditions or insert new conditions.

By Insert key you can insert the individual payment conditions, that means the discount conditions, maturity.

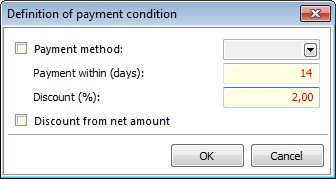

Picture: Entering of the payment conditions

Description of Fields:

During the way of payment |

After marking of a field a selection of way of payment will access. Payment condition will be valid only in case that an invoice will be settled by selected way. |

Payment within (days) |

You can enter maximum number of days by when the invoice must be paid so as the discount percentage be valid. |

Discount (%) |

Discount percentage which is valid when above-mentioned two conditions are fulfilled. |

Discount from net amount |

By checking of this field you determine if a discount will count form amount with VAT or not. |

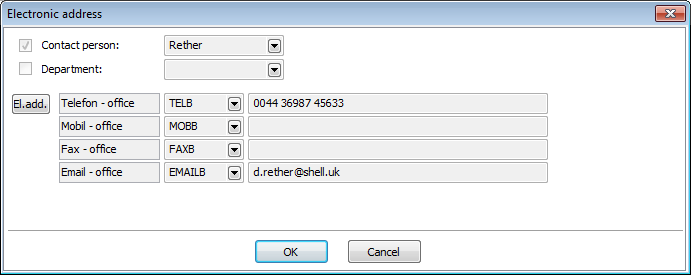

Tab Electronic addresses displays form where the electronic addresses of an appropriate Suppl./Cust are registered.

- Fields - Fields for entering of the electronic addresses will display according to the predefined 4 type of electronic addresses in four rows. Setting of these 4 types: see the Electronic addresses presets in the User parameters book - 4th page (tab Marketing).

- EA(H) - by pressing of this button all electronic addresses of a partner will display. Way of control is described on the 1st page of a Partner card in the Electronic addresses item part.

Picture: Suppl./Cust. - 1st page with electronic addresses

The button ![]() appears for WWW and EMAIL addresses. By pressing it will open the web page address in a web browser or open a window for creating and sending an email.

appears for WWW and EMAIL addresses. By pressing it will open the web page address in a web browser or open a window for creating and sending an email.

By Ins key you insert the individual electronic addresses and by Delete you delete addresses.

Picture: Electronic address

In the lower table of the Electronic addresses tab, a new contact person can be created by Ctrl+F6 shortcut. If you want to add a new contact person to a partner, set the light indicator into the part of the screen and press the Ctrl+F6 keys in the Change or Browse mode. After pressing of the keys a new contact person card in that the data about partner will be pre-filled will display. After you set data and save changes, a new contact person will be entered on the partner card. If you want to cancel the link between a contact person and a partner, set the light indicator on a contact person you want to delete and just press Del key in Change mode.

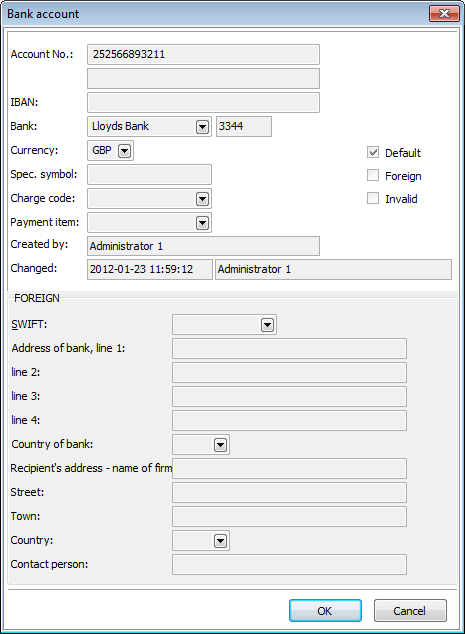

The Bank accounts tab displays the form where the bank accounts of an appropriate Suppl./Cust are registered. Bank accounts are copied to the invoices out and in, advance provided and received and to the items of Payment calendar issued on an appropriate customer.

Picture: Suppl./Cust. - 1st page with a list of the bank accounts of suppl./cust.

By Ins key you insert the individual bank accounts and by Delete you delete accounts. During the inserting of bank account,which is the first in Suppl./Cust., this account set as "Default" ![]() . If the Suppl./Cust. has got more accounts, than the default account cannot be deleted. Marking

. If the Suppl./Cust. has got more accounts, than the default account cannot be deleted. Marking ![]() by the bank account means that the bank account is verified in the system of assessing the reliability of VAT payers and bank accounts of VAT payers.

by the bank account means that the bank account is verified in the system of assessing the reliability of VAT payers and bank accounts of VAT payers.

Picture: Bank account

Fields Description:

The account number |

Bank account number. It is obligatory in case it isn't foreign account. |

|

IBAN |

International form of bank account number. IBAN is used for foreign payments and inland payments in foreign currency. If it is a foreign account, this field is obligatory. |

|

Bank |

Selection of bank (from the book Banks), to which you want to enter the account. If there is no IBAN, this field is obligatory. |

|

Currency |

Account currency. Obligatory field. |

|

Spec. symbol |

Specific symbol. |

|

Charge code |

Charge code. |

|

Payment item |

It is an identifier of purpose of the cash payments. It is used by banks, branches or clients to marking of cash payment:

|

|

SWIFT |

SWIFT code number - a unique bank code by which a bank is identified (marks as BIC too). |

|

Created |

Name of user K2 which created record. |

|

Changed |

Name of user K2 which changed record. |

|

Default |

Setting of account as default. That means it will be pre-filled to invoice in, bank order and statement. |

|

Foreign |

Setting of account as foreign account. |

|

Invalid |

Setting of account as inactive. It will not display in a list of bank accounts. |

|

Foreign |

Information about Foreign Bank - Accessible after account setup as Foreign. |

|

|

Bank address, line 1 |

A field for entering of a bank address. |

|

line 2 |

A field for entering of a bank address. |

|

line 3 |

A field for entering of a bank address. |

|

line 4 |

A field for entering of a bank address. |

|

Country of bank |

Country of bank. |

|

Recipient's address - name of firm |

A field for entering of a recipient's address. |

|

Street |

Street name and house number. |

|

Town |

Town. |

|

Country |

Country. |

|

Contact person |

Name of a contact person. If you edit bank account of a Partner or of a Suppl./Cust. that is bounded with this Partner, the contact persons of a Partner will be offered when selecting from a code list. |

If the Country of Cust./Suppl. is different from the country that is entered to an own company, then the company name and the data from the address will pre-filled in the Recipient's address.

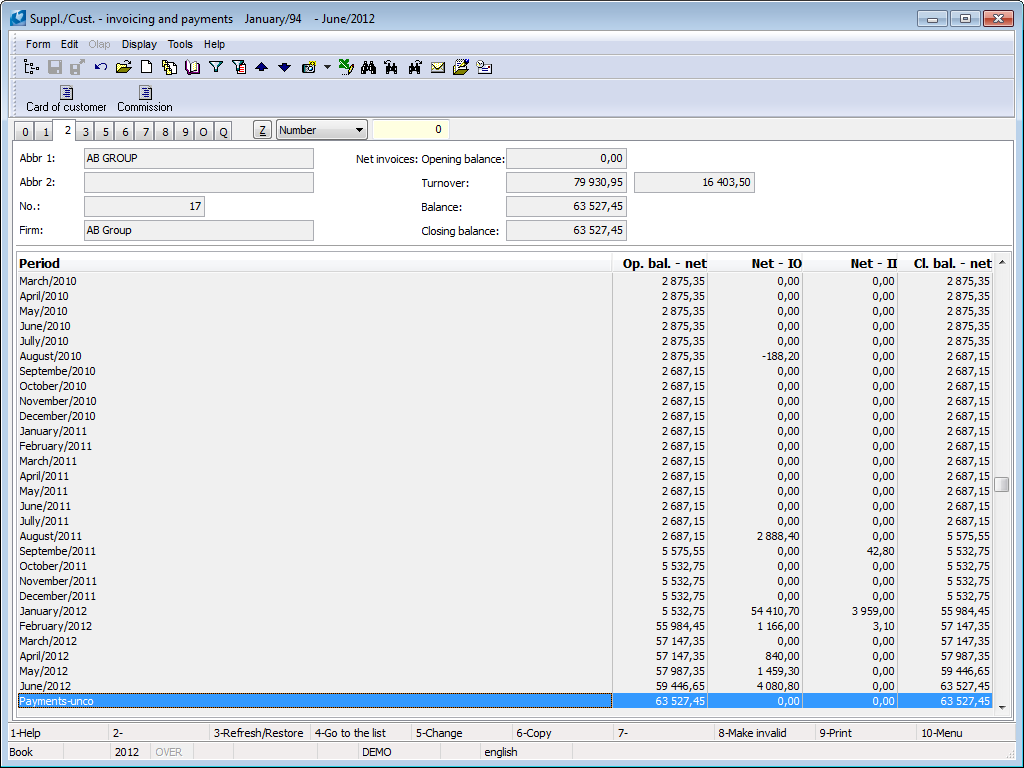

Invoicing and payments (2nd page)

In Suppl./Cust. card on 2nd page information about invoices in/out and executed payments within concrete time interval are available. Selection of displayed interval is started in Browse mode by pressing Alt+F10 key.

Picture: Suppl./Cust. - 2nd page

After pressing Shift+F10 key in Browse mode the display options are available.

Picture: Invoicing and payments - display options

Depending on a selected option, not only displayed columns on 2nd page in Suppl./Cust. card keep changing but also the information displayed in the header card.

Columns offers display per periods and are divided into opening balance (OP), invoice out (IO), invoices in (II) and closing balance. In the page header There is displayed: the description of selected display invoices, opening balance, turnovers, balance and closing balance.

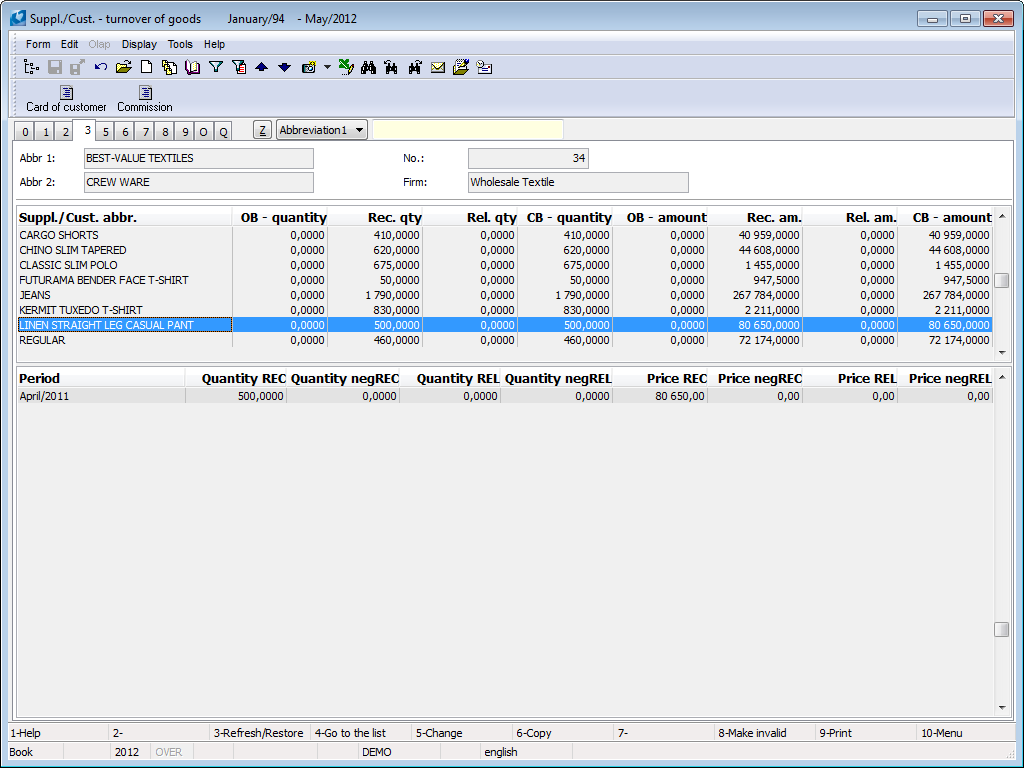

Turnovers of articles (3th page)

On the 3th page of Suppl./Cust. card turnovers of articles of supplier/customer are displayed, in the case that the field Customer / Articles records in the client parameters is checked. Selection of displayed interval is started in Browse mode by pressing Alt+F10 key.

Card of good is displayed by pressing Ctrl + Enter keys.

In the lower part of the form you can see turnovers overviews related to the article, where the light indicator is in the upper part. Turnovers are loaded per periods.

Picture: Suppl./Cust. - 3th page

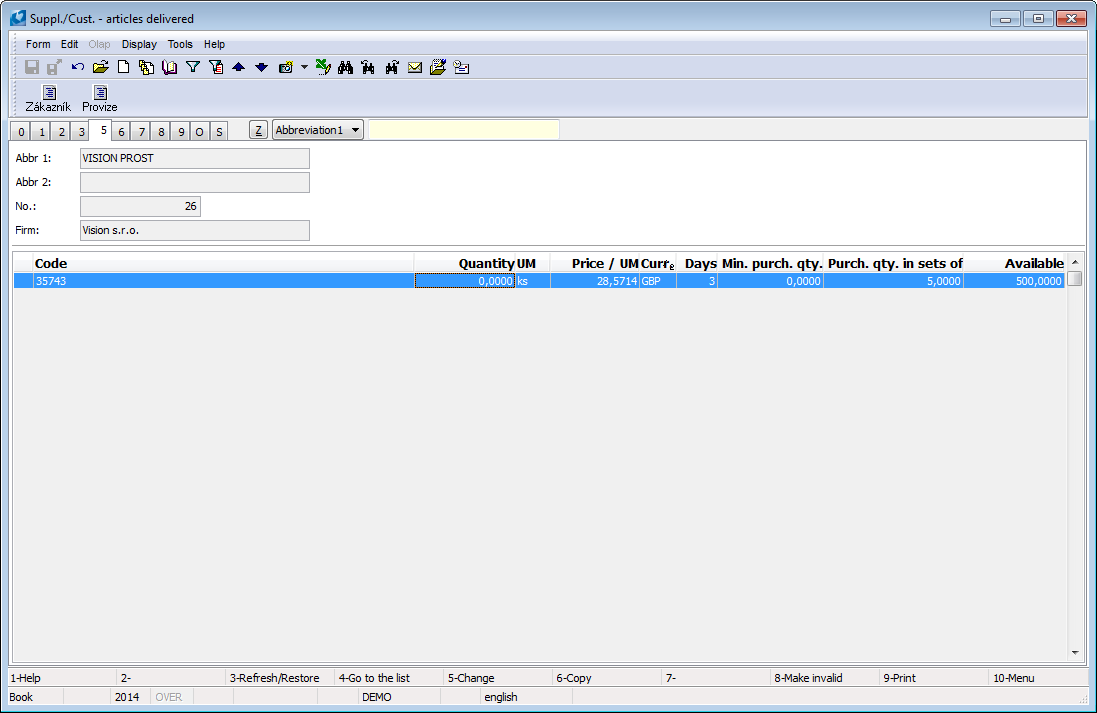

Articles delivered (5th page)

5th page of Suppl./Cust. card is used when the supplier supplies articles by system of fixed prices that are regulated by multipliers. Supplier price will display on 4th page of Articles card as well.

Picture: Suppl./Cust. - 5th page

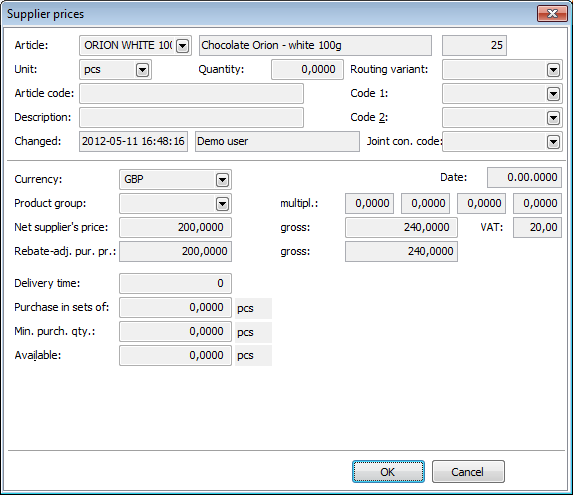

This page of Suppl./Cust. card is accessible in Change mode and in New record as well. By pressing of Ins key the new supplier prices are inserted in this card. The Supplier prices form will be activated.

If you press Ctrl+Enter keys on item of article in Browse mode, you will get on the 4th page of Article Card in Browse mode.

After pressing Enter key on an article item the form Supplier prices displays.

Picture: Supplier prices form

Description of Fields:

Articles |

Abbreviation of article. |

Unit |

The field for a stock unit setting to which the price applies. |

Quantity |

Quantity of articles from which above (including) the supplier price is valid. Default quantity should be equal to zero. |

Article code |

Marking of an article used by a supplier. |

Description |

You can give a next comment to this article. |

Changed |

The date and the time of last change and an user who have made this change. |

Routing variant |

Some articles delivered can have more routing variants. It serves for user identification. |

Code 1 |

Possibility of setting any code. It serves for user identification. |

Code 2 |

Possibility of setting any code. It serves for user identification. |

Date |

This field is useless in the IS K2. |

Currency |

The currency in which the price is specified. |

Product group |

Supplier product group is always assigned to a specific supplier. Product group you select from Supplier product groups book. Here you can define a new product group by pressing F6 key (or Ins) or change (including multiplier values) whichever product group by F5 key. After selecting of a product group the multiplier values will be automatically entered into the appropriate fields. |

Multipliers |

Multiplier means a figure that provides the possibility to take into consideration various variances of supplier prices (discounts,... - multiplier <1; transport, surcharges >1 etc.). For each product group, you can specify four such factors that are further reflected in the net purchase price of articles. Multiplier values are set in the book Supplier product groups on the 1st page. |

Supplier's net, gross price |

Supplier price per one stock unit for the specified quantity. If the Product group is set, this is default price valid for appropriate product group per one stock unit. This is a price that the supplier has in his price list. Net price will be automatically recalculated to Supplier's gross price according to VAT rate defined in the Article card. The same calculation is valid vice versa too - after setting of Supplier's gross price the Supplier's net price will be calculated. |

Rebate-adjusted purchase price |

If the Product group is set, the Rebate-adjusted purchase price is calculated from the Supplier's net price that will be multiplied by all 4 multipliers. Correspondingly Gross purchase price is calculated from Supplier's gross price. A Rebate-adjusted purchase price is automatically entered into an order. Rebate-adjusted purchase prices are only displayed in the form. |

Delivery time |

According to the provided data from supplier you fill the delivery time. |

Purchase in sets of |

The field is filled according to the supplier, K2 does not control these data, it is used for recording only. |

Available |

Here you can fill the quantity of articles that is in the supplier warehouse. You proceed from supplier's provided data. |

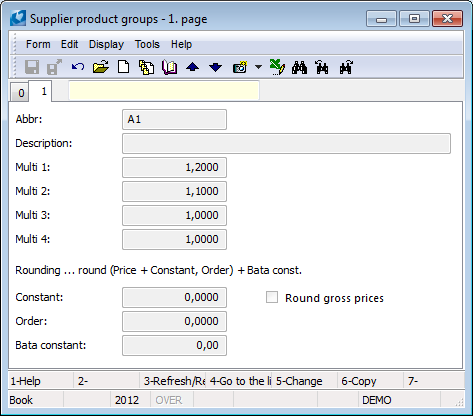

Picture: Supplier product groups - 1st page

Description of Fields:

Abbreviation |

Abbreviation of a supplier product group. |

Description |

Description of a supplier product group. |

Multi 1,2,3,4 |

Multiply values. |

Rounding |

Rounding principle is the same as e. g. in the Client parameters or in the Item of purchase product group. |

Round gross prices |

The option enables to distinguish which prices should be rounded if gross or net prices. |

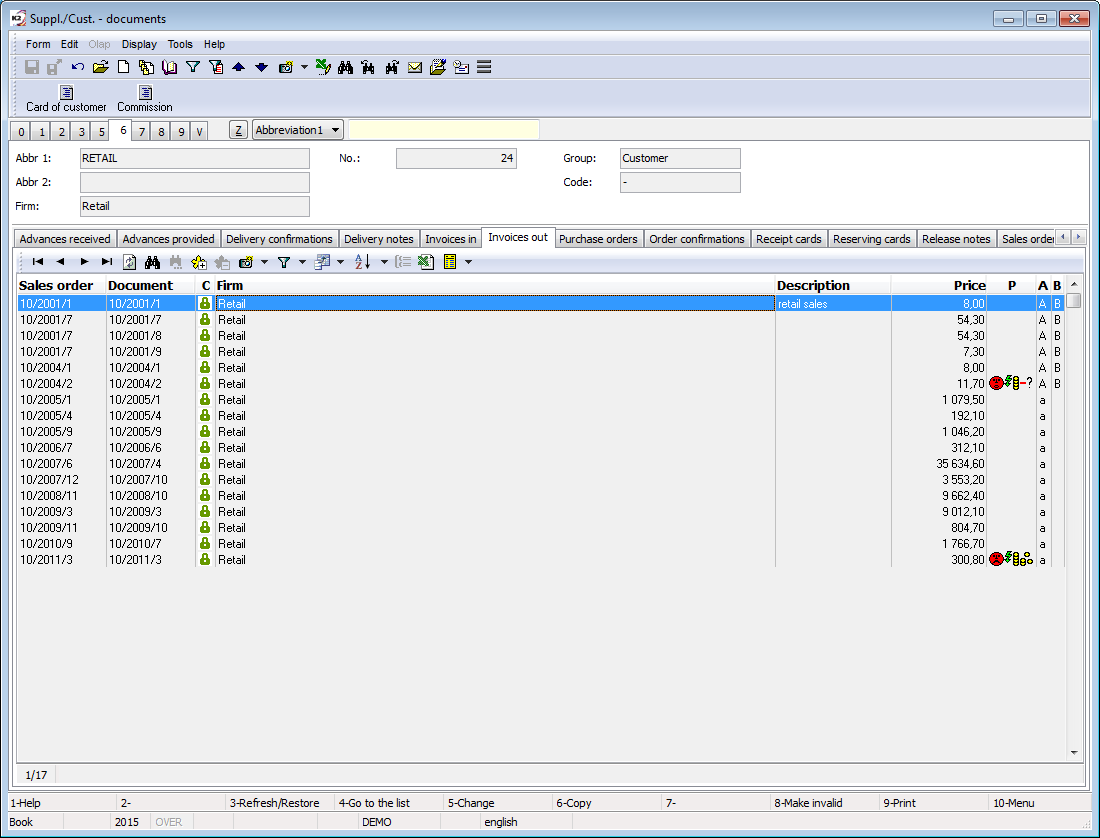

Documents (6th Page)

On the 6th page of a Cust./Suppl. card, the overview of documents of Purchase and Sale modules that are related to an appropriate customer/supplier is displayed. The page displays information for the displayed own companies (see the option Select own companies and the form Show data for the following companies).

Documents are divided into the individual tabs.

Picture: Suppl./Cust. - 6th page

If you press Enter key on an item, where the light indicator is positioned, the 1st page of a document will display.

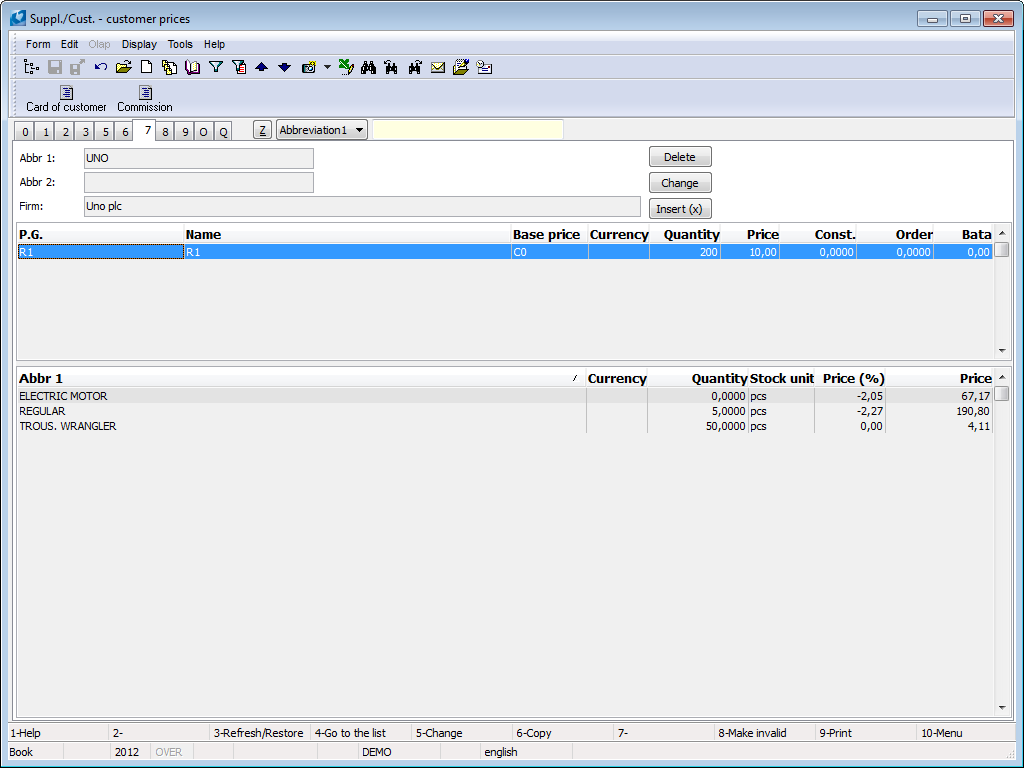

Customer prices (7th page)

Customer prices are displayed on the 7th page of the Suppl./Cust. card. Its are the customer prices for an appropriate customer. In upper part you enter the customer prices of the product groups, in lower part you enter the customer prices, thus so called customer prices. Customer price of the product prices displays at the moment only on the 1st page of Product group form with name of customer (in the Article card the customer prices can display after the conversion of the customer prices). Added customer price will display on the 5th page of the Article card in a list of the price groups (lower part). This price takes precedence over the customer price of a product group.

The chapter Price Creation methodology in K2 IS (part Basic modules) describes an option of price formation in IS K2.

Picture: Suppl./Cust. - 7th page

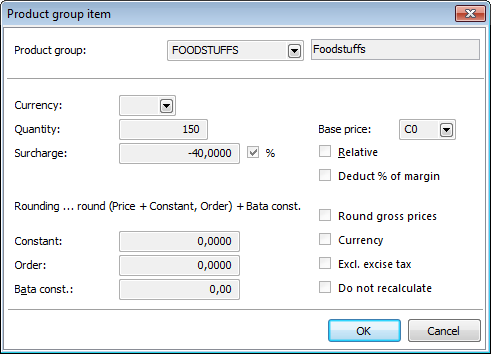

For work with the customer prices you use the buttons Delete, Change and Insert in the Browse mode. If you have the light indicator set in upper part, after pressing of the button Insert the Product group item form will activate. If you move in a lower part, the form Customer article prices displays where you can set appropriate data. By pressing the Change button you change the data in forms. After pressing the Delete button you delete selected product group or a customer price.

The size proportion of both parts can be changed using the mouse by moving the dividing line.

Picture: The Product group item form

Description of Fields:

Product group |

Product group. |

Currency |

The currency in which the price is specified. If the currency is the same as the client currency, it is displayed neither on 1st page of the Product group book in the Currency column nor on the 1th page of the Suppl./Cust. card in the Currency column. |

Quantity |

The minimum quantity of articles, from which (including) the entered price is valid. |

Surcharge |

In this field you set a surcharge amount that will be added to the base price. You can set the surcharge either by an absolute amount or in the percentage (expressed relatively). |

Base price |

The price group from which price the surcharge is based on. If the field is not completed, surcharge is related to so called basic selling price from the 5th page of the Article card (upper part). |

Relative |

If this option is not checked, the price will be calculated directly in the moment of creating and its numerical value is valid. If this field is checked, than the price will count in the moment of the using according to its definition. |

Deduct % margin |

If the option is enabled, the percentage of surcharge, entered in the field Surcharge, is deducted from the selling price. It concerns only to the prices group. Example: You have a basic selling price 100 GBP and surcharge for the price group -10%. Resulting selling price for the price group than will be 90 GBP. After checking of the field Deduct percent of margin the resulting price will be 90,91 GBP. (Amount 100 GBP isn't 100% but 110%.) |

Rounding |

During the calculation of the price groups the programme executes rounding of the prices according to the given algorithm: (Price + Constant, Order) + Baťa Note: "Price" is a selling price edited about surcharge. |

Constant |

Constant is an amount which will be added to a selling price edited about a surcharge. |

Order |

To the field you enter how many places you want to rounding. It is possible to enter not only the decimal numbers, but also rounding off to units, tens etc. |

Baťa |

If you want the resulting price ends by a concrete number, you can enter amount to this field. This amount is added to the price. Example: If you want to have the final prices set as Baťa's, that means the prices has to final by nine, than during the pricing you will enter rounding on the tens (the field Order) and to the field Baťa number "-1". Than the value "-1" will deduct to the calculated selling price. |

Round gross prices |

By checking the flag you ensure rounding of a gross prices according to set algorithm, that means, set rounding in the left part of a form, relates to the gross prices. |

Currency |

By checking you enable to enter the price in foreign currency which is selected on the Article card. Recalculation between the currencies executes by a course from the Article card. |

Excl. excise tax |

Current IS K2 doesn't use the field. |

Do not recalculate |

By checking this field you determine that the appropriate price should not recalculate. If you want to recalculate group prices (customer prices), all prices will be recalculated apart from the price with this flag. |

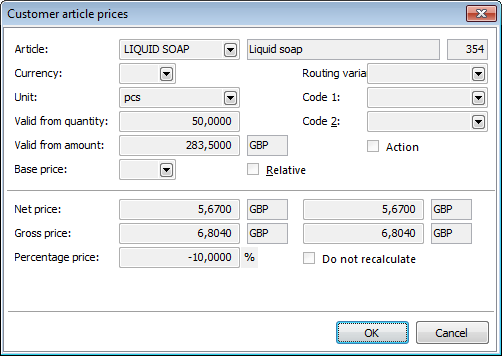

Picture: The Customer article prices form

Description of Fields:

Articles |

Abbreviation of article. After article's selecting its selling price will enter into the fields Net price, and Gross price from Articles card. |

Currency |

The currency in which the customer price is specified. If this currency is the same as the basic currency, it does not fill. |

Unit |

Basic stock unit of this article. |

Valid from quantity |

Quantity of articles from which above (including) the customer price is valid. After setting of an appropriate quantity the field Valid from amount will be calculated by multiplying of the fields Valid from quantity and Net price. |

Valid from amount |

Amount of articles from which above (including) the customer price is valid. The field value is calculated by multiplying number of fields Valid from quantity and Net price. You can change the amount. Than the field Valid from quantity will be actualised according to the ratio of value of this field and of Net price. |

Base price |

If the basic price is not set, it deals with directly determined price. By a selection of Price groups book you can define which of these prices will input into the calculation of a customer price. |

Relative |

If the option is checked, it will be an absolute price which is defined in the moment of creating. By checking the field the price net, gross don't take into account directly but a percent from the field Percentage price. |

Action |

This field is useless in the IS K2. |

Routing variant |

Some articles delivered can have more routing variants. It serves for user identification. |

Code 1 |

Possibility of setting any code. It serves for user identification. |

Code 2 |

Possibility of setting any code. It serves for user identification. |

Net price |

After you complete theNet price, it will be added into the field Articles as selling price from the Article card automatically. Here it is possible to set other price than is given on the Article card. The change will take effect in the fields Valid from amount, Gross price and Percentage price. Note: If a foreign currency is entered in the field Currency, an amount in this currency is entered in the right part of the field Net price. Recalculation of the foreign currency executes from the article card. |

Gross price |

Net price automatically enters after filling of the field Article as a selling price from the Article card as well, after of adding of an appropriate VAT rate. Change of Gross price will take effect in the fields Valid from amount, Gross price and Percentage price. Note: Way of display gross price corresponds with display net price. |

Percentage price |

Percentage price indicates how much percent it should be added to the Basic price. You can set the percentage price with a negative sign, the original selling price will decrease. If you set the percentage price, the field Valid from amount, Net price and Gross price will change. |

Do not recalculate |

By checking this field you set that the price will be entered manually and it should not recalculate. |

After pressing Enter key on an article item in the lower part of selling price the form Customer article prices will display. By pressing Ctrl+Enter on an article item the 2nd page of an Article card display in Browse mode.

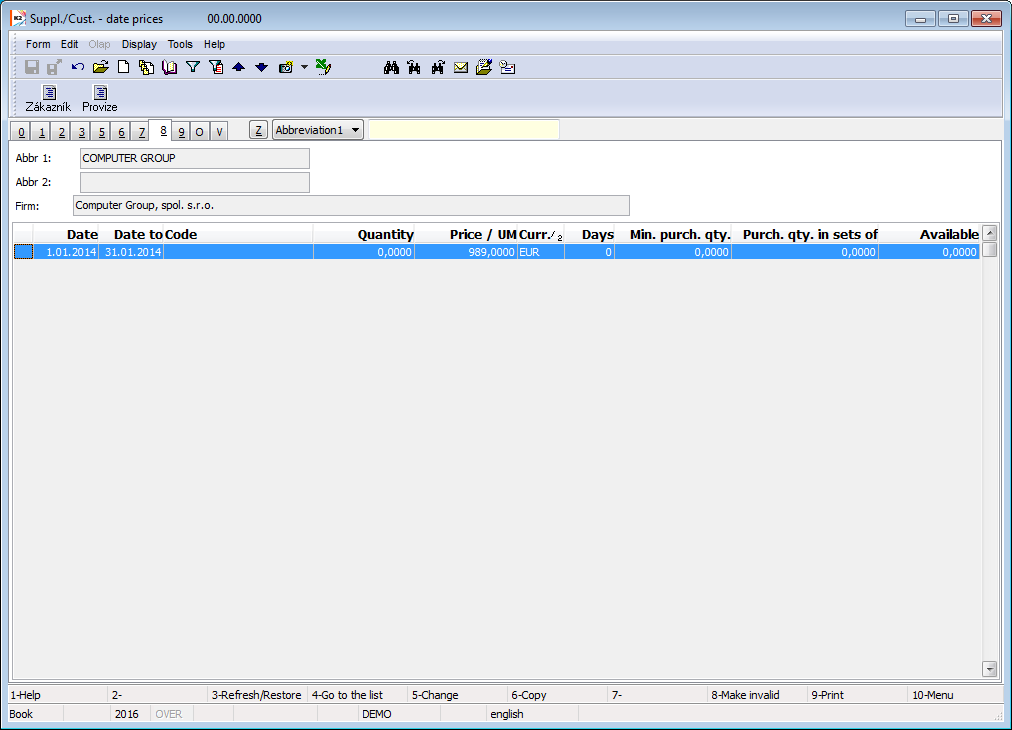

Date prices (8th page)

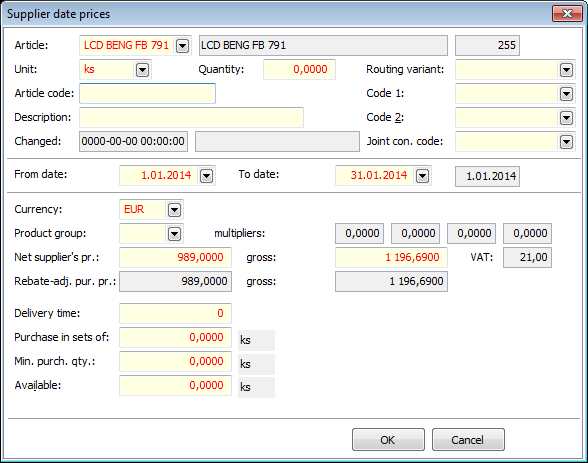

By pressing the Ins key on the 8th page of Suppl./Cust. card in Change mode, you will activate the Supplier date prices form where you can set a price list, i. e. the prices for a particular article at particular date. If you want to find the article prices valid at particular date, you will press Alt+F10 keys in Browse mode and you will fill required date in ordered form. Than a selected date will display in upper blue bar and the corresponding date prices will display in a card. When the date is set to "Not specified", all date prices are displayed.

Picture: Suppl./Cust. - 8th page

Picture: Supplier date prices form

Form contains the same data as the Supplier prices form. Spare there are From date and To date fields. There you select a period where the prices will be valid.

External documents (9th page)

You can assign the ext. documents and documents on 9th page of Suppl./Cust. by the same way as in other modules of programme K2 (see the chapter Basic Code Lists and Supporting Modules K2 – 9th Page).

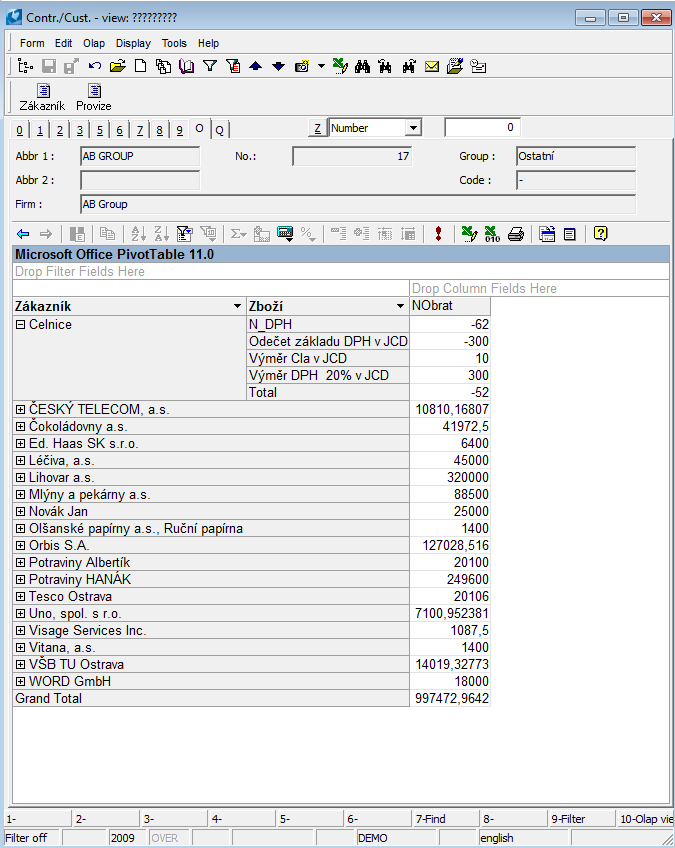

Suppl./Cust. - view (page O)

If you check the field Display the "O" page - views in OLAP in the User parameters, than on the "O" page in OLAP you can create views that help to evaluate K2 IS data.

Picture: Suppl./Cust. - page "O"

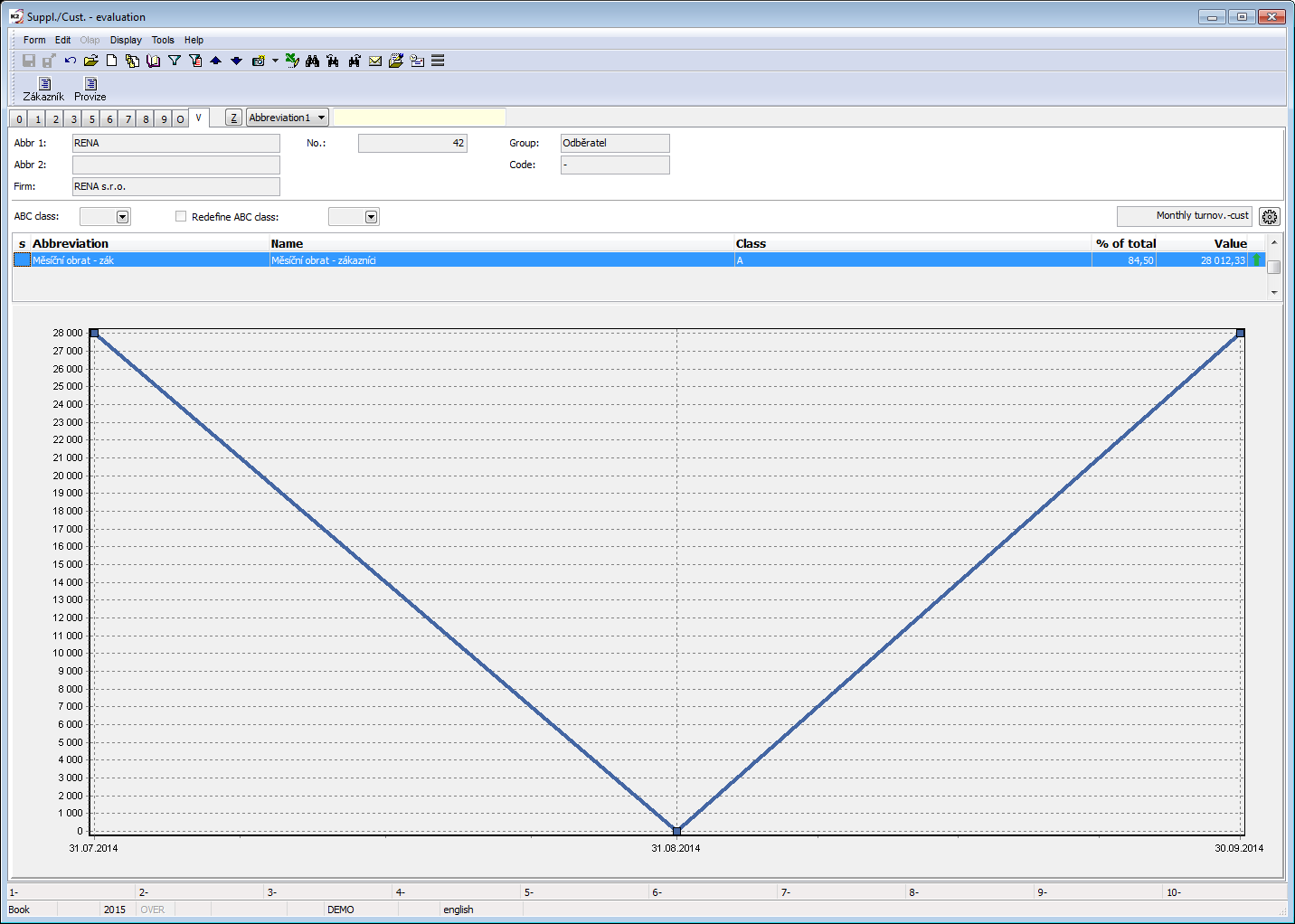

Evaluation (V page)

It contains information resulting from the calculation of ABC analyses.

- The list of all calculated configurations of the current analyses is stated in the table.

- The ABC group field is in the header bar. It is necessary to set so called default configuration if you want to save the appropriate ABC groups to Supplier/Customer card. This can be set on this tab by the button

. In this case, the group from the current (last calculated) default analysis is then save in the customer header.

. In this case, the group from the current (last calculated) default analysis is then save in the customer header. - If the Predefine ABC group option is not activated on the tab, the resulting group will be also written into the next field. However, this field can be redefined by the user to another group (e. g. due to the goal where we want the customer to belong, etc.). In this case, it is no longer overwritten during the calculation.

- At the bottom there is a chart showing the history of the development of the monitored values for the currently marked configuration. If you wish to monitor or compare developments for multiple configurations, just mark these required ones in the table with asterisks.

The "V" page is displayed only if the user has the right Code lists / ABC analyses / Browse ABC analyses.

Picture: The Suppliers/Customers book - V page

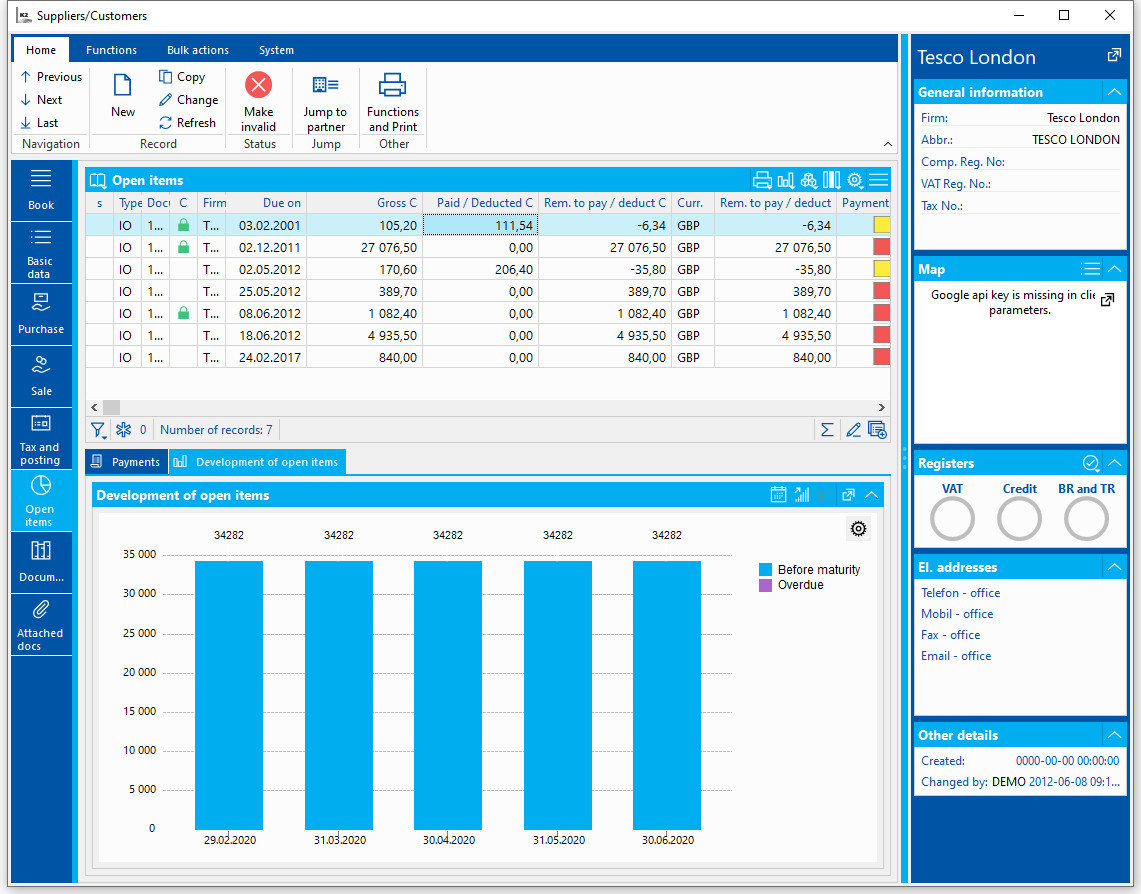

Open item lists on the Suppl./Cust. card

The Open item lists tab id stated on the Suppl./Cust. card in universal forms.

.

Picture: Suppl./Cust. - the Open item list tab

The current balance of the balance is displayed at the top.

At the bottom, payments for document on which the ruler is set are displayed on the Payments tab.

The Development of open items tab displays a chart of the open items development. By default, the status as of the current date is displayed and the status at the end of the previous 4 months is displayed.

By means of button ![]() , you can switch the view to development by weeks. By pressing the button

, you can switch the view to development by weeks. By pressing the button ![]() , you can add another 4 months / weeks (up to a total of 24 can be added gradually). By button

, you can add another 4 months / weeks (up to a total of 24 can be added gradually). By button ![]() , you can removed months / weeks.

, you can removed months / weeks.

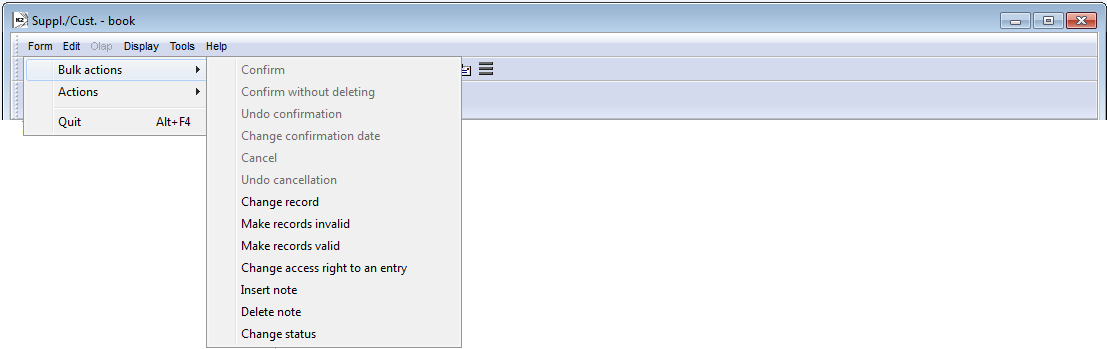

Functions Suppl./Cust. module menu

Picture: The Suppl./Cust.module menu functions.

You can activate the bulk actions only in evaluation filter.

Description of actions:

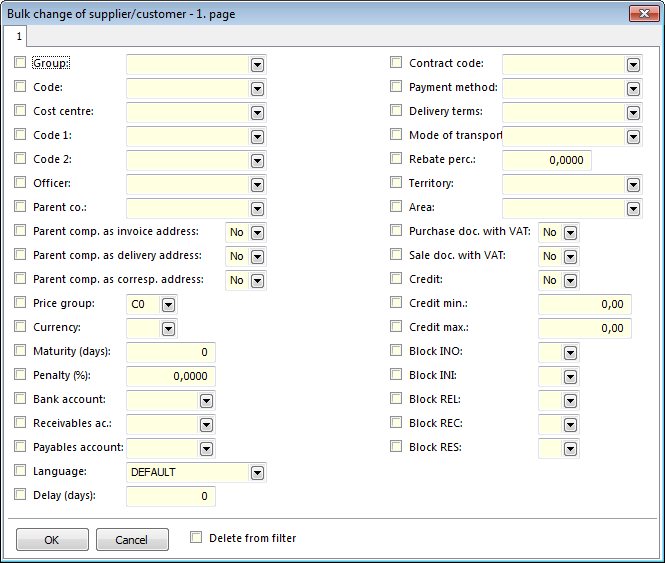

Edit record |

It enables to change in bulk the data of the selected cards. The form contains the fields from the 1st page of Suppl./Cust.card. Check the fields, you want to edit, in the Bulk change of Suppl./Cust.form. Set a value which you want to entered on an individual customer cards for each selected field. Checked option Delete from filter performs deleting Suppl./Cust. cards from filter after launching this action. |

Picture: The Bulk change of Supplier/Customerform

Make records invalid |

Function for bulk cancellation of the records with concurrent deleting of the records from filter. |

Make records valid |

Function for bulk undo the cancellation of the records with records deleting from the filter. |

Change Entry access right |

Assign group of rights for browsing and changing the selected cards. These cards can be browsed and changed only by the Users that have the appropriate group of rights. Other users can see only asterisks instead of those data. Entry access rights are assigned on the 4th page of the Usersbook. |

Insert Note |

A note of the same type can be inserted to the selected records. Concurrently executes deleting of the records from filter. |

Delete note |

It performs deleting of the selected notes of the appropriate records. Detailed description is in Basic functions - Module Menu Functions - Formchapter. |

Change Status |

Allows to change the Statusfield of the selected entries in bulk. |

Cancel Status |

Deletes Status on selected records. |

Update of VAT Reg.No. verification |

The VAT Reg.No. Verification function runs over the selected records. |

Add to key/remove from key |

The function allows you to add/delete the address key for selected records in bulk. |

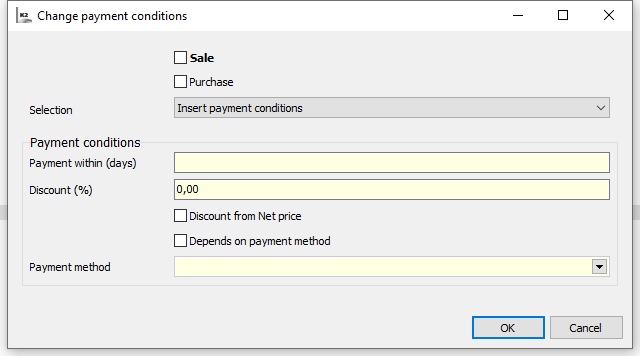

Change payment conditions |

The function allows you to add or delete a payment condition for a discount in bulk. |

Picture: The Change payment conditions bulk action

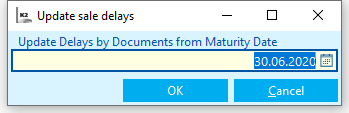

Update Sale Delays |

This function allows you to update the Sale Delay field in bulk. The delay is calculated as the weighted average of the Invoices Out and Other Receivables on the documents from the specified due date. The function also runs over task scheduler. |

Picture: The Update Sale Delays bulk action form

Functions over Suppl./Cust. database

Description of functions:

F8 |

Function for make invalid/valid record. |

Ctrl+P |

Switching to Partners book in Marketing module. In case that a partner tied with supplier/customer does not exist, it is possible to create him. |

Ctrl+Alt+F5 |

The function allows you to select the Status of Article card. |

Ctrl+Enter |

If there are items on the 5th and 8th pages, the 4th page of the Articles card (supplier prices) will be displayed in Browser and on the 7th page from the bottom the 2nd page of the Articles tab will be displayed in Browser (purchase prices). |

Imports

Import of customers

Script enables import of Customers from the file of spreadsheet including of import of e-mail addresses, notes and Bank accounts.

During the preparation of spreadsheet file before the import, you need to observed the following rules:

- Sort column according to column where is name of company.

- If a heading with column description, the heading has to be on the row n. 1 and own data which will be imported on the row n. 2.

- Avoid to empty fields.

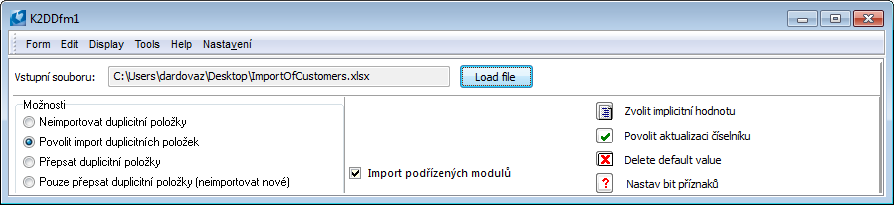

After running of the script you need to load ready spreadsheet file to the field Input file.

Import settings:

Options |

Option to set import permit of duplicate or no-duplicate items is only possible for the Customer. E-mail addresses and Bank accounts are imported according to the setting bellow . |

Do not import duplicate items |

Firms are only imported whose firm name is not in the K2 database. |

Allow import of duplicate items |

All records are imported regardless of conformity of firm names in the database. |

Overwrite duplicate items |

All records are imported. Records of the firms that are in the database will be changed. The others will be inserted as the new ones. |

Overwrite duplicate items only (do not import the new ones) |

Only duplicate items will be imported, i.e. those records that are already in the database K2. These records will be overwritten. |

Import of submodules |

It is set including the import of submodules as the default. |

Picture: Data import form

In the Input columns part the 1st row of imported file will be loaded by the selection and loading of an input file. Option With header means that the data will be imported from the row No. 2, otherwise from the row No. 1.

Assign fields:

- Select Column name in the part Input columns.

- Select Field in the part Fields in K2 - Customers .

- Press the button Connect.

In the columns Input name and Input column in the part Fields in K2 the names of the assigned columns from the imported file display and simultaneously number of assignment loads in the part Input columns. In case of disconnection of the fields you can only select the Field in the part Fields K2 - Customers and press the button Disconnect.

Obligatory field:

By flag ![]() The obligatory fields in the column 'PP' are marked to those you need assign the columns from the Input file and enter Default value in K2 IS.

The obligatory fields in the column 'PP' are marked to those you need assign the columns from the Input file and enter Default value in K2 IS.

Default value  :

:

- By selecting or entering a default value, it is possible to import the specified default value into the K2 database without assigning a column from the tab file processor.

- In the case that the column from Input file will be assigned and together with default value, the default value will be imported in case that en empty value will occur in the input file.

- It is obligatory to complete default value in Required fields and in the fields that refers to code lists and its updates are not allowed (see further on).

- You can insert a default value by icon in the upper part of the form or by Enter key on a record.

Update code lists  :

:

- Flag

in the column 'A' it means that at the fields, which have got binding on the code lists, it is possible to allow updates of these code lists during the import. If code list updating is enabled, there will be a flag in column 'A'

in the column 'A' it means that at the fields, which have got binding on the code lists, it is possible to allow updates of these code lists during the import. If code list updating is enabled, there will be a flag in column 'A'  .

. - In this case that the update of a code list will not be allowed, a default value has to be entered. It will be imported if the assigned column of an input file contains an empty value or a value that is not in a code list.

- You can allow the update by an icon

in the upper part of the form or by Shift+Enter keys on a record.

in the upper part of the form or by Shift+Enter keys on a record.

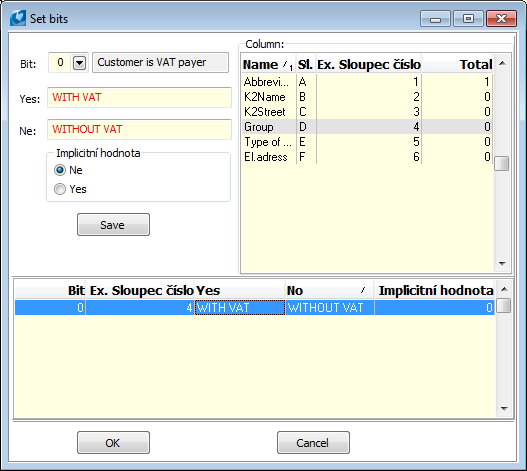

To set a flag bit

For some fields of Customers module the flags are only set in K2 IS. You need to set values for this fields in Flags field.

It deals with this fields:

- 0 Customer is VAT-registered

- 2 Blocking of confirmation of invoice out

- 3 Blocking of creation of invoice out

- 4 Blocking of confirmation of invoice in

- 5 Blocking of creation of invoice in

- 6 Blocking of confirmation of release note

- 8 Blocking of confirmation of receipt card

- 9 Blocking of creation of receipt card

- 10 Blocking of confirmation of reserving card

- 11 Blocking of creation of reserving card

- 12 Check of credits for inv. out

- 14 Customer is VAT payer - sale (VATPsale)

Picture: The form for accounts setting

You need to check the Input file column, mark the bit in which the value is to be saved, choose the default value in case the input file does not contain any value.

At the bottom of the form, you can use the Control button before an import to check which rows of the input file will be skipped, which values will require updating the code lists, etc.

Save setting - In the menu you can save or delete a form setting.

Suppliers/Customers reports

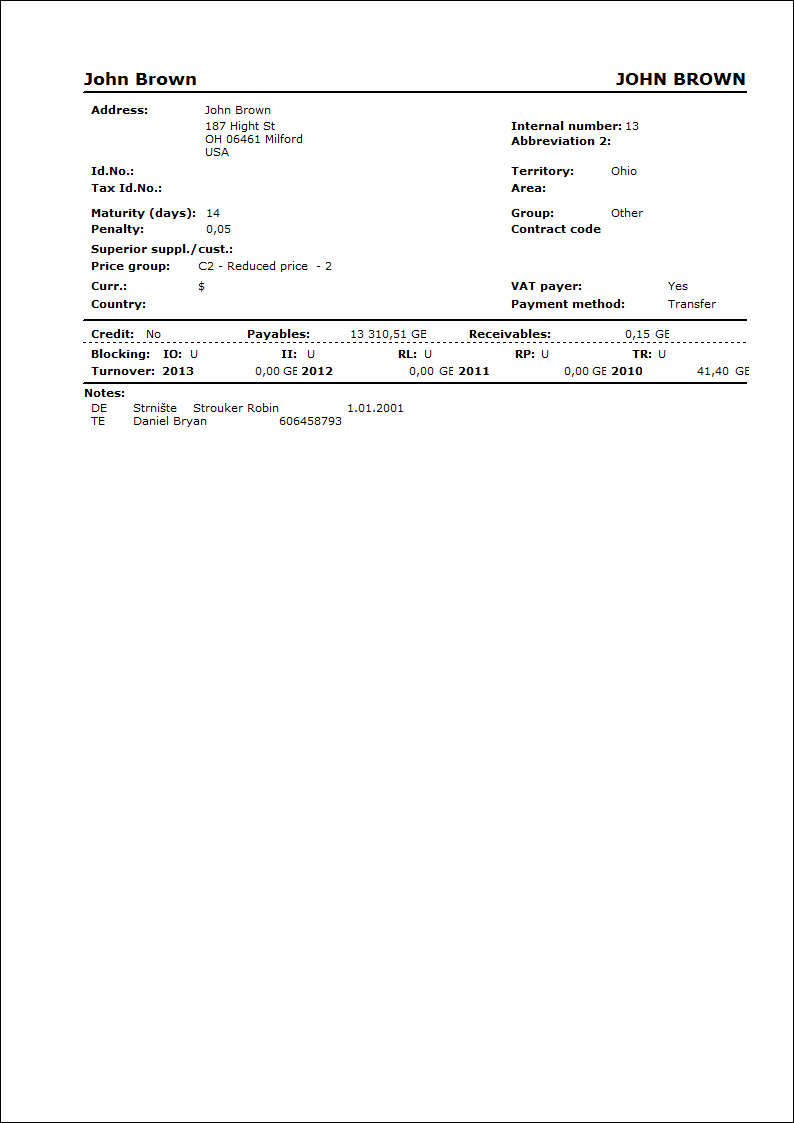

The Customer card (the Supplier Card)

Process No.: CIS003 |

Report ID: SCIS010 |

File: BAZ_KART.AM |

Report description: The report prints a customer card including turnovers per current year, including 3 previous years, and data from a Partner or from theActivities if a Partner is assigned to this card. Displaying the Partner and Activities can be limited by a parameter. |

||

Address in the tree: [Purchase/Supply] [Basic data] [Suppliers][Sale/Processing of contracts] [Basic data] [Customers] |

||

Report parameters:

Show_Activities - Yes Yes - the Partner activities will display. |

Show_marketing_info - Yes Yes - the data from Partner that is assigned to a customer will display. |

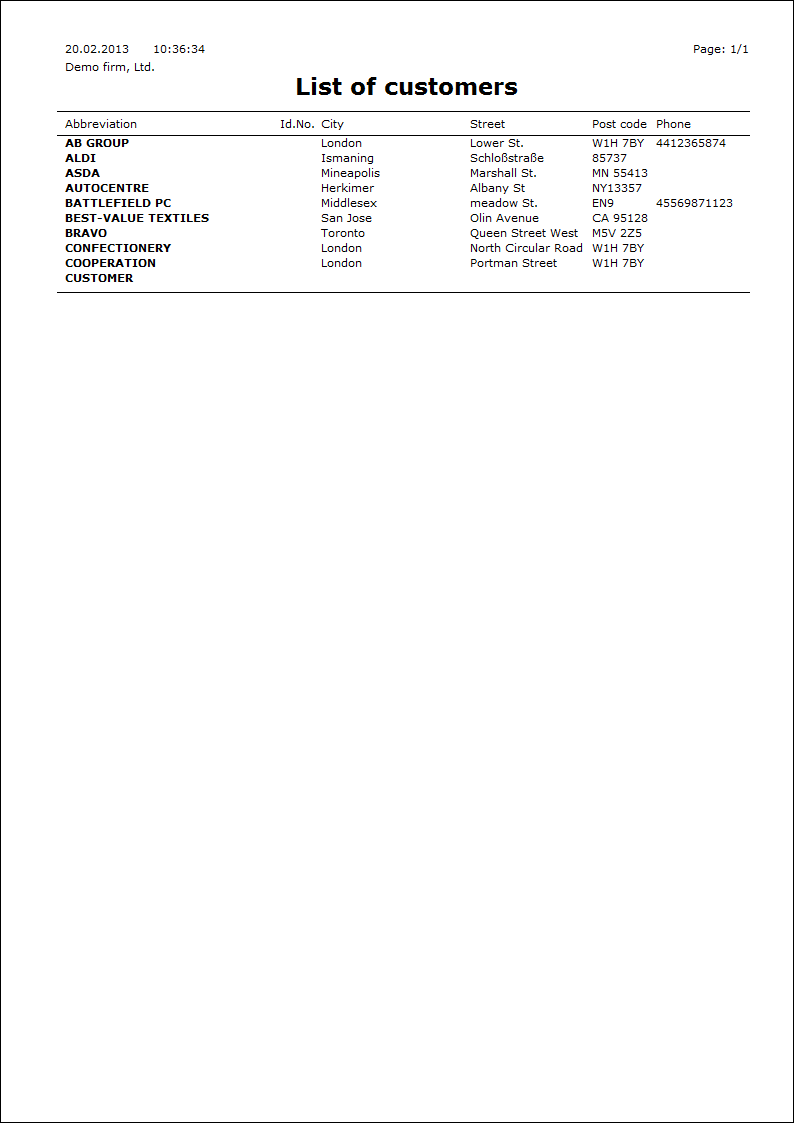

By Abbr

Process No: CIS003 |

Report ID: SCIS001 |

File: BAZ_SEZ1.AM |

Report description: List of the customers/suppliers sorted by abbreviation. |

||

Address in the tree: [Purchase/Supply] [Basic data] [Suppliers] [List of suppliers] [Sale/Processing of sale orders] [Basic data] [Customers] [List of customers] |

||

Reports parameters:

ShowName - NoNo - print Zkr1 of customer; Yes - print name. |

Sorting - 1 Parameter according to which a list of customers is sorted (see description of the report). |

Title Text which is filled as a value of a parameter. It displays as a name of a report during the printing. |